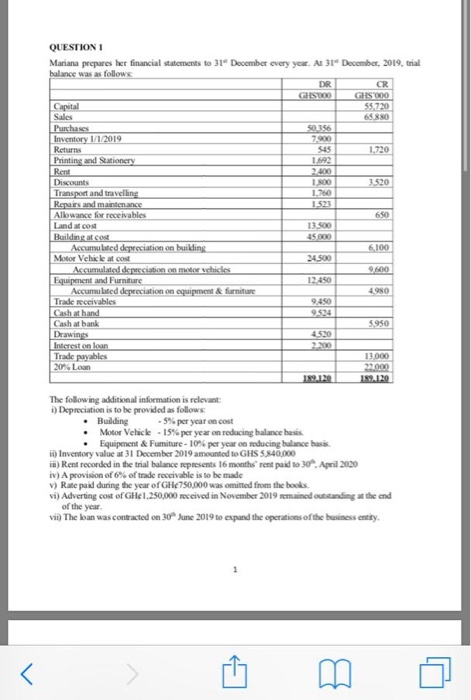

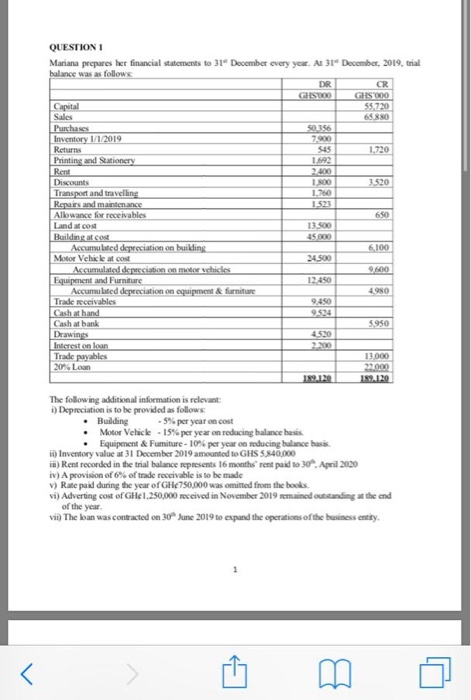

The estimated settlement statement documents costs and credits associated with buying a home. It shows a buyer their estimated total costs for buying a home and shows the seller how much money they will take from the transaction. It is the detailed receipt of the transaction.

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

Is settlement statement same as Closing Disclosure?

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is the aggregate adjustment on the settlement statement?

The aggregate escrow adjustment appears on Line 1007 of the HUD settlement statement. In this manner, what is the aggregate adjustment on closing disclosure? The term “aggregate adjustment” refers to a calculation the lender uses to make sure the correct amount of money is collected in the escrow account.

Is a settlement statement the same thing as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is the purpose of a settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is a settlement estimate?

Settlement Value Estimates This is the sum of your "special" damages, or economic losses.

How do you read a settlement statement for tax purposes?

4:3813:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyerMoreSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyer and seller. And then all of the numbers are added and subtracted at the very bottom.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

Is a settlement date the same as a closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How do insurance companies pay out settlements?

There are generally two types of settlement options your insurance company could offer: a reinstatement settlement, or a one-time lump-sum settlement payment.

What percentage does a lawyer get in a settlement case?

What Percentage in a Settlement Case Goes to the Lawyer? A lawyer who works based on contingency fees takes a percentage of your settlement at the end of your case, which is often around one-third of your settlement, per the American Bar Association (ABA).

How is a settlement amount calculated?

Settlement amounts are typically calculated by considering various economic damages such as medical expenses, lost wages, and out of pocket expenses from the injury. However non-economic factors should also play a significant role. Non-economic factors might include pain and suffering and loss of quality of life.

What part of settlement statement is tax deductible?

The only settlement or closing costs you can deduct on your tax return for the year the home was purchased or built are Mortgage Interest and certain Real Estate (property) taxes. These can be deducted in the year you buy your home if you itemize your deductions.

What expenses can be deducted from the sale of a home?

Types of Selling Expenses That Can Be Deducted From Your Home Sale Profitadvertising.appraisal fees.attorney fees.closing fees.document preparation fees.escrow fees.mortgage satisfaction fees.notary fees.More items...

What items are tax deductible on a closing statement?

Typically, the only closing costs that are tax deductible are payments toward mortgage interest, buying points or property taxes. Other closing costs are not.

When can a settlement agreement be used?

A settlement agreement is usually used in connection with ending the employment, but it doesn't have to be. A settlement agreement could also be used where the employment is ongoing, but both parties want to settle a dispute that has arisen between them.

What is a settlement statement quizlet?

Uniform Settlement Statement. Under RESPA, a lender must use HUD's Form 1 Uniform Settlement Statement to disclose settlement costs to the buyer. This form covers all costs that the buyer will have to pay at closing, whether to the lender or to other parties.

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

How do you write a settlement statement?

A settlement agreement should be in writing....Those requirements include:An offer. This is what one party proposes to do, pay, etc.Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose.A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does a reverse mortgage require a HUD-1 settlement statement?

RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure. Both the HUD-1 and mortgage closing disclosure are standardized forms.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

Examples of Estimated Settlement Statement in a sentence

Estimated Settlement Statement – Seller (Re-Sale and Acquisition Transactions Only)2.

Related to Estimated Settlement Statement

Settlement Statement means a statement showing the purchase price, plus any GST payable by the purchaser in addition to the purchase price, less any deposit or other payments or allowances to be credited to the purchaser, together with apportionments of all incomings and outgoings apportioned at the settlement date.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

Two Separate Views of The Same Transaction

Buyer Loan Charges

- Money isn’t cheap! All of the charges associated with the new loan will be summarized in this section. For a buyer with one loan, this is a pretty typical set of charges. If you are paying any points for your loan, that fee will be included in this section. This buyer did not choose an impound account (the bank will pay their insurance and taxes on their behalf), which is typical. San Franci…

Taxes and Insurance

- Regardless of the number of days in the month the deal closes, escrow companies prorate costs based on a 30-day month. Property taxes and HOA fees in condos are the two items most likely to be prorated on a buyer’s settlement statement. The buyer and seller will either be credited or debited for property taxes based on when the closing falls in the tax year.

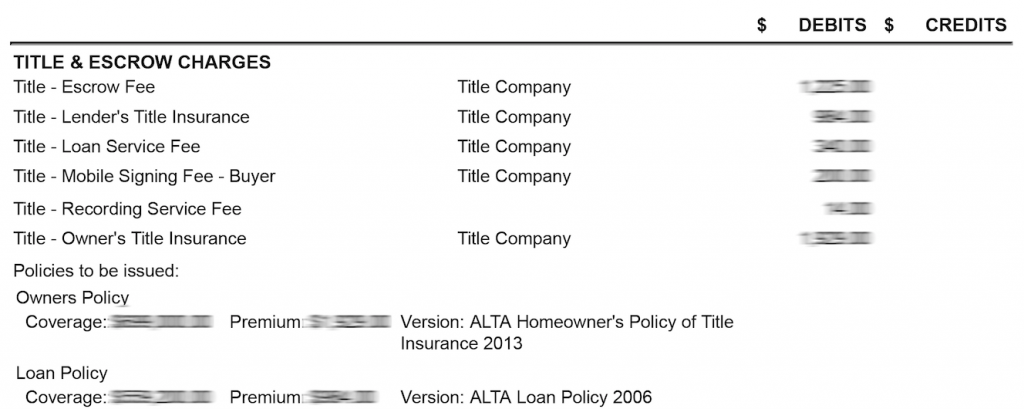

Title and Escrow Charges

- Title and escrow charges are grouped together in SF because it’s a title company usually provides escrow services in addition to title insurance. Your two typical costs are your owner’s title insurance policy, and the escrow fee. The cost of the title insurance policy is based on the cost of the home, while the lender’s policy (see buyer loan charges) is based on the size of the loan. Th…

Other Fees, Costs, and Credits

- Finally, we’ve got everything else. From estimates to recording fees, charges from building or community homeowner’s associations (HOAs), to miscellaneous charges, insurance policies, home warranties, and anything else that doesn’t fit elsewhere.

Balance Due from Buyer

- Once the buyer’s deposits and loans have been credited to the escrow, and all the debits added up as well, the estimated balance due from the buyer shows the remaining money needed to close the transaction. The balance due is equal to the remainder of your down payment and all of the closing costs as listed on the estimated settlement statement.

Real Estate Commissions

- Regardless of the agency relationship (buyer/seller/dual agency), sellers typically pay the entire real estate commission for both the buyer’s real estate brokerage and the seller’s real estate brokerage.

Other Seller Charges

- Sellers typically have a few miscellaneous charges for reporting, signing, and other admin/compliance fees that are usually no more than several hundred dollars.

It’S Just An Estimate!

- Finally, it is important to remember that all of the charges in the closing statement are estimates! Things often adjust based upon the actual closing date (namely, tax prorations and accrued interest). Escrow agents can close a transaction with excess funds, but they cannot close a transaction that does not have enough money in escrow to cover all costs, so escrow agents wil…