The proposal itself is simply an offer to pay, or an offer to receive, a certain amount of money to settle the case. For example, an insurance company might give a proposal for settlement to an injured party where they offer to pay the other party $25,000.00 to settle the case. This is obviously an offer to pay.

Full Answer

What is a proposal for settlement in a personal injury case?

What Is a Proposal for Settlement? An offer of settlement (Fla. Stat. Section 768.79) allows either party to an injury case to offer a settlement to the other party before trial. It was created to encourage early resolution of disputes. Proposals for settlement are derived from England and are sometimes referred to as “the modified English rule.”

What is a proposal for settlement in Florida?

A proposal for settlement in Florida (PFS) is the process in which a party to a civil action makes an offer to settle the case before final judgment. You can find the rules for settlement proposals under Florida rules of civil procedure 1.442 and Fla Stat. 768.79.

How much should an insurance company offer for a settlement?

Once the insurer has arrived at a settlement figure, he or she must decide what to offer. The first offer is going to be a percentage of what the insurer thinks is the final value of the case. For example, the insurer may require that the first offer be 40% of the value of the case. There is no industry-wide standard on this.

What is the first settlement offer in a lawsuit?

The First Settlement Offer. Once the insurer has arrived at a settlement figure, he or she must decide what to offer. The first offer is going to be a percentage of what the insurer thinks is the final value of the case. For example, the insurer may require that the first offer be 40% of the value of the case.

What does it mean when an insurance company offers a settlement?

A settlement is the resolution of a claim outside of court. Typically, this happens after negotiations between the parties prove successful, and the parties (and their insurance companies) agree on an amount that will compensate the victim for their damages.

Is it good to accept a settlement offer?

It is not in your best interest to accept a settlement offer without speaking with an attorney. The initial settlement offer from the insurance company is probably not fair. The offer may be much lower than the value of your damages. If the insurance company sends you a check, do not cash the check.

Why would an insurance company want to settle?

When an insurance company offers you a settlement, they are essentially acknowledging their client's fault in the accident. They want you to settle to avoid litigation or going to court. Insurance companies usually do not want to get legal help involved.

How do insurance companies calculate a settlement?

Insurance companies determine settlement amounts by looking at three factors: liability, damages and the terms of the insurance policy. In order for an insurance company to offer a settlement, liability must be clear.

What happens after you agree to a settlement?

After a case is settled, meaning that the case did not go to trial, the attorneys receive the settlement funds, prepare a final closing statement, and give the money to their clients. Once the attorney gets the settlement check, the clients will also receive their balance check.

Should you accept first offer insurance claim?

Once the offer is made, you have 21 days to decide whether or not to accept it. You should always take legal advice before accepting a Part 36 offer, especially if you have a conditional fee agreement or are using an insurance policy to cover your legal expenses, as you may find you invalidate your contract.

Do insurance companies try to get out of paying?

Insurance companies will seek to decrease payments or deny claims for injuries caused by an insured person's actions. After becoming injured, victims of accidents want nothing more than to move on from the traumatizing experience.

Do insurance companies want to settle fast?

Insurance companies want to settle cases right away, because they don't want you to have an opportunity to speak to a personal injury lawyer. If an insurance company is offering you any money, it is always advisable that you at least have a consultation with an attorney.

How long do insurance companies take to settle a claim?

The time that it takes an insurance claim to finalise could be anywhere between a week, a month or even a year. It depends on a number of factors, such as the type of claim, the complexity of the situation, how severe the damage is and how many people are involved in the process.

How do they determine settlement?

Settlement amounts are typically calculated by considering various economic damages such as medical expenses, lost wages, and out of pocket expenses from the injury. However non-economic factors should also play a significant role. Non-economic factors might include pain and suffering and loss of quality of life.

How do I find out how much my settlement is?

After your attorney clears all your liens, legal fees, and applicable case costs, the firm will write you a check for the remaining amount of your settlement. Your attorney will send you the check and forward it to the address he or she has on file for you.

How do you negotiate a settlement with an insurance claims adjuster?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How long does it take to receive compensation after accepting offer?

In some cases, insurers will process the compensation payout within a few days. In most cases, though, you will have to wait between two and four weeks to receive your compensation.

How do insurance companies negotiate cash settlements?

Let's look at how to best position your claim for success.Have a Settlement Amount in Mind. ... Do Not Jump at a First Offer. ... Get the Adjuster to Justify a Low Offer. ... Emphasize Emotional Points. ... Put the Settlement in Writing. ... More Information About Negotiating Your Personal Injury Claim.

How do you counter offer a settlement?

Countering a Low Insurance Settlement OfferState that the offer you received is unacceptable.Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim.Re-state an acceptable figure.Explain why your counteroffer is appropriate, including the reasons behind your general damages demands.More items...•

Can insurance take back a settlement?

No, in most cases, you will not be able to sue for more compensation or damages after the settlement has been done. In most personal injury claims, the affected person is awarded a settlement with a defined amount of money as compensation and damages for the injuries, pain, and suffering they have gone through.

What is a settlement proposal?

A settlement proposal most commonly refers to an attempt by a person in debt to reduce or eliminate their debt by proposing an alternative to paying the full debt to the creditor. Proposing a settlement is a good idea for someone who is considering bankruptcy or who feels like they can pay some, but not all, of a debt.

What is a proposal payment?

Propose payment terms, including whether you are seeking a cancellation of the debt or simply a debt reduction and offer a payment schedule. Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

What does it mean to request a debt settlement?

Request, in exchange for a debt settlement, that the creditor remove mention of the debt in your credit report and make a good effort to improve your credit rating.

How to close a settlement letter?

Close the letter by reiterating that you are not able to pay off the debt, and that this settlement proposal represents your best effort to give the creditor something.

Why are creditors open to settlement?

Creditors are often open to settlement proposals as they offer an alternative to settling a debt that might otherwise go unpaid. The steps below will guide you on how to write a settlement proposal and seek good terms for a partial or full debt reduction.

What is a request for a creditor to respond to a proposal?

Request that the creditor respond in writing to your proposal, indicating their acceptance, refusal, or request for new terms.

How much should a debt settlement be?

In general, a debt settlement should be about half of the total amount owed. ...

What percentage of settlement is offered?

For example, the insurer may require that the first offer be 40% of the value of the case. There is no industry-wide standard on this. Different insurers have different procedures. Learn more about factors that determine personal injury settlement value.

What is a claim adjuster?

If you're negotiating a personal injury claim with an insurance company, you'll probably be dealing with a "claims adjuster.". It may be helpful to understand how the adjuster typically operates before you put together a written demand letter, and certainly before you accept (or reject and counter) a personal injury settlement offer.

What do adjusters think about in a personal injury case?

In order to value the case, the adjuster has to think about two things: 1) what are the claimant's chances of winning at trial if a personal injury lawsuit is filed in court, and 2) how much might a jury award the plaintiff in damages?

What does an insurance adjuster do?

Just like an attorney, an insurance adjuster will want to investigate and get a full understanding of the facts of the underlying accident and the claimant's injuries and other losses (called " damages " in legalese).

What documents do you need to file a personal injury claim?

The adjuster will usually request documents such as medical bills, proof of earnings, tax returns, and proof of property damage.

What is a third party claim?

If you're making a claim with the insurance company of the person you think is responsible for your accident, you're making a "third party" claim. The first thing the adjuster will want to find out is what the policyholder (that's the person you're saying is at fault for the accident) has to say about what happened. Besides talking to the insured person to hear his or her story firsthand, the adjuster will read any police report or accident report related to the incident.

Is there an industry wide standard for personal injury settlements?

There is no industry-wide standard on this. Different insurers have different procedures. Learn more about factors that determine personal injury settlement value. One very important point is that adjusters often have leeway to adjust the first offer depending on who they are dealing with.

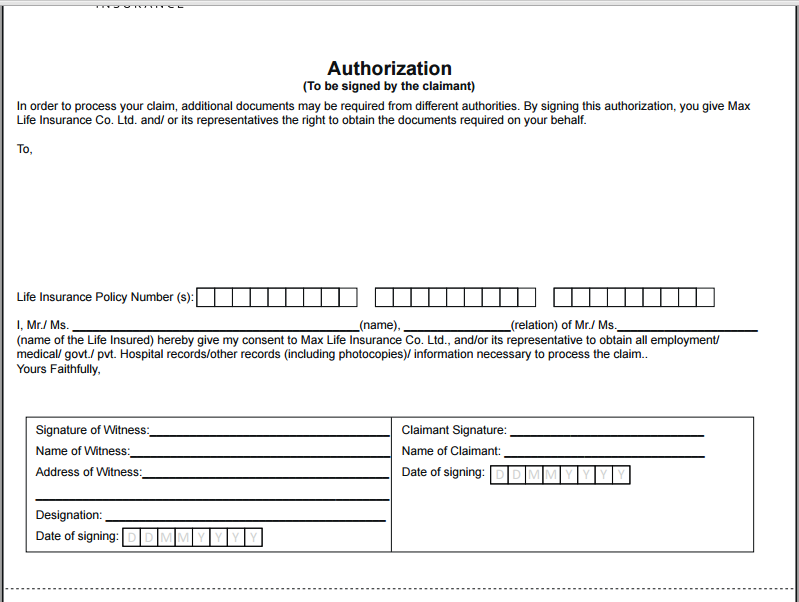

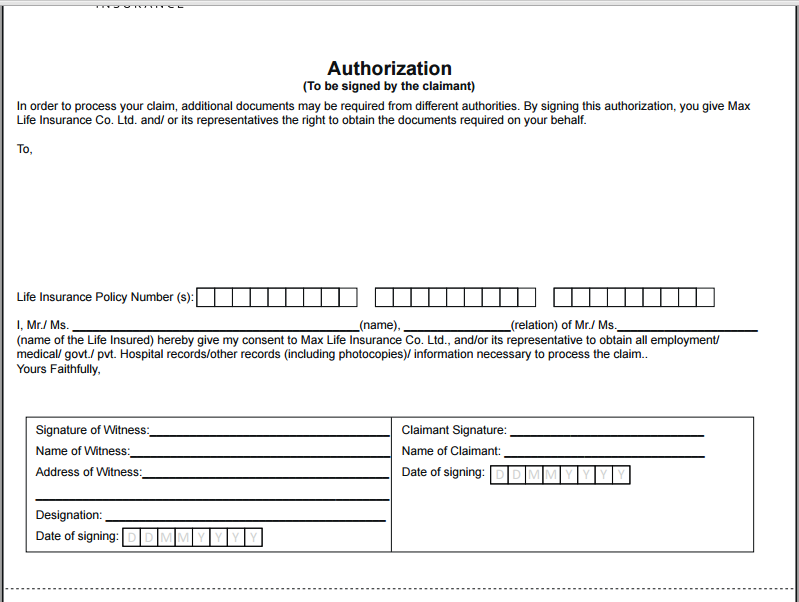

What is fillable insurance proposal?

This fillable insurance proposal template allows you to provide a detailed business proposal of several commercial insurance products to your clients. Start by filling out the tokens on the right, then take a few moments to remove any irrelevant services or add new ones based on your client’s needs.

Why do you need an executive summary for a proposal?

Opening your proposal with an executive summary allows you to demonstrate your knowledge of your client’s needs, wants, and goals. It gives you a chance to provide a bit of background information about your agency before getting to insurance plans and pricing details.

What is a liability assumed under a contract?

Liability assumed under a contract. Bodily injury intentionally caused or aggravated by the Insured. Fines or penalties imposed for violation of federal or state law. Damages arising out of coercion, criticism, demotion, evaluation, reassignment, discipline, defamation,

Is a partnership not an insured?

Any entity, partnership, joint venture, or Limited Liability Company not named as an insured is not covered under these proposed coverages.

How to negotiate a settlement with insurance company?

Your lawyer will probably begin by trying to advocate directly to the insurance company to negotiate for a reasonable settlement. Sometimes, a phone call or demand letter from a lawyer will trigger a higher level of scrutiny by the insurance company than your handling it alone, and it could be enough to settle your claim — without the need for a trial.

Who is the first line of communication for insurance adjusters?

The adjuster is the first line of communication, but there’s always a supervisor who might have more ability to make decisions about a claim. If appealing to a supervisor doesn’t help you reach a resolution, you can contact the department in your state that regulates insurance and file a complaint.

What did the jury find about State Farm?

The jury found that State Farm was unreasonable in its decision not to settle with the injured parties. It also found that the insurance company’s conduct toward Campbell was egregious enough to warrant punitive damages.

Why was the case of the insurance company a case of “egregious” conduct?

The court further found this to be a case of “egregious” conduct by the insurance company because it concealed the truth in order to deprive the plaintiff of fair compensation. The insurance company’s conduct led to the maximum sanction under Massachusetts law for double damages.

What does it mean when your insurance doesn't cover your claim?

It might be that your policy legitimately didn’t cover your claim, or it could be a case of insurance bad faith . Insurance bad faith is when an insurance company fails to cover your claim as it should according to the terms of your policy.

What does premium insurance cover?

You pay a premium to your insurance company for a policy that provides coverage of losses related to your car, home, accident-related medical treatments, and other things.

What happens if your insurance company doesn't pay your claim?

If your insurance company isn’t paying your claim and you don’t know why, it could be a case of insurance bad faith. Learn more about what this means and how to handle it. You probably already know the basics of how insurance is supposed to work. You pay a premium to your insurance company for a policy that provides coverage ...

What happens if you believe your insurance company has used bad faith settlement practices?

If you believe your insurance company has used bad faith insurance settlement practices, you may have a legal claim. Bad faith insurance settlement claims usually require specialized knowledge of that particular area of law. If you're thinking about filing a legal claim against the insurance company, you should consult with an experienced bad faith insurance attorney to explore your legal options and recover additional damages.

What happens if an insurance company fails to file a claim?

If it fails to fulfill its duties as stated in the policy language and by law, you may file a lawsuit for bad faith insurance settlement practice.

What is bad faith settlement?

Insurance is a form of contract in which payments of premiums are exchanged for an insurance company's promise to compensate for legitimate claims. An insurance company has a contractual duty to act in good faith, which is implied in the relationship between the insured and the insurer.

Can insurance companies be held liable for bad faith insurance settlements?

There are several ways an insurance company can be held liable for bad faith insurance settlements and denials. Some bad faith insurance settlement examples are when an insurance company: Fails to inform the insured of pertinent information. Fails to perform proper investigation of the claim. Denies the claim without investigating the claim.

What Is A Proposal For Settlement?

Examples of Proposal For Settlement in Florida

- Example #1:Florida’s rule works like this: Assume both sides file proposals to settle the case at a specific dollar amount. If you go to trial as the plaintiff and receive (via judgment) at least twenty-five percent less money than the amount of the proposal, then you are required by the court to pay the defendant’s attorneys’ fees and costs, which accrued from the date of the proposal for settle…

Carey Leisure & Neal Can Help

- Proposals for settlement are important strategic tools that can have a massive impact on your case and your finances. Because of the proposal’s overreaching effects, it is crucial to listen to your attorney’s advice regarding the proposal. Your attorney knows how these things work and has seen the good and bad consequences of an effective proposal for settlement. Heed your att…

Investigating The Claim

Investigating The Claimant

Gathering Claim Documentation

Determining Settlement Value

Determining The Value of A Pain and Suffering Claim

The First Settlement Offer

- Once the insurer has arrived at a settlement figure, they must decide what to offer. The first offer is going to be a percentage of what the insurer thinks is the final value of the case. For example, the insurance company may require that the first offer be 40% of the value of the case. There is no industry-wide standard on this. Different insurer...

How A Lawyer Can Help You Negotiate The Settlement

Next Steps in The Injury Settlement Negotiation Process