What is the Commission’s approach to settlement offers?

This statement discusses my views on some of those factors and specifically addresses the Commission’s approach to settlement offers that are accompanied by contemporaneous requests for Commission waivers from automatic statutory disqualifications and other collateral consequences.

What is a statutory offer of settlement?

Statutory offer of settlement is a monetary offer extended to a plaintiff by a defendant to settle all disputes before trial. Usually the plaintiff has a short period of time depending on the state and case to accept the offer. If the plaintiff accepts the offer, the settlement will be filed with the court and will be enforceable.

Can a party seeking a settlement make a concurrent settlement offer?

In these circumstances, parties seeking settlements often make contemporaneous settlement offers and waiver requests.

What makes an attractive settlement offer to investors?

Investor protection is at the core of the Commission’s mission and, from the Commission’s perspective, an attractive settlement offer is one that provides appropriate remedial relief, including any return of money to injured investors, more quickly than would be expected in a litigated action. [5]

What does the SEC do with settlement money?

What Does the SEC Do With Money It Collects From Fines? This will depend on the nature of the penalty. If investors or others were harmed financially due to a transgression, the penalties collected will be used to recover those losses and make those investors whole.

Are SEC settlement agreements public?

A Party will publicly disclose the terms of this Settlement Agreement or the Operative Agreements only to the extent reasonably necessary in its judgment to comply with its legal obligations.

How many SEC cases settle?

Roughly 98 percent of all SEC cases settle.

What percentage of SEC cases settle?

Most cases are settled before the SEC brings litigation. According to knowledgeable sources, approximately 60 percent of SEC enforcement actions get resolved even before the Commission's staff files a lawsuit. In addition, they say, roughly 90 percent of cases are resolved after some sort of litigation is filed.

Can settlement negotiations be used as evidence?

The Senate amendment provides that evidence of conduct or statements made in compromise negotiations is not admissible. The Senate amendment also provides that the rule does not require the exclusion of any evidence otherwise discoverable merely because it is presented in the course of compromise negotiations.

Are settlement negotiations discoverable?

Settlement negotiations are not protected from discovery by a settlement-negotiation privilege. Although the Federal Circuit declined to create a settlement-negotiation privilege, it did not hold that settlement negotiations are presumptively discoverable.

How long do SEC cases last?

The length of an SEC investigation depends upon its subject matter and scope. The average SEC investigation lasts anywhere between six months and one year. However, sometimes SEC investigations can last several years and put a tremendous strain on the resources of the party being investigated.

How long does it take SEC to investigate?

two to four yearsHow long does it take for the SEC to investigate alleged securities violations? Longer than you might think. Typically, SEC investigations take two to four years to complete.

Does the SEC lose cases?

SEC Loses Insider-Trading Case: Court 'Distressed' by Counsel's Conduct. The Securities and Exchange Commission was recently handed a significant defeat in SEC v.

What does an SEC investigation mean?

important; overflow:hidden;" scrolling="auto"> The U.S. Securities and Exchange Commission (SEC) investigates companies, brokerage firms, and individuals for a broad range of statutory and regulatory violations.

Are SEC investigations public?

By law, SEC investigations are confidential and non-public. Generally, the SEC Staff will provide information and materials to SEC whistleblowers on a need to know basis only.

What is a SEC consent decree?

A person or company may be able to get the SEC to agree to settle the situation during the investigation. The settlement is typically documented in an agreement (called a "Consent Decree" or "Consent Order"), which the SEC then files in a court for the court's approval.

Can SEC file criminal charges?

While the SEC has extremely broad investigative and enforcement powers, it cannot file criminal charges. It can, and often does, work with the Department of Justice and the United States Attorney's Office to bring those charges.

What crimes does the SEC investigate?

Under these rules, regulations, and statutes, the SEC targets issues such as:Account churning and other fraudulent practices.Blackout trading restriction violations.Fraudulent initial public offerings (IPOs) and initial coin offerings (ICOs)Insider trading violations.Misappropriation of investors' funds or securities.More items...•

How many enforcement actions does the SEC take each year against securities law violators?

The agency filed 697 total enforcement actions in fiscal year 2021, including the 434 new actions, 120 actions against issuers who were delinquent in making required filings with the SEC, and 143 "follow-on" administrative proceedings seeking bars against individuals based on criminal convictions, civil injunctions, or ...

Can the SEC charge?

The SEC Division of Enforcement is the branch of SEC that conducts investigations of alleged violators of the SEC laws and regulations. Although it cannot put any guilty party in jail, it can bring different types of civil actions against offenders.

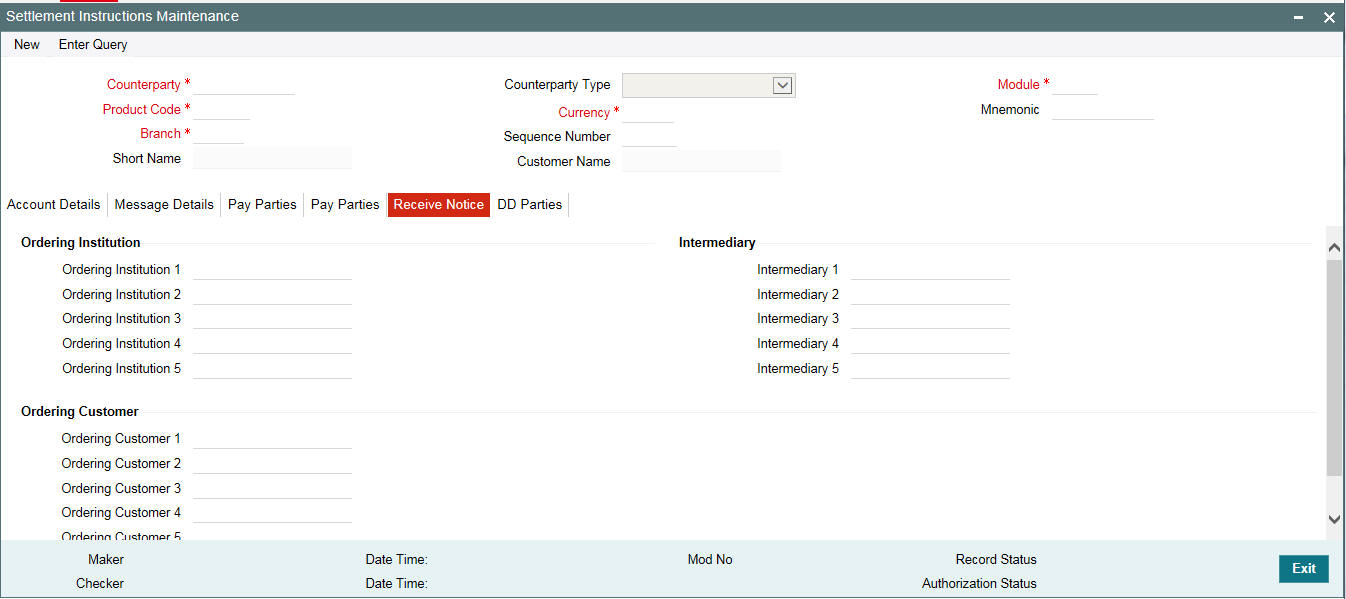

Who can submit a settlement offer to the SEC?

Subject’s counsel may submit a settlement offer to SEC counsel who will consider whether to recommend it to the Commission. If the offer is not recommended to the Commission, the offer does not go on record.

Why does the SEC favor settlement?

The SEC favors settlement because it “return [s] money to injured investors more quickly than would be expected in a litigated action.”. SEC guidelines recommend investors be compensated promptly and properly.

What is a valid settlement offer?

A valid settlement offer must consider current and future investors. The SEC will only settle when, in the judgment of the Commission, the agreement is within the range of outcomes it may reasonably expect if it were to litigate the matter. Settlement offers must include methods to return funds to harmed investors. They generally include a waiver request, future restrictions on securities activities, and a “neither-admit-nor-deny” portion. Although not standard, the SEC will sometimes require the Subject to retract their prior implications of innocence.

What happens when a violation is discovered by the Securities and Exchange Commission?

When violations are discovered by the Securities and Exchange Commission (“SEC” or “Commission”), many investigation subjects (“Subjects”) consider settling with the SEC. This is often the right move, but there are pros and cons to this choice.

What is the greatest negative outcome in proposing a settlement offer?

Waiver of these rights is arguably the greatest negative outcome in proposing a settlement offer. All accepted settlement offers are final, and the Subject loses their ability to appeal or prove their innocence in court.

What is the SEC's priority?

The SEC’s priority is investor protection. According to the SEC Chairman, “the sooner harmed investors are compensated, the offending conduct is remediated, and appropriate penalties are imposed, the better.”. The major purpose of any settlement offer is to quickly settle issues outside of court. A settlement offer with ...

Can a SEC investigation be a settlement offer?

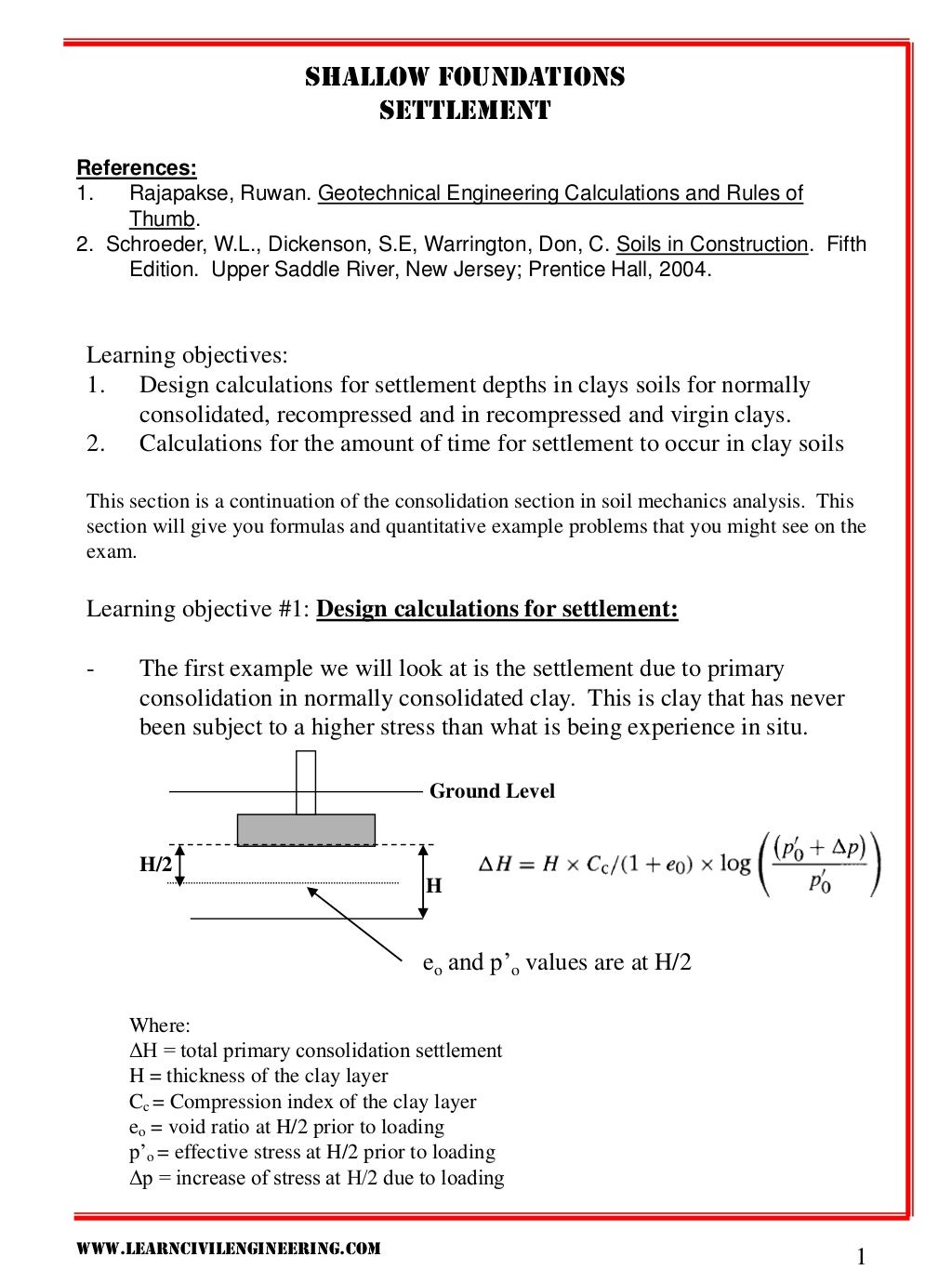

A settlement offer may be proposed by the Subject at any time in response to an SEC investigation. As per federal statute, “any person who is notified that a proceeding may or will be instituted against him or her, or any party to a proceeding already instituted, may, at any time, propose in writing an offer to settle.” (17 CFR § 201.240 (a)). Although settlement offers are accepted anytime, the SEC generally wants to conduct a sufficient investigation before considering one. The Commission wants to consider all potential violations and investor outcomes before assessing a settlement offer’s reasonability.

Factors that Drive Appropriate Settlements

It often is noted that the cost of litigation—or, more accurately, avoiding the cost of litigation— is a key driver of settlements. This is undoubtedly correct, as that cost—in terms of dollars as well as other less-tangible factors—can be significant for many defendants. [2]

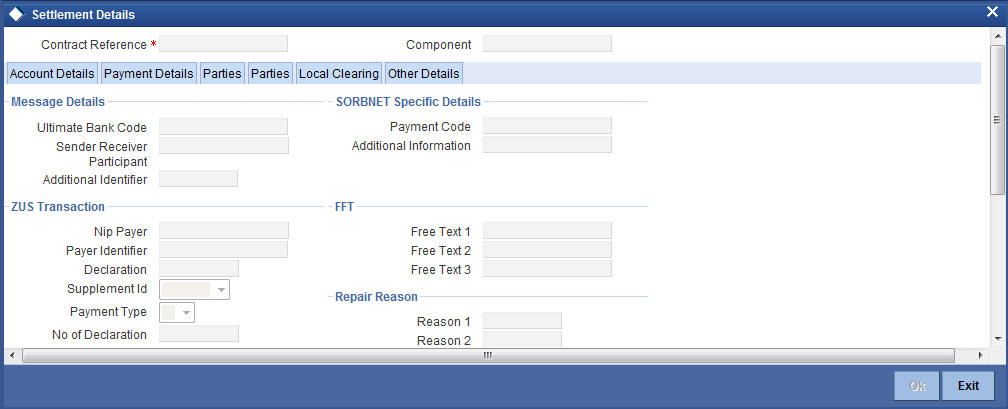

Forms of Contemporaneous Settlement Offers and Waiver Requests

Recognizing that a segregated process for considering contemporaneous settlement offers and waiver requests may not produce the best outcome for investors in all circumstances, I believe it is appropriate to make it clear that a settling entity can request that the Commission consider an offer of settlement that simultaneously addresses both the underlying enforcement action and any related collateral disqualifications.

Endnotes

1 Since arriving at the Commission in May 2017, I have consulted with the directors of the Divisions of Enforcement, Corporation Finance and Investment Management, as well as various others, including my fellow Commissioners, on how to improve the effectiveness and efficiency of our consideration of settlement offers, waiver requests and related matters.

Who reversed the SEC settlement?

In one of her first official actions as Acting Chair of the Securities and Exchange Commission (SEC or Commission), Allison Herren Lee reversed a major policy implemented by recently departed SEC Chairman Jay Clayton involving the SEC enforcement settlement process. This decision could significantly impact the SEC settlement process by causing uncertainty for settling entities as to the business consequences of a settlement. In a rare rebuke, two fellow SEC Commissioners promptly issued a statement decrying the Acting Chair’s decision.

Why does the SEC grant waivers?

The SEC routinely grants waivers to prevent disproportionate and unintended consequences resulting from a settlement. Naturally, settling parties desire certainty regarding the collateral consequences of a settlement they are contemplating.

What are collateral consequences?

These restrictions, commonly referred to as “collateral consequences,” range from prohibiting a settling entity (and possibly its affiliates) from taking advantage of certain exemptions under the federal securities laws to disqualifying an entity from engaging in specific business activities. SEC settlements regularly trigger collateral consequences against settling SEC-regulated entities, like broker-dealers, hedge funds, investment advisers, and public companies. For example, a public company issuer that settles with the SEC could be automatically disqualified from being considered a Well-Known Seasoned Issuer under Rule 405 of Regulation C. Alternatively, a settlement could prohibit a settling investment adviser from providing advisory services to an investment company or from receiving cash fees for solicitations.

What is the most important insight a party can have when considering settlement with the SEC?

Perhaps the most important insight a party can have when considering settlement with the SEC is what the Staff's objectives are in bringing the case . As a civil law enforcement agency charged with regulating and policing the markets, the Commission uses its enforcement function to achieve a variety of objectives. While the Staff will not likely discuss its reasons for pursuing a particular case, discerning the Staff's objectives is essential to knowing where it may have flexibility in recommending reduced charges or remedies. Understanding the Commission's priorities, paying close attention to what Commissioners and Division of Enforcement leaders say in speeches and observing recent enforcement activity may provide important clues concerning why the Staff is focused on specific conduct in a case. Even subtle hints, such as the attendance of a senior officer at a routine meeting, can signal that a case is of particular interest to the Division of Enforcement.

What does the SEC not recommend?

The SEC Staff will generally not recommend to the Commission that it accept in settlement charges or remedies that the Commission could not obtain in a fully adjudicated proceeding. This means that the SEC must have a factual and legal basis for any charges or remedies that it seeks in settlement and cannot simply agree to any claim or remedy that is not factually or legally supported by the investigative record. This is an important limiting principle because it ensures that the Staff cannot leverage the Commission's considerable power to extract settlements on terms that are not supported by the record or that the Commission would not be able to achieve if it were to litigate the matter through to conclusion.

Does the Commission have to settle every case?

The Commission does not have the resources to litigate every case it seeks to bring. For this reason, the Staff is almost always willing to discuss settlement. In most cases, settlement discussions begin somewhere between the conclusion of witness testimony and the beginning of the Wells process. Often, the Staff will offer a party the opportunity to discuss settlement in lieu of receiving a Wells notice. In other cases, a party might broach an interest in discussing settlement before the Staff has completed taking testimony. Sometimes, in cases where liability is clear, it may be in a party's interest to explore settlement at the earliest possible time -- a quick settlement of a non-fraud or technical compliance violation can greatly reduce the disruption and expense of a protracted investigation and Wells process. Generally, however, the Staff will not entertain settlement discussions until it is comfortable it knows all the material facts in a matter (which means that a certain amount of document production and testimony is necessary in any case before the Staff is likely to consider resolution).

Collateral Consequences of Sec Settlements

- Timing

A settlement offer may be proposed by the Subject at any time in response to an SEC investigation. As per federal statute, “any person who is notified that a proceeding may or will be instituted against him or her, or any party to a proceeding already instituted, may, at any time, pr… - Substance

A valid settlement offer must consider current and future investors. The SEC will only settle when, in the judgment of the Commission, the agreement is within the range of outcomes it may reasonably expect if it were to litigate the matter. Settlement offers must include methods to ret…

Contingent Settlement Process

Practical Implications