What Is Bipartite Settlement? Bipartite settlement is a process of wage revision between Government and banks employees of public sector banks. IBA (Indian Bank Association) negotiates from Government side and UFBU (United Forum Of Bank Unions) negotiates from the side of bank employees. Bipartite settlement takes place every 5 years.

What is bipartite settlement in public sector banks pay revision?

In the public sector banks pay revision takes place on the basis of bipartite settlement. The settlement takes place between Indian Banks’ Association (IBA) and United Forum of Bank Unions (UFBU). IBA is representing bank managements while United UFBU is representing officers, employees, and staff organizations.

When did the bipartite settlement end?

The settlement was sign in May 2015 with 15 percent hike. As the 10 th bipartite settlement ended, the new pay scales and other components of wages and service conditions of bank employees need to be revised form 1 st November 2017. What is the bipartite settlement? Salary is an important factor for every working professional.

What is 11 th bipartite settlement negotiation?

IBA is representing bank managements while United UFBU is representing officers, employees, and staff organizations. 11 th Bipartite Settlement negotiation focuses on the merger of Dearness Allowance (DA) and basic pay, the percentage of a hike or the load factor/amount and distribution of the load to different components of salaries.

What is bipartite wage settlement (11th BPS)?

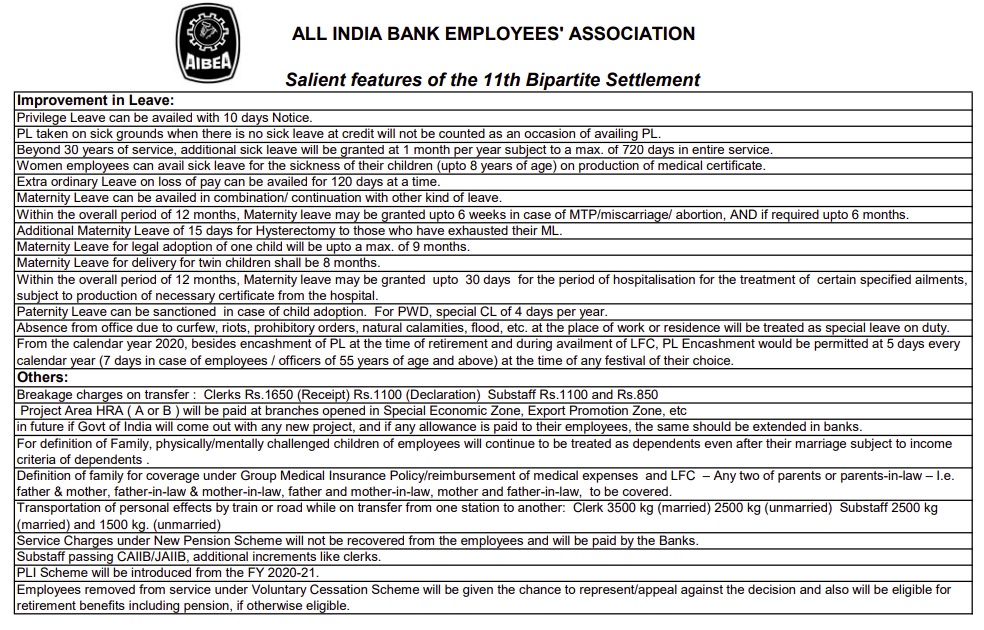

The current bipartite wage settlement (11th BPS) was signed on 11.11.2020 and is effective from 01.11.2017 to 31.10.2022. Under the 11th Bipartite Wage Settlement, the bank employees got a 15% increase in payslip components. Further, for the first time, a performance-linked Incentive (PLI) was introduced as a payslip component.

Which is the latest bipartite settlement?

Wage revision in public sector banks take place every five years. The 11th bipartite settlement is due from November 1, 2017. Wage revision in public sector banks takes place in every five years. The 11th bipartite settlement is due from November 1, 2017.

What will be the new salary after 11th bipartite settlement?

Gross Salary after 11th Bipartite Settlement : The annual wage increase in salary and allowances is agreed at 15% of the wage bill as on 31-3-2017 which works out to Rs. 7,898 crores on Payslip components.

What are settlements in banking?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

Which bank Po has highest salary?

Bank PO Salary The State Bank of India offers the highest salary range among the Public Banks in India. SBI PO salary structure is as follows: The basic pay for SBI PO Rs. 27,620/- with 4 advance increments.

What is the minimum salary of a bank employee?

The basic IBPS clerk salary is Rs 11,765- Rs 42,020 per month. Rs 11,765 is the basic pay in the IBPS clerk salary and the remaining pay includes dearness allowance, house rent allowance, medical allowance and transport allowance.

What are the types of settlement?

The four main types of settlements are urban, rural, compact, and dispersed. Urban settlements are densely populated and are mostly non-agricultural. They are known as cities or metropolises and are the most populated type of settlement. These settlements take up the most land, resources, and services.

What is difference between settlement and clearing?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

What is status of 11th bipartite settlement?

The protracted 11th bipartite wage settlement negotiations between bank unions and the Indian Banks' Association (IBA) concluded on Wednesday, with both sides agreeing to an annual wage increase and allowances of 15 per cent of the wage bill as on March 31, 2017.

What will be the salary of bank PO after 12th bipartite settlement?

As per the revised Bipartite Settlement With four advance increments in the compensation size of a Probationary Officer is 36000-1490/7-46430-1740/2-49910-1990/7-63840.

Is 11th bipartite settlement implemented?

All our unions are aware that the present 11th Bipartite Settlement signed with IBA on 11.11. 2020 is effective from 1st November, 2017 for a period of 5 years and hence the period of this Settlement is to end by 31-10-2022.

When 10th bipartite settlement will be implemented?

As in the case of past Settlements signed by the IBA on behalf of its member Banks, the benefits and obligations in terms of the Tenth Bipartite Settlement signed on 25th May 2015 shall be implemented by all member banks on whose behalf this Settlement has been signed to all their employees irrespective of their Union ...

RAMAKRISHNAN R P

First of all, I Also want to say thanks to our O.M.PRAKASH SHARMA Ji’s, recent message which gave a clear picture about the Unions and our Associations activities/Attitudes towards the BANK EMPLOYEES WELFARE. Here I mean BANK EMPLOYEES means both bank employees in SERIVCE AND ALSO bank employees on retirement.

thirumalaisamy

Sir Resignee pension option issue is not taken.Resignee bank officers who have completed more than thirty years services but till date they are not getting pension.Number of resignee resigned due to medical reasons.Why all are missing in circular and discussion resignee pension option demand .

Subrata Dasgupta

Don't kill your time unnecessarily by posting a very big post which has been discussed earlier.

RAMAKRISHNAN R P

It seems you are well aware of all about bank pensioners and Retirees Welfare angel. Will you please tell me , on one side, we are demanding D.A as per Hon'ble Supreme court order and on the other side, we are also demanding 100 % D.A Neutralization. Pl. tell me which is beneficial and if so, how it will be implemented ???.

Padam Singh

Respected Rama Krishna ji, Will you please explain regarding 100 Percentage da neutralisation. Will it be applicable to all retired persons with svrs 2001 Too. Will there be a clause of minimum basic pension or also for each pensioner.

Suresh Multani

Sir Resignee pension option issue is not taken.Resignee bank officers who have completed more than thirty years services but till date they are not getting pension.Number of resignee resigned due to medical reasons.Why all are missing in circular and discussion resignee pension option demand . Kindly help Resignee pension option demand issue.

RAMAKRISHNAN R P

WHOM I HAVE DISCOURAGED. I THING YOU ARE MISTAKEN ME . I never discouraged any body. Your last para is not relevant with my messages. You identified me wrongly, I suppose. Regarding the Reg.37 is not a new concept. Kindly read once again our Honorable Supreme court order dated 13.02.2018. We have been fighting from 2001 onwards.