Debt collector Cavalry Portfolio Services has reached a settlement to end claims that the company violated the Telephone Consumer Protection Act by calling consumers without their consent. To end the TCPA claims, Cavalry has agreed to create Cash Fund of up to $6,150,00 in value and a Debt Relief Fund of up to $18,000,000 in value to compensate Class Members.

Is cavalry Portfolio Services suing you for old debt?

The notorious debt buyer Cavalry Portfolio Services has sued you for an old debt that they bought from an original creditor . You are considering whether to fight them or to reach a reasonable settlement and get on with your life. You now have to determine how much is a good settlement with Cavalry Portfolio Services?

What are some of the most famous TCPA settlements?

The most famous TCPA settlement occurred in August 2014, when Capital One (and three collection agencies) agreed to pay $75.5 million to end a class action suit that arose from the bank’s use of an autodialer to call consumers’ cell phones.

Was there a settlement in the Horton V Cavalry case?

Home | Horton v. Cavalry Portfolio Services, LLC A settlement has been reached with Cavalry Portfolio Services, LLC ("Cavalry") in two class action lawsuits.

How much debt relief can I claim with cavalry?

If you have an Open Account with Cavalry, you could have claimed a pro rata share of debt relief of up to $599 or claimed a pro rata share from the Cash Fund. You could have claimed debt relief or cash but not both. If you have a Closed Account with Cavalry, you could have claimed a pro rata share from the Cash Fund but not debt relief.

How much will Cavalry Portfolio settle for?

$24 millionCavalry Lawsuits Cavalry Portfolio Services was slapped with a class-action lawsuit for violating the Telephone Consumer Protection Act (TCPA) — the settlement, worth more than $24 million, was granted final approval on Oct. 13, 2020.

How much is the 1800 Contact settlement worth?

price-fixing class action lawsuit has ended in a $15.1 million settlement after four years of litigation. Originally, consumers had filed their antitrust litigation against not only 1-800 Contacts Inc. but also against other retailers including Walgreens, Vision Direct, and Luxottica.

What is AAG TCPA settlement?

American Advisors Group (AAG) has agreed to pay $3.5 million to settle a class action lawsuit alleging the company bombarded consumers with prerecorded telemarketing calls.

Does Calvary Portfolio sue?

Cavalry Portfolio Services lawsuits can be intimidating and financially devastating. If Cavalry Portfolio Services has sued you, it is important to note that you have rights as a consumer. You need a debt defense attorney to advocate on your behalf and advise you through this process.

Are contact lens Settlements real?

The settlement benefits consumers who purchased certain disposable contact lenses between June 1, 2013, and Dec. 4, 2018. Contact lenses in the settlement were sold by Johnson & Johnson Vision Care, Alcon Vision, CooperVision, ABB Concise Optical Group and Bausch & Lomb.

Is online contact lens settlement real?

Thirteen online contact lens retailers have offered a combined amount of $40,000,000 to settle claims made against them by people who purchased contact lenses over the internet.

Is there a lawsuit against AAG?

On October 8, 2021, the Bureau filed a lawsuit and proposed stipulated final judgment and order in the United States District Court for the Central District of California against American Advisors Group (AAG), which the court entered on October 25, 2021.

Is AAG a good company?

Yes, AAG is a reputable company, with excellent ratings from customers on Trustpilot. To add to its credibility, the company is also a member of the National Reverse Mortgage Lenders Association (NRMLA). It's important to note that AAG settled with the Consumer Financial Protection Bureau on Oct. 8, 2021.

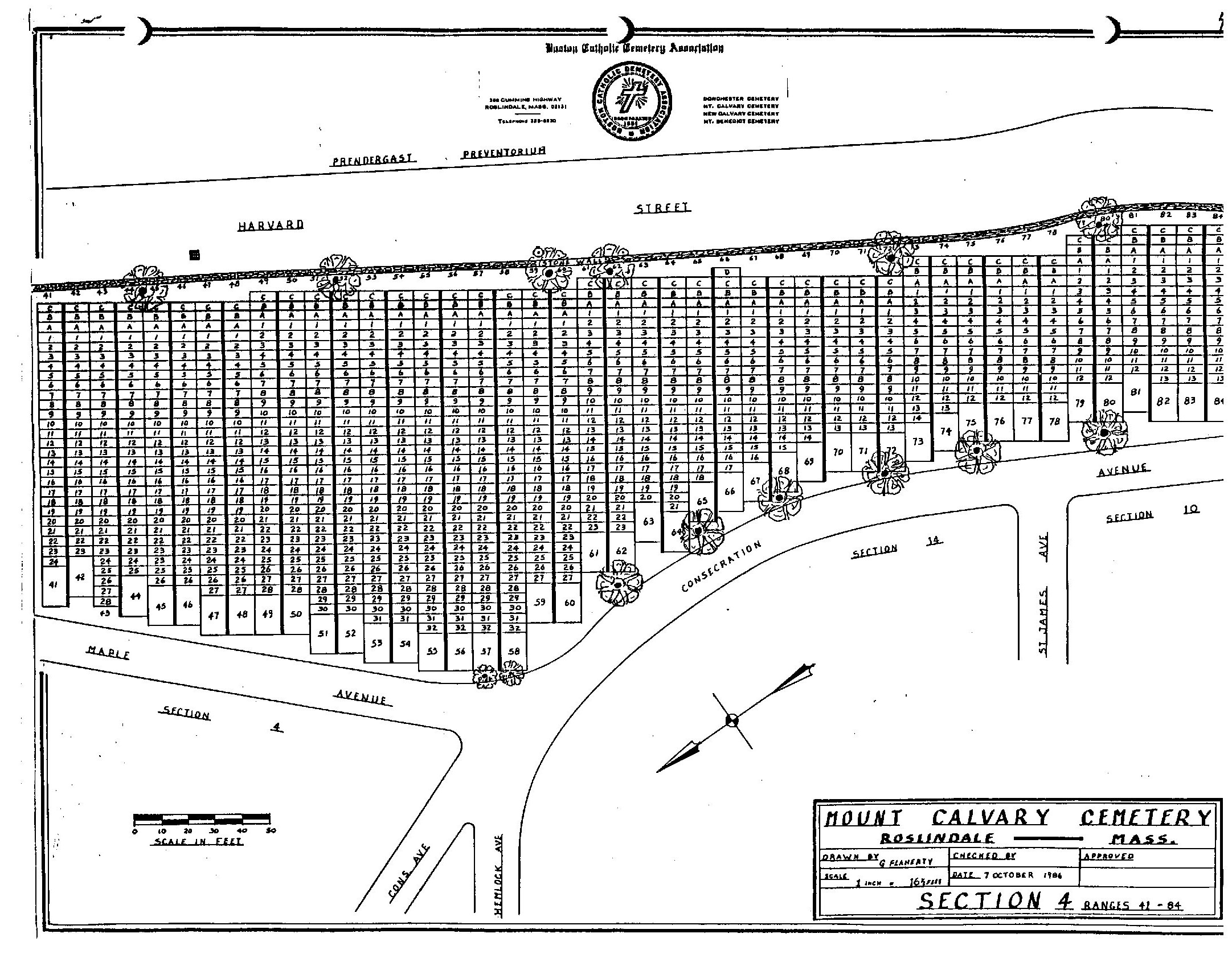

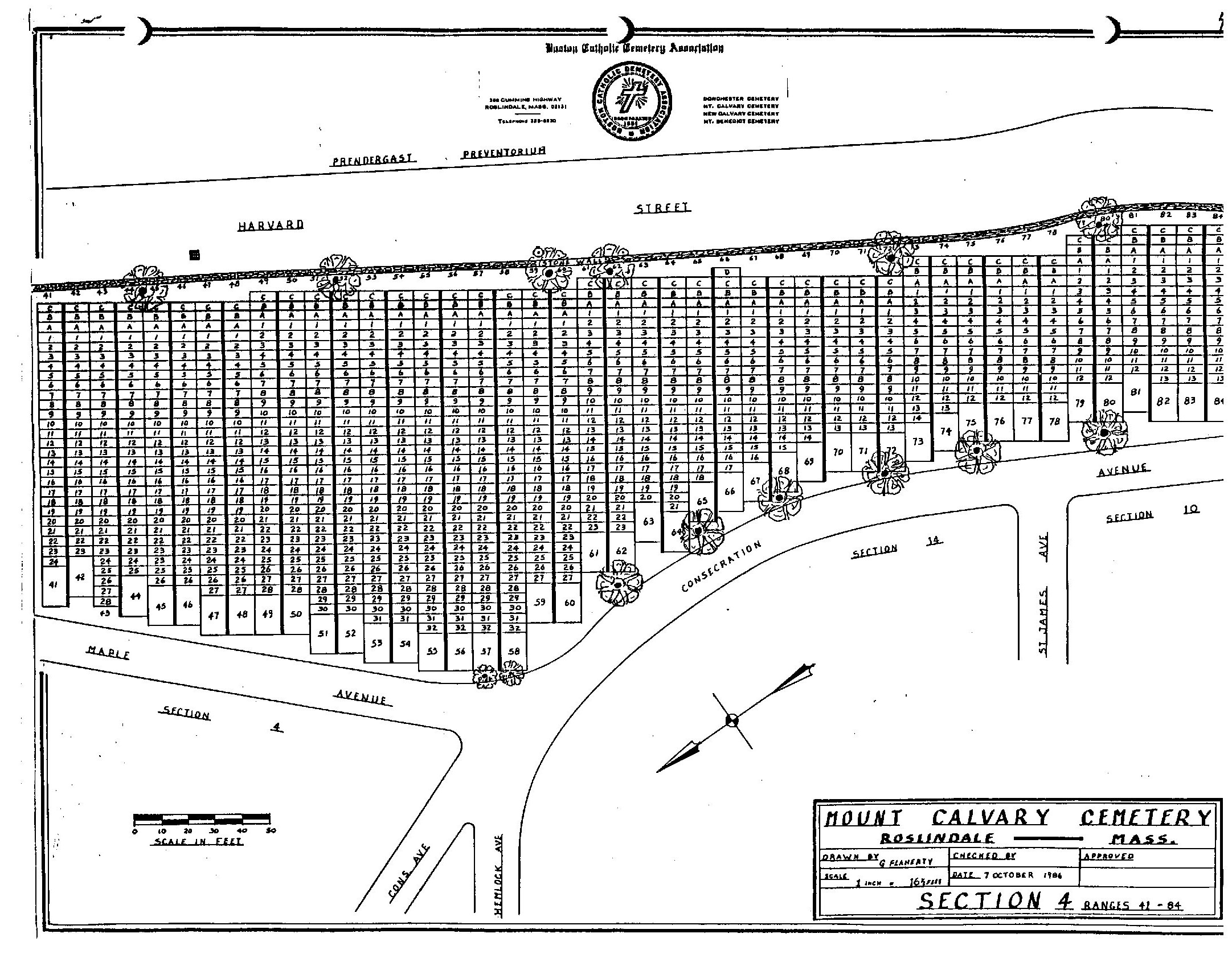

What is a grid settlement?

In urban planning, the grid plan, grid street plan, or gridiron plan is a type of city plan in which streets run at right angles to each other, forming a grid.

Who does Cavalry Portfolio collect for?

Cavalry Portfolio Services, LLC is one of the largest debt collection agencies in the United States. They usually work for companies such as Bank of America or Chase credit card companies/banks. But they will also work for cell phone companies, doctor's offices, and other credit card debt companies.

How do you beat debt collectors?

You can stop calls from collection agencies by sending a certified letter asking them to stop calling. Debt collectors must send you a written “validation notice” that states how much money you owe, the name of the creditor and how to proceed if you want to dispute the debt.

How do you answer a summons without a lawyer?

Take your written answer to the clerk's office. If you've decided to take your answer to the clerk's office in person for filing, bring your originals plus at least 2 copies. The clerk will take your documents and stamp each set of papers "filed" with the date. They will then give the copies back to you.

How much is the contact lens settlement?

Alcon and Johnson & Johnson Vision Care have agreed to settle the claims against them with a $75 million class action settlement. Alcon will contribute $20 million, while Johnson & Johnson will contribute $55 million.

Does Luxottica own 1800contacts?

In June 2012, 1-800 Contacts was sold to WellPoint (now Anthem). In 2013 Wellpoint sold 1-800 Contacts to Thomas H. Lee Partners and glasses.com to Luxottica. AEA Investors acquired a majority interest in 1-800 Contacts in December 2015.

How do I file a claim on Facebook?

There are two ways to submit this claim form to the Settlement Administrator: (a) online on this page; or (b) by U.S. Mail to the following address: Facebook Internet Tracking Litigation, c/o Settlement Administrator, 1650 Arch Street, Suite 2210, Philadelphia, PA 19103.

Capital One Settles For $75.5 Million

The most famous TCPA settlement occurred in August 2014, when Capital One (and three collection agencies) agreed to pay $75.5 million to end a clas...

Bank of America Settles For $32 Million

Some other notable TCPA settlements include: 1. HSBC: $40 million (Sep. 2014) 2. FreeEats.com and AIC Communications: $32.4 million (Sep. 2017) 3....

Woman Awarded $229,500 For TWC Robocalls

Over a span of less than a year, Araceli King of Texas received more than 150 robocalls from Time Warner Cable (TWC). These calls reminded Ms. King...

Dish Network Hit With $280M Fine, $61M Verdict

In January 2017, a North Carolina jury hammered Dish Network with a $20.5 million award in a class action case filed because of 51,000 telemarketin...

ClassAction.com Will Fight For You

As one of the largest consumer protection firms in the country–with 300 attorneys and a support staff of over 1,500–we are one of the few with the...

What happens if you default on a debt settlement?

If you default, the debt collector can then recover the full amount they sued you for without ever having to prove their case. This is a favorite tactic of debt buyers who know that when push comes to shove, they may not be able to prove that you owe them any money.

Who sued you for an old debt?

The notorious debt buyer Cavalry Portfolio Services has sued you for an old debt that they bought from an original creditor . You are considering whether to fight them or to reach a reasonable settlement and get on with your life. You now have to determine how much is a good settlement with Cavalry Portfolio Services ?

When did the TCPA settlement happen?

The most famous TCPA settlement occurred in August 2014, when Capital One (and three collection agencies) agreed to pay $75.5 million to end a class action suit that arose from the bank’s use of an autodialer to call consumers’ cell phones. Here are the five largest TCPA settlements in history:

How do companies violate the TCPA?

Companies violate the TCPA (Telephone Consumer Protection Act) by illegally contacting consumers, often via autodials and/or robocalls. These violations can lead to multimillion-dollar class action settlements. Contact us for a free legal consultation. 855.300.4459. Breadcrumb.

How much did the TCPA increase in 2015?

From just 2014 to 2015, there was a 45 percent increase. These soaring numbers are due to a number of factors, including a boost in public awareness of the TCPA and the expansion and strengthening of the Act. Violations can lead to lawsuits, which often lead to settlements.

How much did Araceli King get for TWC?

Woman Awarded $229,500 for TWC Robocalls. Over a span of less than a year, Araceli King of Texas received more than 150 robocalls from Time Warner Cable (TWC). These calls reminded Ms. King to pay her bill, even though she had never been late with a payment.

Who was the lead plaintiff in the Do Not Call case?

Lead plaintiff Dr. Thomas Krakauer said, "This case has always been about enforcing the Do Not Call law and protecting people from nuisance telemarketing calls. I am thrilled with the jury's verdict, and thrilled we were able to win this enforcement action."

Can a TCPA lawsuit lead to a settlement?

Violations can lead to lawsuits, which often lead to settlements. Over the past few years, for the reasons noted above, TCPA settlements have grown exponentially larger and more frequent. If you are receiving unwanted calls or messages, contact us today to learn your rights and options under the TCPA.

When is the deadline to file a claim for Cavalry?

The deadline to submit a claim was July 29, 2020, and has now passed. If your Account had an outstanding balance with Cavalry as of January 2, 2020, you have an Open Account with Cavalry and you could have claimed a pro rata share of debt relief of up to $599 or claimed a pro rata share from the Cash Fund.

Why is a settlement notice authorized?

A court authorized the Settlement Notice because you have a right to know about a proposed settlement of this class action lawsuit, and about all of your options, before the Court decides whether to approve the Settlement. If the Court approves the Settlement and after any objections or appeals are resolved, an administrator appointed by ...

What happens if you don't have a Cavalry account?

If your Account did not have an outstanding balance with Cavalry as of January 2, 2020, you have a Closed Account with Cavalry and you could have claimed a pro rata share from the Cash Fund but not debt relief.

What is class action litigation?

What is this class action litigation about? A class action is a lawsuit in which the claims and rights of many people are decided in a single court proceeding. Representative plaintiffs, also known as “Class Representatives,” assert claims on behalf of the entire class.

What is a class action against HSBC?

In 2015, Plaintiff Saber Ahmed filed a class action against HSBC Bank USA, N.A. for violations of the TCPA. In 2017, another Plaintiff, John Monteleone, joined and a First Amended Complaint was filed alleging that HSBC and PHH Mortgage Corporation negligently and willfully violated the TCPA. After discovery, motions, and a mediation, the parties reach a settlement in 2018. The Court preliminarily approved a settlement in June 2019, and on December 30, 2019, the court granted final approval to the parties settlement agreement. This included the class definition, articulated as:

When did the parties reach a settlement?

After discovery, motions, and a mediation, the parties reach a settlement in 2018. The Court preliminarily approved a settlement in June 2019, and on December 30, 2019, the court granted final approval to the parties settlement agreement. This included the class definition, articulated as: