Credit card settlement is basically a mutual agreement between the credit card holder and the bank/credit card issuer that helps the credit card holder when it becomes too difficult for him/her to keep up with the credit card dues. This might be because of multiple reasons, from actual financial emergencies to reckless expenses on credit cards.

What is the process of credit card settlement?

What is the credit card settlement process

- Visit the issuer or a debt settlement agency

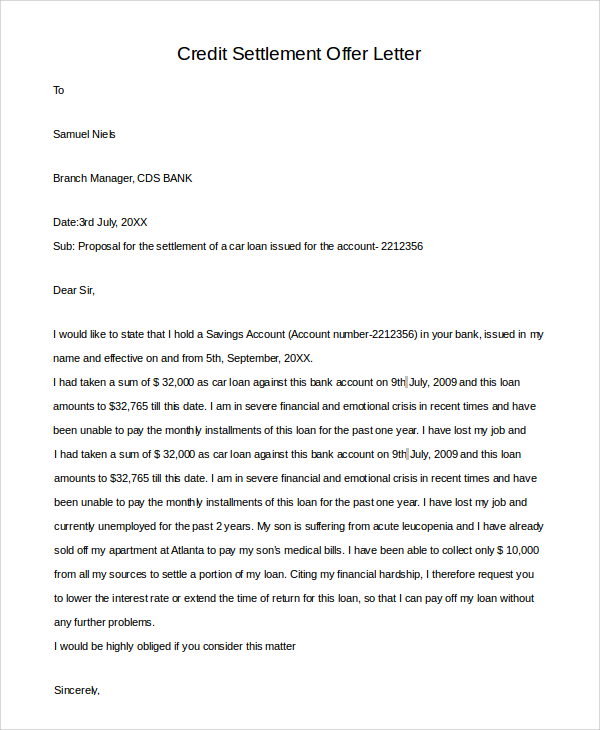

- Explain your inability to make payments via a credit card settlement letter and mention that you’re open to negotiating other repayment terms

- Offer a lump sum or inform the issuer of your plans to file for bankruptcy

Should I accept a credit card settlement?

You should, however, avoid debt settlement companies. To get the ball rolling, you (or your attorney) should contact the creditor and make an offer to settle the debt. A credit card company might accept a settlement if you're very delinquent on your payments.

How to make a settlement with a credit card company?

- Stop using your cards immediately. ...

- Your accounts must be past due. ...

- Be patient. ...

- Speak with the right person. ...

- Make your pitch. ...

- Present your offer verbally. ...

- Have your funds ready to go. ...

- What should you offer? ...

- Let them know you have other creditors. ...

- Be humble and show remorse. ...

Are credit card settlements good?

Settlements generally provide you with a cheaper way of paying the creditor an amount that will make the credit disappear, by closing the credit card or loan account. But having a settled status against a credit card or a loan account has a very negative impact on your credit score.

What is meaning of settlement in credit card?

As stated above, a credit card settlement is when a credit card company forgives a portion of the amount you owe in exchange for you repaying the remaining amount. The remaining amount can be repaid in one single payment or as a series of payments, as determined through the specific agreement.

Is settlement good for credit card?

Settlements generally provide you with a cheaper way of paying the creditor an amount that will make the credit disappear, by closing the credit card or loan account. But having a settled status against a credit card or a loan account has a very negative impact on your credit score.

What happens if I go for credit card settlement?

Credit card bill settlement is the process wherein the bank asks a person to pay an overdue settlement instead of his dues if he is not able to pay his dues. The bank will thereafter discontinue the credit card. Although the person is free of the dues, it hurts your CIBIL™ score.

What is card settlement activity?

What is credit card settlement? The credit card settlement process looks like this: You stop paying your monthly credit card bills. The money that you would have paid your creditors goes into a savings account, usually managed by a debt settlement agency.

How do I clear my credit card settlement?

What is the credit card settlement processVisit the issuer or a debt settlement agency.Explain your inability to make payments via a credit card settlement letter and mention that you're open to negotiating other repayment terms.Offer a lump sum or inform the issuer of your plans to file for bankruptcy.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Can I get loan after credit card settlement?

But if the settlement is made after the write-off, the credit report will be updated as “post-write-off settled”. Under both the conditions, it will impact your credit score and will be considered as a negative aspect by the banks and lenders. They will be reluctant to give you a loan in future.

How do I raise my credit score after a settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

Can I get a credit card after debt settlement?

It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement. Some needed years before they could get a new credit card or loan.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What does settlement mean in banking?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What is settlement in the payment process?

Payment settlement involves collecting the funds for the amount recorded for an order. For example, when using credit cards, the settlement process specifically involves contacting the payment system and collecting the required amount of funds against the credit card.

Does settling a credit card hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

Will settling a charge off raise credit score?

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time.

How long does a settlement stay on your credit report?

seven yearsA settled account remains on your credit report for seven years from its original delinquency date. If you settled the debt five years ago, there's almost certainly some time remaining before the seven-year period is reached. Your credit report represents the history of how you've managed your accounts.

What is credit card settlement?

Credit card debt settlement is a strategy for eliminating your debt by offering to make a single, lump sum payment to credit card companies. To make this credit card lump sum settlement more attractive to your creditors, you’ll need to stop making your monthly payments for a period of time – often six months or more. During that time, you’ll make payments to a savings account with a debt settlement agency instead. When your overdue balances become quite high and the credit card companies are worried you might not be able to make good on your debt, the agency will contact your creditors with your settlement offer. Your creditors may be likely to accept your offer if they feel they have little chance of getting additional payments from you.

What is credit card settlement’s greatest advantage?

The biggest benefit of negotiating credit card settlement is being able to become debt-free without having to pay your debt in full. Most successful settlements require consumers to pay 25% to 80% of their original debt.

What is credit card settlement vs. credit card debt management?

Debt management is an alternate debt relief strategy for paying down credit card debt. Under a debt management plan, you’ll continue making regular payments on your credit card balances, so your credit rating won’t be adversely impacted. You’ll also get help and support from a credit counseling agency that will enable you to pay down your debt more quickly and help you to learn to live debt-free in the future.

What is credit card settlement’s impact on credit scores?

It may take as long as seven years to rebuild your credit, during which time you’ll likely have difficulty getting credit cards, applying for loans, renting an apartment in your name, or qualifying for a mortgage.

What is a credit card settlement?

A settlement is a tactic you can employ when you find it difficult to keep up with your credit card dues. This can happen because of a sudden emergency that requires ample financing for a long period of time, or because of reckless spending. Whatever the reason may be, the main issue at hand is that your credit card dues will grow rapidly every month and cause severe financial stress. In such a situation, it’s consider a settlement that is offered by both banks and debt settlement agencies.

How long does a settlement on a loan last?

This is mainly because your credit history records a settlement as a black mark that can last up to 7 years and hamper most subsequent loan applications.

Why pay a lump sum?

Paying a lump sum helps you settle credit card debt. Credit card settlement severely harms your credit score. Use credit cards only to the extent that you can afford. Credit cards, when used wisely, work in favour of your personal finances. To ensure maximum benefits, you must ensure that your credit card usage ties in with what you can afford.

Do credit cards give you access to a whole range of benefits?

This can be hard to resist given that credit cards boost your purchasing power and also give you access to a whole range of benefits. Depending on the issuer, you may get interest-free borrowing periods, access to special amenities and so on. However, in the event that you do find yourself with significant outstanding debt, ...

Can you settle a credit card without a lump sum?

Here, you may be advised to either set aside a lump sum and offer it in exchange for a complete waiver, or directly appeal for a settlement. Credit card payment settlements are only done in extremely rare cases and issuers do not encourage it. You should consider a settlement as a last resort and even then, there is a very low chance that the issuer will agree to it without you making a lump sum payment. The credit card settlement percentage depends on the issuer and your ability to negotiate.

What is a credit card settlement process?

Advertisements from credit card debt settlement companies suggest that you can use the credit card settlement process to get out of debt for just pennies on each dollar owed. But like all things that sound too good to be true, there are many potential downsides to credit card settlement that you should be aware of before entering a credit card settlement process.

How much can a credit card company settle?

Sometimes the credit card settlement process is effective, and consumers can settle their debt for anywhere between 25% and 80% of the original amount they owed. But other times, credit card companies may refuse to settle and may take consumers to court instead.

How to settle credit card debt without damaging credit?

When consumers want to know how to settle with credit card companies without damaging their credit rating, we typically recommend a debt management program . Debt management involves setting a budget you can live with while you continue to pay down your debt over time. For a small fee, we’ll take responsibility for paying all your bills on time – you just have to make one payment to an account with ACCC each month and we’ll take care of the rest. We’ll also work to seek reductions in interest rates, finance charges, and late fees to help you pay down your debt more quickly.

What happens if you stop paying your credit card bills?

You stop paying your monthly credit card bills. The money that you would have paid your creditors goes into a savings account, usually managed by a debt settlement agency. After several months, when your credit card account is significantly overdue, your settlement agency approaches your credit card company and proposes to settle your debt ...

Does the credit card settlement process affect your credit rating?

Because you must stop paying your bills in order to make debt settlement more attractive to your creditors, your credit rating will inevitably be severely damaged. In fact, it may take as long as seven years before you can apply for loans, credit cards, mortgages, and credit.

What is the settlement for Visa?

What is the Payment Card Settlement? The settlement is the result of a class action lawsuit against Visa and Mastercard. Under its terms, Visa and Mastercard will pay between $5.54 and $6.24 billion dollars to businesses that accepted Visa and Mastercard between 2004 and 2019. By settling, the lawsuit will not go to trial.

Who is eligible to get money from the settlement?

Business owners that accepted Visa and/or Mastercard at any point between 2004 and 2019 are eligible to file a claim.

Why was Visa sued?

Visa and Mastercard were sued for allegedly violating antitrust laws. That is, they were accused of putting rules into place that would prevent competition or incentive to lower interchange rates. The lawsuit claims that if Visa and Mastercard had not engaged in that behavior, businesses would have paid lower interchange fees.

Why do businesses overpay for credit card processing?

Even after this settlement, many businesses will still overpay for credit card processing. That’s because there are multiple fees that make up the final cost, and most businesses aren’t sure where they can save .

Does CardFellow have a cancellation fee?

Our independent experts have negotiated optimal pricing models and terms for our members, resulting in lower-than-market costs with no cancellation fees, lifetime rate-increase protection, and CardFellow’s complimentary statement monitoring.

Will a lawsuit go to trial?

By settling, the lawsuit will not go to trial. Instead, all parties agree to Visa and Mastercard paying the amounts listed above to affected businesses. The Court will weigh in on whether the settlement is fair and reasonable.

Why did Visa and Mastercard file a lawsuit?

The lawsuit is about claims that merchants paid excessive fees to accept Visa and Mastercard cards because Visa and Mastercard, individually, and together with their respective member banks, violated the antitrust laws.

Can a merchant file a claim without an attorney?

It is important to know that every merchant can file their claim with the Claims Administrator and Class Council during the claim-filing period without using the services of an attorney or a third-party claiming service in order to participate in any monetary relief at no-cost.

Can settlement money be owed?

If you want to help businesses win settlement money they may be owed, then please reach out to us for information. If you have clients that are business owners then this is a way to help your clients and earn some extra money.

What is clearing and settlement?

So to start with, clearing and settlement in financial service industry refers to all activities from the time a commitment is made for a transaction until it is settled. So the transactions which has been successfully authorized by Issuing Bank has to be settled before sales can be deposited into the merchant’s bank account. When it comes to Credit card settlement, this is usually being done in three stages:

What is clearing a card?

Clearing: Through this process Issuing Bank exchanges transaction information with the Acquiring Bank. After successful reconciliation with the merchant, Acquiring Bank generates outgoing settlement file for various Card schemes/networks (MasterCard ,Visa etc.).These Card networks then further break these files into clearing files and is sent to different Issuing banks.

What is credit card 101?

Credit card 101: Clearing and settlement While the first article covered the basics of authorization process ,this article delves into the second leg of credit card transaction lifecycle :Clearing and settlement which essentially involves reconciliation and transfer of funds among Issuer, Acquirer and merchant. #payments #creditcardtransactionprocessing

What is a transaction submitted?

Generally transactions are submitted electronically and all POS /virtual payment handling systems are modified to naturally do that at pre-characterized stretches. Generally toward the finish of the business day, the vendor terminal makes a batch of the multitude of transactions finished during the day and sends the equivalent to the acquirer.

What is the second leg of the credit card life cycle?

I ended the previous article by mentioning that obtaining an authorization is just the first step and in this article I would be explaining the second leg of the Credit card transaction life cycle, that is Clearing and Settlement. Technically, the authorization leg is also called BASE 1 and clearing/settlement leg is called BASE 2 .If you haven't read the article on authorization process, I would recommend you to go through that first. Here is the link for the same.

Does an issuance bank charge an exchange fee?

Issuing Bank also levies an Interchange fees on the Acquirer and adjust the same while transferring the fund to Acquirer. We have to remember that when it comes to credit card, it's an unsecured line of credit and eventually any bad debt or fraud transaction is going to fall on Issuer's book and Interchange fees helps the Bank in covering those risks.