Cash settlement is a settlement option frequently used in trading of futures and options contracts, where at the expiration date the underlying assets are not physically delivered while only the difference is being paid by either of the parties depending on the market rate at that point of time; it is the more convenient and preferred method of settlement as it doesn’t require to take a physical position in any trade.

Full Answer

What is a cash settlement in options?

What it is: A cash settlement is a payment in cash for the value of a stock or commodity underlying an options or futures contract upon exercise or expiration.

What is a'cash settlement'?

What is a 'Cash Settlement'. A cash settlement is a settlement method used in certain futures and options contracts where, upon expiration or exercise, the seller of the financial instrument does not deliver the actual (physical) underlying asset but instead transfers the associated cash position.

How do you illustrate a cash settlement using a put contract?

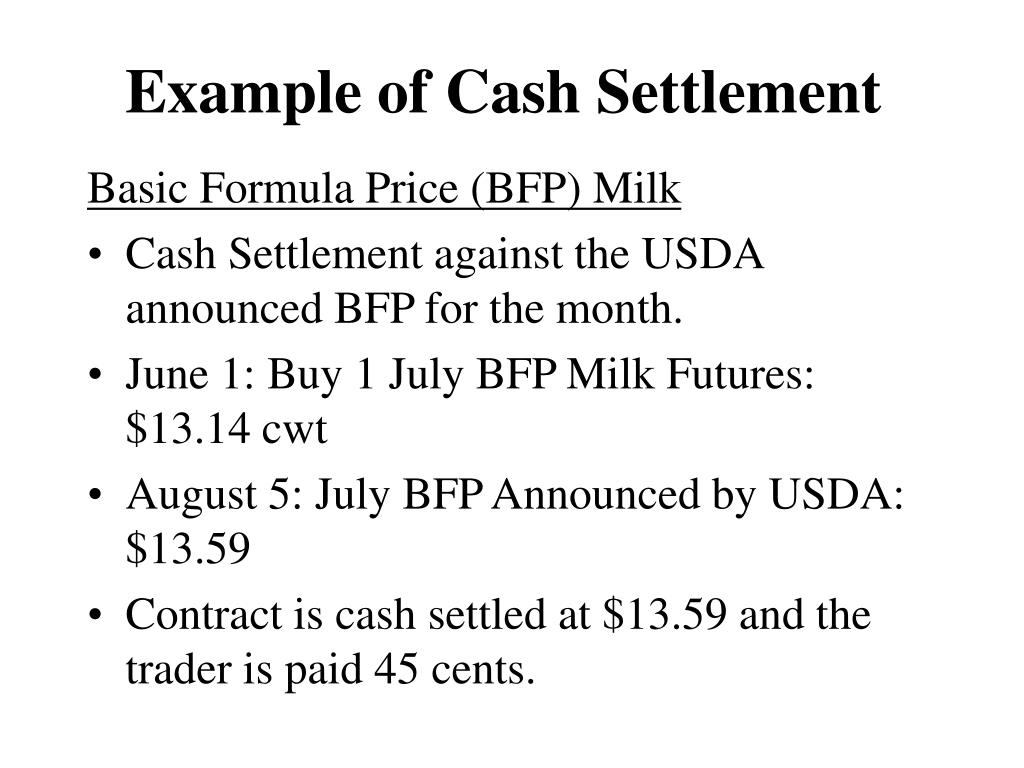

To illustrate a cash settlement using a put futures contract, suppose a contract expires and the spot price in the market of the underlying asset (let's say oranges) is, $100. The price specified in the contract is $150.

What happens to cash settlement at expiry?

Cash settlement can become an issue at expiration because without the delivery of the actual underlying assets, any hedges in place before expiration will not be offset - this means that a trader must be diligent to close out hedges or roll over expiring derivatives positions in order to replicate the expiring positions.

What is pre-settlement money?

Pre-settlement funding is a cash advance for individuals that have a pending personal injury lawsuit (automobile accident, workers comp case or slip and fall, etc.) that are in need of money now.

What should I do with settlement money?

Here is a list of steps to take once you receive a settlement.Take a Deep Breath and Wait. ... Understand and Address the Tax Implications. ... Create a Plan. ... Take Care of Your Financial Musts. ... Consider Income-Producing Assets. ... Pay Off Debts. ... Life Insurance. ... Education.More items...

How long do banks hold settlement checks?

Cashing in Your Settlement Check With Your Bank Generally, a bank can hold funds: For up to two business days for checks against an account at the same institution. For up to five additional days for other banks (totaling seven days)

Can I get a loan off a settlement?

To take out a settlement loan, you apply for a loan after filing an eligible lawsuit. The lawsuit loan company evaluates your case's merit, weighs your chances of winning the suit or the case being settled, and estimates how much you can expect to receive. Based on that information, it may offer you an advance.

Do settlements count as income?

Settlement money and damages collected from a lawsuit are considered income, which means the IRS will generally tax that money. However, personal injury settlements are an exception (most notably: car accident settlements and slip and fall settlements are nontaxable).

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How long does it take for a $30000 check to clear?

Most checks take two business days to clear. Checks may take longer to clear based on the amount of the check, your relationship with the bank, or if it's not a regular deposit. A receipt from the teller or ATM tells you when the funds become available.

What is the largest check a bank will cash?

Banks don't place restrictions on how large of a check you can cash. However, it's helpful to call ahead to ensure the bank will have enough cash on hand to endorse it. In addition, banks are required to report transactions over $10,000 to the Internal Revenue Service.

What happens when you deposit over $10000 check?

Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government. The $10,000 threshold was created as part of the Bank Secrecy Act, passed by Congress in 1970, and adjusted with the Patriot Act in 2002.

How does a settlement loan work?

A lawsuit settlement loan provides cash in advance for pending settlement award or lawsuit judgment. The borrower can pay back the loan once the funds from the settlement are disbursed. Interest will accrue while the loan is outstanding, sometimes at high rates.

Can my lawyer cash my settlement check?

While your lawyer cannot release your settlement check until they resolve liens and bills associated with your case, it's usually best to be patient so you don't end up paying more than necessary.

What is the interest rate on a settlement loan?

The interest rates on lawsuit loans run between 27% and 60% a year—rates that are comparable to payday loans. On a $25,000 loan, the interest can cost you $12,500 or more in just one year.

How can I avoid paying taxes on a settlement?

Spread payments over time to avoid higher taxes: Receiving a large taxable settlement can bump your income into higher tax brackets. By spreading your settlement payments over multiple years, you can reduce the income that is subject to the highest tax rates.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

Should I take a lump sum or structured settlement?

You should take a lump sum settlement for all small settlements and most medium-sized settlements (less than $150,000 or so). But if you are settling a larger case, there are two good reasons for doing a structured settlement. First, the structure guarantees that you won't spend the money too fast.

Can you put settlement money in a Roth IRA?

Importantly, if your "settlement" is paid to you in the form of a paycheck with Social Security and Medicare tax withheld, Kiely said, it is considered "earned income" so you could contribute up to $6,000 in an IRA. It sounds like you're still working, even if the subbing is unsteady.

Why is cash settlement important?

The main contribution of cash settlement would be to reduce the cost and time for the contract settlement since it is cash-settled, there is only one transaction bound to happen during the end of the contract reducing the cost, and since there is no physical delivery , it saves a lot of time and money resulting in high volumes in the market.

What is a sash settlement?

Sash settlement is a type of settlement where there is no transfer of securities, and only the difference amount is transferred against the physical settlement where securities are ought to be transferred.

What is futures option?

Futures and options enable the buyer of the contract to honor the contract by buying the security at a future date; like for instance, the buyer of an equity call option buys the option to buy the security at a certain price on a certain date, so instead of delivering the security on settlement date they just calculate the difference between the current market price and price mentioned in the contract and that difference is exchanged between the parties.

Is it safe to trade cash settlement accounts?

It is equally safe, too, as cash-settled accounts require margins to trade and they have to maintain a minimum balance in the account to facilitate trading in the market, which kind of ensures the party against any future default.

Is an American option available with European options?

Disadvantages. It is only available with the European options and not on American options; European options are not very flexible as compared to European options as they can only be exercised during the maturity, and an American option can be exercised throughout the life of the transaction.

What Is Pre-Settlement Funding?

Pre-settlement funding (sometimes called a “lawsuit advance” or “alternative litigation finance”) is what happens when a plaintiff (an injury victim or someone else bringing a lawsuit) is provided with his or her compensation in advance of a negotiated settlement or a jury verdict.

Is a Pre-Settlement Cash Advance a Loan?

Pre-settlement cash advances are different from conventional loans in several important ways. If your lawsuit does not succeed or if your compensation is not paid for any reason, you keep the pre-settlement cash advance and it does not require repayment.

What Can Pre-Settlement Funding Accomplish?

If you need immediate cash while your personal injury case is pending, the right settlement funding company can provide it. By easing your financial pressures, pre-settlement funding can give you the additional time that you and your attorney need to negotiate a better settlement.

What Else Should You Know?

It’s not always easy to prove that you’ve been injured by someone who was negligent, so it’s important to be advised and represented by a successful and effective personal injury attorney.

What is a cash settlement?

In general, a cash settlement is simply the process of using cash to settle some sort of outstanding obligation, thus fulfilling the terms of the transaction and allowing the matter to be considered resolved ...

Why is a cash settlement ordered?

In the matter of legal situations, a cash settlement is often ordered as a means of restitution in the event of a lawsuit.

Why do vendors offer cash settlements?

Some vendors will also offer a client a cash settlement in order to discharge an outstanding debt. This is often the case when the customer is facing severe financial problems and may be considering bankruptcy. In order to avoid being included as a listed creditor in the bankruptcy, the vendor may offer a cash settlement offer to the client that may be up to half the actual amount owed. Often, this is sufficient to at least cover the actual expenses of the vendor, although it eliminates any profit on the invoiced transactions.

What happens if you don't honor a cash settlement?

In the event that the terms of the cash settlement are not honored, then additional restitution may be ordered, assets may be seized to settle the debt, or one of the parties may spend time behind bars. Is Amazon actually giving you the best price? This little known plugin reveals the answer.

Examples of Cash Settlement Method in a sentence

Cash Settlement Method: Collateralized Cash Price, provided that: (i) "Cash Settlement Reference Banks" shall be five leading dealers selected by the Calculation Agent in its discretion, acting in good faith and in a commercially reasonable manner; and (ii) "Quotation Rate" shall be bid.

Related to Cash Settlement Method

Settlement Method means, with respect to any conversion of Notes, Physical Settlement, Cash Settlement or Combination Settlement, as elected (or deemed to have been elected) by the Company.