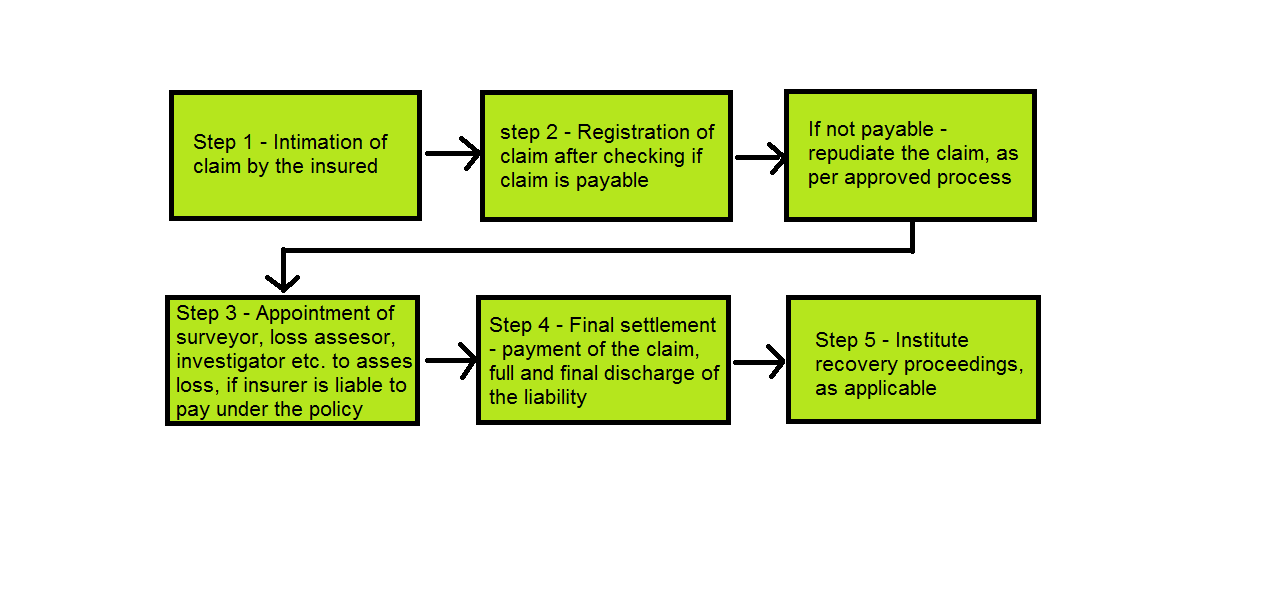

What is claim processing and settlement procedure? It is a process where the policyholder claims financial support from the insurer. Claim Settlement in general insurance is offered only after the due process gets completed.

Full Answer

What is a claim settlement?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury. Tools exist that allow you to automate the entire process.

What is the process of claims processing?

Claims processing starts when you file a request with the insurance provider – either through an insurance agent or medical biller. It is a procedure and the insurance company has to check and counter check the claim request for authenticity. Remember that honesty is paramount.

How many stages are there in a typical claim settlement process?

These were the 4 primary stages of a typical claim settlement process. Depending on the insurance agency, there maybe additional intermediate steps. But keep these broad-level steps in mind to have an overview of how the claims settlement is progressing.

What is claims adjustment and claim procedures?

Insurance Operations – Claim Procedures and the Claim Adjustment Process Claims adjusting is the process of determining coverage, legal liability, and settling a claim.

What is claim settlement procedure?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury. Tools exist that allow you to automate the entire process. Claim Genius too has a wide array of AI-based tech for automating the claims settlement process.

What does claim processing mean?

In essence, claims processing refers to the insurance company's procedure to check the claim requests for adequate information, validation, justification and authenticity. At the end of this process, the insurance company may reimburse the money to the healthcare provider in whole or in part.

What is claims processing in BPO?

Insurance claims outsourcing is the process of hiring a third-party company to take care of your client's insurance claims. The outsourced party will be responsible for handling the whole process.

What is the first step of processing a claim?

The first step in filing a claim involves reporting the accident to the insurance company. Ideally, this should be done within 24 hours of the accident, and certainly within a few days of the accident occurrence.

What are the duties of a claims processor?

Insurance Claims Processor are clerks who process claims for insurance companies. Some of the duties that they perform include processing new insurance policies, modifying existing ones and obtaining information from policyholders to verify the accuracy of their accounts.

What happens after a claim is filed?

After the adjuster submits a report on your claim, your insurance company may issue a settlement, which is the money they agree to give you to fix or replace your damaged property, for example, fix a hole in your roof, repair your car, or replace your belongings.

What are call center claims?

Claims processing is a transaction processing service that is opposed to calling center services dealing with inbound and outbound services. It essentially deals with the back-end work or what is called the "back office work".

What is EOB?

EOB stands for Explanation of Benefits. This is a document we send you to let you know a claim has been processed. The most important thing for you to remember is an EOB is NOT a bill.

What are the different types of insurance claims?

These various general insurance types of insurance policies include:Health Insurance. Health insurances are types of insurance policy that covers the expenses incurred due to medical care. ... Home Insurance. ... Fire Insurance. ... Travel Insurance. ... Factors Defining Your Life Insurance Coverage.

What is claim system?

At its core, a claims management system is a transaction-enabled system of record that an adjuster or claims handler (or an automated process) uses to: Gather and process information regarding the underlying policy and coverages, the claim, and the claimant. Evaluate and analyse the circumstances of the claim.

What are the steps in processing a claim?

Your insurance claim, step-by-stepConnect with your broker. Your broker is your primary contact when it comes to your insurance policy – they should understand your situation and how to proceed. ... Claim investigation begins. ... Your policy is reviewed. ... Damage evaluation is conducted. ... Payment is arranged.

How long does it typically take to receive payment with a clean claim?

A Clean Claim Report must be filed with the Office of Financial and Insurance Regulation for each claim that a health plan has not timely paid. View a Clean Claim Report here. A clean claim must be paid and corrected of all known defects within 45 days after it is received by the health plan.

How a health insurance claim is processed?

Your Claim Intimation/Reference Number will be generated. The hospital should fill in and submit your cashless claim form to your insurer. An authorisation will be sent to the hospital by the insurance company on receiving your cashless claim form. Your medical expenses will be paid by the insurance company.

What is claims in medical billing?

A health insurance claim or a medical insurance claim is a request that is raised by the policyholder for compensation of the expenses incurred for the treatment.

What is claims processing?

Claims processing involves the actions an insurer takes to respond to and process a claim it receives from an insured party. A claim is that payment an insurer makes to an insured party with respect to paid premiums. Note that when processing a claim, the insurer undertakes several actions before reaching a conclusion.

What happens when an insurance company processes a claim?

Note that when processing a claim, the insurer undertakes several actions before reaching a conclusion. The company will review, investigate, and as part of their obligation, act on the claimant’s filing according to what is set out in the insurance contract.

How does a claim start?

Claims processing starts when you file a request with the insurance provider – either through an insurance agent or medical biller. It is a procedure and the insurance company has to check and counter check the claim request for authenticity.

What is the last step in the claims process?

4. Claims settlement. The settlement is the last step in the claims process and involves settling on an amount to be paid to the insured or a healthcare provider. How long it takes to make payments depends but should be relatively faster once the company commits to pay.

What does an adjuster do when you file a claim?

Once you file a claim, an adjuster will investigate, review, and evaluate it based on the policy, loss or damage and/or records from a healthcare provider. This stage also involves identifying liable parties and what deductibles are applicable.

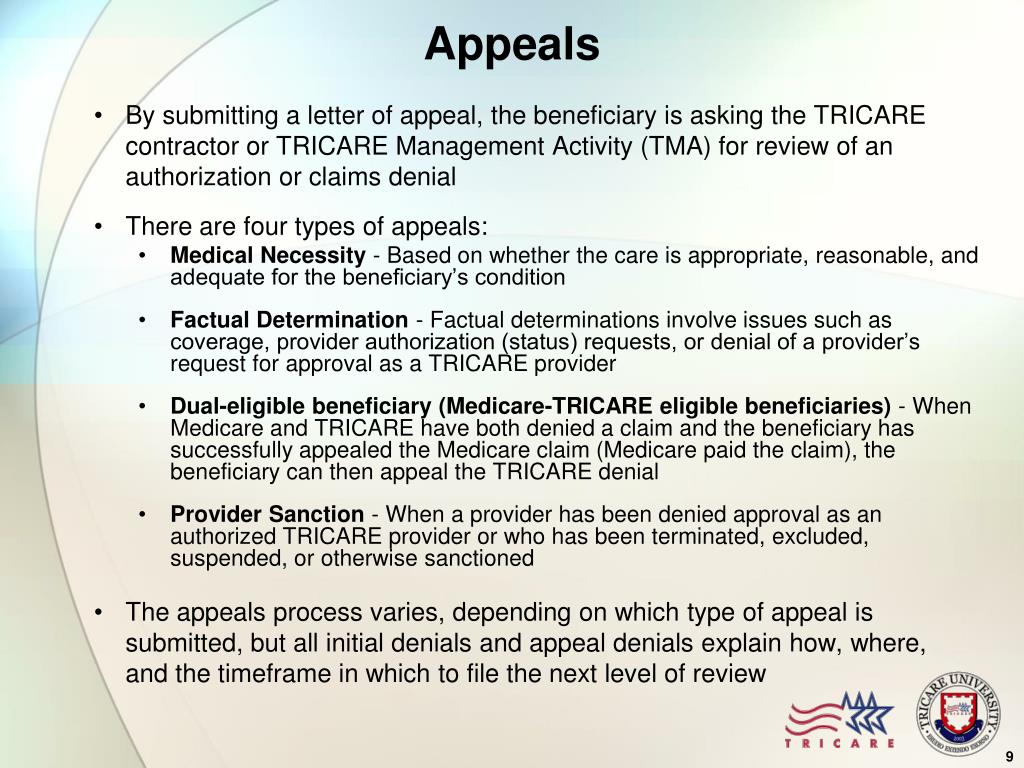

What does it mean when an insurer rejects a claim?

An insurer has the authority to reject claims that it deems invalid if for instance there are elements of forgery. The company will also deny the request if the claim is not in tandem with the terms of the insurance policy.

What is claims processing?

Claims processing begins when a healthcare provider has submitted a claim request to the insurance company. Sometimes, claim requests are directly submitted by medical billers in the healthcare facility and sometimes, it is done through a clearing house. In essence, claims processing refers to the insurance company’s procedure to check ...

What is the process of insurance company adjudication?

Insurance companies use a combination of automated and manual verification for the adjudication of claims. When this is done, payment determination is done, wherein the insurance company decides how much it is willing to pay for the claim.

What is the explanation of benefits?

Usually, the explanation of benefits includes details such as: Amount paid, amount approved, allowed amount, patient responsibility amount (in cases of copay or coinsurance), covered amount, discount amount and so on.

What is a reimbursement claim?

In case of a reimbursement claim, the policyholder first pays the medical bills himself and then, all these expenses will get reimbursed from the insurance company. A reimbursement claim is applicable if the insured policyholder avails of treatments at a non-networked hospital.

What happens after submitting pre-authorization form?

After submitting the pre-authorization form, the insurance company will evaluate the claim based on the form and then grant cashless claim settlements.

How do you check the status of your health insurance claim?

By visiting the insurance company’s official website, you can check the status after entering all relevant details.

How long does it take to get a pre-authorization form?

For planned treatment, the pre-authorization form should be submitted 3-4 days before admission. On the other hand, the form should be submitted within 24 hours in case of an emergency. A policyholder should obey these timelines to enjoy cashless claim settlements. If the timelines are breached, the claim might get delayed or rejected.

What documents do you need to submit to an insurance company for discharge?

Then, the policyholder needs to submit the discharge certificate or summary to the insurer along with a duly filled in claim form, medical reports, original bills, and other relevant documents.

How many ways does a health insurance claim get rejected?

A health insurance claim gets rejected in 3 ways.

Can you claim more than the sum insured?

Health insurance claims are allowable only up to the sum insured limit of the health insurance policy. If the claim surpasses the sum insured amount, the insured policyholder needs to pay the excess amount. So, every policyholder should check and be aware of the sum insured limit before applying for a health insurance claim.

How many stages are there in the insurance claim process?

The insurance claim process typically involves five main stages, from the moment you report your loss to the resolution of your claim. You can prepare for the process by gathering relevant documents (think receipts, original invoices and proof of ownership), gathering photos and accounts of the event or damage, ...

What happens after a claim is reported?

After the claim has been reported, it will need to be investigated by an adjuster to determine the amount of loss or damages covered by your insurance policy. The adjuster will also identify any liable parties, and you can help the process by providing any witness information or other parties’ contact information.

What does an adjuster do after a policy review?

Once the investigation is complete, the adjuster will go through your policy carefully to determine what is and isn’t covered under your policy, and inform you of any applicable deductibles that may apply to your case.

Who do you hire to evaluate damage?

Damage evaluation is conducted. In order to accurately evaluate the extent of the damage, your insurance adjuster may hire appraisers, engineers, or contractors to lend their expert advice. Once the evaluation is complete, your adjuster will provide you with a list of preferred vendors to help with repairs. You’re not obligated to hire these vendors, but it can save you a good deal of time and research.

What is insurance claims process?

Insurance claims Process. Insurance policies promise compensation for the financial loss that you suffer in case of emergencies which are covered under the policy. You buy an insurance policy for this promise and so when the covered contingency occurs, you expect the insurer to fulfil its promise and settle your claims.

Who settles a claim in a tribunal?

Depending on the ruling of the tribunal, the insurance company would settle the claim

How to avail cashless claim?

To avail a cashless claim you should seek treatment at a hospital which is tied-up with the insurance company. In a cashless claim, the insurer settles your hospital bills directly with the hospital and you don’t have to shoulder the financial burden

How long does it take to get a preauthorization form?

The form is available at the hospital. You should submit the form within 24 hours of emergency hospitalisation and 3-4 days before planned hospitalisation.

What is a claim in insurance?

Claim in an insurance policy is when you make a demand on the insurance company for payment of the policy benefits. A claim occurs when the event, which the policy covers, happens and such happening causes a financial loss. If the claim is covered under the insurance policy, the insurer pays the benefits promised under the plan ...

What is a third party claim?

Third party claims: Third party liability claims occur when any other individual is hurt or killed by your vehicle or if any third party property is damaged. The insurance claim process for third party claims is as follows –. You should inform the insurance company immediately of the claim.

What are the two types of claims under motor insurance?

Under motor insurance policies, there are two types of claims – third party liability claims or own damage claims. The insurance claim process for both these instances is different. Here’s what is the process under each instance involves –.

Why Do You Need to Be Well-Versed with The Claims Settlement Process?

The 4 Stages of The Claims Settlement Process

- <picture class="aligncenter wp-image-12897 size-full" title="The Claims Settlement Process - Sta…

1. At the accident site, immediately after the accident has taken place, the victim contacts the insurer directly or through the insurance broker agency.Your job as a carrier at this stage is to take down all the facts as an unbiased third party. A carrier takes detailed notes, either in a notebook …

Can We Help You?

- These were the 4 primary stages of a typical claim settlement process. Depending on the insurance agency, there maybe additional intermediate steps. But keep these broad-level steps in mind to have an overview of how the claims settlement is progressing. Claim Genius has tools and mobile-based apps that can fast-track the claims settlement process. Our AI can speed up d…