The important points

- A settlement is the amount paid from an insurer to their customer to settle the customer’s claim.

- Settlement amounts are determined based on the policy wordings, and usually allow the policyholder several options.

- Settlement payments can be calculated on the basis of replacement cost, actual cash value, agreed value, or other calculations of value.

How to negotiating an insurance claim settlement?

- When To Consider Self-Representation. It's certainly possible to represent yourself in a personal injury claim after an accident come away with a satisfactory result.

- Important First Steps & Tips. ...

- Estimating Your Damages. ...

- Sending Your Demand Letter. ...

- Countering and Accepting a Settlement. ...

How long does an insurance claim take to settle?

In general, state laws dictate that insurance companies must settle within roughly a month of accepting a claim. Many of these states add another 15 days on the front end, allowing insurance companies that amount of time to acknowledge the claim before the settlement clock starts ticking.

What are some reasons for promptly filing an insurance claim?

- Worried about how it will affect your insurance rates

- Wonder if it might be cheaper to do some of the repairs yourself

- Confused about who is responsible for filing an insurance claim

- Don’t understand your policy or the claims process

Should I accept an insurance settlement?

You need not accept an initial settlement offer from insurance companies. Don't accept any settlement offers until you speak with an experienced attorney. The goal of insurance companies is to give the lowest amount of money they can because they want to make a profit. Therefore, insurance providers often offer a settlement that isn't fair.

What is settlement of claim?

Settlement of claims means all activities of the insurer or its agent which are related directly or indirectly to the determination of the compensation that is due under coverage afforded by the insurance policy or insurance contract.

What are the types of claim settlement?

The claim settlement is the final stage of the claim process in insurance....4 Major Types Of Claims SettlementPayment of money.Replacement of the item covered.Reinstatement.Paying for repairs.

How is claim settlement done?

Claim settlement is one of the most important services that an insurance company can provide to its customers....Claims ProcessClaim intimation/notification. ... Documents required for claim processing. ... Submission of required documents for claim processing. ... Settlement of claim.

What are the 4 steps in settlement of an insurance claim?

Negotiating a Settlement With an Insurance Company. ... Step 1: Gather Information Needed For Your Claim. ... Step 2: File Your Personal Injury Claim. ... Step 3: Outline Your Damages and Demand Compensation. ... Step 4: Review Insurance Company's First Settlement Offer. ... Step 5: Make a Counteroffer.More items...

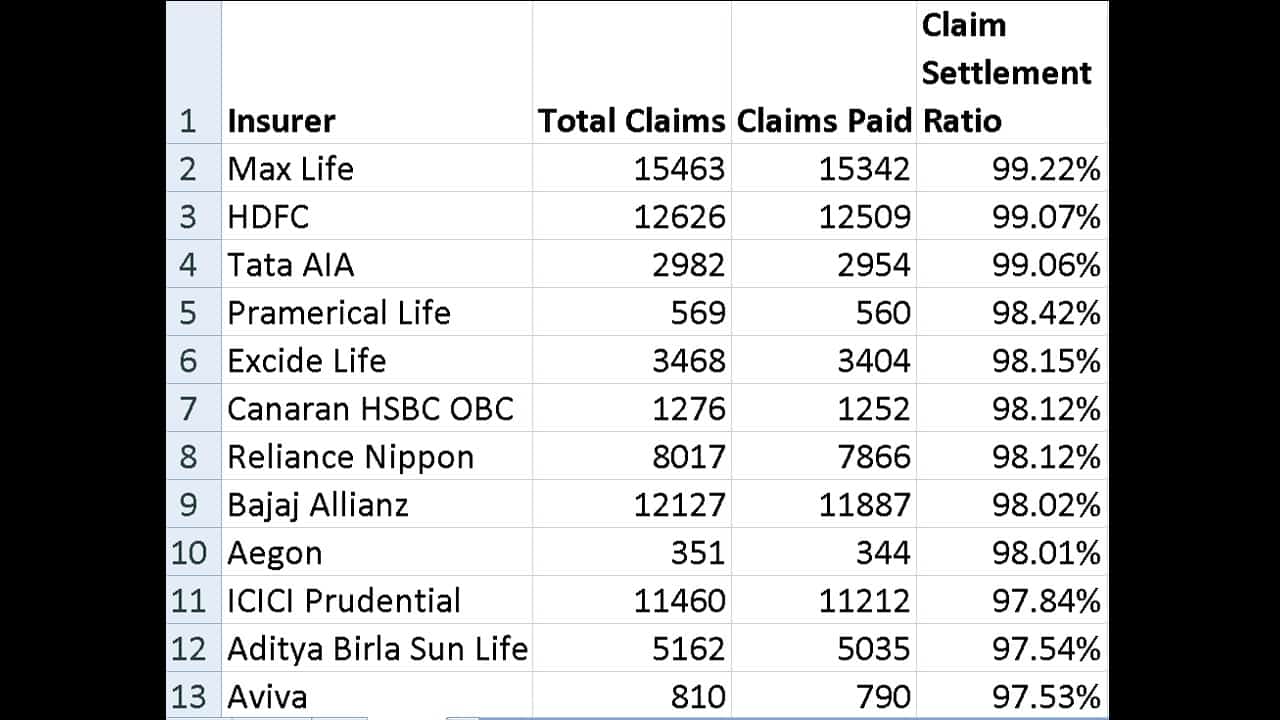

Why is claim settlement important?

If the claims are not resolved, the entire point of purchasing insurance coverage is defeated. To put it another way, the settlement ratio is the ratio of the total number of insurance claims paid out by an insurance company to the total number of claims received.

What are the documents required for claim settlement?

Group Claims Insurance certificate. Original/attested copy of death certificate issued by local municipal authority. Claim form (Lender Borrower/Non Lender Borrower) as applicable. NEFT mandate form attested by bank authorities along with a cancelled cheque or bank account passbook.

How is insurance claim amount calculated?

The actual amount of claim is determined by the formula: Claim = Loss Suffered x Insured Value/Total Cost. The object of such an Average Clause is to limit the liability of the Insurance Company. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum.

Who process the claims?

Claims processing begins when a healthcare provider has submitted a claim request to the insurance company. Sometimes, claim requests are directly submitted by medical billers in the healthcare facility and sometimes, it is done through a clearing house.

Why do insurance companies reject claims?

Every insurance provider states certain conditions under which the claim can be rejected. Some of them are suicide, drug overdose, death by accident under intoxication. Death due to any of these reasons are bound to be rejected as they do not come under a valid claim category as per the insurance companies.

How do insurance companies pay claims?

Most insurers will pay out the actual cash value of the item, and then a second payment when you show the receipt that proves you'd replaced the item. Then you'll get the final payment. You can often submit your expenses along the way if you replace items over time.

Can an insurance company refuse to pay a claim?

Your insurer must give you a reason for refusing to pay your claim. Check the details of your policy carefully to make sure that their decision is reasonable. If you think your insurer is being unreasonable in refusing your claim, you can try to negotiate with them.

Can I keep extra money from insurance claim?

Homeowners can keep the leftover money if there is nothing in writing saying that they must return the unused claim money. Make sure to be truthful when explaining your situation to the insurance company for the claim payout, as lying is considered insurance fraud for which the consequences are harsh.

What is a settlement claim ID?

What is it? A unique settlement ID number is exactly what it sounds like: it's a number that a class action settlement administrator uses to identify who each claim belongs to.

What is a class action lawsuit settlement?

A class action is a legal proceeding in which one or more plaintiffs bring a lawsuit on behalf of a larger group, known as the class. Any proceeds from a class-action suit after legal fees, whether through a judgment or a settlement, are shared among all members of the class.

How long does it take to get paid after a settlement?

While rough estimates usually put the amount of time to receive settlement money around four to six weeks after a case it settled, the amount of time leading up to settlement will also vary. There are multiple factors to consider when asking how long it takes to get a settlement check.

How long after mediation will I get my money?

After months or perhaps years of legal proceedings, most clients will patiently await the finalization of their claim. If you are wondering, how long does it take to get money from a settlement, you can call the lawyer's office for verification. Most likely, the cash settlement will arrive within six weeks.

How do you check the status of your health insurance claim?

By visiting the insurance company’s official website, you can check the status after entering all relevant details.

What is a reimbursement claim?

In case of a reimbursement claim, the policyholder first pays the medical bills himself and then, all these expenses will get reimbursed from the insurance company. A reimbursement claim is applicable if the insured policyholder avails of treatments at a non-networked hospital.

What happens after submitting pre-authorization form?

After submitting the pre-authorization form, the insurance company will evaluate the claim based on the form and then grant cashless claim settlements.

How long does it take to get a pre-authorization form?

For planned treatment, the pre-authorization form should be submitted 3-4 days before admission. On the other hand, the form should be submitted within 24 hours in case of an emergency. A policyholder should obey these timelines to enjoy cashless claim settlements. If the timelines are breached, the claim might get delayed or rejected.

What documents do you need to submit to an insurance company for discharge?

Then, the policyholder needs to submit the discharge certificate or summary to the insurer along with a duly filled in claim form, medical reports, original bills, and other relevant documents.

How many ways does a health insurance claim get rejected?

A health insurance claim gets rejected in 3 ways.

How long do you have to inform your insurance company of your hospitalization?

For a pre-planned treatment, you must intimate your insurance company before your admission. You should inform the company at least 3 to 4 days prior to being hospitalized. You need to fill up and submit a pre-authorization form to the insurance company. This form acts as a claim notification.

What to do if you don't get a settlement?

However, if you fail to reach a settlement, you may have to take your claim to the courts. 3. Head to court. If your negotiation with the insurance adjuster goes nowhere, you may pursue your compensation in court. Depending on the amount of damages you have suffered, you may proceed to small claims court as long as the amount ...

What does an insurance adjuster do?

The insurance adjuster will do all they can to refute your claims of liability and damages. They may do this by referencing areas of your medical records or the police report. It’s important not to argue angrily, but instead respond with well-informed facts that explain why you deserve this level of compensation.

What happens if you get injured in an accident?

Once you are injured in an accident, receiving compensation is more than just a simply filing a claim with the guilty party’s insurance. Most of the time, there will be negotiating involved with the insurance company along with an extensive investigation of your claims. After all of this, insurance companies may still low-ball your claim, ...

What to do if insurance denies your claim?

If they deny your claim without a reasonable basis, then see how to handle insurance bad faith. It’s important to remember to be patient throughout the negotiation. Insurance adjusters want you to get impatient and settle for less than what is reasonable for your damages; stand your ground.

How to settle an accident claim?

1. Submit a demand letter. The first step on the way to settlement is to submit a demand letter to the responsible party’s insurance company. Your demand letter should include how the accident happened, how the defendant is responsible for the accident, the extent of your injuries and damages, and how you have suffered because of these damages. ...

How long does it take to file a personal injury claim in Texas?

For example, Texas requires that personal injury cases be filed within 2 years from the day the accident occurred. Otherwise, compensation will not be available. Once you’ve collected evidence and you know the full extent of your damages, it’s time to file your claim. 1. Submit a demand letter.

What to do if you don't receive a response from insurance?

If you don’t receive a response, contact them consistently until you do. The insurance company can respond in a few different ways. They can say that you haven’t adequately proven your case and are owed nothing. If this is the case, you should speak to a personal injury attorney as soon as possible.

What is claim settlement?

Claim settlement is the process by which an insurer pays money to the policyholder as compensation for an accident or vehicle injury.

Why do you need to be well-versed with the Claims Settlement Process?

If you’re an insurance carrier, you know clients who’ve been in vehicle accidents will be rattled after the experience. The last thing they need is delays from their insurer. But as we’ve all experienced, the claims settlement process can sometimes become a drag.

What happens at the accident site after an accident?

At the accident site, immediately after the accident has taken place, the victim contacts the insurer directly or through the insurance broker agency.

What is an adjuster in insurance?

Adjusters handle the many groups that branch out to study medical reports, investigate the accident scene, talk to witnesses if present, assess the vehicle damage, and start off the process of vehicle repairs and medical recuperations (known in the claims settlement process as ‘indemnification’).

What happens if you get injured by just one driver?

If the accident was caused wholly by just one driver, the claim settlement becomes much simpler, as that driver’s insurance agency pays in full.

How many stages are there in a claim settlement process?

These were the 4 primary stages of a typical claim settlement process. Depending on the insurance agency, there maybe additional intermediate steps.

How is an accident claim filed?

The accident claim is filed in the victim’s name after the details of the victim have been verified. While filing this claim, the person’s policy is reviewed against physical injuries and vehicle damage incurred by both parties.

What is an insurance claim?

Insurance Claim is a demand made by the policyholder to the insurance provider for compensating the losses incurred due to an event that is covered by the policy. The claim is either validated or denied by the insurance company based on their assessment of the event and the nature of the incurred losses. If approved, then the insurance provider ...

What does property insurance cover?

These type of insurances primarily cover a house, which is one of the largest and costliest assets for any individual. It also covers expenses pertaining to accidents. Typically, the claim for damage is filed via the internet to the representative/ agent of the insurer, who is also known as a claim adjuster. In property & casualty claims, the onus lies on the policyholder to clearly and explicitly report all the damages of the deeded property. After that, the claim adjuster does the assessment of the losses incurred by the policyholder.

What is replacement cost settlement?

Replacement Cost Settlements: In case of the replacement cost Replacement Cost Replacement Cost is the capital amount required to replace the current asset with a similar one at the present market rate. Usually, assets replacement occurs when their repair & maintenance charges surge beyond a reasonable level. read more basis of claim settlement, the payments are more favourable for the policyholders as compared to actual cash value settlement. It helps the policyholder to get back to the situation that he/ she was in prior to the loss as it covers the cost of repair and replacement.

What is the first responsibility of an insurance company?

The first responsibility of the insurer is to ensure that the cause of death of the insured doesn’t fall under the excluded category, such as suicide or death resulting from a criminal act.

What are the two methods used in claim settlement?

The two major methods used in claim settlement are: Actual Cash Value Settlements: In case of actual cash value basis of claim settlement, the policyholder doesn’t receive the purchase or replacement value of the item that they have lost. Rather they get the depreciated cost.

What does a house insurance claim cover?

It also covers expenses pertaining to accidents. Typically, the claim for damage is filed via the internet to the representative/ agent of the insurer, who is also known as a claim adjuster.

What is non life insurance?

In non-life insurance, it provides indemnity against losses due to theft, fire or natural disaster. In general, it covers the risk of the policyholder in exchange for a premium. It helps in eliminating the reliance of the dependents on the insured.

What Does Settlement Mean?

A settlement, in the context of insurance, refers to a policy benefit or claims payment. The amount depends on the particular claim, the guidelines stipulated in the insurance policy, and the mutual agreement of the parties involved.

What happens if a policyholder gets into a car accident and is not at fault?

For example, a policyholder gets into a car accident and is not at fault. They file a claim, and once the insurer processes and confirms the details, there would be a settlement to pay for repairs and medical expenses within the appropriate coverage limits of the policy.