What is insurance settlement ratio?

The claim settlement ratio is a metric used to gauge the percentage of life insurance claims an insurer has settled during a financial year against the number of claims it has received including pending claims from the previous year.

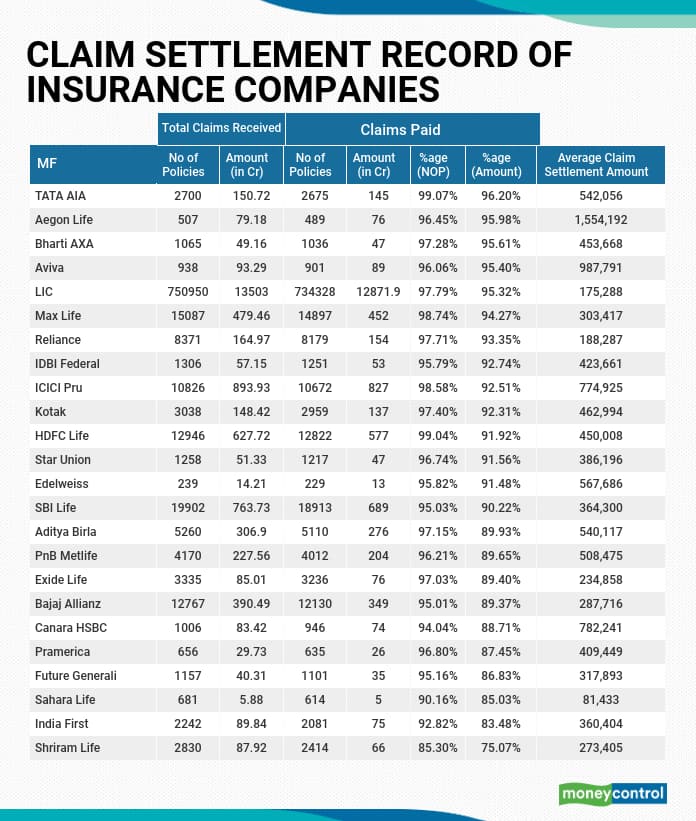

Which insurance company has best claim settlement ratio?

Top General Insurance Companies with Best Claim Settlement RateReliance General Insurance Co. ... SBI General Insurance Company Ltd. ... Shriram General Insurance Co. ... Tata AIG General Insurance Company Ltd. ... United India Insurance Company Ltd. ... Universal Sompo General Insurance Company Ltd.More items...

How is claim ratio calculated?

The formula is: Incurred Claim Ratio = Net claims incurred / Net Premiums collected: So, suppose company ABC in the year 2018 earns Rs 10 Lakh in premiums and settles total claim of Rs 9 Lakh then the Incurred Claim Ratio will be 90% for the year 2018.

What is a claim settlement in insurance?

(Insurance: Claims) If an insurer settles a claim it pays money to a policyholder for the occurrence of a loss or risk against which they were insured.

Is LIC better than private insurance?

While LIC premiums are higher, it also has a higher commission ratio as it mainly sells through an army of agents. Private players rely on bancassurance and online channels to keep costs low. LIC, which has nearly two-thirds of market share, fares well in agent productivity and in cost-to-premium ratio.

What is highest claim settlement ratio?

The highest claim settlement ratio is of the public insurance company LIC at 98.31%.

What is good claim ratio?

If the ICR is between 50% and 100%, is the best claim settlement ratio and a good indication that the insurance company has introduced a good product and is making a healthy profit. Additionally, this is a good indication that the company has taken great pains to educate customers about the claims process.

Is a high loss ratio good?

Insurance underwriters use simple loss ratios (losses divided by premiums) as one of the tools with which to gauge a company's suitability for coverage. In many cases, a high loss ratio—meaning one where the losses approach, equal, or exceed the premium—is considered bad.

Why is claim settlement ratio important?

Claim settlement ratio (CSR) is the % of claims that an insurance provider settles in a year out of the total claims. It acts as an indicator of their credibility. As a general rule, the higher the ratio, the more reliable the insurer is.

How is insurance claim amount calculated?

The actual amount of claim is determined by the formula: Claim = Loss Suffered x Insured Value/Total Cost. The object of such an Average Clause is to limit the liability of the Insurance Company. Both the insurer and the insured then bear the loss in proportion to the covered and uncovered sum.

What are the 4 steps in settlement of an insurance claim?

Negotiating a Settlement With an Insurance Company. ... Step 1: Gather Information Needed For Your Claim. ... Step 2: File Your Personal Injury Claim. ... Step 3: Outline Your Damages and Demand Compensation. ... Step 4: Review Insurance Company's First Settlement Offer. ... Step 5: Make a Counteroffer.More items...

How is claim settlement done?

Claim settlement is one of the most important services that an insurance company can provide to its customers....Claims ProcessClaim intimation/notification. ... Documents required for claim processing. ... Submission of required documents for claim processing. ... Settlement of claim.

Is HDFC life better than LIC?

HDFC and ICICI Prudential Life do slightly better than LIC with yield on advances at 8.72 per cent and 8.5 per cent, respectively. Lastly, LIC runs a large book of non-performing assets. LIC's gross NPAs are at 2.44 per cent, which are comparable to not so well run public sector banks. Net NPAs are at 0.89 per cent.

Which is better Tata AIA or HDFC Life?

HDFC Life Insurance is a life insurance company that offers a wide range of coverage to its customers. On the other hand, TATA AIA Life Insurance provides more comprehensive coverage options with lower premiums. There are many other differences between these two companies in terms of features offered by them.

Which is the No 1 life insurance company in India?

Best Life Insurance Companies in IndiaLife Insurance CompanyClaim Settlement Ratio 2020-21Tata AIA Life Insurance98.02%HDFC Life Insurance98.01%Aviva India Life Insurance98.01%ICICI Prudential Life Insurance97.90%20 more rows

Which is the No 1 general insurance company in India?

ICICI Lombard General Insurance Co. ICICI Lombard General Insurance Company Limited is one of the leading private sector general insurance companies in India. The company has a Gross Written Premium (GWP) of Rs 147.89 billion (FY 2019).