'Clearing, Settlement and Custody' focuses on the clearing, settlement and custody functions by analyzing how they work and the interaction between the organizations involved. The ... read full description The process of clearing and settlement in financial market is often linked with another process, the holding of securities.

What is'clearing settlement and custody'?

'Clearing, Settlement and Custody' focuses on the clearing, settlement and custody functions by analyzing how they work and the interaction between the organizations involved. The ... read full description The process of clearing and settlement in financial market is often linked with another process, the holding of securities.

What is clearing and safe custody?

Clearing and safe custody go hand-in-hand, each an integral part of the settlement process. As a custodian, we have developed and maintained solid relationships with tier 1 custodians across the globe.

What is clearing and settlement in financial markets?

It is important that a strong clearing and settlement system is set in place to maintain the smooth securities trading operations within financial markets. Clearing is the second part of the process which will come after the execution of the trade and before the settlement of the transaction.

What is settlement accounting and how does a custodian handle it?

Custody providers seek to offer their clients services that ease the administration process even when problems with settlement occur. One such process concerns settlement accounting. In terms of settlement accounting, custodians would credit sale proceeds and debit purchase costs on whatever date the trade actually settled.

What is the clearing and settlement process?

The clearing and settlement process is divided into three: Trade Execution – where the buy or sell order is executed by you. This happens on T Day. Clearing – where the responsible entity identifies the number of shares that the seller owes and the amount of money that the buyer owes for every trade.

What's the difference between clearing and settlement?

Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the recipient's or sender's bank account and their bank's reserves.

What is custodian settlement?

Custodians are clearing members but not trading members. They settle trades on behalf of their clients that are executed through other trading members. A trading member may assign a particular trade to a custodian for settlement. The custodian is required to confirm whether he is going to settle that trade or not.

What is a clearing firm custodian?

Clearing brokers not only handle orders to buy and sell securities but also maintain custody of an account holder's securities and other assets (such as cash in the account).

What comes first settlement or clearing?

Clearing and settlement directly follows a trade. Clearing is what comes immediately after the trade, where all the terms of the deal are double-checked. Settlement is the final stage, in which the transfer of securities and money takes place.

Why is clearing and settlement important?

Clearing and settlement Clearing is necessary because the speed of trade is much faster than the cycle time for completing the transaction. In its widest sense, clearing ensures that trades are settled in accordance with market rules, even if a buyer or seller should become insolvent prior to settlement.

What is the difference between custodian and clearing house?

The principal difference between the two sets of services is that custodians have custodial possession of the assets of their customers, while clearing services vouch for the ability of the parties involved to make good on their trading debts.

What is the role of custodian and clearing house in settlement?

Custodians are clearing members but not trading members. They settle trades on behalf of their clients that are executed through other trading members. A trading member may assign a particular trade to a custodian for settlement. The custodian is required to confirm whether he is going to settle that trade or not.

What is custody in a bank?

According to the financial dictionary, custody can be defined as "a safekeeping service that a financial institution provides for a customer's securities. For a fee, the institution collects dividends, interest, and proceeds from security sales and disburses funds according to the customer's written instructions."

What does it mean to custody assets?

First, having custody means having legal access to or directly holding a client's investment assets. In other words, the client gives legal permission for another entity to manage these funds. The custodian is the entity holding the assets for safekeeping, meaning protecting the assets from theft or loss.

What is the role of a custodian?

A custodian is a specialized financial institution (typically, a regulated entity with granted authority like a bank) that holds customers' securities for safekeeping in order to minimize the risk of their misappropriation, misuse, theft, and/or loss.

What is custody fee?

an amount of money charged by a bank or other financial organization for managing an account, investment, etc.: Each year, an annual custodial fee is assessed to individual retirement and education savings accounts.

What does clearing mean in payments?

What Is Clearing? Clearing is the procedure by which financial trades settle; that is, the correct and timely transfer of funds to the seller and securities to the buyer.

What is a clearing and settlement facility?

A clearing and settlement (CS) facility is a facility that clears and settles transactions in financial products.

What is settlement in banking?

Settlement can be defined as the process of transferring of funds through a central agency, from payer to payee, through participation of their respective banks or custodians of funds.

What is post trade clearing and settlement?

Post-trade processing occurs after a trade is complete. At this point, the buyer and the seller compare trade details, approve the transaction, change records of ownership, and arrange for the transfer of securities and cash. Post-trade processing will usually include a settlement period and involve a clearing process.

What is clearing and settlement?

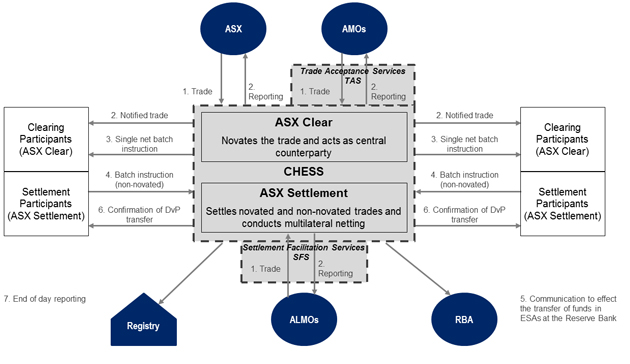

The process of clearing and settlement in financial market is often linked with another process, the holding of securities. Central securities depositories hold securities centrally on behalf of their members to speed the process of clearing and settlement; the selling party does not have to send the securities to the buying party who may be resident overseas. This also helps to reduce the possibility of the loss of securities. This is extremely important in the case of bearer securities where there is no evidence of ownership recorded. The clearing process is carried out by a designated function, and the organization that performs this function is often called a clearing house. The clearing house operates either completely or to a significant degree independently of the exchanges, market or markets its serves. The responsibility for managing and overseeing the trading process is therefore quite separate from the process of controlling the transactions through to settlement. The clearing house does not make the rules and regulations pertaining to carrying out transactions but it does establish the rules, in conjunction with the regulator and the exchange, by which its members clear and settle the business.

What is settlement process?

The settlement process is a key element in identifying and correcting errors made by dealers and traders. Failure to identify the error or act promptly will result in potentially serious financial loss, as well as worrying audit and the regulators.

What is centralized clearing?

In the exchange-traded derivatives markets the use of centralized clearing services is common. Banks and brokers offer their clients the ability to have their transactions executed by counterparties of their choice but the settlement process is centralized through one counterparty. Centralized or global clearing offers advantages and disadvantages to both the broker/bank offering the service and the client utilizing it. The global clearer settles the trades with the clearing house and the client. As part of the service the brokerage due to the execution brokers is paid by the clearer who in turn includes this amount in their clearing charge to the client. In addition treasury settlement is in effect the support function for the activity of dealers in cash instruments as well as providing cash management for other areas of the business using (borrowing) money or depositing excess funds. This activity naturally includes foreign exchange transactions.

What is the role of central clearing house?

The prime role of the central clearing counterparty is risk management . The clearing house mitigates risks by using various techniques to manage the exposures taken by its members. The use of margin as a risk management tool requires the member to provide collateral against a deposit requirement designed to protect the clearing house against default caused by a significant movement in the price of an instrument or instruments. This use of margin is made in conjunction with requirements levied on members, which enables the establishing of a default or compensation fund. Settlement of securities involves not just the clearing house but the local and international central securities depositories and the settlement agents of various participants. Their role is to provide a mechanism to hold securities and to effect transfer among accounts by book entry. The main objective is to centralize securities in either immobilized or dematerialized form that permit the book entry transfer function to operate for the settlement of transactions.

Review

"This primer for those in finance and business explains the processes involved in the conclusion of financial transactions, also known as clearing and settlement processes…This second edition contains four new chapters reflecting global conditions in the world of finance, as well as changes in the regulatory environment that began in response to the 2008 financial market crash.

Review

This summary of current clearing and settlement processes, regulations, instruments, and institutions helps students and professionals understand post-financial crisis developments.

Top reviews from the United States

There was a problem filtering reviews right now. Please try again later.

What is clearing settlement and custody?

Clearing, Settlement, and Custody, Third Edition, introduces the post-trade infrastructure and its institutions. Author David Loader reduces the complexity of this environment in a non-technical way, helping students and professionals understand the complex chain of events that starts with securities trading and ends the settlement of cash and paper. The Third Edition examines the roles of clearing houses, central counterparties, central securities depositories, and custodians. The book assesses the impact on workflow and procedures in the operations function at banks, brokers, and institutions. In consideration of technological and regulatory advances, this edition adds 5 new chapters while introducing new case studies and updating examples.

What are the instruments that are examined with comparison of settlement features such as interest (coupons) and accrued?

Instruments such as bonds and money market instruments are examined with comparison of settlement features such as interest (coupons) and accrued interest, products issued at a discount, maturity and redemption, bonds with warrants and imbedded options.

What Is Clearing?

Clearing is the procedure by which financial trades settle; that is, the correct and timely transfer of funds to the seller and securities to the buyer. Often with clearing, a specialized organization acts as the intermediary and assumes the role of tacit buyer and seller to reconcile orders between transacting parties. Clearing is necessary for the matching of all buy and sell orders in the market. It provides smoother and more efficient markets as parties can make transfers to the clearing corporation rather than to each individual party with whom they transact.

How does clearing protect the parties involved in a transaction?

The clearing process protects the parties involved in a transaction by recording the details and validating the availability of funds.

What is clearinghouse fee?

Clearinghouses charge a fee for their services, known as a clearing fee . When an investor pays a commission to the broker, this clearing fee is often already included in that commission amount. This fee supports the centralizing and reconciling of transactions and facilitates the proper delivery of purchased investments.

What is an ACH clearing house?

An automated clearing house (ACH) is an electronic system used for the transfer of funds between entities, often referred to as an electronic funds transfer (EFT). The ACH performs the role of intermediary, processing the sending/receiving of validated funds between institutions.

Why is clearing necessary?

Clearing is necessary to match all buy and sell orders to ensure smoother and more efficient markets. When trades don't clear, the resulting out trades can cause real monetary losses. The clearing process protects the parties involved in a transaction by recording the details and validating the availability of funds.

What happens when a clearinghouse encounters an out trade?

When a clearinghouse encounters an out trade, it gives the counterparties a chance to reconcile the discrepancy independently. If the parties can resolve the matter, they resubmit the trade to the clearinghouse for appropriate settlement. But, if they cannot agree on the terms of the trade, then the matter is sent to the appropriate exchange committee for arbitration .

How long does it take for a Federal Reserve check to be settled?

Nearly all the checks the Federal Reserve Banks process for collection are now received as electronic check images, and most checks are collected and settled within one business day.