Is escrow included in closing costs?

Escrow fees are a portion of the closing costs that come with buying a home. These costs are paid directly to an escrow company, real estate attorney or title company to conduct the closing and distribute funds to the third parties involved in the real estate transaction. Escrow fees can cover paperwork, distribution of funds and other fees related to the real estate transaction.

Do I need a lawyer during escrow or before closing?

Note that a real estate attorney is required by law to be present at closing in 22 states. 5. Take A Final Walkthrough Of The Property. Buyers should examine the home one more time before closing. During the final walkthrough, inspect for any new damages and ensure the seller left everything agreed on (like appliances).

How much are real estate attorney fees for closing?

Attorneys usually charge by the hour, from $150 to $350. However, some real estate attorneys may have a fee schedule for certain services, such as preparing real estate closing documents. For example, real estate attorney John I. O’Brien in Wakefield, Mass., charges the same closing fee regardless of the cost of the house.

What fees are included with closing costs?

What closing costs are added to basis? These include abstract fees, charges for installing utility services, legal fees, recording fees, surveys, transfer taxes, title insurance, and any amounts the seller owes that you agree to pay (back taxes or interest, recording or mortgage fees, charges for improvements or repairs, and sales commissions).

Is settlement the same as closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

What is escrow in simple terms?

What Is Escrow? Escrow is a legal arrangement in which a third party temporarily holds money or property until a particular condition has been met (such as the fulfillment of a purchase agreement).

Who pays escrow fees in Arizona?

Unless otherwise instructed in writing by the parties, the escrow charges and recording/filing fees shall be paid one-half by Buyer and one-half by Seller.

How much are escrow fees in Nevada?

For real estate transactions, escrow services generally cost between 1 percent and 2 percent of the home's price. Sometimes, depending on the company, escrow fees can be calculated as $2 per thousand of the purchase price, plus $250.

How can I lower my escrow payment?

There are few ways to lower your escrow payments:Dispute your property taxes. Call your local assessor if you think your property tax bill is too high, and ask about the process to dispute your bill.Shop around for homeowners insurance. ... Request a cancellation of your private mortgage insurance.

What is escrow fee?

What Are Escrow Fees? Escrow fees are part of the closing costs when you purchase a home, and they're paid to the title company or directly to the escrow company to set up escrow for your earnest money. These fees cover paperwork — including the recording of the deed — and the exchange of funds.

How much are closing costs for buyer in AZ?

The average mortgage closing costs for buyers in Arizona typically add up to about $1800-$2400+, not including HOA and title fees. At AZ Lending Experts, our buyers usually pay around $1100 in closing costs. These closing costs can also vary depending on the lender and the type of mortgage you are taking out.

How much is escrow fee in AZ?

Escrow fee In order for everything to be finalized, the fee must be paid and, according to Wexler, typically runs about $1,500. Since it's split 50/50, the seller would be responsible for about $750.

Does seller pay closing costs?

The real estate commission or the broker's fee has to be paid by the seller at the time of closing. And the rest of the charges and expenses are the buyer's responsibility. Unless the terms of the deal dictate otherwise, it is the responsibility of the buyers to pay the closing costs.

Who pays for closing costs in Nevada?

They are split between the buyer and the seller and can sometimes be negotiable. Usually, the homebuyer pays somewhere between 2 to 5 percent of the purchase price, but this varies by situation. There are many factors that impact closing costs, two main ones being the location and the property's assigned value.

What is the average closing cost in Nevada?

How Much are Closing Costs in Nevada? Closing costs in Nevada run, on average, $2,915 for a home priced at $293,614, according to a 2021 report by ClosingCorp, which provides research on the U.S. real estate industry. That number makes up 0.99 percent of the home's price tag.

How much are closing costs Nevada?

In Nevada, closing costs usually amount to around 1.0% of a home's sale price, not including realtor fees. With a median home value of $467,453, sellers can expect to pay around $4,708 at closing.

What is escrow and how does it work?

In essence, an escrow is a type of legal holding account for funds or assets, which won't be released until certain conditions are met. The escrow is held by a neutral third party, which releases it either when those predetermined contractual obligations are fulfilled or an appropriate instruction is received.

What is the purpose of escrow?

Escrow is a legal agreement between two parties for a third party to hold onto money or assets until certain conditions are met. Think of escrow as a mediator that reduces risk on both sides of a transaction. In the case of home buying, it would be the sale, purchase and ownership of a home.

What is another word for escrow?

What is another word for escrow?bonddeedguaranteeinsurancepledgesecurity

What is escrow example?

Example of Escrow In return, the seller takes the property off the market and finalizes repairs, etc. All goes well and at the time of the purchase the escrow money is transferred to the seller and the purchase price is reduced by $5,000.

What Are Escrow Fees?

Escrow fees are a portion of the closing costs that come with buying a home. These costs are paid directly to an escrow company, real estate attorney or title company to conduct the closing and distribute funds to the third parties involved in the real estate transaction. Escrow fees can cover paperwork, distribution of funds and other fees related to the real estate transaction.

How to avoid paying escrow fees?

To avoid paying escrow fees, you’ll need to apply for an escrow waiver. You’ll need to check with your local laws and lender requirements to see if you qualify to apply in the first place.

Who charges escrow fees?

Escrow costs are charged by third parties involved in a real estate transaction. An escrow account holds this money until the escrow agent, attorney or title company distributes the funds to the specific parties. Here are a few common escrow fees you can expect.

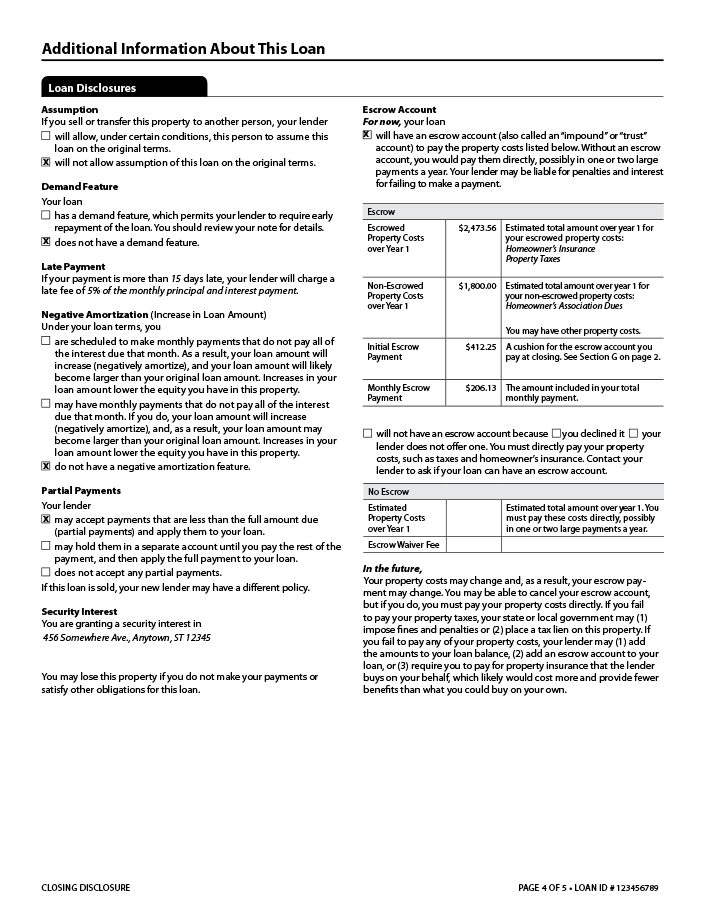

What is escrow money used for?

After closing and throughout the life of the loan, your lender may continue to collect money to fund your escrow account, which is used to pay your annual property taxes and homeowners insurance bills. These fees are typically rolled into your monthly payment and may increase or decrease each year based on whether an annual analysis finds an escrow shortage or surplus.

How much does escrow cost?

Escrow fees can vary depending upon what you state you live in and what the escrow service charges but are usually between 1%-2% of the sale price of the house.

Who pays escrow fees?

In most real estate transactions, the buyer and seller split the escrow fees. However, who pays the escrow fees can also be a part of the negotiations decided upon in the purchase and sale agreement.

What is escrow?

Escrow will come into play once a buyer and a seller have reached an agreement about the sale of a house as outlined in a purchase and sales agreement . Escrow assures that no funds or property will exchange hands until all instructions for the real estate transaction have been followed and completed properly. Think of an escrow officer as a neutral referee between the buyer and the seller who controls the flow of money by holding it in an escrow account throughout the duration of finalizing a real estate transaction.

What happens when you deposit earnest money into an escrow account?

The deposit of the earnest money into the escrow account opens the escrow account and begins the escrow process. When the escrow account is opened , the escrow officer creates an escrow agreement based upon the purchase and sale agreement.

Why does my house fall out of escrow?

A house falls out of escrow when the terms of the purchase contract as negotiated can't be met. This can happen for a variety of reasons. The buyer may not qualify for a mortgage . The home inspection could turn up serious issues that the buyer and seller can't agree on. The appraisal ordered by the lender could come up short leaving the buyer unable to meet the purchase price. Or the title search could reveal hidden liens on the property that must be sorted out before the seller can legally sell the house.

How does escrow work?

How the Escrow Process Works. An escrow process begins after the buyer and seller agree on a sale price. First, a purchase agreement is drawn up between the buyer and the seller when the buyer makes an offer that the seller accepts.

What is escrow in real estate?

Escrow assures the buyer that they can deposit any up-front costs such as earnest money without risk while the details of the sale are ironed out. Sellers are protected from buyers backing out of the sale at the last minute without being at least compensated by the earnest money which is held in the escrow account.

What is title company settlement fee?

What is a Title Company Settlement Fee? The settlement fee is sometimes referred to the closing fee, and it covers costs associated with closing operations.

What are the costs associated with closing a home?

When you are buying a home, there are plenty of costs associated with closing that have nothing to do with the actual cost of the home. These costs are generally associated with insuring, reviewing, and modifying the title of that property. The costs can be broadly called “title fees”.

Does Scott Title Services work with real estate?

Settlement experts from Scott Title Services will seamlessly integrate into your real estate team by working with your lender, real estate agent and yourself to guarantee that the transaction is both successful and as stress free as possible. We coordinate everything to ensure that your interests and rights are protected during the entire closing process and beyond.

What are escrow fees?

An escrow fee, or closing fee, is paid to the title company, escrow company, or attorney for conducting the closing of a real estate transaction. Typically, the title or escrow company oversees the closing as an independent party. In some states, a real estate attorney is required to be present so make sure to check your state’s requirements.

What are closing costs?

These costs include items such as fees for processing, title insurance/search (title closing fee), mortgage taxes, appraisals, closing, and more. They’re necessary costs of doing business and are subject to change. Closing costs can vary depending on where you live, ...

How do escrow services work?

At closing, the escrow officer or real estate attorney creates closing statements and distributes funds accordingly. Examples include.

What is a closing protection letter?

A fee charged by escrow agencies to create a closing protection letter (CPL) – a document that puts liability on the title company if the escrow does not disburse the home purchase funds appropriately.

Why do mortgage lenders charge a tax service fee?

Mortgage lenders require the tax service fee in case a defaulting borrower doesn’t pay their property taxes. Those taxes are deducted from the foreclosure sale and decrease the amount the lender can recover.

How much does a home closing cost?

Home buyers usually pay between about 2% to 5% of the purchase price of their home in closing costs. So, if your home costs $250,000, you might pay between $5,000 and $12,500 in closing fees.

What is escrow in real estate?

Escrow is when an impartial third party holds on to funds and distributes them accordingly to process a transaction. The funds, also known as earnest money, is typically held in an escrow account by an escrow officer or attorney. Escrow costs cover the final closing paperwork and handle the exchange of funds and recording of deeds.

Who pays settlement fee?

Settlement: This fee is paid to the settlement agent or escrow holder. Responsibility for payment of this fee can be negotiated between the seller and the buyer.

What is origination fee?

Origination: The fee the lender and any mortgage broker charges the borrower for making the mortgage loan. Origination services include taking and processing your loan application, underwriting and funding the loan, and other administrative services.

What is appraisal charge?

Appraisal: This charge pays for an appraisal report made by an appraiser.

What is document preparation fee?

Document Preparation: This fee covers the cost of preparation of final legal papers, such as a mortgage, deed of trust, note or deed.

What is real estate commission?

Real estate commission: This is the total dollar amount of the real estate broker’s sales commission, which is usually paid by the seller. This commission is typically a percentage of the selling price of the home.

Who pays the surveyor fee?

Survey: The lender may require that a surveyor conduct a property survey. This is a protection to the buyer as well. Usually the buyer pays the surveyor’s fee, but sometimes this may be paid by the seller.

Who pays for recording a deed?

Recording fees: These fees may be paid by you or by the seller, depending upon your agreement of sale with the seller. The buyer usually pays the fees for legally recording the new deed and mortgage.

What is escrow fee?

Escrow fees are part of a deal’s closing costs. Let’s explore the typical fees that can show up on a buyer’s closing statement, and help to avoid future cases of sticker shock.

How to pay for escrow?

This is the fee for the escrow service itself, usually a certain amount per $1000 of the sale price. With the escrow fee you are paying to make sure: 1 The escrow agent is properly licensed in your state 2 They have the knowledge, training and expertise to handle supplemental and unusual escrow situations 3 Your escrow process follows all applicable laws, and the sale will be legal and valid 4 The escrow agent is an independent third party, competent and trustworthy to caretake and disburse your money.

How long does legal escrow need to be stored?

Legal escrow documents need to be stored by the escrow company for a minimum of five years. This fee helps with the storage and retrieval of the large volume of paperwork involved.

Is escrow legal in my state?

With the escrow fee you are paying to make sure: The escrow agent is properly licensed in your state. They have the knowledge, training and expertise to handle supplemental and unusual escrow situations. Your escrow process follows all applicable laws, and the sale will be legal and valid.

Who needs to be dealt with in escrow?

Spouses, ex-spouses, grantees, trustees, business partners, extra government agencies or authorities, all may need to be dealt with in order to facilitate the escrow. All of these contacts take time and documentation.

Does a closing statement include escrow costs?

The seller’s closing statement contains escrow costs as well. The seller will have the same Escrow fee as the buyer, the same Processing and E-Document fees, and an Archive fee. Closing costs from the escrow company are not a mystery, and don’t need to be a surprise, either.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

How much does it cost to sell a house in 2021?

A 2021 study we conducted found that it costs $31,000 on average to sell a home. But ideally your sale price covers the costs of all the transaction fees, your mortgage payoff, and then some, leaving you with a tidy sum to add to your bank account.