One is called the Closing Disclosure and the other is called the ALTA Settlement Statement. What is Alta commitment? A title commitment (or whatever name yours goes by) is basically the title company’s promise to issue a title insurance policy for the property after closing.

Full Answer

What is an Alta statement and why do I need one?

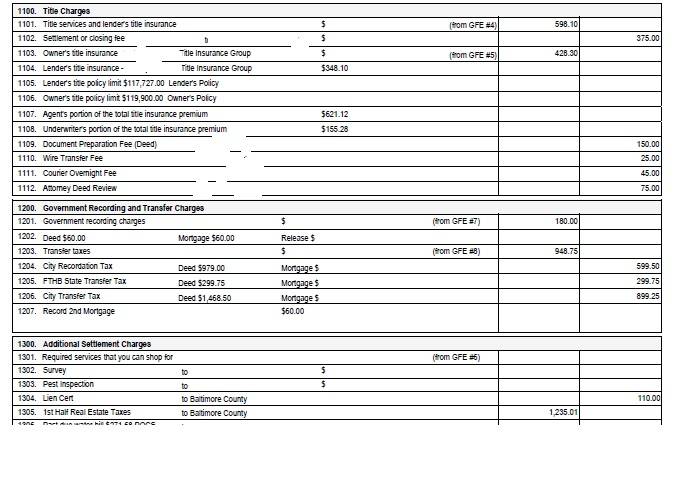

What is an ALTA Statement? The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

Is the Alta settlement statement the same as HUD 1?

Is the ALTA Settlement Statement the Same as HUD 1? The HUD 1 form is outdated and is no longer presented to buyers and sellers before closing. It was replaced in 2015 by the Loan Estimate that the buyer receives and the Closing Disclosure forms given to both buyers and sellers.

Is it possible to have a combined Alta buyer’s statement?

But please note that it is possible to have a combined ALTA Buyer’s or Seller’s statement. ALTA Settlement Statement Combined – The Combined settlement is a document that bundles together all transactions as they apply to both the buyer and the seller.

What is the American land title Association’s settlement statement?

Today, we would like to discuss the American Land Title Association (ALTA) Settlement Statement. This statement was created by ALTA in compliance with the Consumer Financial Protection Bureau’s (CFPB) TILA RESPA (TRID) Integrated Disclosure rule. We understand this is a mouthful of acronyms.

What is a settlement statement?

Who is responsible for preparing the settlement statement?

Is a settlement statement the same as a closing statement?

What is an ‘excess deposit’ at closing?

What information is needed to complete a closing document?

When are property taxes prorated?

Does the seller get a closing statement?

See 4 more

About this website

How do you read an Alta statement?

The ALTA statement is an itemized list of all the cost components that the seller and the buyer are supposed to pay during the home closing process to multiple parties. The statement segregates these cost components into 8-9 sections. Each cost component could either be debited or credited to the concerned party.

What is a title commitment in Florida?

What is a Title Commitment? A title commitment is a report. Through such report a title insurance company discloses to all parties involved in the real estate transaction the defects, liens, and obligations that affect the subject property.

Is Alta the same as settlement statement?

ALTA has developed standardized ALTA Settlement Statements for title insurance and settlement companies to use to itemize all the fees and charges that both the homebuyer and seller must pay during the settlement process of a housing transaction.

How do you read a settlement statement for tax purposes?

4:3813:06How To Read A Closing Statement - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyerMoreSo it starts with the agreed upon sale price. And then debits and credits are applied to both buyer and seller. And then all of the numbers are added and subtracted at the very bottom.

How long is a title commitment good for in Florida?

Authorized Signatory. The issuing title agent signs on this line. A commitment remains in effect for a period of six months after issuance.

How long does it take to get a title commitment in Florida?

Process Takes Around Two Weeks.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

What does Alta stand for?

American Land Title AssociationAmerican Land Title Association (ALTA)

What items on a settlement statement are tax deductible?

The seller of a business or investment property may deduct condo fees, fees paid out of escrow (for utility bills, insurance, etc.), fire/casualty insurance premiums, interest, and real estate taxes. They can also include the same selling expense items as the seller of a principal residence.

How do you read a settlement?

0:217:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What would be a credit to the buyer on the settlement statement?

Credit to buyers. Amount of buyer's new loan shown as a credit to the buyer. Provides the new lender with a title insurance policy on the property; insures their Deed of Trust of being in 1st lien position. Reflects status of the property taxes.

What does the title company do in Florida?

What does a title company do? The title company handles the title search and escrow aspects of the transaction. They coordinate and act as the center point for the closing for buyers, sellers, lenders, realtors and third parties such as surveyors, insurance companies, and inspectors.

What happens to the items listed in Schedule B 2 of the title commitment?

Schedule B-2 in a title commitment lists all matters that constitute an encumbrance on the title to the property. If these matters are not disposed of in some manner (such as the release of an existing deed of trust), they will appear in Schedule B of the final title policy.

What are the consequences of the seller's failure to provide association documents by the deadline set forth in the contract?

C- Source documents for all receipts and disbursements. What are the consequences of the seller's failure to provide Association documents by the deadline set forth in the contract? A- The buyer can terminate the contract at any point up through the end of the investigation period.

Sample Real Estate Closing Statements

Sample Real Estate Closing Statements Here are sample real estate closing statements for a buyer under various scenarios. These are actual real estate closing statements for transactions over the last couple of years with the address, names, etc. removed.

Understanding Credits & Debits in a Real Estate Closing Statement

A real estate closing statement outlines all costs associated with a house purchase. For buyers, it will include any earnest money paid down, credits for work the seller has agreed to and remaining costs owed at closing. For sellers, it will include anything that needs to be paid to close the deal.

What is the Seller’s Closing Statement: A Breakdown of ... - UpNest

Wondering About The Seller’s Closing Statement? Hooray! You’ve got a buyer for your home.You’ve signed the purchase agreement and received the earnest money deposit. Now all that’s left is to close the deal. It’s also the moment — when you can’t stand the thought of even seeing another piece of paper — that the Seller’s Closing Statement drops into your hands.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

How many types of ALTA statements are there?

There are 4 types of ALTA statements made according to their unique recipients. These four types of statements are:

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

Where Can I Download a Sample ALTA Settlement Statement?

You can download a sample ALTA statement by clicking the text link below.

What is an ALTA Statement?

The ALTA settlement statement is an itemized list of all of the fees or charges that the buyer and seller will pay during the settlement portion of a real estate transaction. Everything from the sale price, loan amounts, school taxes and other pertinent information is contained in this document.

What is closing disclosure?

The closing disclosure is provided to the buyer and pertains a list of fees and costs and how they work into the buyer’s total expense. It is important to note that only the lender can provide the Closing Disclosure to the buyer 3 days prior to closing? And only the buyer should be able to see it unless they allow the release of it by signing a release disclosure. You should also know that the lender is obligated under the TRID regulations, and the lender can be penalized for failing to disclose 3 days after they’re loan application is approved and again 3 days prior to closing.

What is a settlement statement?

Settlement Statements – This is the version supplied solely to the buyer and contains only information pertinent to the buyers side of the transaction.

What is a HUD-1?

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. It is now outdated. The Closing Disclosure was introduced in 2015 as a document that instead contains this information strictly for the buyer.

Why is a standard form required for title insurance?

Having a standard form for nearly all title insurance policy transactions maintains that all exchanges of land are done smoothly and efficiently.

Is ALTA the same as net sale?

No, an ALTA settlement statement is not the same as the net sale sheet. A net sheet is a document that can be provided throughout the sale process to give the seller an estimate on what they can expect to make. The net sale sheet is not final, and multiple sheets may be provided as offers are made and transactions process. An ALTA settlement statement is provided during the closing of a transaction and contains solid numbers rather than estimates.

What is the ALTA Settlement Statement?

In the real estate industry, the ALTA Settlement Statement is a form that lists all of the credits and expenses involved with a transaction in detail. Each of these forms is available in four different variations, including:

Where Can I Download a Sample ALTA Settlement Statement?

It is not the same thing as the net sale sheet. An ALTA settlement statement is different. Net sheets are documents that may be presented to sellers during the course of the sale in order to provide them with an estimate of how much money they can anticipate to make from the transaction. The net sale sheet is not final, and many sheets may be presented as offers are made and transactions proceed through the stages of completion and settlement. During the conclusion of a deal, an ALTA settlement statement is given, which gives actual figures rather than projections.

What does an ALTA policy cover?

The ALTA (American Land Title Association) policy covers the same items as the CLTA policy as well as many additional risks such as unrecorded mechanic’s liens, assessments, encumbrances, encroachments, easements, water rights, mining claims, patent reservations, conflicts of boundary lines, shortages in area access to

What is the difference between Alta and HUD?

A Hud-1 used to be the primary statement associated with real estate and is used to document all cash transactions and how they affect both parties. ALTA statements were put into use to provide thorough breakdowns for agents and brokers to receive at the end of the transaction.

Who prepares Alta statement?

The Title Company prepares the ALTA and the Lender reviews and approves it. Typically, we (Buyer & Buyer’s Agent) will receive this a day or 2 prior to closing. This flow works well because the Buyer, Seller, and agents know the terms of the transaction and often can quickly discover any errors.

What is an Alta settlement?

The ALTA Settlement Statement is a form that itemizes all of the credits and costs associated with a real estate transaction. Seller Settlement Statement which mainly focuses on the fees that the seller is responsible for. Buyer Settlement Statement that focuses on the buyer’s closing and loan costs. 7

What is the Alta extended coverage?

An ALTA Extended Coverage loan policy from the Standard Coverage Policy by offering insurance against matters which cannot be determined by an examination of public records. Its advantage to the lender lies in its ability to include matters that are not generally public record.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.

How many versions of ALTA Settlement Statement are there?

There are four versions of the ALTA Settlement Statement available:

How to contact ALTA?

Contact ALTA at 202-296-3671 or [email protected].

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

Does the seller get a closing statement?

Buyers tend to sign the bulk of the paperwork at closing, making some sellers wonder if they will even receive a settlement statement.