Debt consolidation and debt settlement are strategies for making debt manageable, but they are different methods and bring different results. Debt consolidation reduces the number of creditors you’ll owe. Debt settlement tries to reduce the amount of debt you owe.

What is consolidation and settlement when referring to soil?

Rather, the settlement is an outcome of consolidation of clays. Consolidation is natural process involving the compression of the soil mass by expulsion of water and this compression is nothing but settlement.

Should you do debt consolidation, bankruptcy or settlement?

If you’ve exhausted all other options trying to pay off your debts, your last resort may be to either settle your debt or file for bankruptcy. These options should only be considered if you’ve tried everything else and cannot pay down or eliminate your debt.

Does debt consolidation really do anything?

Does Debt Consolidation Really Work? Yes! Like most things in life, the amount of effort you’re willing to put into debt consolidation will greatly impact the final results. If you choose to consolidate on your own through a loan or a credit card balance transfer, your chances of success are greater if you stick to a well-mapped repayment plan.

Is debt consolidation a bad thing?

Debt consolidation services can be a really good option to help you take control of your debt. These companies provide a valuable service to the person who has found themselves in a debt situation they can no longer control. If you have escalating debt because of late payment and over limit fees, a debt counselor can help stop this from happening.

What is difference between consolidation and settlement?

Debt consolidation and debt settlement are both forms of debt relief that may help you manage your debt, but they have very different functions. In general, debt consolidation reduces the number of creditors you owe, while debt settlement reduces the total debt you owe.

What is the difference between consolidation and settlement of soil?

Different from immediate settlement, consolidation settlement occurs as the result of volumetric com- pression within the soil. For granular soils, the consolidation process is sufficiently rapid that consolida- tion settlement is generally included with immediate settlement.

What is the relation between consolidation and settlement?

The rate of settlement of a saturated soil is expressed by the coefficient of consolidation (cv). The rate of settlement of a soil, and hence the value of cv, is governed by two factors: the amount of water to be squeezed out of the soil; and the rate at which that water can flow out.

Is debt consolidation the same as debt settlement?

Debt consolidation is a way to combine one or more debts and pay them off with a single monthly payment, ideally with more favorable terms. A debt settlement, on the other hand, is a way to renegotiate the terms of what you owe so a creditor is willing to accept less than what is owed.

What is consolidation definition?

Definition of consolidation 1 : the act or process of consolidating : the state of being consolidated. 2 : the process of uniting : the quality or state of being united specifically : the unification of two or more corporations by dissolution of existing ones and creation of a single new corporation.

What is settlement of soil?

What is Settlement? Settlement is the downward movement of the ground (soil) when a load is applied to it. The load increases the vertical effective stress exerted onto the soil. This stress, in turn, increases the vertical strain in the soil. This increase in vertical strain causes the ground to move downward.

What is the process of consolidation?

Consolidation processes consist of the assembly of smaller objects into a single product in order to achieve a desired geometry, structure, or property. These processes rely on the application of mechanical, chemical, or thermal energy to effect consolidation and achieve bonding between objects.

What causes consolidation settlement?

The consolidation settlement is induced due to volumetric change. Since soil particles are practically incompressible, consolidation settlements is caused by a reduction in voids due to gradual squeezing out of water.

What is the total settlement?

Total settlement refers to the overall change in vertical distance. Differential settlement involves an expected amount that the total settlement will vary between points over a horizontal distance, which can be caused by variations in the foundation soil profile and wall height over a certain distance.

Does debt settlement hurt your credit?

While settling an account won't damage your credit as much as not paying at all, a status of "settled" on your credit report is still considered negative. Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account.

What is a disadvantage of debt consolidation?

One of the biggest disadvantages of debt consolidation is that it is not accessible to everyone. If you have poor credit, you will probably not get approved for the loan. Even if you do, you might not be getting the best interest rate if your credit score is below 700.

What is the disadvantage of debt settlement?

Cons of Debt Settlement Late fees: When you stop sending payments to your creditors, you'll begin accruing late fees, interest charges and other penalties. Time commitment: The normal time frame for a debt settlement case is two to three years.

What is the main difference between consolidation and compaction?

Compaction is a process where a mechanical pressure is used to compress the soil mass for the purpose of soil improvement. Consolidation is a process where steady and static pressure causes compression of saturated soil.

What's the difference between consolidation and compaction?

Following are the differences between compaction and consolidation of soils. Compaction is the compression of soil by the expulsion of air from the voids of the soil. Consolidation is the compression of soil by the expulsion of water from voids of the soil. It is a quick process.

What is the difference between consolidation and compressibility?

Abstract. Compressibility and consolidation can be distinguished as: compressibility — volume changes in a soil when subjected to pressure amounts of settlement. consolidation — rate of volume change with time time to produce a given settlement.

What is the difference between normally consolidated and Overconsolidated soils?

Overconsolidation. If the current state of soil is on the normal compression line it is said to be normally consolidated. If the soil is unloaded it becomes overconsolidated.

How does debt consolidation work?

Debt consolidation works by combining your existing debts into one new debt, ideally at a lower interest rate. For example, let’s say you owe $2,50...

What is a consumer credit counseling service?

Consumer credit counseling organizations are generally nonprofit organizations offering certified and trained counselors. These counselors can help...

Can I negotiate a debt settlement on my own?

The first step of the DIY debt settlement negotiation process is to dig into your debts to assess how much you owe and whether it’s possible to pay...

How does debt settlement affect my credit score?

Debt settlement can be harmful to your credit score because the process requires you to stop paying your bills and go delinquent on your debts. Alo...

What is debt consolidation?

Debt consolidation is a form of debt relief that combines multiple debts into one new consolidated debt. Instead of owing money to multiple creditors and having multiple monthly payments, debt consolidation lets you reorganize those debts into a single combined total. A couple of the most common ways to consolidate debt include 0% balance transfer credit cards and debt consolidation loans, or personal loans, from a bank or credit union.

What is debt settlement?

Debt settlement is an option that you can manage on your own if you are comfortable talking with your creditors and asking to make a deal on your debts.

How to get a better deal on debt settlement?

Instead of hiring a debt settlement company, you’ll often get a better deal for your overall financial situation by working with a consumer credit counseling agency. Instead of going delinquent on your debts and potentially taking a hit on your credit score, consumer credit counseling can help you stay current on your bills and pay off debt without the potential risks and longer-term consequences of debt settlement.

How does consumer credit counseling work?

If you sign up for this type of program, the consumer credit counseling service will work with your creditors and attempt to reduce your interest rate and fees.

How does debt management work?

With a debt management plan, you generally make one monthly payment to the consumer credit counseling agency, which then forwards payment to your creditors. They do not renegotiate the total amount of debt, but they help you make a plan to pay off your debt, while potentially helping reduce fees and costs.

What is credit counseling?

Some credit counseling organizations will help you create and implement a debt management plan for your debts. With this type of plan, you still pay the total amount of principal you owed. You make a single payment to the organization each month and the organization makes a payment to your creditors.

How long does it take to settle a debt?

And keep in mind that the debt settlement process can take two to four years, depending on the overall amount of your debt and the complexity of your situation.

What is the difference between debt settlement and debt consolidation?

Debt settlement is helpful in cutting your total debt owed, while debt consolidation is useful for cutting the total number of creditors that you owe. With debt consolidation, multiple loans are all rolled into a new consolidation loan that has one monthly interest rate.

What is consolidation loan?

This is a single loan that rolls all of your prior debts into one monthly payment at one interest rate. Consolidation loans are offered through financial institutions —including banks, credit unions, and online lenders—and all of your debt payments are made to the new lender going forward.

What Is Debt Settlement?

While debt consolidation allows you to combine multiple debts into a single loan, debt settlement utilizes a very different strategy, When you settle debt, you’re effectively asking one or more of your creditors to accept less than what’s owed on your account. If you and your creditor (s) reach an agreement, then you would pay the settlement amount in a lump sum or a series of installments.

Why is debt settlement important?

Debt settlement is helpful in cutting your total debt owed, while debt consolida tion is useful for cutting the total number of creditors that you owe.

What is the advantage of debt settlement?

The advantage of debt settlement is that you can eliminate debts without having to pay the balance in full. This may be an attractive alternative to bankruptcy if you’re considering a Chapter 7 filing as a last resort when in dire financial straits.

What is secured debt consolidation?

Secured debt consolidation loans require you to use one or more assets as collateral, such as your home, car, retirement account, or insurance policy. For example, if you take out a home equity loan to consolidate debt, then your home would secure the loan.

What happens if a creditor counteroffers?

If your creditor chooses to counteroffer, then you can weigh whether the amount they’re asking for is realistic for your budget. Once you and a creditor agree on a settlement amount, you can arrange to make the payment.

As nouns the difference between consolidation and settlement

is that consolidation is the act or process of consolidating, making firm, or uniting; the state of being consolidated; solidification; combination while settlement is the state of being settled.

English

The act or process of consolidating, making firm, or uniting; the state of being consolidated; solidification; combination.

What is debt settlement?

Debt settlement is negotiating with creditors to settle a debt for less than what is owed. This method is most often used to settle a substantial debt with a single creditor, but can be used to deal with multiple creditors.

How Does Debt Settlement Work?

You, or a representative negotiating for you, make an offer to your creditor to settle the debt for less than what is owed. For example, if you owed $10,000, you might offer the creditor a lump-sum payment of $5,000.

What are the pros and cons of debt consolidation?

The cons to debt consolidation are just as obvious: 1 The debt is not forgiven or even reduced. You still owe the same amount of money and if you don’t d decrease your spending the problem will never go away. 2 Getting an effective debt consolidation requires a good credit score. If you have a poor credit score, you might be denied a debt consolidation loan, or the interest rate on the loan might be the same as the interest rate on your credit cards. 3 Time can also be an issue. You should be prepared to spend anywhere from 2–5 years in a debt consolidation program before eliminating the debt.

How much do debt settlement companies charge?

The fees generally are 20–25% of the final settlement , so if your final settlement is $5,000, you could owe another $1,000 to $1,250 in fees.

How long does it take to settle a debt?

Time Frame – The normal time frame for a debt settlement case is 2–3 years, which means 24–36 months of late fees and penalties added to the amount you owe.

Does debt settlement affect credit score?

Impact on Credit Score – Debt settlement will have a negative impact on your credit score. Not paying the full amount is a negative. Missing payments while negotiating a settlement is a negative.

Is debt settlement good for your credit?

The pros and cons of debt settlement and debt consolidation vary, especially with regard to the amount of time it will take to eliminate debt s and the impact it will have on your credit score. When used properly, either can help you get out of debt sooner and save money.

What is the difference between creep and immediate settlement?

Since soil particles are practically incompressible, consolidation settlements is caused by a reduction in voids due to gradual squeezing out of water. Finally, creep settlement occurs under a constant load and is depended on the stress history, the type of soil and the anisotropy of the soil.

How long does creep settlement last?

The settlement process may be completed almost immediately or may last for a significant amount of time (even decades) depending on the soil’s permeability and water drainage paths.

Consolidation

- When the construction of the foundation is done(application of additional load), pore water pressure in the saturated clay increases as the hydraulic conductivity of the clay is very small. Some time is required for excess pore water pressed to dissipate and increase the stress to be t…

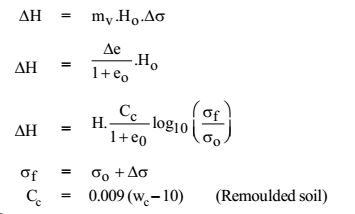

Primary Consolidation

- The definition of primary consolidation is discussed above under the terminology. Let’s the method of primary Consolidation settlement calculation There are two different stages of soil. 1. Normally Consolidated Soil 2. Over Consolidated Soil It is required to assess the consolidation of soil is done based on the above states. In simple terms, the normally consolidated soil is experie…

Secondary Consolidation

- Secondary consolidation settlement occurs after the completion of dissipation of the excess pore water pressure developed immediately after the application of load. The settlement caused due to the plastic adjustment of the soil fabrics at the end of the primary consolidation is called secondary consolidation. Secondary Consolidation also can be explained as slippage and reorie…

Types of Tests to Find Consolidation Settlement

- One dimensional consolidation test

- Oedometer Test

- Incremental Loading Oedometer