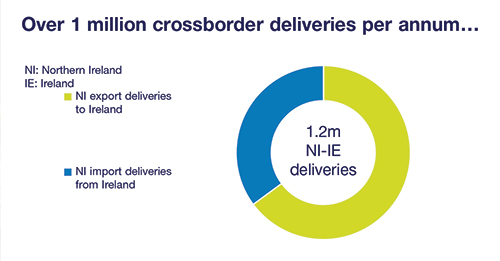

A cross-border settlement is defined as a securities settlement that takes place in a country other than the country in which one trade counterparty or both are located. Again, in most cases the settlement takes place in the country of - 2 - issue of the securities, but one counterparty or both are located outside the country of issue.

What is a cross-border settlement?

A cross-border settlement is defined as a securities settlement that takes place in a country other than the country in which one trade counterparty or both are located.

How is cross-border trade settlement conducted in China?

Historically, cross-border trade settlement with an entity in China was primarily conducted through USD.

What is RMB cross-border settlement?

What is RMB cross-border settlement? RMB cross-border settlement allows cross-border transactions to be settled in China’s currency. Historically, cross-border trade settlement with an entity in China was primarily conducted through USD.

What is cross-border trade?

In simple words, buyers who want deals and offers that are available across the border, buy products from sellers of that country, and this is cross-border trade. As a result, a merchant is expected to deliver the products and services to the buyers from another country. It helps the sellers to expand their business at a global level.

What is RMB cross border trade settlement?

What is RMB cross-border settlement? RMB cross-border settlement allows cross-border transactions to be settled in China's currency. Historically, cross-border trade settlement with an entity in China was primarily conducted through USD.

What does cross border payments mean?

Cross border payments refer to transactions involving individuals, companies, banks or settlement institutions operating in at least two different countries. Experts predict that global cross border payment flows are expected to reach US$156 trillion by 2022.

What is cross border payments in Blockchain?

Blockchain technology in cross-border payments can enable secure transfers between an infinite number of bank ledgers. This allows one to bypass banking intermediaries who serve as middlemen to help transfer money from one bank to another.

What is the problem with cross border payments?

Cross-border payments sit at the heart of international trade and economic activity. However, for too long cross-border payments have faced four particular challenges: high costs, low speed, limited access and insufficient transparency.

What are the 2 payments covered under cross-border payments?

Cross-border payments can be made in several different ways. Bank transfers, credit card payments and Alternative Payment Methods (APMs) are the most prevalent ways of transferring funds across borders.

What is the definition of cross-border?

cross-border. adjective [ before noun ] /ˈkrɒsˌbɔːdər/ us. between different countries, or involving people or businesses from different countries: cross-border mergers.

What is KYC in blockchain?

KYC Blockchain systems enable transparency and immutability that, in turn, allows financial institutions to validate the trustworthiness of data present in the DLT platform. The decentralized KYC process acts as a streamlined way for gaining secure and swift access to up-to-date user data.

Can I use blockchain to transfer money?

Using blockchain to send money. Blockchain is groundbreaking technology that optimizes the way money is transferred and transactions are processed. While it has been used in many fields since its introduction in 2009, blockchain technology is still most widely used in money transfers and transaction reconciliation.

How do you transfer money on blockchain?

How do I initiate a transfer from Blockchain Exchange to my Wallet?Login to Blockchain Exchange.Open the Balances sidebar on the right.Select Withdraw and choose the appropriate currency.Select My Blockchain Wallet in the Destination Address field. ... Enter the amount and hit Send.

How do banks settle international payments?

The sending bank removes money from the sender's bank account, clearing the transaction. It's not until after the receiving bank puts forth the funds, both institutions settle the payment, and the banks exchange capital that the process ends.

How does money get transferred between countries?

Money transfer instructions are sent from the sender's bank to the recipient's bank and may be transmitted to intermediary banks before arriving at the final bank. Depending on the bank or financial institution, you may be able to make an international money transfer online, over the phone, or on a money transfer app.

How big is the cross-border payment market?

Juniper Research estimates that business-to-business cross-border payments will reach $35 trillion by 2022 and as of 2021, 83% of global businesses of all sizes found it easy to send or receive cross-border payments.

What are the three different types of nodes in Hyperledger fabric?

The types of nodes are explained next in more detail.Client. The client represents the entity that acts on behalf of an end-user. ... Peer. A peer receives ordered state updates in the form of blocks from the ordering service and maintain the state and the ledger. ... Ordering service nodes (Orderers)

What is blockchain remittance?

Service providers can then use blockchain-based payment systems to transmit and receive money between two people, at any point in the world. The ability to eliminate unnecessary third parties will reduce transaction costs and speed up the completion of remittance transactions.

How can blockchain be used in banking?

Blockchain is basically a distributed ledger. It can store facts like, who owns a particular piece of land or say a bond. The technology can be used to keep an immutable record of ownership and enable transaction of the asset amongst distrusting parties.

How does ripple network work?

Ripple is a blockchain-based digital payment network and protocol with its own cryptocurrency, XRP. Rather than use blockchain mining, Ripple uses a consensus mechanism, via a group of bank-owned servers, to confirm transactions.

What is Cross-Border Trade?

When a consumer buys a product online from a merchant who is located in another country, it is cross-border trade. In this practice, customers and sellers are located in different countries with different policies. It generally occurs in case a product or service isn’t available in the buyer’s country or it is with an offer that a buyer wants to grab.

What Are The Cross-border Trade Challenges?

It’s true that cross-border trade is thriving each moment, but the hurdles are not less. These hurdles may be encountered by both buyers in general and merchants in particular. Apart from trust issues, there are multiple challenges that really DO exist and the prime ones among those are categorized into two parts:

What Are The Benefits of cross-border trade (CBT)?

With multiple benefits cross-border is something every merchant wants to focus on. Glance over some of them below:

What is B2C trade?

The act of selling a product from one country to the buyer of another via B2C is cross-border trade. In simple words, buyers who want deals and offers that are available across the border, buy products from sellers of that country, and this is cross-border trade . As a result, a merchant is expected to deliver the products and services to ...

What percentage of online commerce is cross-border?

More than 21% of the global online trade totality consists of cross-border trade. 67% of shoppers in the US are at least spending 10% of their monthly online shopping budget on cross border eCommerce. Amazon and eBay are two of the most popular marketplaces for shopping cross-border, especially in North America and Europe.

Why is expansion important?

Expansion leads to a bigger customer base and numerous clients for the products and services you offer across the border. The presence in the global market hence always helps the merchants to increase their customer base.

Why is it important to sell across borders?

Selling across-border means bigger target group for your product, which means that you have a bigger customer base to cater. Once your product gets recognized in the international market, it keeps on amplifying the sales with no loss to bear.

What is RMB settlement?

RMB cross-border settlement allows cross-border transactions to be settled in China’s currency. Historically, cross-border trade settlement with an entity in China was primarily conducted through USD. As part of the effort by the Chinese government to promote the use of the RMB as a trade currency, asset currency and reserve currency, in 2009, ...

What transactions can be settled in RMB?

Therefore, various transactions, including but not limited to goods or services trade, cross-border lending/borrowing, profit repatriation or registered capital injection, can be settled in RMB.

What is the Foreign Investment Law of the PRC?

Meanwhile, according to the Foreign Investment Law of the PRC approved by The National People’s Congress on March 15, 2019, article 21: “Foreign investors may exercise discretion in accordance with applicable law to remit into or out of China, in renminbi or any other currency, their contributions, profits, capital gains, income from disposition of assets, intellectual property royalties, lawfully acquired compensation, indemnification proceeds, proceeds of liquidation, etc.”

Can you enhance your relationship with trading partners?

You may be able to enhance your relationships with trading partners, obtain better pricing and manage your foreign exchange risk . The topics are discussed in the context of either remitter or beneficiary being in mainland China, and the other outside of mainland China, such as in the United States.

What Is Cross-Border Financing?

Cross-border financing—also known as import and export financing—refers to any financing arrangement that occurs outside a country's borders. Cross-border financing helps businesses participate in international trade by providing a source of funding that enables them to compete globally and conduct business beyond their domestic borders.

Why do companies seek cross-border financing?

Companies that seek cross-border financing want to compete globally and expand their business beyond their current domestic borders.

What are the two types of risk associated with cross-border financing?

Two types of risk associated with cross-border financing are political risk and currency risk.

What is cross border payment?

Cross-border payments defined as funds paid to or taken in from different countries, so the location where the merchant is registered is different from the country where the customer's card was issued. Many different scenarios need to be accounted ...

Why do merchants need to deal with international payments?

Many different scenarios need to be accounted for when a merchant needs to deal with international payments because each country has its own set of rules. The demand for cross-border payments is so high that steps are being made to improve cross-border payments as a whole.

What is an ebanx?

EBANX offers a complete payment solution that helps your business to cross borders and process international payments in Latin America.

Do national borders limit business?

National borders do not limit the range at which a business can function. It’s vital for any company to understand how cross-border payments work to have an efficient business.

Is cross border payment expensive?

So while cross-border payments are costly, they are in such high demand, that they grow. Cross-border transactions affect individuals as well as companies. Remittances are often sent from an immigrant family living in developing countries. These kinds of transactions are also subject to cross-border payment fees.

What Is Cross-Border Settlement?

Advantages and Disadvantages of Cross-Border Settlement

- Advantages

When a company has global subsidiaries, it is common for them to use cross-border financing services. By choosing cross-border financing, these companies can increase their borrowing capacity and gain access to the resources they need to compete on a global scale. Factoring is … - Disadvantages

Currency risk and diplomatic risk are two possible pitfalls of cross-border settlement. Currency risk refers to the probability that businesses will lose revenue as a result of variations in currency prices arising from foreign trading. Companies can find it difficult to obtain a favourable exchang…

Particular Points to Consider

- Most companies, as well as sponsors, have opted for loan funding over debt financing in recent years. This has had an effect on the nature of many cross-border loan financing agreements, particularly because covenant-lite (cov-lite) loans offer borrowers much more flexibility than conventional loan terms. Get Your Jeton Business Account

What Is Cross-Border Trade?

What Do Facts & Figures Say About Cross Border Trade?

- Here are some global facts & figures for Cross Border Trade: 1. According to Forrester, cross-border shopping will make up 20% of e-commerce in 2022. Not only this, but the sales will reach $627 billion. 2. As much as 70% of consumers make at least one international purchase a year. 3. The cross-border trade sales were marked to be US$ 300 Billion in the year 2012. 4. More than …

How to Sell on Marketplace to Leverage Cross Border Boom?

- Marketplaces are driving cross-border sales. Amazon and eBay are two of the most popular marketplaces for shopping cross-border, especially in North America and Europe. Cross-border sales now accou...

- China is reshaping cross-border commerce in North America.The rise of eCommerce in China, which is now larger than the markets of North America and Western Europe combined, will fo…

- Marketplaces are driving cross-border sales. Amazon and eBay are two of the most popular marketplaces for shopping cross-border, especially in North America and Europe. Cross-border sales now accou...

- China is reshaping cross-border commerce in North America.The rise of eCommerce in China, which is now larger than the markets of North America and Western Europe combined, will force cross-border...

4 Ways How Ecommerce Solves Cross-Border Puzzles For Online Sellers

- 1. Seamless payment processes:

Choice of payment processes differs from region to region. The developed world prefers Paypal whereas Asians generally don’t. Chinese use Alipay and WeChat and Indian prefer COD. However, it is a credit card that is the most popular method of payment across the world. It is th… - 2. Established Fulfilment network:

Like payment systems, people across geographies have different tastes for their fulfilment method. The U.S customers want direct delivery to their doorsteps whereas French also expects the same but with some collection points. Therefore it adds to the complexity to the operations a…

What Are The Benefits of Cross-Border Trade (CBT)?

- With multiple benefits cross-border is something every merchant wants to focus on. Glance over some of them below: 1. Global Expansion 2. Sustainability 3. Increased access to end customers 4. Brand Awareness 5. Increased Revenue 6. Build a customer base 7. Selling of low-demand products globally Now let us go through them one at a time.

What Are The Cross-Border Trade Challenges?

- It’s true that cross-border trade is thriving each moment, but the hurdles are not less. These hurdles may be encountered by both buyers in general and merchants in particular. Apart from trust issues, there are multiple challenges that really DO exist and the prime ones among those are categorized into two parts: 1. External Challenges 2. Internal Challenges Now let’s discuss t…

5 Points to Consider Before Practicing The Cross-Border Trade

- While practicing cross-border trade, there are points that a merchant should take care of. It is to make the most of the business and to turn the maximum profit.

What Is Cross-Border Financing?

Understanding Cross-Border Financing

- Cross border financingwithin corporations can become very complex, mostly because almost every inter-company loan that crosses national borders has tax consequences. This occurs even when the loans or credit are extended by a third party, such as a bank. Large, international corporations have entire teams of accountants, lawyers, and tax experts that evaluate the most t…

Advantages and Disadvantages of Cross-Border Financing

- Advantages

Many companies opt for cross-border financing services when they have global subsidiaries(e.g., a Canadian-based company with one or more subsidiaries located in select countries in Europe and Asia). Opting in for cross-border financing solutions can allow these corporations to maximiz… - Disadvantages

In cross-border financing, currency risk and political risk are two potential disadvantages. Currency riskrefers to the possibility companies may lose money due to changes in currency rates that occur from conducting international trade. When structuring terms of a loan across nations a…

Real World Example of Cross-Border Financing

- In Sept. 2017, Japanese conglomerate Toshiba agreed to sell its roughly $18 billion memory chip unit to a consortium led by Bain Capital Private Equity. The group of investors included American companies, Apple, Inc. and Dell, Inc., among others. The acquisition required U.S.-headquartered companies within the consortium to obtain Japanese yen to complete the deal. Bain Capital als…

Special Considerations

- In recent years many corporations, along with sponsors, have chosen loan financing over debt financing. This has affected the structure of many cross-border loan financing deals, particularly as covenant-lite (cov-lite) loans allow the borrower significantly more flexibility than some traditional loan terms. Cov-lite loans require fewer restrictions on collateral, re-payment terms, a…