- A debt settlement agreement is a form of contract.

- A settlement agreement should contain eight facts, including a description of the debt, the amount owed, the original creditor, and any account numbers.

- Make clear that the amount you pay brings the debt to $0 and closes the matter entirely.

How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

How to negotiate a debt settlement?

If you want to make a proposal to repay this debt, here are some considerations:

- Be honest with yourself about how much you can pay each month. ...

- Write down a summary of your monthly take-home pay and all your monthly expenses (including the amount you want to repay each month and other debt payments). ...

- Decide on the total amount you are willing to pay to settle the entire debt. This could be a lump sum or a number of payments. ...

Is a debt settlement worth it?

The short answer: Yes, debt settlement is worth it if all of your debt is with a single creditor, and you’re able to offer a lump sum of money to settle your debt. If you’re carrying a high credit card balance or a lot of debt, a settlement offer may be the right option for you. There are numerous debt settlement and credit card companies that promise to help you settle your debt for half or even a small fraction of the total balance you owe, but is debt settlement really a good idea?

What is a debt settlement arrangement?

A debt settlement agreement is a legal document that outlines an arrangement between a creditor and debtor where the creditor forgives part of the debt in exchange for immediate payment. It's important to note that this is not bankruptcy, it is just one more option you can use to get out of debt.

What is a debt settlement contract?

A debt settlement agreement is a legal document that outlines an arrangement between a creditor and debtor where the creditor forgives part of the debt in exchange for immediate payment. It's important to note that this is not bankruptcy, it is just one more option you can use to get out of debt.

What happens when a debt is settled?

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as "settled" or "account paid in full for less than the full balance."

How do I get out of a debt settlement agreement?

Generally, those options are to:Continue to handle the debt on your own.Contact the creditors for help.Settle the debt either on your own or with the assistance of a third party.Work with a nonprofit credit counseling agency through a debt management plan. ... Seek legal protection through bankruptcy.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Can I get loan after settlement?

First, you will need to have settled all of your debts. This means that you must have reached an agreement with your creditors and made all of the required payments. Once your debts are settled, you will then need to apply for a loan.

What are the negative effects of debt settlement?

Debt settlement can cause your credit score to fall by more than 100 points, and it stays on your credit report for seven years. If your creditors close accounts as part of the settlement process, this can cause your credit utilization to increase, which also negatively affects your credit score.

What happens if you stop paying debt review?

Your creditors will issue you with a Section 129 letter which confirms you are in arrears. This will be followed by a summons and if ignored leads to a default judgement. It is at this point that a warrant of execution is issued, and your car can be repossessed and sold at auction to cover some of your debt.

What happens if you cancel a debt management plan?

When you cancel, the provider will tell your creditors, so they might start charging you interest and late payment fees again, as well as expecting you to resume higher payments. You'll also have to deal with your creditors yourself again. Think about how you're going to cope with this.

What happens if you stop paying credit consolidation?

First, you would start to accrue late fees and charges. Then after a certain amount of time your loan will go into default. This means you failed to uphold your end of the loan agreement, and your loan will be sent to a collection agency.

What happens after 7 years of not paying debt?

Unpaid credit card debt will drop off an individual's credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person's credit score.

How long does it take to rebuild credit after debt settlement?

Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement.

How long does debt settlement affect credit?

Settled Accounts Remain on Your Credit Report for Seven Years. When you settle, the account will not be removed immediately from your credit report. If you were late on payments, the account will remain on your credit report for seven years from the original delinquency date.

Can a settled debt be removed from credit report?

That's a common question. Yes, you can remove a settled account from your credit report. A settled account means you paid your outstanding balance in full or less than the amount owed. Otherwise, a settled account will appear on your credit report for up to 7.5 years from the date it was fully paid or closed.

Is settled in full good on credit report?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

How do I raise my credit score after debt settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

How long does debt settlement affect credit?

Settled Accounts Remain on Your Credit Report for Seven Years. When you settle, the account will not be removed immediately from your credit report. If you were late on payments, the account will remain on your credit report for seven years from the original delinquency date.

How long does a debt settlement company have to make payments?

The debt payment schedule proposed by the company is as follows: After three months of making payments to the debt settlement company, ...

What would a debt settlement company advise the borrower to do?

During the process, the debt settlement company would advise the borrower to stop making payments to their creditors and instead make payments to the debt settlement company (albeit at a lower payment rate).

What is a debt covenant?

Debt Covenants Debt covenants are restrictions that lenders (creditors, debt holders, investors) put on lending agreements to limit the actions of the borrower (debtor). Intercreditor Agreement. Intercreditor Agreement An Intercreditor Agreement, commonly referred to as an intercreditor deed, is a document signed between one or more creditors, ...

What happens if a debt settlement falls through?

If a debt settlement falls through, the borrower will end up with more than the initial debt owed.

How to settle a debt?

In a debt settlement, the borrower may engage with a debt settlement company, who would act on the borrower’s behalf. The typical process for a debt settlement is as follows: 1 The borrower explains their financial situation to a debt settlement company. 2 During the process, the debt settlement company would advise the borrower to stop making payments to their creditors and instead make payments to the debt settlement company (albeit at a lower payment rate). 3 The debt settlement company would put the payments made by the borrower into a savings account#N#Savings Account A savings account is a typical account at a bank or a credit union that allows an individual to deposit, secure, or withdraw money when the need arises. A savings account usually pays some interest on deposits, although the rate is quite low.#N#. 4 Once the savings account’s reached a certain threshold, the debt settlement company would engage with the borrower’s creditors to negotiate a debt settlement. 5 If negotiations are successful, the debt settlement company would retain a portion of the money in the savings account (it is collected as fees by the debt settlement company) and distribute the remainder to the borrower’s creditors.

What is the legal status of a non-human entity that is unable to repay its outstanding debts?

Bankruptcy Bankruptcy is the legal status of a human or a non-human entity (a firm or a government agency) that is unable to repay its outstanding debts. , the borrower may attempt to reach a debt settlement with their creditors. In a debt settlement, the borrower may engage with a debt settlement company, who would act on the borrower’s behalf.

What happens if a debt settlement company is successful?

If negotiations are successful, the debt settlement company would retain a portion of the money in the savings account (it is collected as fees by the debt settlement company) and distribute the remainder to the borrower’s creditors.

What is debt settlement agreement?

The Debt Settlement Agreement is a contract signed between a creditor and debtor to re-negotiate or compromise on a debt. This is usually in the case when an individual wants to make a final payment for a debt that is owed. The debtor offers a payment that is less than the outstanding due (usually between 50% to 70%) if ...

What is debt settlement?

Debt Settlement. It is understood amongst the Parties that the Debtor has an outstanding debt with the Creditor. Through the mutual interest of the Parties, they agree that this outstanding debt shall be marked as paid if Debtor shall make payment of $______________ by ______________, 20___.

What happens after a debt payment is made?

After the payment has been made by the Debtor the Creditor shall make any and all efforts to remove the outstanding debt from the Credit Reporting Agencies. Furthermore, the Creditor declares that they will not make additional information that could harm the Debtor’s credit report.

How to sign a debt agreement?

The Debtor must sign this Agreement to formally enter it. He or she will need to locate the words “Debtor’s Signature” then sign the blank line after them. Adjacent to this he or she should enter the current Date. Finally, the Debtor must print his or her Name on the blank line labeled “Debtor’s Name.” The Creditor must sign his or her Name on the “Creditor’s Signature” line, then supply the Date he or she signed this document on the empty line next to it. Below this, the Creditor must sign his or her Name. If the Creditor is a Business Entity, then an individual who is authorized by that Business Entity to sign this document on its behalf must sign his or her Name. When Printing his or her Name, the Signature Party should follow it with the Legal Name of the Business Entity as reported in the first paragraph (i.e. John Doe, 1X Corp.).

What happens after payment?

After Payment – After the last payment is complete the Creditor will agree to remove all harmful postings from the Debtor’s credit report.

What is debt settlement?

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly. Get Debt Help.

What do debt settlement companies have to explain?

Debt settlement companies must explain price and terms, including fees and any conditions on services.

Why Work with a Debt Settlement Company?

Often there’s a good reason – a layoff or reduction in pay, big medical bills, an unexpected emergency expense. No matter what the reason, it can be difficult to get out from under overwhelming debt on your own. This is particularly true for credit card debt or other revolving debt, that never seems to decrease, even if you’re paying monthly.

How long does it take for a debt settlement to pay?

Meanwhile, the company will negotiate with your creditors to settle for a lower amount. Once you’ve paid the amount the agreement is for into the escrow account, the debt settlement company will pay your creditor. This process can take 2-3 years.

How much does a debt settlement company charge?

Debt settlement companies charge a fee, generally 15-25% of the debt the company is settling. The American Fair Credit Council found that consumers enrolled in debt settlement ended up paying about 50% of what they initially owed on their debt, but they also paid fees that cut into their savings. The report gives an example of a debt settlement client whose $4,262 account balance was reduced to $2,115 with the settlement. So, at first it would seem she saved $2,147, the different between what she owed and what the settlement amount was. But she also paid $829 in fees to the debt settlement company, so she ended up saving $1,318.

What happens when you settle a debt?

In debt settlement, the company will instruct you to stop making payments to the creditors. Your accounts become delinquent, and the debt settlement company tries to negotiate a settlement on your behalf. In the meantime, you give your money to the debt settlement company, who also is not paying the creditor with it.

How much money did a debt settlement save?

The report found that debt settlement clients settled an average of about 50% of what was originally owed, but realized savings of about 30%.

What is debt settlement agreement?

1. Overview. No matter the protective measures taken, it is a simple market fact that borrowers default on loan terms or payments. In some cases, the overall amount may be too much for the debtor to manage, and continuing payments may force it into bankruptcy.

What is debt settlement?

Debt settlement is a means of reducing or eliminating unsecured debt by negotiating an agreed upon payoff amount with creditors. This usually does not occur if a debt is secured, since the lender will have the right to take the property that secures the loan in lieu of payment.

What is a Promissory Note?

Promissory notes are legal lending documents. If you're going to lend money to someone, you'll need one. You've also likely signed one in the past, if you've ever taken out a loan. Find out when you need a promissory note and how to create one.

How to lower debt?

If you're wallowing in debt, sending a debt settlement letter to creditors to lower your amount of debt might work, as it does for many people who want to eliminate debt. See what you can do to put your finances and your life back on track.

What happens if you settle a debt?

Settling a debt can result in income tax liability. Creditors must report any forgiven debt in excess of $600 to the IRS, and the debtor will receive an IRS form for the amount of the forgiven debt. Talk to an attorney or a tax professional for additional details about these consequences.

What to do if your agreement is complicated?

If your agreement is complicated, do not use the enclosed form. Contact an attorney to help you draft a document that will meet your specific needs.

Do you have to make a large payment to settle a debt?

There are pros and cons for the borrower looking to settle a debt. Although your monthly payments will be reduced, you will usually need to make an immediate large sum payment to complete the settlement. Your creditors may report any settlement to the credit bureaus.

What is debt settlement?

Debt settlement is when your debt is settled for less than what you currently owe, with the promise that you’ll pay the amount settled for in full. Sometimes known as debt relief or debt adjustment, debt settlement is usually handled by a third-party company, although you could do it by yourself.

How does debt settlement work?

It’s usually done by a third-party company or sometimes a lawyer, and you’ll need to pay for their services — either as a flat fee or a percentage of your savings. This means that even if your debt is settled for less than what you owe, you still have additional costs outside of your outstanding debt.

Why do debt settlement companies ask you to stop paying?

For instance, many debt settlement companies ask that you stop making payments on your credit card during negotiations because lenders and creditors are not as likely to negotiate with a consumer who is still able to make monthly payments on their bills. Not paying bills, of course, damages your credit.

How to avoid debt settlement scams?

While there are many companies looking out for your best interest, some debt settlement companies are scams. You can avoid fraudsters by: 1 Avoiding businesses that make false promises: If a company says that it can make your debt go away and stop debt lawsuits and collections, beware. Remember, your creditor isn’t obligated to accept a settlement, and some won’t work with debt settlement companies. Getting your debt and related problems to disappear is not a guarantee. 2 Not paying fees before debt settlement: If your debt settlement company requires money before it’s done any work, that’s a red flag. Read the fine print when it asks for payment, and make sure that you know what it’s going toward. 3 Keeping up with communications: If your debt settlement company doesn’t tell you about the risks involved in debt settlement or the consequences of not making payments to your debt collectors, that’s a problem. You should know every risk before handing over your money (or pausing payments), and it’s your debt settlement company’s job to make sure that you’re aware of what’s at stake.

How much does a third party debt settlement charge?

However, it’s not unusual for a third-party debt settlement professional to charge between 15 percent and 25 percent of the debt that gets resolved.

What happens if you settle your debt for less than what you owe?

This means that even if your debt is settled for less than what you owe, you still have additional costs outside of your outstanding debt. As this company negotiates your debt, you’ll need to start making payments to your debt settlement company.

How long does it take to settle a debt?

It’s not unusual for the entire process to take as long as three to four years.

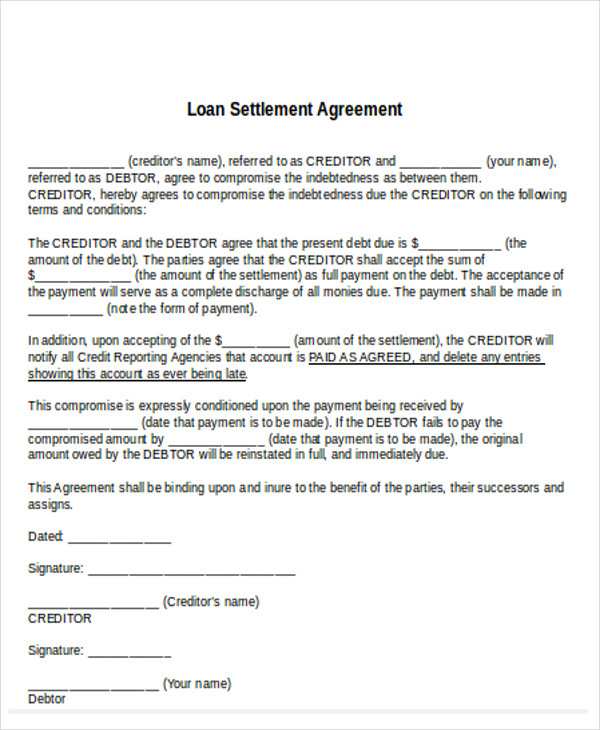

What a Debt Settlement Agreement Must Include

After you have negotiated a debt settlement with a creditor, such as a credit card company, you will need to formalize your agreement in writing. You can write the agreement yourself and send two copies to your creditor so that they can send a signed copy back to you. Or it may be easier to have your creditor draft up a letter and send it to you.

Sample Debt Settlement Letter Template

Here is a general template that you can use to draft your debt settlement agreement. You can add to, remove, or modify the information contained in this agreement to match your circumstances. The agreement letter can be either simple or complex, depending upon your specific financial situation and the type of debt that you owe.

When Should You Consider a Debt Settlement Agreement?

A debt settlement agreement is when you, or a debt settlement company working on your behalf, negotiate with a creditor to reach an agreement on a payoff amount for your debt. A debt settlement agreement is a binding contract that either you or the creditor drafts.

A Good Debt Settlement Agreement Should Be Specific, Comprehensive, and in Writing

No debt settlement agreement is valid until it is put into writing and signed by both you and your creditor. In many cases, your debt collector will be glad to furnish you with a debt settlement letter with all of the information already filled out.

Understanding A Debt Settlement

- A debt settlement is entered into by a borrower when they lack the capacity to pay the outstanding amount of debt to their creditors. Instead of declaring bankruptcy, the borrower may attempt to reach a debt settlement with their creditors. In a debt settlement, the borrower may engage with a debt settlement company, who would act on the borrower’s...

Practical Example

- A borrower is required to make monthly debt payments of $10,000 to her creditor for a period of three months. The debt payment schedule is as follows: Due to unforeseen events, the borrower is unable to satisfy the debt payment schedule shown above – the borrower is left with $0 in her savings account but earns a monthly disposable income of $8,000. The borrower engages with …

Advantages of A Debt Settlement

- 1. Lowering the amount of debt outstanding

A debt settlement would lower the amount of debt outstanding. In the example above, although the borrower owed $30,000 in debt, the borrower only ended up paying $24,000. - 2. Avoiding bankruptcy

A debt settlement allows the borrower to avoid bankruptcy. Depending on the country, consumer bankruptcy can last up to ten years – significantly impacting the credit score of a borrower. In addition, declaring bankruptcy can potentially impact employability.

Implications of A Debt Settlement

- Although a debt settlement lowers the amount of debt outstanding and allows the borrower to avoid bankruptcy, there are significant repercussions to be considered, such as:

More Resources

- CFI offers the Financial Modeling & Valuation Analyst (FMVA)™certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following CFI resources will be helpful: 1. Credit Administration 2. Debt Covenant 3. Intercreditor Agreement 4. Loan Servicing