How to write a successful debt settlement agreement?

Prepare Your Debt Settlement Offer

- Assess your budget – how much are expenses and income? Put what is left in an account to pay off the settlement.

- Consider taxes – The IRS considers the difference between what you owe and settle for income

- Consider credit reporting – You don’t want your creditor to report settled or paid settled

What to include in a debt settlement letter?

There are some key details that all debt settlement offer letters should have:

- The full name used for the credit account

- Your full address

- Your account numbers or a reference number from the creditor

How do you write a letter of settlement?

Settlement Agreement Letter Writing Tips. The letter should specify the important details. The letter should also specify how the settlement can be tackled. The letter should specify the amount. The letter should be clear and simple. The letter should express the terms & conditions from the standpoint of both the parties.

Should I write a debt settlement offer letter?

What Your Settlement Letter Should Include

- The letter should be on company letterhead, regardless of whether you’re dealing with a collection agency or the original creditor. ...

- The letter should include a date so you know when the settlement offer was made.

- Make sure the correct account number is listed on the debt settlement letter. ...

What happens when a debt is settled?

Settling a debt means you have negotiated with the lender and they have agreed to accept less than the full amount owed as final payment on the account. The account will be reported to the credit bureaus as "settled" or "account paid in full for less than the full balance."

What are debt settlement documents?

A debt settlement agreement is a document from a debt collector offering for a client to settle a debt for less than the full amount owed. You may need to use this type of agreement if someone defaults on a loan or credit card because they cannot afford to make the payments.

How long does debt settlement stay on your record?

seven yearsDear LSM, A settled account remains on your credit report for seven years from its original delinquency date. If you settled the debt five years ago, there's almost certainly some time remaining before the seven-year period is reached. Your credit report represents the history of how you've managed your accounts.

How do I get out of a debt settlement agreement?

Steps to Canceling a Debt Settlement ContractStep 1: Submit Notice of Intent to Cancel to Both your Creditor and Debt Settlement Company. ... Step 2: Request the Company's cancellation steps. ... Step 3: Pay fines. ... Step 4: Pay lenders' outstanding debts or renegotiate.

How much do debt collectors settle for?

Some want 75%–80% of what you owe. Others will take 50%, while others might settle for one-third or less. Proposing a lump-sum settlement is generally the best option—and the one most collectors will readily agree to—if you can afford it.

Can I get a credit card after debt settlement?

It depends on how poor your credit score is after debt settlement. Some individuals have testified that their application for a mortgage was approved after three months of debt settlement. Some needed years before they could get a new credit card or loan.

Does debt settlement stay on credit?

How Long Do Settled Accounts Stay on a Credit Report? Settling an account will cause the status to show that you no longer owe the debt, but the account will stay on your credit report for seven years from the original delinquency date.

Can I get a mortgage after debt settlement?

Most lenders won't want to work with you immediately after a debt settlement. Settlements indicate difficulty with managing financial obligations, and lenders want as little risk as possible. However, you can save enough money and buy a new home in a few years with the right planning.

What is debt settlement and how does it work?

Debt settlement is when your debt is settled for less than what you currently owe, with the promise that you'll pay the amount settled for in full. Sometimes known as debt relief or debt adjustment, debt settlement is usually handled by a third-party company, although you could do it by yourself.

How long does it take to improve credit score after debt settlement?

between 6 and 24 monthsHowever, a debt settlement does not mean that your life needs to stop. You can begin rebuilding your credit score little by little. Your credit score will usually take between 6 and 24 months to improve. It depends on how poor your credit score is after debt settlement.

Is settled in full good on credit report?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

What Is a Settlement Offer Letter?

The main reason to negotiate a debt settlement is to find debt relief, but it can also save you money. When you eliminate debt through a debt settlement, you’ll also decrease your use of credit, which will increase your credit score.

Things To Consider While Pursuing Debt Settlement

As with each form of debt relief, debt settlement has advantages and disadvantages .

Steps To Take if You Seek a Settlement Offer

The first decision for you to make is whether you will negotiate the debt settlement yourself or hire debt settlement professionals to negotiate on your behalf. Professionals can help you, especially if you believe that you lack the communication skills necessary to negotiate with debt collectors.

Writing the Settlement Offer Letter

A debt settlement letter is, in effect, a written legal contract. It’s important to make direct, explicit, and detailed statements.

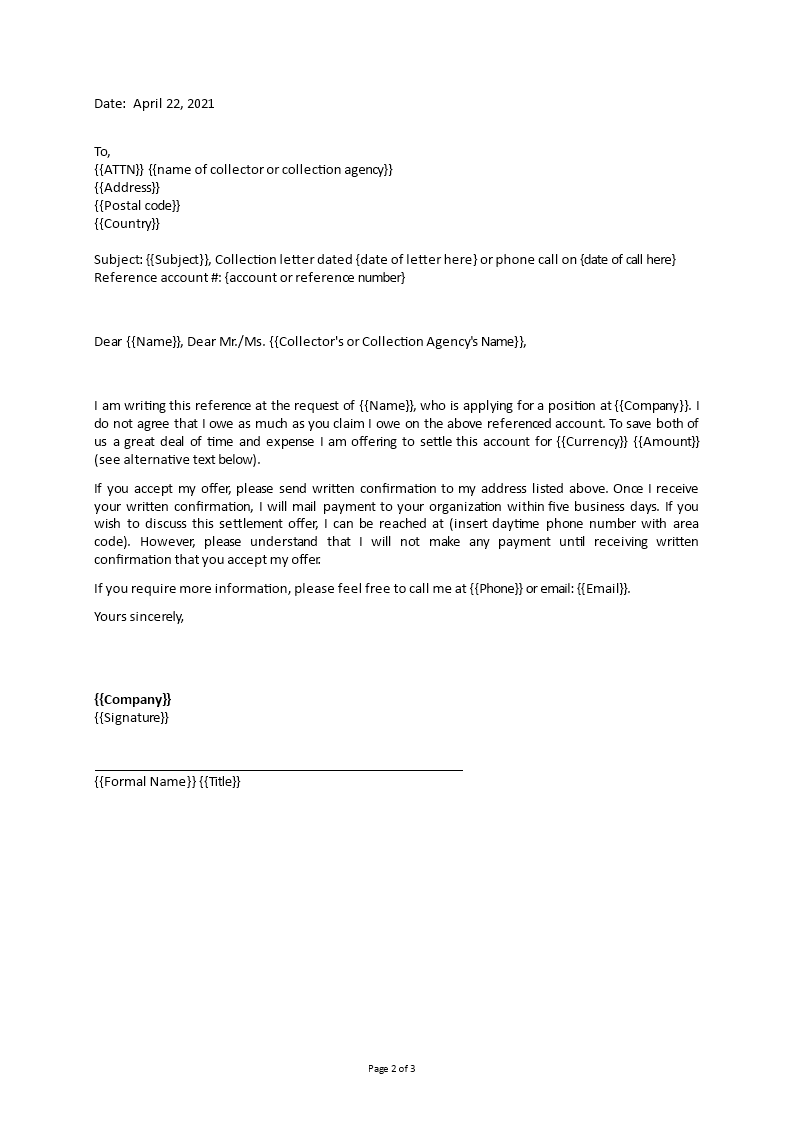

Debt Settlement Letter Template

This letter is in reference to the account number identified above and its outstanding debt. Due to financial difficulties, I am unable to pay the outstanding balance in full. [ Explain your hardship to the creditor here.]

How to Write a Debt Settlement Proposal Letter?

So, that it’s easy to get the idea of the structure, it must contain an introduction of yourself and your account. Don’t forget to put the facts of your case with the details such as your credit card number, address, and phone number. In the letter, you should also offer an exact amount of money – a lump sum – that you are willing to pay.

What is debt settlement?

The primary aim of debt settlement is to partially free you from the weight of unpaid bills. It’s an agreement between a debtor and a creditor, in order to find the possibility of paying less than what you own now. One of the first milestones of the whole process is writing a debt settlement letter.

What Is This Letter For?

Debt settlement letters help a debtor to engage in a constructive dialogue with a creditor. After you validate that you owe the debt, the process of a debt settlement begins. According to the Fair Debt Collection Practices Act (FDCPA), a debt settlement company has five days to send you a letter validating that the debt is yours after their call.

Why do creditors and collectors write letters?

The main advantage of having written correspondence is to save texting history of debt settlement letters from a debtor and also settle letters from a creditor back to the debtor.

When was Debtquest USA founded?

Our company was founded in 2009 out of a desire to help Americans. Our service is proclaimed excellent based on more than 200 reviews. We know what we are doing. Join DebtQuest USA, and let’s start your new life together!

Is a Debt Settlement Itself the Right Option for Me?

Surely, debt settlement itself is not for every American debtor. You should have more than $7,500 in unsecured debt. If you are ready for your credit score to change (going down and then going up after the process), then it can be a solution for you. In other cases, you can try credit counseling. That may be a better option.

What is a Settlement Letter for Debt?

If you’ve been struggling with debt for a while, you may have heard about debt settlement. But did you know that the settlement process often starts with writing a letter? In light of that, we’ve created a guide to writing a settlement letter for debt settlement.

What is a settlement letter for debt?

Before we can get into specifics about writing a debt settlement letter, it’s vital to understand the concept of debt settlement itself. At its core, debt settlement involves negotiating with your creditors and asking them to forgive a portion of your debt in exchange for a lump-sum payment.

Pros and cons of writing a debt settlement letter

While writing a settlement negotiation letter may seem like the obvious choice over paying the full amount you owe, like any other financial decision, this has its advantages and disadvantages. We’ve laid them out for your consideration below. Read them carefully to get a better idea of whether or not you want to go this route.

How to write a settlement negotiation letter

If you’ve weighed the pros and cons of settling your debt and decided that you do want to write a debt settlement offer letter, the next step is to learn how to put one together. To that end, we’ve listed the components of an effective settlement letter below. Use these points as a template when you’re ready to write your letter.

The bottom line on writing a debt settlement offer letter

When you’re genuinely struggling financially, writing a debt settlement letter can be one of the first steps toward finally becoming debt-free. That said, since settling your debt can have lasting implications on your overall financial health, it’s important to think this decision through before you put pen to paper.

What Is a Debt Settlement Letter?

If you’re unable or unsure about negotiating a debt settlement over the telephone, negotiating by letter is a reasonable option. It’s not much different negotiating with your creditor by telephone, but it might take longer. There are several ways to prepare a settlement letter, including hiring an attorney to write it for you or going online to download a template to use as a starting point. There are also several sample letters you can look at to get an idea of what your completed letter should look like.

How does debt settlement work?

Luckily, there are many debt relief options. Debt settlement is one of the most advertised and for good reason. It’s often used for credit card debts and allows borrowers with unmanageable debt to pay off one or more debts for less than the full amount. The creditor then forgives the remaining debt. This may sound too good to be true, but it’s not. How well it works for you will depend on your financial situation and whether you choose to hire a debt settlement company to help you or do the debt settlement process yourself. This article will explain how to handle debt settlement on your own and how to write the best debt settlement letter possible.

What is the first step in a debt settlement?

The first step in a debt settlement negotiation with a bank, credit card company, or collection agency is to confirm the debt belongs to you. Some debts pass through multiple collection agencies once they leave the original creditor. During that time, mix-ups can occur or debts can become so old they are past the statute of limitations and legally uncollectible .

How long do you have to be behind on your debt to get a creditor to accept your debt?

To increase your chances of getting a creditor to accept your debt, you need to be at least 90 days behind on your payments with that creditor. And during the negotiation process, you’ll need to continue not making any payments. This will hurt your credit score and the extra fees and interest may increase your overall debt. But it’s easier to convince a creditor that you can’t fully pay off your debt when you haven’t made any payments for several months. Remember, a creditor is willing to settle a debt for less than what you owe because they fear your financial situation is so uncertain that they won’t recover any money from you in the near future.

What is Upsolve for bankruptcy?

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

How to reach out to your creditor?

Now it’s time to reach out to your creditor. You can do this by telephone or by letter. Either way, you’ll need to have some cash saved up beforehand. Most debts get settled after the borrower makes a one-time lump-sum payment of the outstanding debt. In other cases, you’ll need to pay two or three large payments over a short period of time instead. Creditors rarely agree to let borrowers use a payment plan with monthly payments to settle their debts.

How long does it take to settle a debt?

Another major advantage is that the DIY debt settlement process tends to be faster, perhaps six months or less. In contrast, using a debt settlement company can easily take several years. Not only does this extra time mean it takes longer to get debt relief, but that’s more time for your debt to accrue interest and penalties.

Why do you need a debt settlement letter?

A well thought out debt settlement letter can make all the difference when it comes to liability. This helps in ensuring that both parties uphold their part of the agreement. Since it may negatively impact your credit score, you may feel nervous about settling your debt.

How to write a settlement letter to a creditor?

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

What Is Debt Settlement?

Debt settlement is the meticulous process of negotiating terms with your creditors, in hopes of them forgiving a portion of your debt. Those who look for debt settlement usually are doing so because they can’t pay off all the debt they’ve accumulated. Instead, they offer a decent portion of the debt owed upfront in exchange for the account to close in full.

How does debt settlement work?

Debt settlement works to negotiate with your creditors to forgive all or part of your debt. Throughout this process, communication is usually done with written letters. Written letters work best to convey the clear and detailed terms you have for your creditor. A debt settlement letter is a written proposal for you to offer a specific amount ...

How much does a debt settlement amount settle for?

If the request is accepted, debt settlement amounts usually settle for around 50 to 80 percent of the total balance. Reaching out to your creditors and addressing the issue can also relieve some of the stress you feel to pay off your debt.

What happens if you don't settle your debt?

If you hire professionals, you may owe them various fees and payments. Settling debt can often appear as a bad financial move and can negatively impact your credit health.

How to settle debt on your own?

The following are the key steps in reaching a debt settlement: Decide if you want to work on your own or hire debt settlement professionals. Professionals can be of great help, but sometimes their fees can get quite expensive. Save up the amount of money you are proposing before even getting started.

How long does it take to settle a debt with a collection agency?

They have five days to do so under the Fair Debt Collection Practices Act (FDCPA).

How to settle a debt on your own?

When you’re working to settle a debt on your own, you want to do everything in writing. This is especially true if you’re making formal debt settlement agreements. Creditors and collectors will try to get you to agree to things over the phone. Don’t fall for it! Ask them to send you their proposal in writing. Avoid saying anything that acknowledges that you’re obligated to repay the debt. You can use these debt settlement letter templates to negotiate everything in writing.

Can you admit to a debt?

Never admit that you owe the debt or that you’re supposed to pay it. This can reset the statute of limitations on collecting the debt in some states!