What is ESR (evaluated receipt settlement)?

Evaluated receipt settlement (ERS) is a unique process where the creation of an invoice against a goods receipt happens automatically. The invoice is posted on the basis of the data in the purchase order and goods receipts. In this process, it is not necessary for the vendor to submit an invoice.

What is SAP evaluated receipt settlement?

Welcome to our tutorial on SAP evaluated receipt settlement. To summarize the normal SAP procure to pay process, it involves sending a purchase order to a vendor, receiving the goods from the vendor along with an invoice, then posting the invoiced amount against the goods receipt through invoice verification.

What are the advantages of a receipt settlement in QuickBooks?

Evaluated receipt settlement has numerous advantages. First, it eliminates much of the non-value added activity associated with the payables function. Second, there are no variances between the billed amount on the supplier invoice and the amount received, since there is no supplier invoice.

What is ERS settlement process in SAP?

SAP Evaluated Receipt Settlement Process. In order to realize the above-mentioned advantages, ERS must be set up correctly in SAP. As mentioned, this will happen as a result of communication between the buyer and supplier in agreement of the terms of the automatic settlement.

What is evaluated receipt settlement in SAP?

ERS — Evaluated Receipt Settlement is the process of settling goods receipt automatically. The Vendor Invoices are posted automatically(without actually receiving from the vendor) in the system based on the information in the purchase order and goods receipt.

What are the benefits of evaluated receipt settlement?

It was pioneered by General Motors (GM) to save the company time and money (1). Major benefits of ERS include invoice variance prevention (2), the elimination of non-value-added work (like tasks associated with reconciliation), and opportunity cost of capital savings (3).

What does Evaluated receipt Settlement enable companies to accomplish?

EVALUATED RECEIPT SETTLEMENT Increase Accounts Payable efficiency with Evaluated Receipts Settlement (ERS). Enable the ERS functionality based on vendors, purchase order lines and/or purchasing trade agreement lines and let the system generate invoices.

What is the purpose of ERS?

Evaluated Receipt Settlement (ERS) allows you to settle goods receipts without receiving an invoice. Based on the order price specified in the purchase order and the quantity entered on the goods receipt, the system can determine the correct invoice amount.

What is ERS payment?

Introduction. What is ERS? ERS stands for “Evaluated Receipt Settlement,” and is an automated invoice and payment system. Keysight creates an invoice on your behalf once the goods are received into Keysight's inventory or are consumed in production.

What is ers in banking?

ERS is the automated exchange rate calculator for banks, built on unique architecture that allows system to fetch currency exchange rates against US Dollars from Reuters / Bloomberg based on each individual institution's time zone and schedule.

What does ers stand for in Procurement?

Evaluated Receipt SettlementERS stands for “Evaluated Receipt Settlement,” and is an automated invoice and payment system.

What is ers in SAP?

Evaluated Receipt SettlementWhen you use Evaluated Receipt Settlement (ERS), you agree with the vendor that the latter will not submit an invoice in respect of a purchase order transaction. Instead, the system posts the invoice document automatically on the basis of the data in the purchase order and goods receipts.

Why do we keep invoice on hold?

Holds are placed on invoices to prevent payment of invoices. Holds can be placed on an invoice either automatically by the system during the online approval process in the accounts payable module or manually entered into the system.

What is an ERS agreement?

ERS is a process designed to eliminate the need for a supplier to provide a paper copy of an invoice to the customer. 3. ERS payments are calculated based on the goods receipt date and the quantity in the customer's receipt record, using the. price on the contract, purchase order or scheduling agreement.

How do you maintain ers?

To maintain vendor master data for ERS, select the following indicators in the Purchasing data view of the vendor master record:GR-Based Inv. Verif. ... AutoEvalGRSetmt Del. ... AutoEvalGRSetmt Ret – Check this indicator to allow the automatic creation of credit memos with respect to returned materials.

What is the full form of ERS?

Electronic Reservation Slip (ERS), which is a printed version of the IRCTC's e-ticket with reservation details.

Is a receipt a legal document?

Receipt has two legal definitions: (1) A legal document evidencing a buyer has purchased and taken possession of the goods. A receipt can range from a small paper itemization of goods purchased in a retail setting to a document that a person storing an item has to prove another's ownership (i.e. a warehouse receipt).

How can I get proof of payment without receipt?

Common proofs of payment include a check or credit card statement showing that the bill was paid. Other forms of proof may be a store receipt, credit card receipt, or paid invoice.

How do I prove I get paid with a check?

Print a copy of the bank or credit card statement that shows your proof of payment. If you paid by check, obtain a front and back copy of the canceled check image that corresponds with the check number you used for the payment.

What legally needs to be on a receipt?

The receipt need not be in any particular form but must show the following: (1) The name and place of business of the retailer. (2) The serial number of the retailer's permit to engage in business as a seller or the retailer's Certificate of Registration—Use Tax. (3) The name and address of the purchaser or lessee.

What is SAP evaluated receipt settlement?

Evaluated receipt settlement (ERS) is a unique process where the creation of an invoice against a goods receipt happens automatically. The invoice is posted on the basis of the data in the purchase order and goods receipts. In this process, it is not necessary for the vendor to submit an invoice. Thus, there must be a prior agreement between the buyer and supplier to enable SAP evaluated receipt settlement functionality.

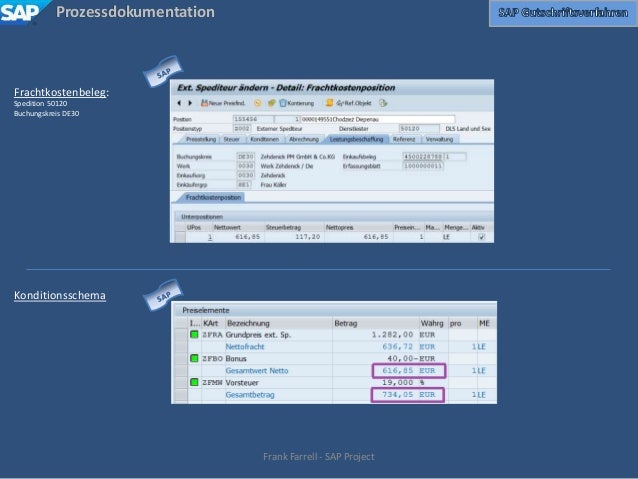

What is the transaction code for SAP evaluated receipt settlement?

Now we are ready to create the purchase order that will be used for the SAP evaluated receipt settlement. Use transaction code ME21N and enter the required information, taking care to use the following details:

What is purchasing info record?

A purchasing info record is like a data register where material and vendor details are stored with a one-to-one relationship between material and vendor. We know which material can be procured from which vendor through this master record. It also contains settings relevant to activate SAP evaluated receipt settlement.

What is defaulted from purchase order?

The material, plant and storage location are defaulted from the purchase order.

What is an evaluated receipt settlement?

The concept of Evaluated Receipts Settlement – making payment based on receipt information without matching to an invoice – has been around for decades. The concept is simple: If your Purchasing Department and your suppliers can agree on details for what is being purchased and at what price, the Accounts Payable process can be all but eliminated, with payments generated automatically once ordered items are recorded as being received

What is an ERS settlement?

Think of Evaluated Receipts Settlement (ERS) as a process for your business that involves outside partners that do business without invoices. When completing an ERS transaction, a supplier will ship goods based upon an Advance Shipping Notice (ASN). Once the goods are received, the purchaser confirms the purchase order/contract, verifies the goods are in their custody, and then pays the supplier. In other words, when ERS is used, the parties agree that the vendor will not submit an invoice. Rather, an automated system posts the invoice automatically based upon the final data of a purchase order and goods receipts. The main advantage of using an ERS system is to eliminate discrepancies in invoices. Since the invoice is generated at the end of a transaction, it is more likely to contain the most accurate information.