Settlement finality, as defined in general, is the discharge of an obligation by a transfer of funds and a transfer of securities that have become irrevocable and unconditional. This concept has been increasingly focused on while the G-10 countries attached their importance on the risk management in settlement systems.

What is the meaning of finality?

Definition of finality 1 a : the character or condition of being final, settled, irrevocable, or complete b : the condition of being at an ultimate point especially of development or authority 2 : something final especially : a fundamental fact, action, or belief

What does'finality of payment'mean?

BREAKING DOWN 'Finality Of Payment'. Since many online banking and bill payment services use the Automatic Clearing House (ACH) system to process payments, which doesn't result in an immediate transfer, many companies do not consider a bill paid until after they're assured of the finality of payment.

What is the legal definition of settlement in law?

Legal Definition of settlement. 1 : the act or process of settling. 2a : an agreement reducing or resolving differences especially : an agreement between litigants that concludes the litigation the states finally agreed upon a settlement and a consent decree — W. J. Brennan, Jr. entered into a property settlement prior to the divorce.

What is the etymology of the word final?

the state of being final, finished, or complete; a final or conclusive arrangement; a settlement Etymology: [L. finalitas the being last.] Etymology: [L. finalitas the being last.]

What is finality in payments?

Finality of payment is the moment at which recently transferred funds become the legal possession of the receiving party. The concept is mainly familiar to institutional account holders, who often are more exposed to counterparty risks.

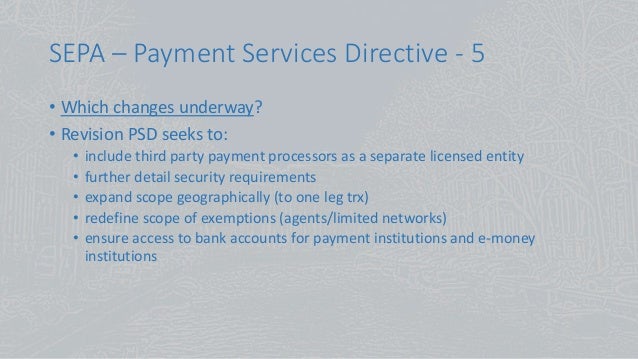

What is the settlement finality directive?

The Settlement Finality Directive (the Directive) regulates systems (Designated Systems) used by financial market participants to transfer financial instruments and payments. It was transposed into Irish law in 2010 by the European Communities (Settlement Finality) Regulations 2010 (the Irish Regulations).

What is Csdr regulation?

The Central Securities Depository Regulation (CSDR) is the latest step in establishing an EU-wide harmonised regulatory framework for financial market infrastructures. Settlement across borders presents higher risks and costs for investors within one country.

What is settlement finality?

Put simply – all transactions (daily transactions, security trades etc) have to be "settled" to be considered "final". Hence, the term Settlement Finality.

What does "finality" mean?

Finality: Finality simply refers to the idea that the occurrence of event is “final” and “permanent”. You cannot undo this event – it has occurred, and will remain ‘occurred’

Why is it called "reasonable finality"?

I say "reasonable finality" because finality in proof of work and proof of stake are still not truly "final". Technically, a settled payment can still be reversed. It may be improbable – but not impossible. Let's go over some of the ways:

Why don't centralized solutions have finality?

Finally, even our current centralized solutions don’t have finality because they can always be hacked, burned down, gun-to-the-head etc etc. Perfect finality is probably impossible. There are too many external factors outside of the system that can remove finality.

Is it easier to achieve finality in financial transactions?

However, achieving finality with financial transactions is actually easier said than done. We tend to equate "extremely difficult" to "impossible".

Is finality always probabilistic?

However, neither of them achieve true finality. Finality will always be probabilistic (i.e there's a chance – however small – that a transaction can be reversed) First, let's go over finality in proof of stake and proof of work.

Examples of settlement in a Sentence

I got the house in the divorce settlement. The parties have not been able to reach a settlement in the case.

Legal Definition of settlement

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

What Is Finality of Payment?

In finance, the term "finality of payment" refers to the moment at which funds, recently transferred from one account to another, officially become the legal property of the receiving party.

When is finality of payment important?

The precise timing of when finality of payment is achieved is especially relevant when dealing with complex derivative transactions. These transactions are predominantly carried out by large financial institutions trading in over the counter (OTC) markets, which generally function with limited regulatory oversight and without the backing of government insurance arrangements, such as the FDIC. For these institutions, the liquidity of the counterparties to these derivative contracts is of paramount importance, especially under situations of financial strain, such as a credit crunch. In these situations, the question of whether a particular payment has been finalized in the strict legal sense can mean the difference between survival or failure for an especially vulnerable firm.

Is the finality of a transaction a concern?

Therefore, the question of whether a particular transaction has been finalized is a very practical concern, as the funds in question might otherwise be exposed to total or partial loss. By having a strict operational definition of the finality of payment, a receiving institution can have clarity around when recently received funds will cease to be vulnerable to counterparty risks .

Why is finality important?

Finality is considered to be important because, absent this there would be no certainty as to the meaning of the law, or the outcome of any legal process. The importance of finality is the source of the concept of res judicata - that the decisions of one court are settled law, and may not be retried in another case brought in a different court.

What does "being final" mean?

The state of "being final"; the condition from which no further changes occur

Why is a delay warranted in the death penalty case?

Given the questions and mitigating issues involved in this case -- and the finality of a death sentence -- a delay is warranted to provide time for a thorough review of all the facts and circumstances to truly ensure that justice is done.

What is settlement finality?

Settlement finality is a statutory, regulatory, and contractual construct.2 Settlement is actually a two-step process: first is the operational settlement, which consists of all the steps using technology or otherwise to complete the process of trade, transfer, or corporate action. The second step is the legal settlement that happens when the regulatory framework provides the final approval, at which point a transaction is deemed to be fully settled. The problems due to the uncertain nature of operational settlement in Ethereum are well-known, even if generally ignored. The concept of legal settlement, on the other hand, simply does not even exist in the security token protocols based on Ethereum.

What are the principles of settlement finality?

Principles of settlement finality and authoritative validation of transactions remain some of the most important cornerstones of establishing trust in the financial markets infrastructure. It is up to the blockchain application designers to understand the spirit and intent of these principles and select technologies that facilitate the implementation of such principles rather than hinder them. It is up to the business participants (company management, securities attorneys, and broker-dealers) to recognize the importance of these principles and the limitations of some blockchain platforms.

What is legal finality in blockchain?

Smart contracts have to also provide for legal settlement. A permissioned blockchain such as Hyperledger Fabric is designed for guaranteed finality. The KoreProtocol of KoreChain, a blockchain application built on Fabric for managing the entire lifecycle of private securities, is designed to ensure legal finality also. One example of legal finality is that directors’ approval of private securities trades under certain conditions, as set forth in the shareholder agreement , is necessary before such trades are deemed to be final. The KoreProtocol is designed to capture this requirement and the KoreChain is designed to implement it.

What is the principle of financial markets infrastructure?

In “Principles of Market Infrastructure,” a publication of the Bank of International Settlements, Principle 8 (Settlement Finality) requires that “An FMI [Financial Markets Infrastructure] should provide clear and certain final settlement, at a minimum by the end of the value date. Where necessary or preferable, an FMI should provide final settlement intraday or in real-time.”