What is free of payment FOP settlement? FOP settlement involves delivery of the securities without a simultaneous transfer of funds – hence ‘free of payment’. Funds may either be remitted by other, mutually agreed means, or payment may not be made at all.

What is free of payment (FOP)?

FOP settlement involves delivery of the securities without a simultaneous transfer of funds - hence 'free of payment'. Funds may either be remitted by other, mutually agreed means, or payment may not be made at all.

What does free of payment mean?

Free of payment is a settlement method for a securities transaction in which the delivery or reception of the securities is not linked to a corresponding transfer of funds. free of payment (Financial definition)

What does FOP stand for?

They are known by a variety of names, including free delivery, free of payment or FOP delivery, or in the United States, delivery versus free. FOP settlement involves delivery of the securities without a simultaneous transfer of funds – hence 'free of payment'. Funds may either be remitted by other, mutually agreed means,...

What is the difference between free delivery and FOP?

They are known by a variety of names, including free delivery, free of payment or FOP delivery, or in the United States, delivery versus free. FOP settlement involves delivery of the securities without a simultaneous transfer of funds – hence 'free of payment'.

What is FOP in banking?

How to create a FOP notice?

Does IB charge fees for FOP transfers?

What is free of payment settlement?

Free (DVF) is a settlement mechanism/method in which the transfer of securities occurs for free (without the simultaneous exchange of associated payment). The payment is sent via a separate wire Under DVP, the lender is paid immediately.

What is a free of payment transfer?

free of payment (FoP) A transfer of securities without a corresponding transfer of funds.

How long do FOP transfers take?

If your current firm accepts electronic requests, the transfer will take approximately 5 days to process. Transfer requests that must be mailed to your current firm may take 2 to 4 weeks to complete.

What is a free receive?

4) Free receive: securities are received without an offsetting receipt of funds.

Why does the FOP settle?

FOP settlement involves delivery of the securities without a simultaneous transfer of funds – hence 'free of payment'. Funds may either be remitted by other, mutually agreed means, or payment may not be made at all.

What is FOP account?

A banking form of payment (FOP) is one where Google and the Payment integrator (Partner Bank or integrator) perform a one-time exchange of account identity credentials and user authorization in order to establish an Association between Google and the Bank.

What happens to people with FOP?

FOP may eventually result in complete immobilization. Affected individuals may experience progressive pain and stiffness in affected areas, complete fusion of the spine, and/or pain in affected areas of the body caused by abnormal bony growths that compress the nerves in these areas (entrapment neuropathies).

How do you know if you have FOP?

In most cases, an accurate diagnosis of fibrodysplasia ossificans progressiva (FOP) can be made based on a patient's characteristic malformation of the big toe, in addition to rapidly changing swellings on the head, neck or back.

How common is FOP?

Fibrodysplasia ossificans progressive (FOP), also known as myositis ossificans (1), is a rare autosomal dominant disorder with an incidence of one in two million births with no sexual, racial, or regional predisposition (2).

What is DVP RVP FOP trade and difference between them?

DVP stipulates that the buyer's cash payment for securities must be made prior to or at the same time as the delivery of the security. Delivery versus payment is the settlement process from the buyer's perspective; from the seller's perspective, this settlement system is called receive versus payment (RVP).

What is the safest way to receive money?

What Are the Most Secure Payment Methods?Payment Apps. Mobile payment apps are designed to free you from cash and credit cards by allowing you to digitally transfer funds to family, friends, or merchants. ... EMV-Enabled Credit Cards. ... Bank Checks. ... Cash. ... Gift Cards. ... Stay Protected.

How do I accept large payments?

Top Ways To Accept Online PaymentsAccept Credit Cards and Debit Cards Online. ... Accept Online Payments with eChecks and ACH. ... Look Into Mobile Payments, Which Continue to Grow. ... Provide an Online Payment Gateway. ... Add Click-to-Pay Email Invoicing. ... Schedule Recurring Billing. ... Build an Online Store.More items...

What is an example of a transfer payment?

Examples of transfer payments include welfare, financial aid, social security, and government subsidies for certain businesses.

What are three types of transfer payments?

The three major types of transfer payment at the federal level are social insurance programs, welfare, and business subsidies. Social insurance programs provide benefits to people regardless of their income level.

What is the difference between payment and transfer?

When you transfer, you are moving money between your own Absa accounts, also known as interaccount transfers. For example, if you have a cheque account and a savings account, you can move money between these accounts instantly. When you pay, you are paying money into someone else's bank account.

What is the purpose of transfer payments?

A transfer payment is a mode of payment where a party recieves the money, but no goods or services are offered in return. The governments and governmental agencies typically disburse these payments to those who have no other means of income and have a poor quality of life.

Free of Payment (FOP) Transfers | IB Knowledge Base

Free of Payment (FOP) is term used by IB to refer to a process of transferring long US securities between IB and another financial institution (e.g. bank, broker or transfer agent) through the Depository Trust Company (DTC).

Interactive Brokers

We would like to show you a description here but the site won’t allow us.

Definition of term free of payment (FOP) - iotafinance.com

Translations: FR franco paiement (loc.) ES libre de pago (loc.) DE franko Zahlung (loc.) , ohne Gegenwertverrechnung (loc.) Synonym: delivery versus free Free of payment is a settlement method for a securities transaction in which the delivery or reception of the securities is not linked to a corresponding transfer of funds.

Comparison of Delivery vs. Payment (DVP) and Delivery vs. Free (DVF or ...

Upon delivery, the security is debited from Fannie Mae’s issuer account and credited to Fannie Mae’s CMPSD account for $100,000 in par. Because the securities were delivered

free of payment definition | English definition dictionary | Reverso

free of payment translation in English - English Reverso dictionary, see also '-free',for free',free agent',free alongside ship', examples, definition, conjugation

Understanding the Brokerage Account Transfer Process

At times, investors transfer their securities accounts between broker-dealers. While the process generally runs smoothly for the vast majority of the thousands of accounts transferred each year, there are times when delays occur and investors pose questions.

Examples of Free of Payment" or "FOP in a sentence

Transactions in Eligible Securities other than China Connect Securities can be settled in CCASS, either on a Free of Payment, or FOP, basis, or on a Delivery versus Payment, or DVP, basis or on Realtime Delivery versus Payment, or RDP, basis.

Related to Free of Payment" or "FOP

date of payment means the date of the negotiable instrument drawn by the Receiver General for Canada and given for payment of an amount due and payable;

What is settlement of a trade?

Settlement of a trade through a link between two separate payment systems or securities settlement systems.

What is the risk between the time of the agreement on a transaction and the time of actual settlement?

The risk that between the time of the agreement on a transaction and the time of actual settlement the counterparty to the transaction fails to fulfil its obligations.

What is non DVP settlement?

Non-DvP settlement processes typically expose the parties to settlement risk. They are known by a variety of names, including free delivery, free of payment or FOP delivery, or in the United States, delivery versus free. FOP settlement involves delivery of the securities without a simultaneous transfer of funds – hence 'free of payment'. Funds may either be remitted by other, mutually agreed means, or payment may not be made at all. This is the case in the transfer of securities gifted or inherited, or, in a country retaining paper securities certificates, in the dematerialisation of such securities, by transfer FOP into the name of the electronic custodian, with beneficial ownership retained by the transferor.

What is DVP in financial transactions?

From an operational perspective DVP is a sale transaction of negotiable securities (in exchange for cash payment) that can be instructed to a settlement agent using SWIFT Message Type MT 543 (in the ISO15022 standard). Use of such standard message types is intended to reduce risk in the settlement of a financial transaction, and enable automatic processing. Ideally, title to an asset and payment are exchanged simultaneously. This may be possible in many cases such as in a central depository system such as the United States Depository Trust Corporation .

What is DVP in securities?

Delivery versus payment or DvP is a common form of settlement for securities. The process involves the simultaneous delivery of all documents necessary to give effect to a transfer of securities in exchange for the receipt of the stipulated payment amount. Alternatively, it may involve transfers of two securities in such a way as to ensure that delivery of one security occurs if and only if the corresponding delivery of the other security occurs.

What is settlement of securities?

Settlement of securities is a business process whereby securities or interests in securities are delivered, usually against ( in simultaneous exchange for) payment of money, to fulfill contractual obligations , such as those arising under securities trades.

What is clearing in a settlement?

A number of risks arise for the parties during the settlement interval, which are managed by the process of clearing, which follows trading and precedes settlement. Clearing involves modifying those contractual obligations so as to facilitate settlement, often by netting and novation .

What are the two goals of electronic settlement?

Immobilisation and dematerialisation are the two broad goals of electronic settlement. Both were identified by the influential report by the Group of Thirty in 1989.

How does electronic settlement work?

If a non-participant wishes to settle its interests, it must do so through a participant acting as a custodian. The interests of participants are recorded by credit entries in securities accounts maintained in their names by the operator of the system . It permits both quick and efficient settlement by removing the need for paperwork, and the simultaneous delivery of securities with the payment of a corresponding cash sum (called delivery versus payment, or DVP) in the agreed upon currency.

What was the weakness of paper based settlement?

In the United Kingdom, the weakness of paper-based settlement was exposed by a programme of privatisation of nationalised industries in the 1980s, and the Big Bang of 1986 led to an explosion in the volume of trades, and settlement delays became significant.

Where does settlement take place?

Nowadays, settlement typically takes place in a central securities depository.

How long does it take to settle a stock?

In the United States, the settlement date for marketable stocks is usually 2 business days or T+2 after the trade is executed, and for listed options and government securities it is usually 1 day after the execution. In Europe, settlement date has also been adopted as 2 business days after the trade is executed.

What is FOP in banking?

Free of Payment (FOP) is term used by IB to refer to a process of transferring long US securities between IB and another financial institution (e.g. bank, broker or transfer agent) through the Depository Trust Company (DTC).

How to create a FOP notice?

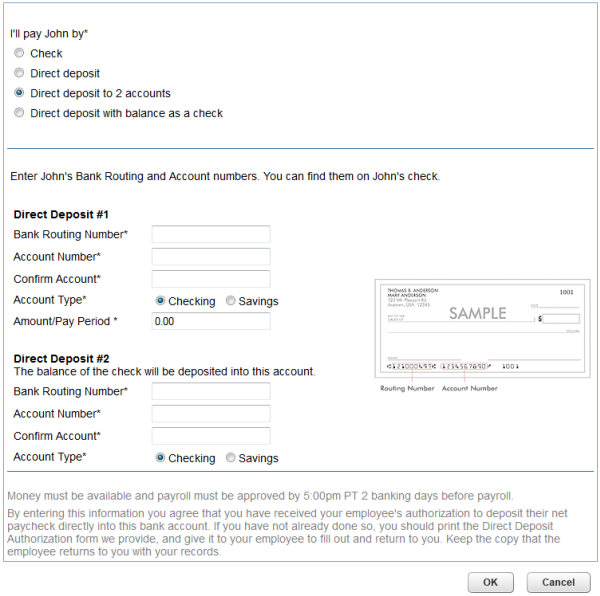

The following steps are to be followed in order to create a FOP notice: 1. Log into Account Management. 2. Select Funding or Funds Management and then Position Transfers. 3. From the drop-down list, select the Transfer Method: Free of Payment. 4. Select the applicable transaction Type: Deposit or Withdraw.

Does IB charge fees for FOP transfers?

While IB does not assess a fee to process FOP transfers, other firms may and we therefore recommend that you confirm with the contra-firm their policies in this regard prior to submitting a request. In the event a contra-firm does charge a fee to IB, the fee will be passed to the IB account holder.