Full Answer

What is settlement risk in foreign exchange?

Foreign exchange (FX) settlement risk is the risk of loss when a bank in a foreign exchange transaction pays the currency it sold but does not receive the currency it bought. FX settlement failures can arise from counterparty default, operational problems, market liquidity constraints and other factors.

How risky is the settlement of FX trades?

The settlement of FX trades can lead to significant risk exposures when one counterparty to a trade sends a currency payment to the other and needs to wait before receiving the currency it is buying. Over the past two decades, market participants have made significant progress in reducing FX settlement risk.

What is the difference between FX settlement risk and principal risk?

FX settlement risk is the risk that a firm will pay the currency it sold, but fail to receive the currency it bought FX settlement risk is a bilateral credit exposure to the counterparty Often referred to as Principal Risk or Herstatt Risk Payment-versus-payment (PVP) settlement eliminates FX settlement risk

What is a corporate FX settlement?

FX Settlement A corporate FX transaction involves a bank, on behalf of their corporate client, paying for the currency it sold at an agreed rate to another bank and receiving a different currency in return for the funds being cleared and settled in the local clearings.

What is foreign exchange settlement risk?

Foreign exchange (FX) settlement risk is the risk of loss when a bank in a foreign exchange transaction pays the currency it sold but does not receive the currency it bought. FX settlement failures can arise from counterparty default, operational problems, market liquidity constraints and other factors.

What is the meaning of settlement risk?

Settlement risk is the risk that arises when payments are not exchanged simultaneously. The simplest case is when a bank makes a payment to a counterparty but will not be recompensed until some time later; the risk is that the counterparty may default before making the counterpayment.

How do you calculate settlement risk?

This daily volatility has been calculated using the Simple Moving Average (SMA) approach. The other values are calculated as follows: Pre-settlement volatility over the ten day period = 0.50% * sqrt (10) = 1.59% Pre-settlement FX rate impact works out to =1.59%*1.395 =0.022.

How are FX transactions settled?

Foreign-exchange transactions are settled via correspondent banks or via CLS, which is an international system for settlement of such transactions. Danmarks Nationalbank makes settlement accounts available to the banks for settlement via CLS. A foreign exchange transaction consists of two opposite payments.

Is settlement risk a financial risk?

What Is Settlement Risk? Settlement risk is the possibility that one or more parties will fail to deliver on the terms of a contract at the agreed-upon time. Settlement risk is a type of counterparty risk associated with default risk, as well as with timing differences between parties.

Is settlement risk a credit risk?

Generally, this happens because one party defaults on its clearing obligations to one or more counterparties. As such, settlement risk comprises both credit and liquidity risks. The former arises when a counterparty cannot meet an obligation for full value on due date and thereafter because it is insolvent.

Are FX futures cash settled?

For those traders who want to take their contract to expiration, there are two ways an FX contract can be settled: cash settlement or physical delivery of the currency. For many FX futures, the last trading day is generally the second business day prior to the third Wednesday of the contract month.

Why do settlements fail?

A trade is said to fail if on the settlement date either the seller does not deliver the securities in due time or the buyer does not deliver funds in the appropriate form.

What is pre settlement risk?

The risk that a counterparty will default prior to the financial instrument's final settlement. This means that the counterparty may suffer loss because the contract is not carried out but at least (unlike settlement risk) the non-defaulting party will not have paid out under the contract.

How long does FX take to settle?

Standard settlement periods for most currencies is 2 business days, with some pairs such as CAD/USD settling next business day. In order for a date to be a valid settlement date for an FX transaction, the central banks for both currencies must be open for settlements.

How long do FX trades take to settle?

two business daysThe settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date.

What is a settlement limit?

Settlement Limit means the maximum amount the Company will pay to or for each passenger stated in the Limits of Liability section of this endorsement.

What is pre settlement risk?

The risk that a counterparty will default prior to the financial instrument's final settlement. This means that the counterparty may suffer loss because the contract is not carried out but at least (unlike settlement risk) the non-defaulting party will not have paid out under the contract.

What is the meaning of credit risk?

Credit risk is a measure of the creditworthiness of a borrower. In calculating credit risk, lenders are gauging the likelihood they will recover all of their principal and interest when making a loan. Borrowers considered to be a low credit risk are charged lower interest rates.

What does settlement limit mean?

Settlement Limit means the maximum amount the Company will pay to or for each passenger stated in the Limits of Liability section of this endorsement.

Why do settlements fail?

A trade is said to fail if on the settlement date either the seller does not deliver the securities in due time or the buyer does not deliver funds in the appropriate form.

What Is Settlement Risk?

Settlement risk is the possibility that one or more parties will fail to deliver on the terms of a contract at the agreed-upon time. Settlement risk is a type of counterparty risk associated with default risk, as well as with timing differences between parties. Settlement risk is also called delivery risk or Herstatt risk.

What are the two types of settlement risk?

The two main types of settlement risk are default risk and settlement timing risks. Settlement risk is sometimes called "Herstatt risk," named after the well-known failure of the German bank Herstatt.

What is default risk?

Default risk is the possibility that one of the parties fails to deliver on a contract entirely. This situation is similar to what happens when an online seller fails to send the goods after receiving the money. Default is the worst possible outcome, so it is really only a risk in financial markets when firms go bankrupt. Even then, U.S. investors still have Securities Investor Protection Corporation ( SIPC) insurance.

How is settlement risk minimized?

Settlement risk is minimized by the solvency, technical skills, and economic incentives of brokers. Settlement risk can be reduced by dealing with honest, competent, and financially sound counterparties.

Is settlement risk in securities?

Unsurprisingly, settlement risk is usually nearly nonexistent in securities markets. However, the perception of settlement risk can be elevated during times of global financial strain. Consider the example of the collapse of Lehman Brothers in September 2008. There was widespread worry that those who were doing business with Lehman might not receive agreed upon securities or cash.

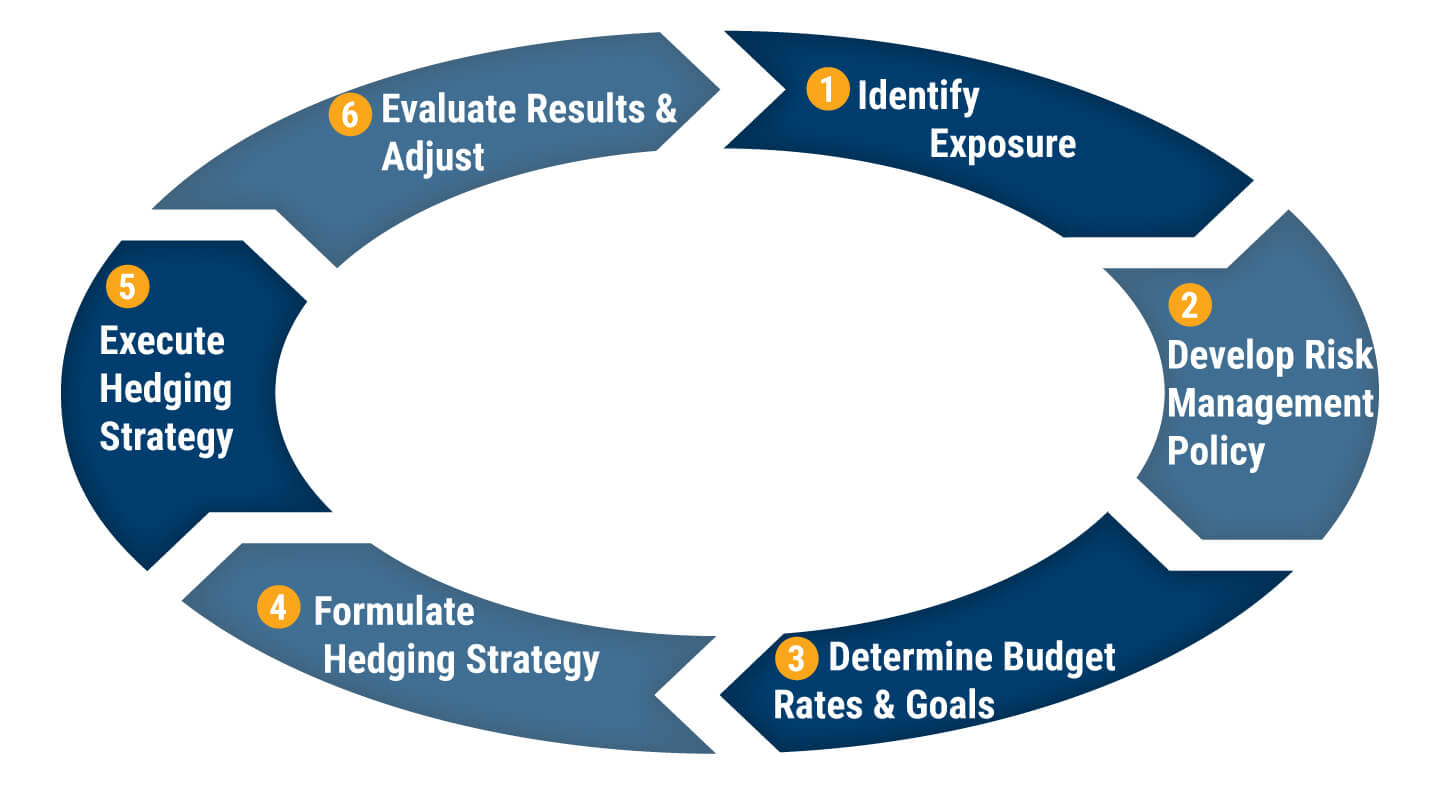

What is hedging in FX?

Companies that are subject to FX risk can implement hedging strategies to mitigate that risk. This usually involves forward contracts, options, and other exotic financial products and, if done properly, can protect the company from unwanted foreign exchange moves.

What is foreign exchange risk?

Foreign exchange risk refers to the losses that an international financial transaction may incur due to currency fluctuations. Also known as currency risk, FX risk and exchange-rate risk, it describes the possibility that an investment’s value may decrease due to changes in the relative value of the involved currencies.

What are the risks of foreign exchange?

There are three types of foreign exchange risk: 1 Transaction risk: This is the risk that a company faces when it's buying a product from a company located in another country. The price of the product will be denominated in the selling company's currency. If the selling company's currency were to appreciate versus the buying company's currency then the company doing the buying will have to make a larger payment in its base currency to meet the contracted price. 2 Translation risk: A parent company owning a subsidiary in another country could face losses when the subsidiary's financial statements, which will be denominated in that country's currency, have to be translated back to the parent company's currency. 3 Economic risk: Also called forecast risk, refers to when a company’s market value is continuously impacted by an unavoidable exposure to currency fluctuations.

How does an import/export business expose itself to foreign exchange risk?

An import/export business exposes itself to foreign exchange risk by having account payables and receivables affected by currency exchange rates. This risk originates when a contract between two parties specifies exact prices for goods or services, as well as delivery dates. If a currency’s value fluctuates between when the contract is signed and the delivery date, it could cause a loss for one of the parties.

What happens if currency fluctuates between the date of the contract?

If a currency’s value fluctuates between when the contract is signed and the delivery date, it could cause a loss for one of the parties. There are three types of foreign exchange risk: Transaction risk: This is the risk that a company faces when it's buying a product from a company located in another country.

What is economic risk?

Economic risk: Also called forecast risk, refers to when a company’s market value is continuously impacted by an unavoidable exposure to currency fluctuations.

What is translation risk?

Translation risk: A parent company owning a subsidiary in another country could face losses when the subsidiary's financial statements, which will be denominated in that country's currency, have to be translated back to the parent company's currency. Economic risk: Also called forecast risk, refers to when a company’s market value is continuously ...

What Is Cross-Currency Settlement Risk?

Cross-currency settlement risk is a type of settlement risk in which a party involved in a foreign exchange transaction sends the currency it has sold but does not receive the currency it has bought. In cross-currency settlement risk, the full amount of the currency purchased is at risk. This risk exists from the time that an irrevocable payment instruction has been made by the financial institution for the sale currency, to the time that the purchase currency has been received in the account of the institution or its agent.

How do financial institutions manage cross currency settlement risk?

Financial institutions manage their cross-currency settlement risk by having clear internal controls to actively identify exposure. In general, the real risk is small for most cross-currency transactions.

Can you settle two forex transactions at once?

With forex trades occurring 24/7, the two legs of a currency transaction will usually not be settled simultaneously since for one side of the currency it may be daytime and the other the middle of the night.

What is settlement risk in forex?

FX settlement risk - the risk of their bank in the foreign exchange transaction paying the currency without receiving the currency in return.

How to manage FX settlement?

Corporate treasury departments have four options for managing FX settlement: 1 ignore it; 2 settle most of their trades with their principal cash management bank where there is no settlement risk; 3 use the Continuous Linked Settlement (CLS) System; or 4 use bilateral settlement.

Is there a risk of defaulting on a deal in the US$5 trillion/day FX market?

After the credit/liquidity crunch, there is even more risk of the bank defaulting on a deal in the US$5+ trillion/day FX market. For many banks, FX transaction settlement risk is typically higher than credit risk, often three times as high. No wonder the central banks continue to be concerned about FX settlement risk.

Is CLS settlement transparent?

The CLS settlement process, shown in figure above, is fully automated and transparent, participants have a global view of their FX positions in real time, so they know exactly what their FX and same day funding requirements will be. Also CLS is easier to use because it provides post trade and pre-settlement matching, generally within 30 minutes of trading, i.e. once the trade is matched the corporate treasury department can be sure the trade will settle. Compliance with Sarbanes Oxley and other process regulations are also improved as the whole settlement process is fully automated and transparent.

How much does CLS settle?

According to the BIS 2019 Triennial Survey, CLS settles approximately 31 percent of FX transactions in the 18 CLS-settled currencies.The total volume of all CLS-settled currencies equates to USD5.34 trillion. The remaining 69 percent falls into two broad categories:

How much is non-CLS trade?

According to the BIS 2019 Triennial Survey, trades in which a non-CLS currency is on at least one side of the trade equate to approximately USD1.25 trillion –an increase from approximately USD930 billion (or 35 percent) since the BIS 2016 Triennial Survey.

How does PvP eliminate FX settlement risk?

PvP eliminates FX settlement risk by ensuring that a payment in a currency occurs if and only if the payment in the other currency takes place. The establishment of CLS and other actions led to a big reduction in FX settlement risk. Even at the height of the Great Financial Crisis, FX markets remained resilient.

Who wrote the settlement of FX trades?

by Morten Linnemann Bech and Henry Holden. The settlement of FX trades can lead to significant risk exposures when one counterparty to a trade sends a currency payment to the other and needs to wait before receiving the currency it is buying.

How much is the FX market worth in 2019?

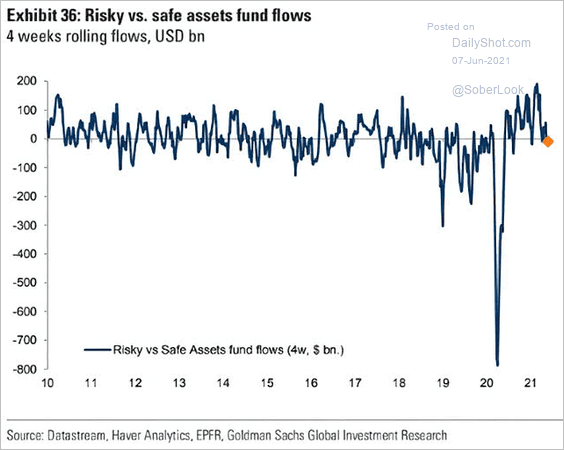

After taking account of the number of payments for each instrument, in April 2019 daily global FX trading of $6.6 trillion translated into gross payment obligations worth $18.7 trillion ( Table A.1 ). Bilateral netting reduced the payment obligations to $15.2 trillion. About $6.3 trillion was settled on a PvP basis using CLS or a similar settlement system. This left an estimated $8.9 trillion worth of FX payments at risk on any given day. The proportion of trades with PvP protection appears to have fallen from 50% in 2013 to 40% in 2019, although available data are not fully comparable across time ( Graph A.1, left-hand panel).

Is the FX market resilient?

Even at the height of the Great Financial Crisis, FX markets remained resilient. However, FX settlement risk appears to have increased since 2013 in both relative and absolute terms ( Graph A.1, left-hand panel). To help assess progress in reducing FX settlement risk, the Triennial Survey was expanded in 2019 to collect data on FX settlement.

Is FX a settlement risk?

Some FX transactions, such as non-deliverable forwards, are settled with a single payment and are therefore not subject to FX settlement risk. FX trades can also be bilaterally netted, which eliminates a need for settlement.

Is the triennial survey a settlement risk?

To help assess progress in reducing FX settlement risk, the Triennial Survey was expanded in 2019 to collect data on FX settlement. Different FX instruments give rise to different numbers of payments. For example, spot and outright forwards result in two payment obligations, whereas swaps result in four payments of principal (two at inception and two at repayment). Some FX transactions, such as non-deliverable forwards, are settled with a single payment and are therefore not subject to FX settlement risk. FX trades can also be bilaterally netted, which eliminates a need for settlement.

What is settlement risk in FX?

Foreign exchange (FX) settlement risk is the risk of loss when a bank in a foreignexchange transaction pays the currency it sold but does not receive the currency it bought. FXsettlement failures can arise from counterparty default, operational problems, market liquidityconstraints and other factors. Settlement risk exists for any traded product but the size of theforeign exchange market makes FX transactions the greatest source of settlement risk formany market participants, involving daily exposures of tens of billions of dollars for thelargest banks. Most significantly, for banks of any size, the amount at risk to even a singlecounterparty could in some cases exceed their capital.

How are FX payments made?

12. FX-related payments generally are made in two primary steps: the sending ofpayment orders and the actual transmission of funds. It is important to distinguish betweenthese two steps: the first is an instruction to make a payment, while the second involves anexchange of credits and debits across correspondent accounts and the accounts of the centralbank of the currency involved.4 The first step is normally effected one or two days beforesettlement date (although there are some variations according to currency and institution)while the second stage takes place on the settlement date itself.

Definition and Examples of Settlement Risk

Settlement Risk vs. Default Risk vs. Replacement Risk

- Settlement risk, default risk, and replacement risk are the three parts of counterparty risk. Default, or credit, risk is the risk that the counterparty will fail to deliver because it goes bankrupt. For example, every time a bank makes a loan, there is a risk that the counterparty or borrower of the loan won’t pay it back. Replacement risk is the risk that if a counterparty defaults, there won’t be …

What It Means For Individual Investors

- Individual investors don’t often deal with material settlement risks—that risk is passed to middlemen such as market makersand brokers. Individuals who participate in over-the-counter derivatives and other financial transactions that are not on a marketplace may need to consider settlement risk. Want to read more content like this? Sign upfor The Balance’s newsletter for dail…

What Is Cross-Currency Settlement Risk?

Understanding Cross-Currency Settlement Risk

- One reason that cross-currency settlement risk is a concern is simply due to the difference in time zones around the world. Foreign exchange trades are conducted globally around the clock and time differences mean that the two legs of a currency transaction will generally not be settled simultaneously. As an example of cross-currency settlement risk, consider a U.S. bank that purc…

Herstatt Bank and Cross-Currency Settlement Risk

- Although a failure in a cross-currency transaction is a small risk, it can happen. On June 26, 1974, German bank Herstatt was unable to make foreign exchange payments to banks it had engaged in trades with that day. Herstatt had received Deutsche Mark but, due to lack of capital, the bank suspended all U.S. dollar payments. This left those banks that had paid Deutsche Mark without t…