What is a HUD settlement statement?

The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called "closing agents," to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Is the HUD-1 Settlement Statement still used in 2020?

The HUD-1 settlement statement is still used in 2020 for reverse mortgages. These types of mortgages are very popular with sellers over the age of 62 who want to pull equity out of their homes. 4

What is a HUD-1 closing statement deductible?

The HUD-1 Closing Statement - What is Deductible? – Support The HUD-1 Closing Statement - What is Deductible? A taxpayer who has closed on a home equity line of credit (HELOC), a manufactured home, or a reverse mortgage may bring you a HUD-1 closing statement.

Is the Alta settlement statement the same as a HUD form?

The Alta Settlement Statement has both the buyer and seller information on it with all credits and charges listed, more like the HUD-1 form.

What is the difference between a HUD and a settlement statement?

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate. Another acronym used in relation to the HUD form is GFE, which means 'Good Faith Estimate'.

What does HUD mean in real estate?

U.S. Department of Housing and Urban DevelopmentHUD Homes | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

Is HUD and closing disclosure the same?

The Closing Disclosure combines and replaces the HUD-1 Settlement Statement and the final Truth-in-Lending (TIL) statement. The form mirrors the information provided on the Loan Estimate.

Who prepares the HUD settlement statement?

A HUD-1 or HUD-1A Settlement Statement is prepared by a creditor or, more typically, by the settlement agent who conducts the closing on the creditor's behalf.

Is buying a HUD home a good idea?

What are "HUD homes," and are they a good deal? Answer: HUD homes can be a very good deal. When someone with a HUD insured mortgage can't meet the payments, the lender forecloses on the home; HUD pays the lender what is owed; and HUD takes ownership of the home. Then we sell it at market value as quickly as possible.

What are the disadvantages of buying a HUD home?

List of the Cons of Buying HUD HomesSome HUD homes do not qualify for a typical mortgage. ... Money for any repairs must go into an escrow account. ... You must commit to living in a HUD home for at least one year. ... A HUD realtor is necessary to complete the purchasing process.More items...•

When should I receive the HUD-1 Settlement Statement?

In such case, the completed HUD-1 or HUD-1A shall be mailed or delivered to the borrower, seller, and lender (if the lender is not the settlement agent) as soon as practicable after settlement.

What is the difference between a settlement statement and a closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

What does HUD stand for in mortgage?

U.S. Department of Housing and Urban DevelopmentFederal Housing Administration | HUD.gov / U.S. Department of Housing and Urban Development (HUD)

What is the primary purpose of the settlement statement?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

What is a closing statement?

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

How do I get my HUD payoff statement?

Requests for payoff statements, subordinations, releases, and other documentation specific to these programs can be submitted to:Payoff Requests: [email protected] Requests: [email protected] Requests: [email protected] Partial Claim document submittal: [email protected] items...

What is the purpose of HUD?

The Department of Housing and Urban Development (HUD) is responsible for national policy and programs that address America's housing needs, that improve and develop the Nation's communities, and enforce fair housing laws.

Can you negotiate HUD home price?

When buying a HUD home, there is no negotiation process. Unlike a regular home for sale on the market, there is no back and forth discussion with the seller. Instead, there is a bidding process, and the highest acceptable offer will be chosen.

When can investors bid on HUD homes?

Insured HUD Homes: A period of 15 days. On the 16th day, real estate investors can place bids if the home is still available. Uninsured HUD Homes: A period of 5 days, and on the 6th day, real estate investors can begin to bid for the investment property.

Is a HUD-1 required for a cash sale?

Federal law does not require the use of the HUD-1 or the new Closing Disclosure in all cash transactions. While some states have laws requiring the use of a state promulgated form in cash transactions, in general the HUD-1, the Closing Disclosure or any other settlement statement can be used in cash transactions.

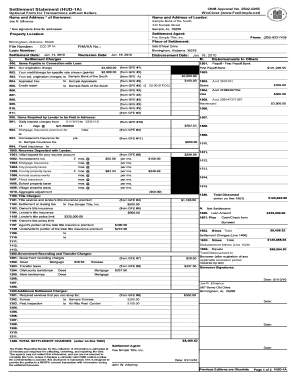

What is a HUD-1 settlement statement?

A HUD-1 settlement statement, also referred to simply as a settlement statement , details every charge associated with your new loan. It also outlines who is responsible for each of those charges — the buyer or the seller — as well as any credits you may receive for things like taxes, insurance or deposits.

What is the first page of a HUD settlement statement?

The first page of the settlement statement has a transaction overview, including the amount of cash you need to bring to closing. The sections below are highlighted so you can have an idea of what they look like on the HUD-1 settlement statement you’ll receive.

How long do you have to give a closing disclosure?

In contrast, lenders must give you a closing disclosure three days before closing. Everyone taking out a HELOC, reverse mortgage or manufactured home loan should ask their lender for the HUD-1 document at least a day before closing to allow time to review the contents, fix errors and raise questions with the lender.

What is section 300?

No. 5 (Section 300): Cash at settlement from/to borrower. This section explains if you need to bring cash to the settlement. In most cases, the closing costs for a reverse mortgage refinance or HELOC will be subtracted from the loan, so you don’t need to bring funds to the closing.

How long does it take to pay down a HELOC?

You can borrow as much as you need up to your maximum loan amount, then pay it down to zero as many times as necessary during a set draw period that usually ends after 10 years.

What is section 200 in mortgage?

No. 4 (Section 200): Amount paid by or on behalf of borrower. This section details any credits you receive toward costs you’ve already paid or that the seller is paying. Line 201 shows the money you’ve already paid, such as an earnest money deposit, while Line 202 reflects the principal amount of the new loan.

How many sections are there in a settlement statement?

The settlement statement lists charges in three sections. The first section shows charges that cannot change. The next section outlines charges that cannot change by more than 10%, while the final section outlines charges that may change.

What is HUD-1 settlement statement?

The HUD-1 settlement statement outlines your exact mortgage payments, a loan’s terms (such as the interest rate and term) and additional fees you’ll pay, called closing costs (which total anywhere from 2% to 7% of your home’s price). Compare your HUD-1 to the good-faith estimate your lender gave you at the outset; make sure they’re similar and ask your lender to explain any discrepancies.

How long before closing do you get your HUD-1?

Thanks to new regulations put in effect in October 2015 known as TRID (which stands for TILA-RESPA Integrated Disclosure), you will receive your HUD-1 three days before closing so that you have plenty of time to check it over. (Before TRID, home buyers received this form only 24 hours ahead of time, which resulted in a lot more last-minute surprises and holdups.)

How long before closing can you walk through a home?

Do a final walk-through: A buyer’s contract usually allows for a walk-through of the home 24 hours before closing. First and foremost, you’re making sure the previous owner has vacated (unless you’ve allowed a rent-back arrangement where they can stick around for a period of time before moving). Second, make sure the home is in the condition agreed upon in the contract. If you’d had a home inspection done earlier and it had revealed problems that the sellers had agreed to fix, make sure those repairs were made.

Who is present at closing?

The cast includes the home seller, the seller’s real estate agent as well as your own, buyer and seller attorneys, a representative from a title company (more on that below), and, occasionally, a representative from the bank or lender where you got your loan.

Do you need a title clearance before you can own a home?

Title clearance: Before you can own or “take title” to a home, most lenders will require a title search of public property records to make sure there aren’t any liens or issues with transferring the property into your name (which is rare, but if something does crop up, it’s better to know that upfront).

Why was the HUD-1 Settlement Statement required in 2010?

The reason behind all of these amendments and changes was to create more transparency and progress in consumer protection, which leads us into the 1986 HUD-1 Form.

When did the HUD-1 change to the closing disclosure?

The Consumer Financial Protection Bureau (CFPB) took over administration from HUD and replaced the HUD-1 with the Closing Disclosure in October of 2015. It is similar to the HUD-1 in that it details the loan terms and costs, including the interest rates, closing costs, taxes, monthly payments, and more.

What is the real estate settlement procedure act?

1974: The Real Estate Settlement Procedures Act (RESPA) was created to help protect consumers from foul practices, forcing lending institutions to disclose settlement costs upfront. This act is enforced by the Consumer Financial Protection Bureau (CFPB) and includes all types of mortgages. RESPA requires different disclosures during different parts of the home closing process and also offers protection to consumers in areas including: 1 Limiting the amount put into escrow for real estate charges 2 Allowing buyers to use their own title company and title insurance 3 Prohibiting lenders from receiving a fee in exchange for a referral

What is the difference between HUD-1 and HUD-1?

Another big distinction between the Closing Disclosure and the HUD-1 is where the HUD-1 listed all terms, charges and credits for both the buyer and the seller, the Closing Disclosure has a separate form for the buyer as it does for the seller. This provides for more consumer protection at the closing table. Another change that came up ...

How long does a loan estimate need to be in the hands of the buyer before closing?

These two documents must be in the hands of the buyer at least 3 days prior to the closing date in order to find any errors or issues before closing. If certain changes are made to the disclosure, the 3-day waiting period starts over. This is one big change with the new TRID rules.

What to do if you make a mistake in closing disclosure?

Mistakes happen, so don’t be afraid to ask questions or seek clarification before you sign the paperwork at closing. If it is a major mistake, the buyer can obtain an explanation, and even negotiate a deal or walk away from the loan.

What is HUD-1 form?

1986-2015: Prior to October 2015, the Settlement Statement was known as the HUD-1, which is a standard government form issued by the Closing Agent that lists all credits, charges and home loan terms for both the buyer and the seller in all real estate transactions that required a mortgage. The charges for both the borrower and seller were listed on the same form, with borrower charges on one side of the form and seller charges on the other.

What is a HUD-1 statement?

When you refinance or purchase a home, one of the first things that your lender is going to provide you with is a HUD-1 Settlement Statement. This particular statement contains all the fees and costs that incurred with the financing of your home. In order to ensure that it is 100% accurate, it is important for both the seller and buyer to fully comprehend this document and to review it as it contains a handful of details that are important for both parties. The Real Estate Settlement Procedures Act (RESPA) requires that the HUD-1 statement is utilized in every federally regulated mortgage loan.

How many sections are there in HUD-1?

The HUD-1 Settlement Statement form contains twelve main sections, and a lot more subsections. You will notice that some sections on the form are specifically referred to the borrower’s costs and fees. Other sections on the form refer to the seller that’s in the transaction. One day prior to the closing, every party to the transaction is required to attain a copy of the HUD-1 Settlement Statement form. However, in a lot of cases, the form’s entries are still changing a couple of hours before the closing is conducted. A title agent, lender, or real estate professional can answer any question you may have that regard to the HUD-1 Settlement Statement form.

What is section L on HUD?

This section on the HUD-1 Settlement Statements details information on loan fees, costs that were paid to real estate professionals, items paid in advance such as homeowners insurance and interests, and several required escrow items. You will notice that additional subsections detail items such as home warranties, survey, home inspections, deed fees, and title fees. Section L subsections are 1400-Total Settlement Charges, 1300-Additional Settlement Charges, 1200-Government Recording and Transfer Charges, 1100-Title Charges, 1000-Reserves Deposited with Lender, 900-Items Required by Lender to be Paid in Advance, 700-Total Sales/Broker’s Commission on Price, and 800-Items Payable in Connection with Loan. Before signing any closing document, make sure to carefully review each of these items in this section. In order to make sure that you understood all the charges stated in this section, prior to closing, ask any questions. If you stop and think about it, it is better to prevent than lament.

Who is responsible for reviewing HUD-1?

Buyers and sellers are the ones who are responsible for reviewing their HUD-1 Settlement Statement form in order to ensure that it is accurate. Before the end of closing, every error found must be corrected. Until every question that relates to the HUD-1 Settlement Statement has been satisfactorily answered, no seller or buyer is obligated to complete a closing. Alongside his or her loan officer, the HUD-1 needs to be especially reviewed by the buyer before the closing of a home purchase or mortgage loan. Comparing the mortgage loan documents to the HUD-1 Settlement Statement will prevent the buyer from obligation to loan terms that are incorrect.

What is section J in a mortgage?

This section contains details on the buyer’s amounts paid, amount due, and amount of cash that the borrower gets or pays at closing. The subsections in section J are 300-Cash at Settlement To/From Borrower, 200-Amounts Paid or in Behalf of Borrower, and 100-Gross Amount Due from Borrower. In order to determine what exactly the borrower will need to take or pay home from closing, it is important that this section is carefully reviewed.