What is an'account settlement'?

Account Settlement. What is an 'Account Settlement'. An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero.

What is the history of IEX?

IEX was launched as a national securities exchange in September 2016. On October 24, 2017, IEX received regulatory approval from the SEC to list companies. IEX listed its first public company, Interactive Brokers, on October 5, 2018.

How does the IEX exchange work?

When IEX applied for exchange status, it dropped the broker-based priority mechanism, and as an exchange it gives priority to the best price first followed by the time of order submittal (as do other exchanges).

What is an official settlement account?

An official settlement account is a special type of account used in international balance of payments (BoP) accounting to keep track of central banks' reserve asset transactions with one other. The official settlement account keeps track of transactions involving gold, foreign exchange reserves, bank deposits and special drawing rights (SDRs).

Is IEX owned by government?

The Indian Energy Exchange (IEX) is an Indian electronic system based power trading exchange regulated by the Central Electricity Regulatory Commission (CERC). IEX started its operations on 27 June 2008.

What is IEX and how it works?

About Us. Indian Energy Exchange is India's premier energy marketplace, providing a nationwide automated trading platform for the physical delivery of electricity, renewables, and certificates.

How do I open an IEX account?

The details of the process required to be followed for acquiring Membership at IEX is available at Membership – Admission Process on our website....In the following Banks a Member can open settlement account.HDFC Bank Limited.Indusind Bank Limited.State Bank of India.

Who is the owner of IEX company?

Chairman and Managing Director. Mr. Satyanarayan Goel is the Chairman and Managing Director of the Company with effect from February 19, 2021.

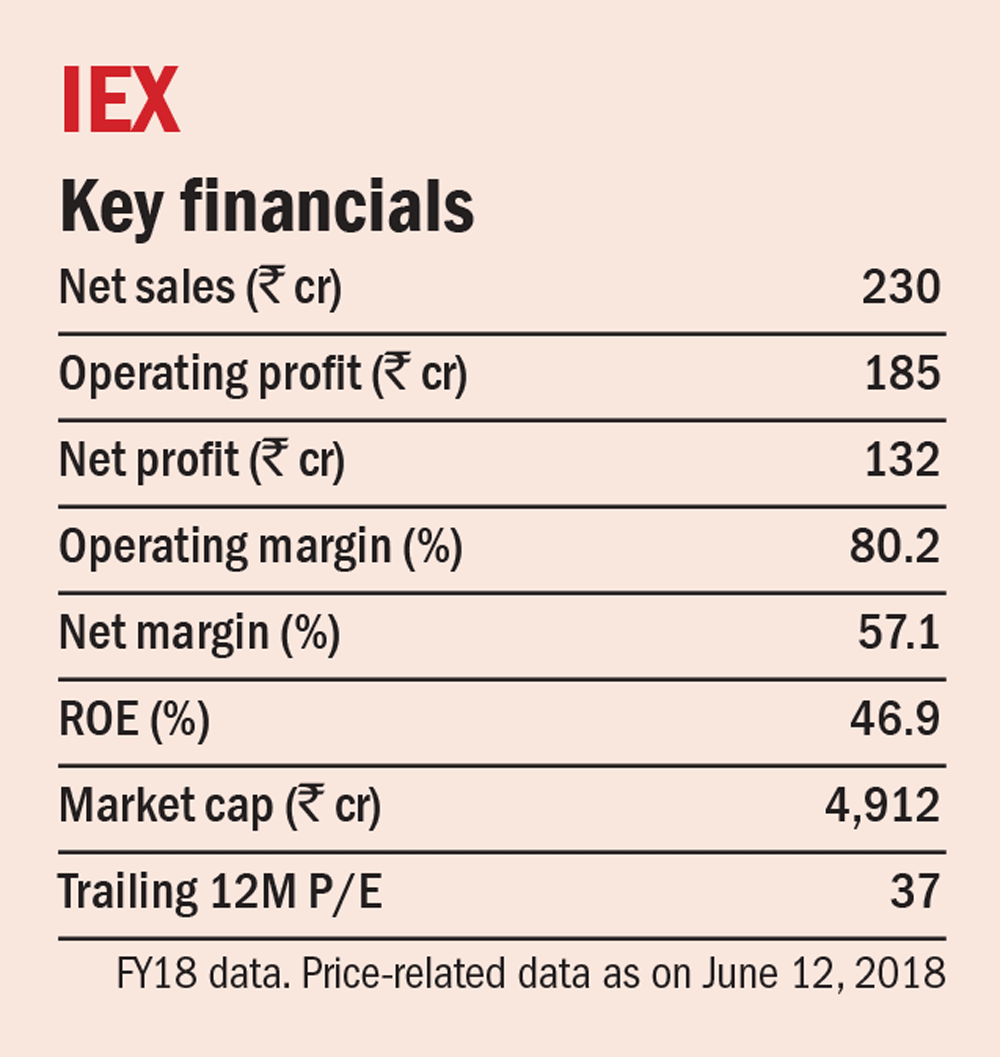

Is IEX debt free?

The company has shown a good revenue growth of 18.76% for the Past 3 years. Company has been maintaining healthy ROE of 48.42% over the past 3 years. Company has been maintaining healthy ROCE of. Company is virtually debt free.

Is it good to invest in IEX?

Company reported net profit after tax of Rs 86.96 Crore in latest quarter. For the past year, IEX has remained richly valued given its clean balance sheet, near monopoly and bright future prospects. It has maintained BUY rating and value IEX at Rs 240 i.e. 50x P/E on FY24E EPS.

What is IEX fee?

150. (Only for Facilitator and Proprietary member) 50. (Only for Facilitator member)

Is IEX monopoly under threat?

The reason why IEX today is a undisputed monopoly is because this “order matching” and “price discovery” happens at the exchange level. This means that both the buyer and the seller will need to be on the same platform (either on IEX or PXIL) for their orders to be matched and get executed.

What companies are listed on IEX?

The following broker-dealers are approved Members of IEX Exchange.a. ABEL NOSER, LLC. ABN AMRO CLEARING CHICAGO LLC. ... b. BARCLAYS CAPITAL INC. ... c. C&C TRADING L.L.C. ... d. D.A. DAVIDSON & CO. ... e. E*TRADE SECURITIES LLC. ... f. FIS BROKERAGE & SECURITIES SERVICES LLC. ... g. G1 EXECUTION SERVICES, LLC. ... h. HILLTOP SECURITIES INC.More items...

Is IEX a good investment for long term?

Q4Fy22 results for IEX have been outstanding: EBITDA also went higher during the period by 22.6% YoY at Rs. 94.9 crore and margins at 84.7%. Consequently, PAT for the quarter has increased to Rs. 88.6 crore, up 45.3% YoY.

Is IEX giving bonus shares?

On October 21, 2021, the board of the company had approved an issue of bonus shares (2:1) wherein shareholders will get two bonus shares for every one share held by them. “IEX made an announcement on bonus shares on October 21, 2021.

Why there is no promoter in IEX?

Pursuant to divestment by them of the Equity Shares of IEX, they currently hold no Equity Shares in the company. Currently, IEX is a professionally managed company and does not have an identifiable promoter in terms of the SEBI ICDR Regulations and the Companies Act, 2013.

What companies trade on IEX?

The following broker-dealers are approved Members of IEX Exchange.a. ABEL NOSER, LLC. ABN AMRO CLEARING CHICAGO LLC. ... b. BARCLAYS CAPITAL INC. ... c. C&C TRADING L.L.C. ... d. D.A. DAVIDSON & CO. ... e. E*TRADE SECURITIES LLC. ... f. FIS BROKERAGE & SECURITIES SERVICES LLC. ... g. G1 EXECUTION SERVICES, LLC. ... h. HILLTOP SECURITIES INC.More items...

How do I trade on IEX?

How can I trade on IEX Exchange? Because IEX Exchange is a national securities exchange, only U.S. registered broker-dealers can directly trade here. If you invest in mutual funds or a 401(k), your asset manager may use a broker to trade on IEX Exchange.

How do I buy shares in IEX?

You can easily buy IEX shares in Groww by creating a demat account and getting the KYC documents verified online.

What happens to IEX?

Indian Energy Exchg share price was Rs 159.80 as on 06 Sep, 2022, 10:24 AM IST. Indian Energy Exchg share price was down by 0.53% based on previous share price of Rs 158. Indian Energy Exchg share price trend: Last 1 Month: Indian Energy Exchg share price moved down by 3.35%

IEX Cloud

IEX’S TRADING DATA WAREHOUSING, REFINING, AND DELIVERY PLATFORM (INFORMAL)

Describing IEX

IEX is a financial technology company that operates IEX Exchange, a U.S. securities exchange committed to serving all market participants.

Logo

The logo is composed of the mark and the wordmark. The mark and wordmark should never appear separately in public communications.

Color Versions

The priority is to use the full-color official logo whenever possible and should not be considered interchangeable with secondary options unless technical requirements mandate it.

Clear space & minimum size

We have specified half of the mark as the measure and use it to establish the margin around the logo (mark + wordmark).

Logo Misuse

Please use our logo appropriately and use only assets supplied directly by IEX.

Color Palette

Our colors reflect our ethos of setting new standards, leveling the playing field, and winning together.

What is a settlement account?

Settlement Account means an account at a central bank, a settlement agent or a central counterparty used to hold funds or securities and to settle transactions between participants in a system;

When will merchants pay the amount due?

Merchant will pay the amounts due by the next Business Day if sufficient funds are not available in the Settlement Account.

Can a merchant change a settlement account?

Merchant may change the Settlement Account upon prior written approval by Bank, which approval will not be unreasonably withheld.

Is a settlement account a repurchase asset?

The Settlement Account is (and shall continuously be) part of the Repurchase Assets. The Settlement Account shall be subject to setoff by the Agent for the benefit of the Agent and any Buyer against any of the outstanding Obligations.

What Is an Official Settlement Account?

An official settlement account is a special type of account used in international balance of payments (BoP) accounting to keep track of central banks' reserve asset transactions with one other. The official settlement account keeps track of transactions involving gold, foreign exchange reserves, bank deposits and special drawing rights (SDRs).

Why do nations keep an eye on the official settlement account?

Nations keep an eye on the official settlement account to gauge their economic health in the global economy. If there are continual outflows of reserve assets for a country, it means that its competitiveness in producing exported goods is relatively weak, or it's business environment is not as attractive as that offered by other countries for direct foreign investment.

What is capital account?

The capital account records the change in foreign and domestic investments, government borrowing and private sector borrowing. When there is either a balance of payments deficit or surplus, inflows of reserve assets or outflows of reserve assets bring the ledger back into balance. This is recorded in the official settlement account.

Why do countries look to these accounts?

Countries look to these accounts to monitor capital outflows and inflows to and from other countries.

Is Eric a licensed insurance broker?

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

What is IEX stock?

Investors Exchange ( IEX) is a stock exchange based in the United States. It was founded in 2012 in order to mitigate the effects of high-frequency trading. IEX was launched as a national securities exchange in September 2016. On October 24, 2017, IEX received regulatory approval from the SEC to list companies.

Why was the IEX created?

IEX was created in response to questionable trading practices that had become widely used across traditional public Wall Street exchanges as well as dark pools and other alternative trading systems. The IEX exchange aims to attract investors by promising to "play fair" by operating in a transparent and straightforward manner, while also helping to level the playing field for traders. Strategies to achieve those goals include:

What is IEX discretionary peg?

IEX discretionary peg is a primary peg that may execute at up to midpoint price when the quote is stable.

What happens when Iex exchanges apply for exchange status?

When IEX applied for exchange status, it dropped the broker-based priority mechanism, and as an exchange it gives priority to the best price first followed by the time of order submittal (as do other exchanges).

When did IEX start listing?

A former managing director at Morgan Stanley, she reported to Katsuyama. The company aimed to start listing companies in 2017.

When did IEX go public?

On October 24, 2017, IEX received regulatory approval from the SEC to list companies. IEX listed its first public company, Interactive Brokers, on October 5, 2018. The exchange said that companies would be able to list for free for the first five years, before a flat annual rate of $50,000.

Does IEX have API?

IEX also offers an API service, allowing developers to query US and Canadian stock data.

What Is An Official Settlement account?

Understanding Official Settlement Accounts

- Official settlement accounts are used in international balance of payments accounting, and represent the current account and the capital account of central banks. The current account keeps a record of a country's imports and exports of goods, services, income and transfers, and whether the country is a net creditor or net debtor. The capital account records the change in for…

Monitoring An Official Settlement Account

- Nations keep an eye on the official settlement account to gauge their economic health in the global economy. If there are continual outflows of reserve assets for a country, it means that its competitiveness in producing exported goods is relatively weak, or it's business environment is not as attractive as that offered by other countries for direct foreign investment. A nation runnin…