Dispute Settlement in International Trade

- Negotiation. Negotiation is a settlement method which is usually applied in international dispute settlement. ...

- Mediation. Mediation is the method of resolving dispute between the parties through the role of a third party. ...

- Commercial arbitration. ...

What is true regarding international trade?

large revenue opportunities are often found in foreign markets. it provides more opportunities to smaller firms than larger firms. international trade is protected against exchange risks. it reduces the need for insuring businesses against political risks.

What is international trade payment terms?

The terms of credit or payments in international trade are contractual matters of prior arrangement between seller and purchaser, and their determination depends upon a number of factors such as exporter’s knowledge about the buyer, buyer’s financial standing, exchange restrictions in the importing country, competition in the foreign market.

What are the barriers to the International Trade?

What are the factors that affect international trade?

- Impact of Inflation:

- Impact of National Income:

- Impact of Government Policies:

- Subsidies for Exporters:

- Restrictions on Imports:

- Lack of Restrictions on Piracy:

- Impact of Exchange Rates:

What is trade settlement process?

Trade settlement is the process of transferring securities into the account of a buyer and cash into the seller's account following a trade of stocks, bonds, futures or other financial assets. In the U.S., it normally takes three days for stocks to settle. Trade and Settlement Dates

How is international trade settled?

The special rupee vostro account would be opened in the corresponding banks of the partner trading country. For settlement, Indian importers undertaking imports would make payment in Indian rupee. This would be credited into the special account of the corresponding bank against invoices of the oversea supplier.

What are the types of international trade settlement?

The classification of Trade settlement can be done into 3 types:Normal/ Rolling Settlement.Trade-to-Trade Settlement.Auction.

What is meant by international trade?

international trade, economic transactions that are made between countries. Among the items commonly traded are consumer goods, such as television sets and clothing; capital goods, such as machinery; and raw materials and food.

What are the 3 types of international trade?

So, in this blog, we'll discuss the 3 different types of international trade – Export Trade, Import Trade and Entrepot Trade.Export Trade. Export trade is when goods manufactured in a specific country are purchased by the residents of another country. ... Import Trade. ... Entrepot Trade.

What are the 4 methods of payment in international trade?

The most common methods of payment in international trade include:Cash In Advance.Open Account Terms.Consignment.Documentary Collection.Letters of Credit.

What are the reasons for international trade?

Key Takeaways. The five main reasons international trade takes place are differences in technology, differences in resource endowments, differences in demand, the presence of economies of scale, and the presence of government policies.

What are features of international trade?

The following are the distinguishing features of international trade:(1) Immobility of Factors: ... (2) Heterogeneous Markets: ... (3) Different National Groups: ... (4) Different Political Units: ... (5) Different National Policies and Government Intervention: ... (6) Different Currencies: ... Specific Terms: ... Heterogeneous Group:More items...

What are the 5 elements of international trade?

Firstly, let's start with the elements of international trade. They are; * Balance of payments * Visible trade * Invisible trade * Trade gap * Correcting a deficit * Exchange rates * Why countries trade?

Who is the father of international trade?

In the early 1900s, a theory of international trade was developed by two Swedish economists, Eli Heckscher and Bertil Ohlin.

What are the types of trade?

What are the types of trade? What are the examples of trade?Domestic trade.Wholesale trade.Retail trade.Foreign trade.Import trade.Export trade.

What is trade booking and settlement?

Trade Clearing and Settlement After a trade is executed, the transaction enters what is known as the settlement period. During settlement, the buyer must make payment for the securities they purchased while the seller must deliver the security that was acquired.

Q1. What is meant by trade settlement date?

The settlement date is when a transaction is complete, and the buyer must pay the seller while the seller will transfer the assets to the buyer.

Q2. Can I sell my stock before the date of settlement?

Settled funds are defined as cash or the sale proceeds of fully paid for securities. Since no effort was made to deposit extra cash into the accoun...

Q3. Who are the participants that are involved in the process of settlement?

The participants are involved in clearing corporations, clearing members, custodians, depositors, clearing banks, and professional clearing members.

Q4. What constitutes a poor delivery?

A poor delivery occurs when a share transfer is not completed due to a violation of the exchange's rules.

Q5. What are the terms "pay-in" and "pay-out"?

The buyer provides money to the stock exchange, and the seller sends the securities on the pay-in day. The stock exchange delivers the money to the...

What is international trade?

International trade, economic transactions that are made between countries. Among the items commonly traded are consumer goods, such as television sets and clothing; capital goods, such as machinery; and raw materials and food. Other transactions involve services, such as travel services and payments for foreign patents ( see service industry ).

Why is international trade important?

International trade and the accompanying financial transactions are generally conducted for the purpose of providing a nation with commodities it lacks in exchange for those that it produces in abundance; such transactions, functioning with other economic policies, tend to improve a nation’s standard of living.

What were the tenets of mercantilism after Adam Smith?

After Adam Smith, the basic tenets of mercantilism were no longer considered defensible. This did not, however, mean that nations abandoned all mercantilist policies. Restrictive economic policies were now justified by the claim that, up to a certain point, the government should keep foreign merchandise off the domestic market in order to shelter national production from outside competition. To this end, customs levies were introduced in increasing number, replacing outright bans on imports, which became less and less frequent.

What was the protectionist policy of the last quarter of the 19th century?

But the protectionism of the last quarter of the 19th century was mild by comparison with the mercantilist policies that had been common in the 17th century and were to be revived between the two world wars. Extensive economic liberty prevailed by 1913. Quantitative restrictions were unheard of, and customs duties were low and stable. Currencies were freely convertible into gold, which in effect was a common international money. Balance-of-payments problems were few. People who wished to settle and work in a country could go where they wished with few restrictions; they could open businesses, enter trade, or export capital freely. Equal opportunity to compete was the general rule, the sole exception being the existence of limited customs preferences between certain countries, most usually between a home country and its colonies. Trade was freer throughout the Western world in 1913 than it was in Europe in 1970.

What was the importance of mercantilists?

It insisted that the acquisition of wealth, particularly wealth in the form of gold, was of paramount importance for national policy. Mercantilists took the virtues of gold almost as an article of faith; consequently, they never sought to explain adequately why the pursuit of gold deserved such a high priority in their economic plans.

What was the trade policy of the mercantilists?

The trade policy dictated by mercantilist philosophy was accordingly simple: encourage exports, discourage imports, and take the proceeds of the resulting export surplus in gold. Mercantilists’ ideas often were intellectually shallow, and indeed their trade policy may have been little more than a rationalization of the interests of a rising merchant class that wanted wider markets—hence the emphasis on expanding exports—coupled with protection against competition in the form of imported goods.

What was the Anglo-French trade agreement?

A triumph for liberal ideas was the Anglo-French trade agreement of 1860, which provided that French protective duties were to be reduced to a maximum of 25 percent within five years, with free entry of all French products except wines into Britain. This agreement was followed by other European trade pacts.

Why does international trade occur?

International trade occurs because one country enjoys a comparative advantage in the production of a certain good or service, specifically if the opportunity cost of producing that good or service is lower for that country than any other country. If a country opts not to trade with other countries, it is considered to be an autarky.

What are the factors that influence international trade?

1. International differences in climate. International differences in climate play a significant role in international trade – for example, tropical countries export products like coffee and sugar. In contrast, countries in more temperate areas export wheat or corn. Trade is also driven by differences in seasons and geography.

What are the three arguments for a protectionist trade policy?

The three major arguments for a protectionist trade policy are: Generally, tariffs or import quotas lead to gains for producers and losses for consumers. Therefore, the imposition of tariffs or import quotas is generally created from the political influence of the producers.

Why do economists favor free trade agreements?

Most economists favor free trade agreements because of the potential for gains from trade and comparative advantage. This is because these economists believe that government intervention will reduce the efficiency of the markets.

What is an import?

An import refers to a good or service brought into the domestic country. An export refers to a good or service sold to a foreign country. International trade is a method of economic interaction between international entities and is an example of economic linkage. Other forms of economic linkages include (1) foreign financial investment, ...

What is multinational corporation?

Multinational Corporation (MNC) A multinational corporation is a company that operates in its home country, as well as in other countries around the world. It maintains a. , and (3) foreign employees. The growth in these forms of economic linkages is known as globalization.

What is the difference between an export and an import?

The exchanges can be imports or exports. . An import refers to a good or service brought into the domestic country . An export refers to a good or service sold to a foreign country. International trade is a method of economic interaction between international entities and is an example of economic linkage.

What Is Settlement?

Jim wants to sell his stock of Company ABC and Jerry is interested in buying the same stock. The two of them meet one afternoon, agree on a price, and shake hands. The transaction is completely done now, right? Not exactly. Back when all banking and trading was done via paper, Jim would need to locate his paper stock certificate and then take this to a local brokerage firm and have it verified, signed, and stamped in order to transfer ownership to Jerry. Jerry would need to run to his local bank and withdraw cash, or possibly a certified bank note for the agreed upon amount. Then the two would need to meet again to exchange the money and the stock certificate. Only after that final step would the transaction be considered completely finished.

What is the trade date of a securities transaction?

The trade date is referred to as time 'T,' which is the date that both parties on a sale price. The date that the funds and securities are actually exchanged is the settlement date (referred to as 'S') which general takes a couple business days to complete. So based on our simple example above:

How long does it take to settle a stock?

Under Rule 15c6-1a, the Securities Exchange Commission (SEC) required most securities to be settled within 3 business days of the trade (T+3). However, in 2017, this requirement was revised to a settlement time of 2 business days, or T+2. There were two reasons for making this change. First, the lag time between trade agreement and settlement does have risks, including risk that the funds or certificate will not be delivered (or further delayed) or stock prices significantly change so either the buyer or seller wants to renegotiate a better deal. In addition, the seller needs to wait several days for this cash, so they are losing the opportunity to invest this money until the funds are available. Therefore, shortening the lag time from three business days to two effectively lowers these risks. Second, now that most trading and the exchange of funds and certificates are digital, neither party needs to run to the bank for cash or look for a paper certificate in their home safe, so the logistical time required to complete settlement is much quicker.

Why is there a lag time between trade agreements?

First, the lag time between trade agreement and settlement does have risks, including risk that the funds or certificate will not be delivered (or further delayed) or stock prices significantly change so either the buyer or seller wants to renegotiate a better deal.

What is the difference between a trade date and a settlement date?

The date an order is filled is the trade date, whereas the security and cash are transferred on the settlement date. The three-day stock settlement period is represented by

Why is the settlement date important?

The settlement date is important for deciding who receives a stock dividend. The dividend goes to the owners of the stock at the end of the dividend record date, which is set by the stock issuer, usually quarterly. Since stocks must settle in order for ownership to transfer, the settlement date for a trade must be no later than ...

How long does it take for a stock to settle?

In the U.S., it normally takes three days for stocks to settle.

What is freeriding in trading?

Settlement date also is important for determining whether a trader is freeriding -- a violation of trading regulations in which a cash-account trader sells a security before buying it. A cash account doesn't have access to loans from the broker, as would be the case in a margin account.

Why Does International Trade occur?

- International trade occurs because one country enjoys a comparative advantage in the production of a certain good or service, specifically if the opportunity cost of producing that good or service is lower for that country than any other country. If a country opts not to trade with other countries, it is considered to be an autarky. If we consider ...

Sources of Comparative Advantage

- 1. International differences in climate

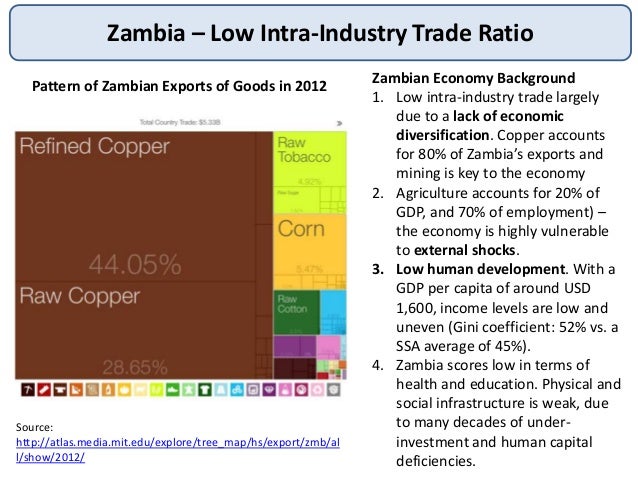

International differences in climate play a significant role in international trade – for example, tropical countries export products like coffee and sugar. In contrast, countries in more temperate areas export wheat or corn. Trade is also driven by differences in seasons and geography. - 2. Differences in factor endowments

Differences in factor endowments imply that some countries are more resource-rich than others in land, labor, capital, and human capital. According to the Heckscher-Ohlin model, a country enjoys a comparative advantage in production if the resources are abundantly available within th…

Examples of International Trade Policies

- Most economists favor free trade agreements because of the potential for gains from trade and comparative advantage. This is because these economists believe that government intervention will reduce the efficiency of the markets. Yet, many governments introduce protectionist policies to protect domestic producers from foreign producers. There are two major protectionist policies:

Arguments For A Protectionist Trade Policy

- The three major arguments for a protectionist trade policy are: 1. National security 2. Job creation 3. Protection of infant industries Generally, tariffs or import quotas lead to gains for producers and losses for consumers. Therefore, the imposition of tariffs or import quotas is generally created from the political influence of the producers.

Additional Resources

- Thank you for reading CFI’s guide to International Trade. To keep advancing your career, the additional CFI resources below will be useful: 1. Free Foreign Exchange Fundamentals Course 2. Globalization 3. Non-Tariff Barriers 4. Excise Tax 5. North American Free Trade Agreement (NAFTA)