Full Answer

What is the difference between LME official price and settlement price?

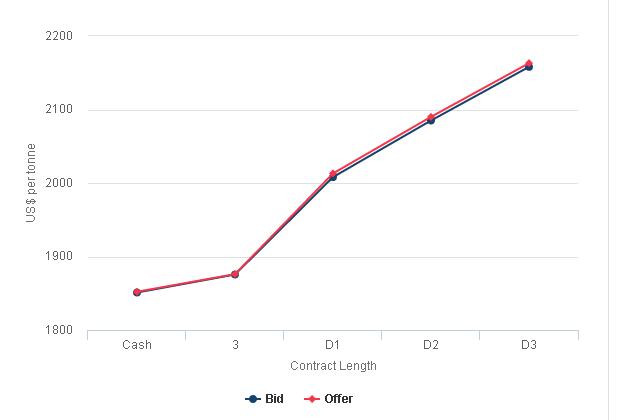

The LME Official Price is used as the global reference for physical contracts. The LME Official Settlement Price is the price at which all LME futures are settled. Prompt dates Cash, three month and 15 month: LME Tin, LME Steel Billet, LME Cobalt and LME Molybdenum.

What are the benefits of the LME?

These prices are often unpredictable and have a big influence on profits of companies. LME offers as well buyers as sellers the opportunity to hedge their material price risk and have protection further future fluctuation in prices. Real time LME prices

How is the price of the LME price calculated?

It pays a floating price based on the arithmetic average (mean) of the US$ LME Cash Settlement Price, converted to rand at the average rand/US$ exchange rate for the calculation period.

What time does the LME publish exchange rates?

12.30-13.25 London time Currency USD (LME also publish exchange rates for EUR, GBP, JPY) Trading day and price points Trading day and price points London Singapore New York LMEselect open 01.00 09.00 20.00 LME Asian Reference Price Established 06.55 - 07.00 (07.55 - 08.00 BST*) Provisional prices published 07.01 (08.01 BST*)

What is cash settlement price in LME?

The LME Official Price is the last bid and offer price quoted during the second Ring session and the LME Official Settlement Price is the last cash offer price.

How is LME price determined?

The Unofficial and Closing Prices are based on trading activity on LMEselect. The LME Asian Reference Price is calculated using the volume-weighted average of trades transacted on LMEselect during the most liquid period of Asian trading hours.

What does LME mean in shipping?

The London Metal Exchange (LME) is a commodities exchange that deals in metals futures and options.

What is Closing Time LME?

Trading day and price pointsTrading day and price pointsLondonNew YorkLME Closing Price established15.50 - 17.0010.50 - 12.00Ring close17.0012.00LME Final Closing Price published from17.5012.50LMEselect close19.0014.007 more rows

What is LME 3 month?

LME cash contracts are for settlement or delivery two Business Days forward from the trading day. A 3 Month price represents the price agreed to settle or deliver material 3 months from the time the price is agreed.

How do you trade in LME?

1:083:19Trading on the LME - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe open outcry method helps members and their clients to trade the LME's unique prompt dateMoreThe open outcry method helps members and their clients to trade the LME's unique prompt date structure. By training face to face rather than on a screen it's far easier to trade multiple damages.

What LME means?

LMEAcronymDefinitionLMELet Me ExplainLMELarge Marine EcosystemLMELiability Management Exercise (finance)LMELocal Management Entity28 more rows

What does the acronym LME stand for?

LMELondon Metal Exchange Business » Stock Exchange -- and more...Rate it:LMELocal Management Entity Computing » NetworkingRate it:LMELiquid Metal Embrittlement Academic & Science » ChemistryRate it:LMELight Malt Extract Miscellaneous » Food & NutritionRate it:LMELine Monitoring Equipment Computing » TelecomRate it:20 more rows

What is LME copper price?

LME Copper Closing PricesContractPrice3-month8078.50Month 18099.75Month 28093.75Month 38081.753 more rows

Can LME cancel trades?

The LME may also cancel or revoke orders and trades/transactions in accordance with the LME's Policy on Error Trades and Erroneous Order Submission.

What time does LME open?

*Ring 1 and Ring 2 make up the first (pre-lunch) session of Ring trading. LME Official Prices, used as a reference in physical contracts, are established during Ring 2. **Ring 3 makes up the second (post-lunch) session of Ring trading....Resources.Ring 2 (12.30 - 13.15)Kerb trading13:25 - 13:35Interval13:35 - 15:0010 more rows

Why did LME stop trading?

LONDON — The London Metal Exchange said Wednesday it had been forced to halt the nickel market once again after a “systems error” allowed a small number of trades to go through below its newly imposed daily price limit. The LME said trades executed below the lower daily price limit would be canceled.

What is LME copper price?

LME Copper Closing PricesContractPrice3-month8078.50Month 18099.75Month 28093.75Month 38081.753 more rows

Are LME contracts futures or forwards?

www.lme.com/metals LME base metal contracts are, strictly speaking, forward contracts. This means that, unlike standard futures, profits and losses are realised at expiry, not before (see sections on margins for more information).

What is the LME price of gold?

Live Gold Pricebid+/-USD/Oz1711.1314.02GBP/Oz1485.5515.85EUR/Oz1718.8713.57More data2 more rows

What is price of the commodity?

Prices of a commodity are based on the supply and demand of the commodity. This is similar to other non-commodity products. Commodities however are bought and sold at prices while exchange of these products usually takes place on a later date somewhere in the future.

How is LME settlement price determined?

The LME Cash Settlement Price is determined by a number of factors, including, in part, by the amount of industrial metal available for trading on the LME.

What is daily settlement price?

Daily Settlement Price means the settlement price for a Swap calculated each Business Day by or on behalf of BSEF. The Daily Settlement Price can be expressed in currency, spread, yield or any other appropriate measure commonly used in swap markets.

What is disruption cash settlement price?

Disruption Cash Settlement Price means, in respect of each principal amount of Notes equal to the Calculation Amount, an amount equal to the fair market value of the relevant Note (but not taking into account any interest accrued on such Note and paid pursuant to Conditions 5 and 19) on such day as shall be selected by the Issuer in its sole and absolute discretion provided that such day is not more than 15 days before the date on which the Election Notice is given as provided above adjusted to take account fully for any losses, expenses and costs to the Hedging Entity of unwinding or adjusting any related hedging arrangements in respect of the Note, all as calculated by the Calculation Agent in its sole and absolute discretion.

What is cash settlement amount?

Cash Settlement Amount means, for every Board Lot, an amount calculated by the Issuer as follows (and , if appropriate, either (i) converted (if applicable) into the Settlement Currency at the Exchange Rate or , as the case may be , (ii) converted into the Interim Currency at the First Exchange Rate and then (if applicable) converted into Settlement Currency at the Second Exchange Rate):

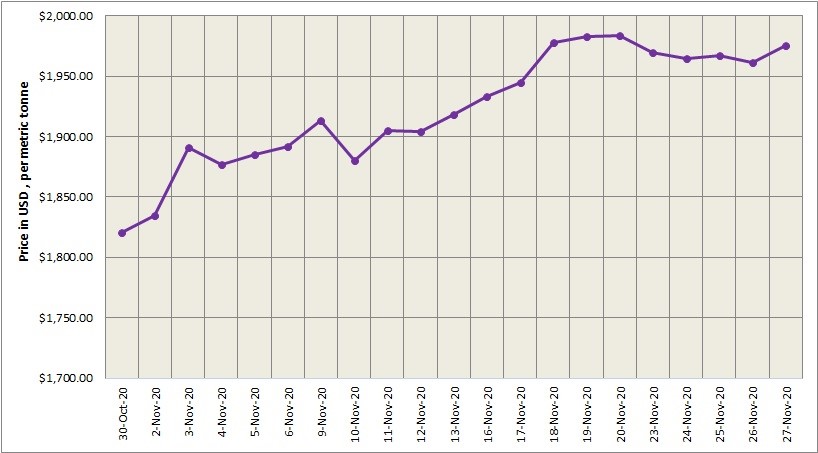

When did LeadFX leave Fremantle?

Final shipments of lead concentrate left the Fremantle port in March 2015. (2) LeadFX’s realized average lead sale price in the table above is the weighted average of realized sales prices at each period end adjusted for the impact of gains and losses on futures contracts. (3) The LME Cash Settlement Price above is the daily closing cash settlement price averaged over the period.

What is final settlement?

Final Settlement means permanent settlement of the Contractor’s actual allowable costs or expenditures as determined at the time of audit, which shall be completed within three years of the date the year-end cost settlement report was accepted for interim settlement by DHCS. If the audit is not completed within three years, the interim settlement shall be considered as the final settlement.

What is the monthly settlement date?

Monthly Settlement Date means the 25th day of each calendar month (or if such day is not a Business Day, the next occurring Business Day).

Why is the LME Nickel called the "Trade at Settlement"?

“Trade at settlement” is so called because TAS functionality on other markets allows participants to trade the unknown “settlement price” - the price which determines daily margin. On the LME the price used to determine daily margin, discovered after 16.30, is known as the “Closing Price”, not the “settlement price”.

When is the LME closing?

The London Metal Exchange (LME) introduced trade-at-settlement (TAS) functionality on LMEselect for 3-month LME Nickel Closing Prices on 18 February 2019.

What is the LME rulebook?

The LME Rulebook sets out the rules and regulations of the London Metal Exchange.

What is LME Clear?

LME Clear provides clearing and settlement services for users of the London Metal Exchange on all Ring, electronic and telephone trades.

How long are cash settlement contracts tradable?

Our cash-settled contracts are tradable out to 15 months on LMEselect or the inter-office market.

What happens to the TAS order after the closing price is discovered?

Once the Closing Price is discovered, the TAS order delivers the underlying 3-month contract at the Closing Price, plus or minus the traded TAS price.

Examples of LME Settlement Price in a sentence

Some contracts specify a single fixed price, which does not vary with changes in the LME Settlement Price or the MWP.

Related to LME Settlement Price

Daily Settlement Price means the settlement price for a Swap calculated each Business Day by or on behalf of BSEF. The Daily Settlement Price can be expressed in currency, spread, yield or any other appropriate measure commonly used in swap markets.

What is LME trading?

The LME is one of the main commodities markets in the world and allows for the trading of metals options and futures contracts. It also lists futures contracts on its London Metal Exchange Index (LMEX), which is an index that tracks the prices of the metals that trade on the exchange.

Who bought the LME?

In 2012, the LME was acquired by the Hong Kong Exchanges and Clearing. 3 Consolidation has become a common trend among the world's exchanges as they battle to reduce costs and boost their survival prospects in a highly competitive sector. For example, the CME Group acquired the New York Mercantile Exchange (NYMEX) in 2008. NYMEX, in turn, had merged with the Comex commodities exchange in 1994, creating the largest physical commodity exchange at the time. 4

What Is the London Metal Exchange (LME)?

The London Metal Exchange (LME) is a commodities exchange that deals in metals futures and options. The LME is a non-ferrous exchange, meaning the exchange does not trade iron and steel. Instead, tradable contracts include aluminum, copper, gold, silver, cobalt, and zinc.

How does LME trade metals?

The LME has three methods of trading metals: open outcry, through the LME Select electronic trading platform, or by telephone systems. The nature of commodity exchanges is changing rapidly. The trend is moving in the direction of electronic trading and away from traditional open outcry trading, where traders meet face-to-face or in trading pits .

What is a hedger in the LME?

A hedger might be a producer or consumer and seek a position in a future or options contract to protect from future price moves in the metals market.

What metals are listed on the LME?

Futures and options contracts on metals such as gold, silver, zinc, and copper are listed for trading on the LME.

How to trade on LME?

An investor looking to trade on the LME has three options: via the LME's electronic portal, LMEselect, the Ring, or on the 24-hour telephone market. Investors must conduct their trading through an LME member. Information on how to become a member as well as a list of LME-certified members is available on the exchange's website.

What Is the Settlement Price?

The settlement price, typically used in the mutual fund and derivatives markets, is the price used for determining a position's daily profit or loss as well as the related margin requirements for the position.

How are settlement prices calculated?

Settlement prices are typically based on price averages within a specific time period. These prices may be calculated based on activity across an entire trading day—using the opening and closing prices as part of the calculation—or on activity that takes place during a specific window of time within a trading day.

What happens if you own a call option with a strike price of $100?

If you own a call option with a strike price of $100 and the settlement price of the underlying asset at its expiration is $120, then the owner of the call is able to purchase shares for $100, which could then be sold for a $20 profit since it is ITM. If, however, the settlement price was $90, then the options would expire worthless since they are OTM.

When is the settlement price determined?

The settlement price will be determined on the settlement date of a particular contract.

Is the settlement price the same as the opening price?

While the opening and closing prices are generally handled the same way from one exchange to the next, there is no standard on how settlement prices must be determined in different exchanges, causing variances across the global markets.

How are LME prices tracked?

LME prices, though, are now tracked by the second and distributed by computer through the major news vendor companies . Trading takes place either through the “open outcry” floor trading sessions or via a 24-hour telephone based inter-office market.

What is the LME?

Consequently, the LME acts as a barometer of supply and demand for metals worldwide and its official prices are used by industry as the basis price for contractual purposes. These prices can in turn be protected by hedging on the Exchange through a variety of futures and options contracts.

Why is LME based on shipping dates?

Because LME contracts were originally based on shipping dates as opposed to harvest months (as with agricultural commodities), LME uniquely adopted a system of daily delivery dates out to three months. This coincided with the approximate sailing times for copper from Chile and tin from Malaysia. Because sailing times were not exact, the daily prompt system enabled the users of the Exchange to move their positions backwards or forwards to coincide with the eventual arrival dates.

What happened to the LME after it was established?

Soon after the LME was established, the prices being quoted began to be published in the financial press, and those published prices started to be used by all sections of the metal industry as a reference for physical contracts. This, in turn, led to an increase in the types of businesses using the Exchange for hedging purposes.

What is the London metal exchange?

The London Metal Exchange (LME) is one of London’s most prestigious markets. In terms of volume, it is Europe’s largest pure commodity exchange and it is the 10th largest futures market in the world. As a truly international market, with some 95 percent of its business coming from overseas, the LME is a significant contributor to ...

When did the LME become a recognized investment exchange?

There have been other significant changes over the years, including, in 1986, the passing of the Financial Services Act which resulted in the LME becoming a more formally regulated “Recognized Investment Exchange” and, in 1987, the introduction of a clearinghouse which matches, clears and guarantees Exchange contracts.

How long is the LME contract?

In recent years, to meet industrial demand, the old three-month trading period has been superceded by a period of up to 27 months for copper, aluminum and zinc and up to 15 months for lead, nickel, tin and aluminum alloy. The quality of the metals that underpin the LME’s contracts is strictly controlled and these specifications are updated from time to time to ensure that the contracts best serve industry needs.

What is LME futures?

LME offers futures and options various contracts for aluminium, copper, tin, nickel, zinc, lead, aluminium, alloy, NASAAC (North American Special Aluminium Alloy), steel billet, cobalt and molybdenum. . Contrary to other exchanges the trade is still in the ring.

What is the London Metal Exchange?

The London Metal Exchange was founded in the year 1877, but has a history from the year 1571. LME is now the world’s leading market for non-ferrous metals. LME prices are very important for companies who trade in these metals. The owner is LME Holdings Limited and is located at Leadenhall Street, City of London, United Kingdom. The London Metal Exchange started with copper and very soon lead and zinc followed. After that the trade was extended with aluminium and other metals. About $US 11.6 trillion annually is the total value of the trade. For commodities most of the deals are made to be delivered in three month’s time. This is an old custom that goes back in time because copper cargoes needed a 3 month’s journey to deliver the copper from Chile.

What metals were traded on the London Metal Exchange?

The London Metal Exchange started with copper and very soon lead and zinc followed. After that the trade was extended with aluminium and other metals. . About $US 11.6 trillion annually is the total value of the trade. . For commodities most of the deals are made to be delivered in three month’s time.