Model B Model B clearing agreements involve a contract for brokering services between the customer and the broker, and a contract for custody services between the broker and the custodian. Income flows from the custodian to the customer, and the custodian is responsible for reporting income flows to individual customers.

What is a Model B clearing agreement?

Model B clearing agreements are a type of clearing member trade agreement (CMTA) used by investors and their brokers. There are a number of differences between model B agreements and model A agreements. Clearing agreements are divided into two categories -- bilateral trade agreements and clearing member trade agreements.

Why Lek securities Model B clearing services?

In response to industry changes, Lek Securities has witnessed an increase in demand for its Model B clearing services, especially from firms looking to outsource much of the administrative load.

Why are wealth managers turning to Model B clearing services?

Many clearers still prefer a light touch approach, forcing wealth managers to look externally for tax and reporting expertise. In response to industry changes, Lek Securities has witnessed an increase in demand for its Model B clearing services, especially from firms looking to outsource much of the administrative load.

Why BNY Mellon Pershing clearing?

Clearing, Custody and Settlement - Pershing - BNY Mellon | Pershing Clearing, Custody and Settlement As the industry's largest provider of clearing and settlement solutions,¹ BNY Mellon's Pershing can help you power your business by driving growth, creating scale and managing costs, and helping you stay ahead of new regulations.

What is settlement and clearing?

Settlement involves exchanging funds between the two banks, while clearing can end without any interbank money movement. In the clearing process, funds move between the recipient's or sender's bank account and their bank's reserves.

What is meant by clearing agreement?

: an agreement between nations as to the method of settlement of commercial accounts that is usually designed to avoid transfer of foreign exchange specifically : an agreement between two countries designed to force a balance of trade between them with exports being offset by imports and the use of cash remittances ...

What does a clearing broker do?

What Is a Clearing Broker? A clearing broker is a member of an exchange that acts as a liaison between an investor and a clearing corporation. A clearing broker helps to ensure that the trade is settled appropriately and the transaction is successful.

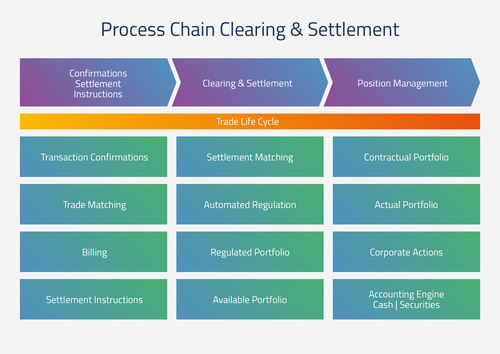

How clearing and settlement process is working?

The clearing corporation receives funds and securities from the clearing banks and depositories for purchase and sale transactions respectively. So, if a clearing member is settling a purchase transaction, then the corporation receives the money in its clearing account via the clearing bank.

What is the purpose of a clearing house?

A clearing house is an intermediary between buyers and sellers of financial instruments. It is an agency or separate corporation of a futures exchange responsible for settling trading accounts, clearing trades, collecting and maintaining margin monies, regulating delivery, and reporting trading data.

How do clearing agents make money?

Clearing firms make big money by selling memberships to professional individual traders and corporations. The higher the membership price, the more rights and privileges the member enjoys. At the time of publication, the selling price for a Chicago Mercantile Exchange, or CME, membership was $400,000.

Who is the largest clearing firm?

Rank Firm Parent company Main phone Website B-D clients % chg. vs.RankFirmPhone1Pershing LLC(201) 413-25642Penson Worldwide Inc.(212) 273-68353National Financial Services LLC(617) 563-87384Broadcort & Merrill Lynch Professional Clearing Corp.(646) 855-3507; (212) 670-501912 more rows

What are examples of clearing firms?

Two examples of clearing firms are ETC – Electronic Transaction Clearing – and AXOS Clearing. Both of these firms operate as independent clearing houses supervised by the Financial Industry Regulatory Authority and serve as clearing firms for brokerages that do not have clearing capacity on their own.

What is a bilateral clearing agreement?

A reciprocal trade agreement between two governments for a limited time and a specific amount is called a bilateral clearing agreement. The exporters in both countries are paid in their local currency, although the value in the agreement is usually expressed in a major currency, such as the U.S. dollar.

How do you write a contract payment?

The payment agreement should include:Creditor's Name and Address;Debtor's Name and Address;Acknowledgment of the Balance Owed;Amount Owed;Interest Rate (if any);Repayment Period;Payment Instructions;Late Payment (if any); and.More items...•

What is a Model B clearing service?

In response to industry changes, Lek Securities has witnessed an increase in demand for its Model B clearing services, especially from firms looking to outsource much of the administrative load. This type of clearing service was born out of the London Stock Exchange (LSE), and was first introduced to outsource counterparty risk, where an executing broker would give up a trade on the LSE to a clearing member for settlement.

Why do portfolio managers need to offer tailored portfolios?

In order to remain competitive , managers need to offer tailored portfolios for their individual clients, which in turn increases the demand for bespoke clearing solutions.

Is Model B outsourced?

Now however, with the increase cost in outsourcing, Model B has taken on a life of its own, allowing asset managers and family offices to utilise the infrastructure and particular competence of their clearer for accounting, regulatory reporting, and tax preparations, without giving up their brand recognition and personalised service. Everything from trading and portfolio management, to tax and regulatory reporting can be outsourced under one roof – effectively minimising the number of third parties and thus reducing the levels of both risk and cost.

What Is Clearing?

Clearing is the procedure by which financial trades settle; that is, the correct and timely transfer of funds to the seller and securities to the buyer. Often with clearing, a specialized organization acts as the intermediary and assumes the role of tacit buyer and seller to reconcile orders between transacting parties. Clearing is necessary for the matching of all buy and sell orders in the market. It provides smoother and more efficient markets as parties can make transfers to the clearing corporation rather than to each individual party with whom they transact.

How does clearing protect the parties involved in a transaction?

The clearing process protects the parties involved in a transaction by recording the details and validating the availability of funds.

What is clearinghouse fee?

Clearinghouses charge a fee for their services, known as a clearing fee . When an investor pays a commission to the broker, this clearing fee is often already included in that commission amount. This fee supports the centralizing and reconciling of transactions and facilitates the proper delivery of purchased investments.

What is an ACH clearing house?

An automated clearing house (ACH) is an electronic system used for the transfer of funds between entities, often referred to as an electronic funds transfer (EFT). The ACH performs the role of intermediary, processing the sending/receiving of validated funds between institutions.

Why is clearing necessary?

Clearing is necessary to match all buy and sell orders to ensure smoother and more efficient markets. When trades don't clear, the resulting out trades can cause real monetary losses. The clearing process protects the parties involved in a transaction by recording the details and validating the availability of funds.

What happens when a clearinghouse encounters an out trade?

When a clearinghouse encounters an out trade, it gives the counterparties a chance to reconcile the discrepancy independently. If the parties can resolve the matter, they resubmit the trade to the clearinghouse for appropriate settlement. But, if they cannot agree on the terms of the trade, then the matter is sent to the appropriate exchange committee for arbitration .

Does the NYSE have clearing firms?

Stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ , have clearing firms. They ensure that stock traders have enough money in their account, whether using cash or broker-provided margin, to fund the trades they are taking.

What is BNP Paribas clearing?

BNP Paribas Securities Services is the number one custodian in Europe, and the number five worldwide [1]. Our clearing capabilities span cash equities, fixed income and listed derivatives, with a 90% global market coverage. Along with a market-leading proposition in Europe, we are one of the largest third-party clearers in the APAC region [2] and are expanding our presence in Latin America.

What is direct clearing?

As a direct clearing member, the third-party provider assumes responsibility for adapting to all market and CCP changes. Local experts can manage the shifting maze of regulations across markets, along with any changes that are introduced in the clearing space – whether it is large scale M&A market transformations, the launch of new trading venues, or iterative updates to rule books. As a result, international brokers no longer need to stay up-to-speed on the changes taking place in each of the markets in which they operate.

What is third party clearing?

Third-party clearing enables brokers to team with an expert, on-the-ground partner to help navigate market complexities and evolutions, cut costs and reduce their capital consumption – freeing brokers to concentrate on their core competencies.

Can third party clearing houses optimise margin calls?

Third-party clearers can also optimise margin calls and collateral management. Margin calls are sent by the CCP to the general clearing member, so at BNP Paribas Securities Services we centralise and harmonise the margin call process across all venues. Clients can cover any risk increases with the collateral of their choice (i.e. cash or securities). We then optimise the collateral posted to CCPs on a daily basis. Consolidated reporting indicates each CCP margin requirement and is sent daily.

Can brokers benefit from more attractive pricing?

Brokers can benefit from more attractive pricing too. The more scale a clearer has at a CCP, the more cost allocation can be reduced, which can in turn benefit clients.

Is it uneconomic to join clearing houses?

Direct membership of clearing venues comes at a substantial cost, making it uneconomic for firms that lack significant volumes and scale. In Europe, where the market is highly fragmented, members will need to connect to multiple clearing houses, with each bringing its own connectivity and operating specificities.

Does BNP Paribas have margin call?

At BNP Paribas, we monitor clients’ intraday positions and risk, and provide single netting per CCP with a centralised margin call process across CCPs. Clients can cover changes in risk with their collateral of choice, while our liquidity optimisation tool enables brokers to finance their daily margin calls in the most efficient way possible and according to their individual needs.