The money market settlement fund (which will be opened with a zero balance) is the account used to pay for and receive proceeds from any trades you make. If you transfer money from your checking account but aren't quite sure what to invest it in, it will sit in your settlement account until you make a purchase.

Are mutual funds worth the money?

These funds' nose-bleed fees might be worth it in terms of their long-term performance. Managed mutual funds that may be worth the money. The fees for mutual funds are higher because they are actively managed by portfolio managers who choose stocks that are likely to outperform benchmark indexes.

What is the point in money market funds?

- The money market is a financial exchange where banks and companies buy and sell short-term debt securities.

- Money market investments like T-bills and CDs are safe and very liquid, paying reliable interest.

- Money market accounts and money market funds are common ways that individuals can invest in the market.

Is a money market fund risky?

Money market funds are low risk but not risk-free. Over the decades of their use, only a few have “broken the buck” and reported a net asset value of under $1. Generally, those failures were resolved successfully by the funds themselves or, in the case of 2008, with the financial backing of the U.S. government.

Do money market funds pay?

Money market funds often pay a monthly dividend, but some alternatives exist. Money market funds are a popular and useful cash management tool in the right circumstances. Before you use money market funds, make sure you understand how they work and the risks you might be taking.

What is the Vanguard Federal money market settlement fund?

The fund invests at least 99.5% of its total assets in cash, U.S. government securities, and/or repurchase agreements that are collateralized solely by U.S. government securities or cash (collectively, government securities). As such it is considered one of the most conservative investment options offered by Vanguard.

Can you withdraw money from Vanguard settlement fund?

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

Is Vanguard Federal money market fund Safe?

You could lose money by investing in this Fund. Although a money market fund seeks to preserve the value of an investment at $1 per share, it cannot guarantee it will do so. Investment in this Investment Option is not insured or guaranteed by the FDIC or any other government agency.

What is a money market fund used for?

The primary purpose of a money market fund is to provide investors a safe avenue for investing in secure and highly liquid, cash-equivalent, debt-based assets using smaller investment amounts. In the realm of mutual-fund-like investments, money market funds are characterized as a low-risk, low-return investment.

Why can't I withdraw my money from Vanguard?

When you sell funds you'll need to wait for the trade to settle before you can withdraw the cash. This normally happens 2 business days after the trade completes.

How did money get into my settlement fund?

When you buy or sell stocks, and other securities, your transactions go through a broker, like Vanguard Brokerage. Money to pay for your purchases is taken from your settlement fund and proceeds from your sales are received in your settlement fund.

Can you lose money in a money market fund?

Because money market funds are investments and not savings accounts, there's no guarantee on earnings and there's even the possibility you might lose money.

Can you lose your money in a money market account?

Money market funds are offered by investment companies and others. Money market funds are not insured by the FDIC or the NCUA, which means you could possibly lose money investing in a money market fund.

Are money market funds Worth It?

A money market fund is an excellent option if you're looking for a safe, short-term, and liquid vehicle to park your cash. These mutual funds are designed to provide low costs, great liquidity and very low risk.

How safe are money market funds?

Key Takeaways. Both money market accounts and money market funds are relatively safe. Banks use money from MMAs to invest in stable, short-term, low-risk securities that are very liquid. Money market funds invest in relatively safe vehicles that mature in a short period of time, usually within 13 months.

How do I put money in a money market fund?

Buy into a money market fund. Your online brokerage or other services (such as mutual fund companies) will help you invest a specific amount of money into money market funds by writing a check or making an online transfer.

What are the disadvantages of a money market account?

Disadvantages of a Money Market AccountMinimums and Fees. Money market accounts often need a minimum balance to avoid a monthly service charge, which can be $12 per month or more. ... Low Interest Rate. Compared to other investments, money market accounts pay a low interest rate. ... Inflation Risk. ... Capital Risk.

How long does it take Vanguard funds to settle?

Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction. During this time, you must have settled funds available before you can buy anything.

How long does it take to withdraw money from Vanguard?

Follow the on-screen instructions. When you withdraw cash it can take up to 5 business days to be paid to your bank account.

How long does it take Vanguard to transfer funds to bank?

Digital transfers may take as little as 5 to 7 days. You can follow your transfer's progress online via the “Track Your Transfer” link on your Account Details page. If paperwork is required, the transfer may take longer.

How do I withdraw money from my Vanguard IRA?

From the Holdings tab, find the Transact dropdown menu. Select Withdraw from IRA to begin your distribution.

What is the benefit of opening a settlement fund?

One of the key perks of opening settlement funding accounts like an MMDA is that it encourages you to have an emergency fund. Such accounts can penalize you if you withdraw money often rather than saving it.

What is a money market account?

A money market account is a type of settlement account that has many of the same features as a savings account, only it can pay a higher rate of interest in certain circumstances. It shouldn’t be confused with other similarly named account types such as the money market mutual fund (MMDA).

How long can you live off an emergency fund?

Your emergency fund should usually consist of enough money to live off for six months while you search for a new job or opportunity to keep you ticking over. And when you do need to access your settlement funds, a company like Rightway can help you access them, hassle-free. Be sure to do your research and learn more about their services.

Is money market settlement safe?

Luckily, money market settlement funds are one safe place to invest your money. Here’s everything you need to know about settlement funds.

What Is a Money Market Fund?

A money market fund is a mutual fund that invests solely in cash and cash equivalent securities, which are also called money market instruments. These vehicles are very liquid short-term investments with high credit quality .

What is the difference between money market and mutual fund?

In contrast, money market funds have substantially lower requirements that are even lower than average mutual fund minimum requirements. As a result, money market funds allow investors to take advantage of the safety related to a money market investment at lower thresholds.

How long does a money market fund have to be redeemable?

Securities and Exchange Commission (SEC) rules dictate the fund portfolio must maintain a weighted average maturity (WAM) of 60 days or less. 1 Just like other mutual funds, money market funds issue redeemable units (shares) to investors and must follow guidelines set out by the SEC. All the attributes of a mutual fund apply to a money market mutual fund, with one exception that relates to its net asset value (NAV). 2 We'll take an in-depth look at this exception later on.

Can you buy a money market fund that only invests in Fannie Maes?

For instance, if you like the housing sector, you can buy a money market fund that solely invests in Fannie Maes . Tax-free funds do not provide as many options. These funds invest in short-term debt obligations issued by federally tax-exempt entities (municipal securities) and have a lower yield.

When did the Reserve Primary Fund fail?

In another case, the Reserve Primary Fund failed in September 2008. The prestigious fund held hundreds of millions in short-term loans to Lehman Brothers and, when that investment firm went bankrupt, a wave of panicked selling ensued among Reserve's own investors.

Is money market safe?

The securities in which these funds invest are stable and generally safe investments. Money market securities provide a fixed return with short maturities. By purchasing debt securities issued by banks, large corporations, and the government, money market funds carry a low default risk while still offering a reasonable return.

Do tax free funds have a lower yield?

Tax-free funds do not provide as many options. These funds invest in short-term debt obligations issued by federally tax-exempt entities (municipal securities) and have a lower yield. In some cases, you can purchase tax-free funds that are exempt from both state and local taxes; however, these kinds of exemptions are exceptions rather than the norm.

Preserve your cash until you decide how to use it

Money market mutual funds offer you a place to store your cash and potentially earn income—without as much risk to your investment as stock or bond funds.

Are you investing outside of an IRA or other retirement account?

If you're in one of the highest tax brackets and investing outside of your retirement account, you may be able to reduce your tax exposure with a tax-exempt money market fund.

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

How does Smartasset help you?

With SmartAsset, you can get matched up with three advisors who can empower you to make smart financial decisions. SmartAsset also helps take the mystery out of retirement planning by answering some of the most commonly asked questions in a simple , personalized way. Learn more about how SmartAsset can help you find your advisor match and get started now.

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

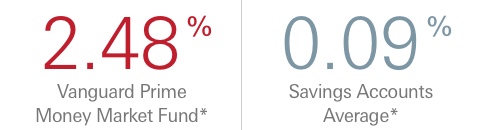

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.

How to get a prospectus for a mutual fund?

You can request a mutual fund prospectus by calling Schwab at 1-800-435-4000. Please read the prospectus carefully before investing.

Does Schwab have sweep funds?

Schwab has eliminated sweep money market funds as a cash feature for most new and existing accounts. Limited accounts and account types may be eligible to have a money market fund as the designated cash feature. More complete information about all of Schwab’s available cash features can be found in the Cash Features Disclosure Statement.

How does a money market fund work?

Although you can often use them in the same ways, bank accounts and money market funds work differently "under the hood." If you take money from your bank account, the transaction is completed immediately. However, a money market fund isn't exactly the same as cash. Each share is actually part-ownership in a raft of different investments, worth about $1. That means there's a lot of behind-the-scenes paperwork involved in processing the transaction. The trade date is when you actually placed the buy or sell order. The settlement date is three business days later, when the formalities have concluded and your funds are available.

What is the settlement date on a stock?

The settlement date is when you get the money in your account, which only matters to you. The trade date is the one the government and the markets care about. At year's end the trade date determines which tax year a transaction is recorded under. If you're waiting out the 31-day period to avoid the "wash sale" rules, you're counting from the trading date. The three-day wait is also important if you're alternately buying and selling. If you try to resell shares before their settlement date, that's "freeriding," which is illegal. If it happens, your cash account will be suspended for 90 days.