There are three main types of offers in compromise:

- Doubt as to collectibility — This is the most common type of offer in compromise. ...

- Doubt as to liability — This is where the IRS reduces your taxes owed because there is a doubt that you owe the assessed amount.

- Effective Tax Administration — This applies in cases where you would suffer financial hardship if you paid the full tax bill. ...

The taxpayer's role is to understand and meet his or her tax obligations. The IRS role is to help the large majority of compliant taxpayers with the tax law, while ensuring that the minority who are unwilling to comply pay their fair share.

How much should I pay for an offer in compromise?

Offer in Compromise Formula: 24-Month Repayment. For a 24-month repayment plan, use this formula to determine what you should offer in your Offer in Compromise: ( Available Monthly Income x 24) + Value of Personal Assets. Using the numbers from the examples above, the formula would look like this: ($300 x 24) + $5,000 = $12,200.

How does the IRS evaluate an offer in compromise?

How does the IRS evaluate an Offer in Compromise. How does the IRS evaluate an Offer in Compromise? The IRS employs a very specific formula for determining whether to accept an Offer in Compromise. First, the Offer in Compromise must be for a sum that is greater than the reasonable collection potential (“RCP”) of the taxpayer in question.

How to file a successful offer in compromise?

You're eligible to apply for an Offer in Compromise if you:

- Filed all required tax returns and made all required estimated payments

- Aren't in an open bankruptcy proceeding

- Have a valid extension for a current year return (if applying for the current year)

- Are an employer and made tax deposits for the current and past 2 quarters before you apply

Who is eligible for an offer in compromise?

Offer In Compromise – Who Is Eligible? Most individual and business taxpayers who owe income taxes, payroll taxes, penalties or interest may submit an Offer in Compromise to settle these liabilities. However. the IRS will not grant settlements to every single taxpayer who submits an offer.

How much does the IRS usually settle for with a offer in compromise?

Each year, the Internal Revenue Service (IRS) approves countless Offers in Compromise with taxpayers regarding their past-due tax payments. Basically, the IRS decreases the tax obligation debt owed by a taxpayer in exchange for a lump-sum settlement. The average Offer in Compromise the IRS approved in 2020 was $16,176.

How much should I offer in offer in compromise?

An offer in compromise (with doubt as to collectability) to the IRS should be equal to, or greater than what the IRS calculates as the taxpayer's reasonable collection potential.

Is offer in compromise a good idea?

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship.

What are the consequences of offer in compromise?

If the IRS accepts your offer in compromise, you'll need to meet all the terms of your agreement with the agency. If you fail to comply with the agreement, the IRS can sue you for up to the original amount of the tax debt plus penalties and interest (minus any payments you've made).

How hard is it to get an offer in compromise?

But statistically, the odds of getting an IRS offer in compromise are pretty low. In fact, the IRS accepted only 15,154 offers out of 49,285 in 2021.

Does IRS usually accept offer in compromise?

In most cases, the IRS won't accept an OIC unless the amount offered by a taxpayer is equal to or greater than the reasonable collection potential (RCP). The RCP is how the IRS measures the taxpayer's ability to pay.

What happens if IRS rejects offer in compromise?

The IRS will try to contact you to provide you with one opportunity to pay the missing amount. If you do not make the payment, the offer will be withdrawn and returned to you without appeal rights. All payment(s) already received will be applied to your tax liabilities. The IRS will also keep the application fee.

What is the minimum payment the IRS will accept?

What is the minimum monthly payment on an IRS installment agreement?Amount of tax debtMinimum monthly payment$10,000 or lessNo minimum$10,000 to $25,000Total debt/72$25,000 to $50,000Total debt/72Over $50,000No minimumMay 16, 2022

How long does an offer in compromise take?

between 7 and 12 monthsMost OICs take between 7 and 12 months to complete, which means the taxpayers would send 7 to 12 monthly payments to the IRS. These payments can be considerable, and there's no guarantee that the IRS will accept the OIC. In fact, in 2020, the IRS approved only one-third of OIC applications.

Does IRS forgive debt after 10 years?

In general, the Internal Revenue Service (IRS) has 10 years to collect unpaid tax debt. After that, the debt is wiped clean from its books and the IRS writes it off. This is called the 10 Year Statute of Limitations.

What happens if you owe the IRS more than $25000?

If you owe more than $25,000 you may still qualify for an installment agreement, but you will need to complete a Collection Information Statement, Form 433F. Otherwise, contact the IRS to discuss your payment options at 1-800-829-1040.

How is offer in compromise calculated?

There are 2 basic Offer in Compromise formulas: On a 5-month repayment plan: (Available Monthly Income x 12) + Value of Personal Assets. On a 24-month repayment plan: (Available Monthly Income x 24) + Value of Personal Assets.

How is an offer in compromise calculated?

To calculate the amount you can pay with an offer in compromise calculator, you subtract the value of your total assets from the total debts you owe. Next, you take the value of your total income per month and multiply it by the number of months you have in the statute of limitations.

How is OIC calculated?

There are 2 basic Offer in Compromise formulas: On a 5-month repayment plan: (Available Monthly Income x 12) + Value of Personal Assets. On a 24-month repayment plan: (Available Monthly Income x 24) + Value of Personal Assets.

What happens if IRS rejects offer in compromise?

The IRS will try to contact you to provide you with one opportunity to pay the missing amount. If you do not make the payment, the offer will be withdrawn and returned to you without appeal rights. All payment(s) already received will be applied to your tax liabilities. The IRS will also keep the application fee.

How do I fill out an offer in compromise?

9:2811:03How to Complete IRS Form 656 Offer in Compromise - YouTubeYouTubeStart of suggested clipEnd of suggested clipUse only now I do want to explain to you that an offer and compromise. Does suspend the collectionMoreUse only now I do want to explain to you that an offer and compromise. Does suspend the collection statute expiration dates while you're in this. Not. Only for the time you're in it.

Make Sure You Are Eligible

Before we can consider your offer, you must be current with all filing and payment requirements. You are not eligible if you are in an open bankrup...

If Your Offer Is Accepted

1. You must meet all the Offer Terms listed in Section 8 of Form 656, including filing all required tax returns and making all payments; 2. Any ref...

If Your Offer Is Rejected

1. You may appeal a rejection within 30 days using Request for Appeal of Offer in Compromise, Form 13711 (PDF). 2. The online self-help tool may pr...

The Process and Filing Requirements

When you submit your application for an OIC, you will also have to include a $150 filing fee and an initial payment on the settlement amount (unless you meet the Low Income Certification guidelines.) This payment is non-refundable, but the amount will vary based on the payment option that you select. There are two payment options to choose from:

Next Steps

Contact a qualified tax attorney to help you navigate your federal and/or state tax issues.

What is IRS offer in compromise?

An IRS Offer in Compromise is an IRS program that allows a taxpayer to make an offer for less than the total amount owed. If the IRS accepts the offer, you pay less than you owe, and the IRS wipes clean the rest of the taxes owed. After your payment, you are in good standing, and you don’t owe anything else. However, you will need to stay in tax compliance for five years going forward.

Do you have to meet certain requirements to qualify for an offer in compromise?

You must meet certain requirements to qualify for an Offer in Compromise. Additionally, there are three main situations where you might qualify.

Can IRS accept an offer?

To take advantage of this program, you have to submit an offer. The IRS will only accept an offer if they feel that your offer is equal to or greater than the amount they would ever collect from you, even if they used enforced collection actions (garnishment, or levies).

What is an offer in compromise?

The Offer in Compromise program is a powerful tax relief program designed by the IRS to reduce the tax liability of struggling business owners or individual taxpayers. It is also referred to as the federal tax settlement program. When used correctly, it can save you thousands of dollars because you pay less than the full amount due (your “offer amount”). Unfortunately, not everyone with tax debt qualifies for the program.

What is the average offer in compromise amount?

Essentially, the IRS reduces the tax debt owed by a taxpayer in exchange for a lump-sum payment. The average offer in compromise the IRS accepted in 2020 was $16,176.

What are the chances that the IRS will approve my request for an OIC?

In 2019, the IRS received 54,225 offers in compromise and accepted only 17,890 of them — that’s a success rate of roughly 33%.

How does the IRS calculate the minimum offer it will accept?

The IRS formula to calculate your OIC is a two-step process based on your monthly income and the value of your assets, so the IRS can estimate your “reasonable collection potential.” The OIC formula, which determines what you’re able to pay, looks like this:

What does an offer in compromise success story look like?

However, there are plenty of success stories out there for taxpayers looking to reduce their tax debt and participate in the offer in compromise program.

How much is the IRS offering in compromise 2020?

In 2020, the IRS approved 17,890 offers in compromise with a total value of $289.4 million ( source ). Divide $289.4 million by 17,890, and, presto, you get an average offer in compromise of $16,176. Of course, that number is meaningless. The real question is, “how much will the IRS settle for in my case?”.

What is an OIC payment?

Unfortunately, not everyone with tax debt qualifies for the program. In a nutshell, the OIC is a settlement or agreement between you and the IRS. The IRS is like any other creditor.

How long does it take to accept an offer in compromise?

The offer in compromise process can be lengthy. Keep close track of the dates — if the IRS doesn’t reject, return, or you withdraw your offer within two years of the date the IRS receives it, then the offer is deemed accepted.

How long do you have to pay taxes after accepting an offer?

Make sure you don’t owe taxes next year. If the IRS accepts your offer but you don’t file and pay all taxes on time for the five years after the acceptance, the IRS will notify you your offer is in default and may terminate the offer and you’ll owe your full debt (not the reduced amount of the offer).

What happens if IRS doesn't process offer?

If the offer meets one of the criteria, the IRS won’t process your offer and will return it to you. The IRS will send you a letter explaining why it could not process your offer and will return your application fee. Any payments you submitted with your offer will also be returned, except for criteria number seven. If your offer is not processed due to unfiled tax returns, any offer payments will be applied to the amount you owe.

What is the offer in compromise prequalifier tool?

You can complete the Offer in Compromise Pre-Qualifier Tool to find out if you may qualify for an offer in compromise.

Can you request a telephonic conference with an offer manager?

At any time, you may ask for a telephonic conference with the offer manager to discuss areas of disagreement. Additionally, certain disputes may qualify for Fast Track Mediation which allows for an expedited review of a specific area of disagreement. The mediation is not binding on either party, and certain cases and issues are not eligible. For more information, see Fast Track Mediation.

Do you have to pay taxes if you have an installment agreement?

No. If you have an installment agreement in place, you do not have to make payments while your offer is being processed. If your offer is not accepted and you have not incurred any additional tax debt, your installment agreement with the IRS will be reinstated with no additional fee.

Can you request an installment agreement with IRS?

If the IRS finds you can full pay the liability, you can request an installment agreement. The IRS reviews OICs for possible fraudulent intent. Submitting an OIC with false information, or making a false statement to an IRS employee, is considered fraud and may be subject to civil or criminal penalties.

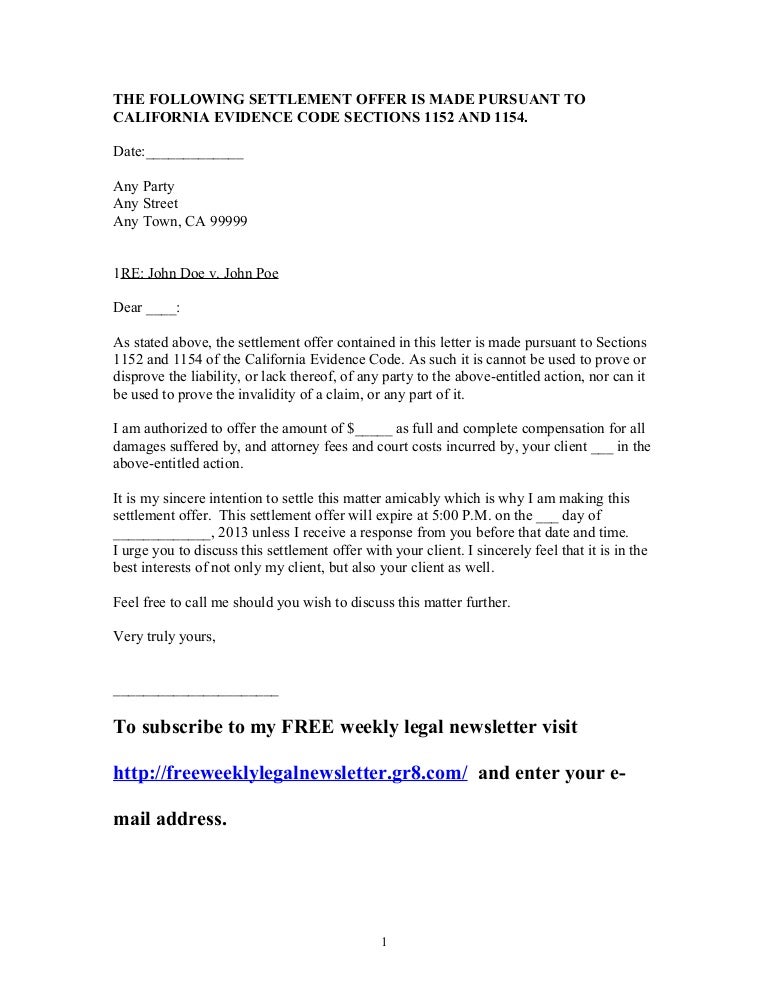

What is the purpose of the settlement rule?

The purpose of this rule is to encourage settlements which would be discouraged if such evidence were admissible. Under present law, in most jurisdictions, statements of fact made during settlement negotiations, however, are excepted from this ban and are admissible.

What is the only escape from admissibility of statements of fact made in a settlement negotiation?

The only escape from admissibility of statements of fact made in a settlement negotiation is if the declarant or his representative expressly states that the statement is hypothetical in nature or is made without prejudice. Rule 408 as submitted by the Court reversed the traditional rule.

Why was the House Bill drafted?

The House bill was drafted to meet the objection of executive agencies that under the rule as proposed by the Supreme Court, a party could present a fact during compromise negotiations and thereby prevent an opposing party from offering evidence of that fact at trial even though such evidence was obtained from independent sources. The Senate amendment expressly precludes this result.

When does the policy considerations underlie the rule not come into play?

The policy considerations which underlie the rule do not come into play when the effort is to induce a creditor to settle an admittedly due amount for a lessor sum. McCormick §251, p. 540. Hence the rule requires that the claim be disputed as to either validity or amount.

Is an offer to compromise a claim receivable?

As a matter of general agreement, evidence of an offer-to compromise a claim is not receivable in evidence as an admission of, as the case may be, the validity or invalidity of the claim. As with evidence of subsequent remedial measures, dealt with in Rule 407, exclusion may be based on two grounds. (1) The evidence is irrelevant, since the offer may be motivated by a desire for peace rather than from any concession of weakness of position. The validity of this position will vary as the amount of the offer varies in relation to the size of the claim and may also be influenced by other circumstances. (2) a more consistently impressive ground is promotion of the public policy favoring the compromise and settlement of disputes. McCormick §§76, 251. While the rule is ordinarily phrased in terms of offers of compromise, it is apparent that a similar attitude must be taken with respect to completed compromises when offered against a party thereto. This latter situation will not, of course, ordinarily occur except when a party to the present litigation has compromised with a third person.

Is a compromise statement considered a criminal case?

Statements made in compromise negotiations of a claim by a government agency may be excluded in criminal cases where the circumstances so warrant under Rule 403. For example, if an individual was unrepresented at the time the statement was made in a civil enforcement proceeding, its probative value in a subsequent criminal case may be minimal. But there is no absolute exclusion imposed by Rule 408.

Is an unaccepted offer of judgment admissible?

The same policy underlies the provision of Rule 68 of the Federal Rules of Civil Procedure that evidence of an unaccepted offer of judgment is not admissible except in a proceeding to determine costs.