A settlement statement consists of things such as: The price of the property in question The buyers mortgage loan size Any other deductions the buyer incurs during the mortgage transactions The United States uses a standard lending mortgage form known as the HUD-1 settlement statement.

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

What details are included in A HUD-1 Settlement Statement?

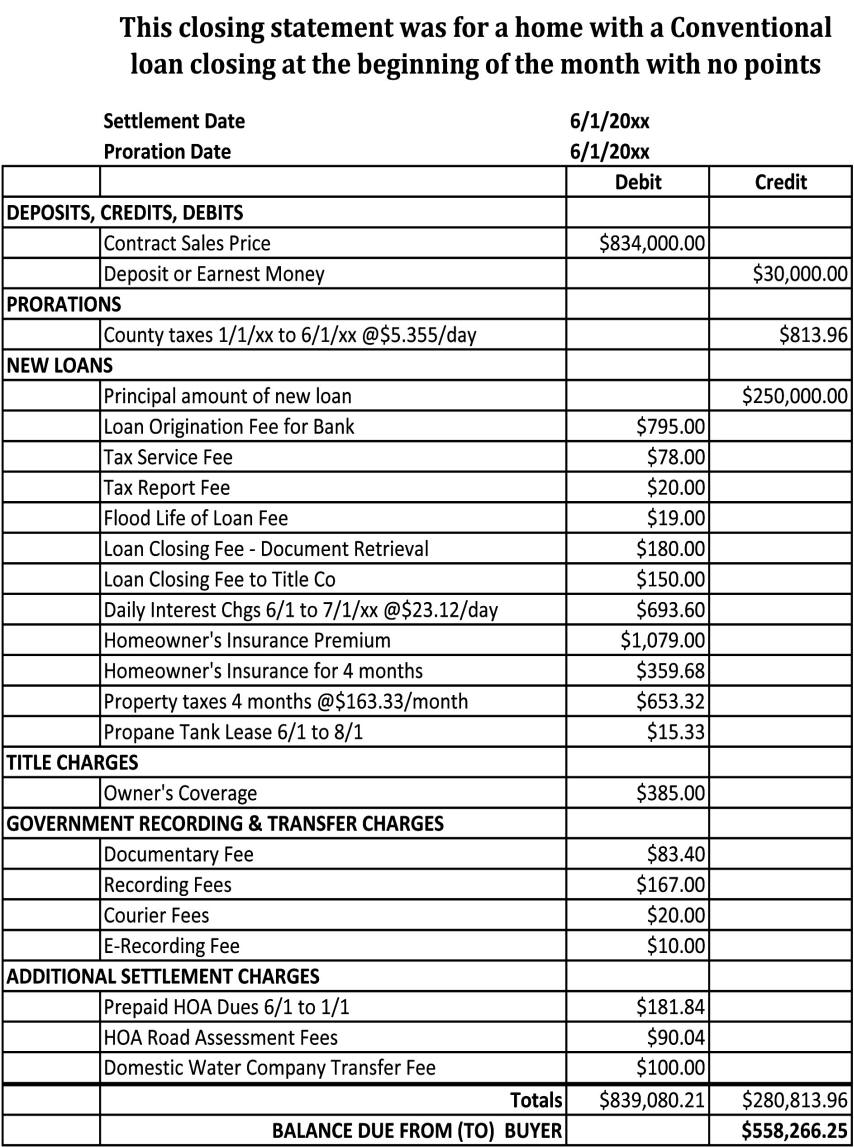

A HUD-1 settlement statement, also referred to simply as a settlement statement, details every charge associated with your new loan . It also outlines who is responsible for each of those charges - the buyer or the seller - as well as any credits you may receive for things like taxes, insurance or deposits.

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

What is the definition of settlement house?

settlement house- a center in an underprivileged area that provides community services center, centre- a building dedicated to a particular activity; "they were raising money to build a new center for research" Based on WordNet 3.0, Farlex clipart collection. © 2003-2012 Princeton University, Farlex Inc. Want to thank TFD for its existence?

.JPG?t=20170613T110026Z?w=166&h=113&iar=1)

What is the purpose of a settlement statement in real estate?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is the settlement statement the same as the closing?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is a closing statement in a settlement?

The closing statement, also called a closing disclosure or settlement statement, is essentially a comprehensive list of every expense that either the buyer and seller must pay to complete the purchase of a home (or whatever the property is).

How do you read a mortgage settlement statement?

0:217:31How To Read A Settlement Statement From Your Real Estate ClosingYouTubeStart of suggested clipEnd of suggested clipSo on page one of the closing disclosure you're going to see the parties identified at the top soMoreSo on page one of the closing disclosure you're going to see the parties identified at the top so seller and buyer the property. Address and the loan. Amount.

What happens at settlement for the seller?

At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged. Your conveyancer or solicitor can check and negotiate the settlement period with the seller.

What are settlement documents?

Definition. A settlement document records the vendor data that is created when settlement is performed for home delivery or agency services for each employee or service company. Each settlement document comprises a document header and at least one document item.

Who typically prepares the closing statement?

It is usually handed out at least three days before the closing, so that the seller and their agent can review it. The document is usually prepared by a lawyer, escrow firm, or a title company.

What is a closing statement example?

An example of a closing argument is the lawyer opening with a statement, "How can my client be in two places at once?". The lawyer could then incorporate the theme of an alibi, arguing that the defendant could not have possibly committed a crime because they weren't even in the country when the crime took place.

Is HUD settlement statement the same as closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

What would be a credit to the buyer on the settlement statement?

Credit to buyers. Amount of buyer's new loan shown as a credit to the buyer. Provides the new lender with a title insurance policy on the property; insures their Deed of Trust of being in 1st lien position. Reflects status of the property taxes.

Where does the purchase price appear on a settlement statement?

Where does the purchase price appear on the settlement statement? debit for the buyer credit for the seller. Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges.

What is a closing statement called?

Virtually any other type of loan comes with its own closing statement. This document may also be called a settlement sheet or credit agreement.

Is HUD settlement statement the same as closing disclosure?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

Where do I find closing statements?

If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase. Other parties that may have copies of the settlement documents include your real estate agent, or the financial institution that holds the loan for the property.

Is a closing disclosure the same as clear to close?

A Closing Disclosure is not technically the same as being declared clear to close, but the disclosure typically comes after you have been cleared. After reviewing your Closing Disclosure, you can look forward to a final walkthrough of the home and closing day itself.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

How many pages are required for HUD-1?

The HUD-1 is a three-page form generally required to be provided to a borrower one day before closing. The mortgage closing disclosure is a five-page form generally required to be provided to a borrower three days before closing.

What is included in HUD-1?

These forms also include comprehensive information about the borrower’s loan, detailing the principal and interest as well as all of the upfront costs, commission charges, service costs, and any deductions associated with the loan. Loan terms are also included, such as details on principal, interest, variable rates, prepayment penalties, and any special clauses associated with a loan such as escrow requirements.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

What is settlement statement?

A settlement statement is the statement that summarizes all the fees and charges that both the home-buyer and seller face during the settlement process of a housing transaction. The table below gives further explanation as to what these fees and charges are for both buyer and seller.

When are sellers charged for taxes?

Seller is charged their portion of the current year taxes from January 1st to the closing date. Based on either prior year taxes or most recent mill levy and assessed value. This determines pursuant to the contact.

What is a mortgage payoff?

Mortgage Payoff. The payoff amount is sent to the existing mortgage company and includes additional interest a few days beyond closing. Title Insurance (Owner’s Policy) Typically paid for by the seller, however the contract gives the option for either buyer or seller to pay.

What is a HUD-1 settlement statement?

This five-page document combines the previous HUD-1 Settlement Statement, the Truth in Lending Act disclosures and the Good Faith Estimate. On its own, however, a settlement statement can be defined as a document which fully summarizes all fees that both a borrower and lender will be required to pay during the settlement of a loan.

What is included in closing disclosure?

The first is for your loan calculations, which include the total number of payments you'll make over the life of the loan, your finance charges and your APR. Section two lists other disclosures, such as your appraisal and contract details. The third section contains contact details for the lender, the buyer's real estate agent, the seller's agent and the settlement agent. The final section is where you sign and date that you have received and reviewed the document.

What is page 2 of closing costs?

Page 2 is dedicated to all the details associated with your closing costs. It is here that you'll want to examine origination charges, like application and underwriting fees, and service fees, such as appraisals and credit reports. There's also a section for other costs that include things like taxes and government fees, initial escrow payments due at closing and real estate commissions.

What is page 4 on a loan?

Page 4 is exclusively for loan disclosures. It is here that you will learn how much a late payment will cost you, if the lender will accept a partial payment and whether or not you will have an escrow account. Should the lender not require an escrow account, page 4 will reveal if you are being charged an escrow waiver fee.

When is a closing disclosure required?

All lenders are required to provide a Closing Disclosure at least three business days prior to any settlements or refinance closing dates. This time gives you a chance to review the terms of the document and ensure they are close to or match the estimates that were given by the lender at the beginning of the process.

What is HUD-1 Settlement Statement?

Janet Wickell. Updated January 29, 2020. The HUD-1 Settlement Statement is a standard government real estate form that was once used by settlement agents, also called closing agents, to itemize all charges imposed upon a borrower and seller for a real estate transaction.

Who studied the statement of sale?

Most buyers and sellers studied the statement on their own, with the assistance of their real estate agent and the settlement agent. The idea was that the more people who reviewed it, the more likely it became that errors would be detected.

When Is the HUD-1 Distributed?

Before October 3, 2015, RESPA stated that borrowers should be given a copy of the HUD-1 at least one day prior to settlement. 5 However, entries could easily still be coming in, right up until a few hours before closing.

What is HUD-1 form?

The statutes of the Real Estate Settlement Procedures Act (RESPA) required that the HUD-1 form be used as the standard real estate settlement form in all transactions in the United States that involved federally related mortgage loans. 2.

When did the closing disclosure change?

Borrowers began receiving a form called the Closing Disclosure instead of a HUD-1 for most kinds of mortgage loans after October 2015. The change was in response to the TILA RESPA Integrated Disclosures, or simply TRID, which overhauled the way mortgages are processed and disclosed. 3.

What is the 701 and 702 section?

This section deals with the commissions paid to real estate agencies. Lines 701 and 702 show how the commissions are split between two participating agencies. 6

What is tabulated before being brought forward to page 1 in Section L or page 2?

Many entries are tabulated before being brought forward to page 1 in Section L or page 2. Columns contain charges that are paid from either the borrower's or the seller's funds. Your closing statement probably won't have entries in all these lines.

Who provides settlement services?

The decision about who provides settlement (also known as closing or escrow) services varies from one market to another. In many places, the buyer chooses the settlement company, but in others the seller chooses. When closing on a house, the buyer will provide funds to buy your home and the settlement agent will review the sales agreement to determine what payments you’ll receive. The title to the property is transferred to the buyers and arrangements are made to record that title transfer with the appropriate local records office.

What do you need to do before closing on a house?

Before closing on a house, you need to get to the settlement table. You’re near the end of the process of selling your home, but don’t breathe a sigh of relief just yet. While it’s certainly true that you can lighten up on the perfectionism required to show your home at any moment, as a seller you still need to cooperate with your buyer, ...

What are adjustments at closing?

At a typical closing, adjustments are made to the final amounts owed by the buyer and you as the seller. For example, if you’ve been paying your property taxes through an escrow account, you may be credited extra for prepaid taxes or you may receive less money at settlement if the property taxes haven’t been paid properly.

How long can you rent back a house?

Generally, you’re restricted to a maximum rent-back of 60 days because lenders would require ...

Can you move onto your next home after a settlement?

Once the settlement papers are signed and the house keys are transferred, you’re free to move onto your next home.

Can you negotiate a settlement date with a buyer?

Buyers and sellers typically negotiate a settlement date that is mutually agreeable. If you have sold your home and are not yet ready to move into your next residence, you can sometimes negotiate a “rent-back” with the buyer that allows you to stay in the home after the settlement by paying rent to the buyer.