The payment settlement is the process through which the merchant finally gets paid for the goods and services sold online. It is one of the critical stages in a payment gateway system. How the Payment Settlement Process Works:

Full Answer

What is a good settlement amount?

What is a good settlement amount? Very roughly, if you think that you have a 50% chance of winning at trial, and that a jury is likely to award you something in the vicinity of $100,000, you might want to try to settle the case for about $50,000.

How to cash out structured settlement payments?

- Withdraw any payment or amount of money earlier than the pre-set date

- Change the amount of the periodic payments (how much to get in a payment)

- Change the future payment structure (when to get the payments)

How to sell structured settlement payments?

Your Quick Guide to Selling Structured Settlement Payments

- Decide How Much You Want to Sell. When selling structured settlement payments, you have the option of selling the entire annuity or part of it.

- Ask for Quotes. Next, you’ll need to consult with a company to get a quote. ...

- Sign the Contract. ...

- Get a Judge’s Approval. ...

- Get Cash Now by Selling Structured Settlements. ...

What is average settlement period?

The Average Settlement Period for Trade payables depicts with an average of 250 days an even higher period for goods to be paid by the business to suppliers. Considerable reasons for this result might be a special trade payment agreement with some suppliers.

What do you mean by payment settlement?

What is “Settlement” in the Payment Processing World? Simply put, payment gateway settlement is when the bank transfers funds immediately with no waiting. It is the process where the money is transferred or routed from the customer's bank to the merchant's bank.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

What is the meaning of settlement in banking?

Settlement can be defined as the process of transferring of funds through a central agency, from payer to payee, through participation of their respective banks or custodians of funds.

What is payment settlement and clearing?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

What are the types of settlements?

The four main types of settlements are urban, rural, compact, and dispersed.

Who is part of payment and settlement?

The Reserve Bank of India (India's Central Bank) maintains this payment network. Real-time gross settlement is a funds transfer mechanism where transfer of money takes place from one bank to another on a 'real time' and on 'gross' basis. This is the fastest possible money transfer system through the banking channel.

What is the settlement process?

What is settlement? Property settlement is a legal process that is facilitated by your legal and financial representatives and those of the seller. It's when ownership passes from the seller to you, and you pay the balance of the sale price. The seller sets the settlement date in the contract of sale.

How do I make a settlement payment?

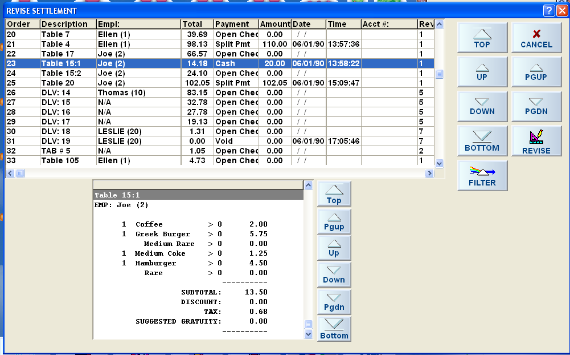

Payment settlement involves collecting the funds for the amount recorded for an order. For example, when using credit cards, the settlement process specifically involves contacting the payment system and collecting the required amount of funds against the credit card.

What happens during settlement?

Settlement, or completion, is the final process in the sale of a property that takes place after the seller and buyer exchange contracts of sale. It all culminates on settlement day when the title is transferred to the buyer and they take physical and legal ownership of the property.

What happens first clearing or settlement?

Clearing Banks Every clearing member has to open a clearing account with one of these banks. If the clearing member is settling a purchase transaction, then it needs to ensure that the funds are made available in this account before the settlement.

How do bank settlements work?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is settlement risk in payment system?

Foreign exchange (FX) settlement risk is the risk of loss when a bank in a foreign exchange transaction pays the currency it sold but does not receive the currency it bought.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

What do you mean by payment?

Payment is the transfer of money, goods, or services in exchange for goods and services in acceptable proportions that have been previously agreed upon by all parties involved. A payment can be made in the form of services exchanged, cash, check, wire transfer, credit card, debit card, or cryptocurrencies.

What is settlement in Bharatpe?

A. In Bharat QR, there is no settlement process. Settlement time will be midnight to midnight. Merchant will get the credit on T+1 basis except bank holidays.

What is the difference between settlement and reconciliation?

A settlement is a time between customers making payment and merchant account receiving the fund. In contrast, payment reconciliation is a term used for reviewing all business transactions, including income and expenses.

What is the payment system in India?

According to definition of PSS Act 2007, Payment System means a system that enables payment to be effected between a payer and a beneficiary, involving clearing, payment or settlement service or all of them.

Is a payment system applicable to stock exchanges?

However, as per Section 34 of the PSS act, the above definition of payment system is not applicable to stock exchanges or clearing corporations set up under stock exchange. The “Settlement” means according to the above acts ‘the settlement of payment instructions received and these include settlement of securities, ...

Examples of Settlement Payment in a sentence

At the request of Defendants’ counsel, the Settlement Administration Account Agent or its designee shall apply for any tax refund owed on the Settlement Payment and return the proceeds, after deduction of any expenses incurred in connection with such application (s) for refund, in accordance with the written direction of Defendants’ counsel.

More Definitions of Settlement Payment

Settlement Payment means an Up Settlement Payment or a Down Settlement Payment, as applicable.

What is a payment settlement entity?

payment settlement entity as used in this document means the banks and other organizations with contractual obligations to make payment to participating payees ( merchants) in settlement of payment cards, or third- party settlement organizations.

What is cash settlement?

Cash Settlement means immediately available funds in U.S. dollars in an amount equal to the Redeemed Units Equivalent.

What is daily settlement price?

Daily Settlement Price means the settlement price for a Swap calculated each Business Day by or on behalf of BSEF. The Daily Settlement Price can be expressed in currency, spread, yield or any other appropriate measure commonly used in swap markets.

What is a qualified settlement fund?

Qualified Settlement Fund or “Settlement Fund” means the interest-bearing, settlement fund account to be established and maintained by the Escrow Agent in accordance with Article 5 herein and referred to as the Qualified Settlement Fund (within the meaning of Treas. Reg. § 1.468B-1).

What is default settlement method?

Default Settlement Method means Combination Settlement with a Specified Dollar Amount of $1,000 per $1,000 principal amount of Notes; provided, however, that the Company may, from time to time, change the Default Settlement Method by sending notice of the new Default Settlement Method to the Holders, the Trustee and the Conversion Agent.

What is net settlement amount?

Net Settlement Amount means the Gross Settlement Amount minus: (a) all Attorneys’ Fees and Costs paid to Class Counsel; (b) all Class Representatives’ Compensation as authorized by the Court; (c) all Administrative Expenses; and

What is the settlement date of a note?

Settlement Date means, with respect to the Called Principal of any Note, the date on which such Called Principal is to be prepaid pursuant to Section 8.2 or has become or is declared to be immediately due and payable pursuant to Section 12.1, as the context requires.

Why TIPS?

As a response to the growing consumer demand for instant payments, a number of national solutions have been developed, or are under development, across the EU. A challenge for the Eurosystem is to ensure that these national solutions do not (re)introduce fragmentation into the European retail payments market.

How does it work?

TIPS offers final and irrevocable settlement of instant payments in euro, at any time of day and on any day of the year. Participating payment service providers can set aside part of their liquidity on a dedicated account opened with their respective central bank, from which instant payments can be settled.

Participation

TIPS adheres to the same participation rules as are valid for TARGET2.

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.