What does Pos mean on a statement?

What do bank statement abbreviations mean?

- BMACH - ATM. BMACH is a brand of an ATM.

- TFR - Transfer

- FPI – Faster Payment Inwards. An FPI payment is made using the ‘Faster Payment’ electronic system. ...

- POS – Point of Sale. ...

- FPO – Faster Payment Outwards. ...

- S/line – Statement Line. ...

- INT’L – International. ...

- BP – Bill Payment. ...

- BGC – Bank Giro Credit. ...

- CHG – Charge. ...

Is settlement statement same as Closing Disclosure?

You may also see the settlement statement come into play in along with the “Closing Disclosure” form. This is among the fairly common closing documents for seller. If you find at a later time you need a copy of your closing statement, contact the settlement agent for the home purchase.

What does "POC" mean?

What Else Can POC Stand For?

- Potential Officers Course (UK)

- Progressive Offset Control (Celeris)

- Psychiatric Outpatient Clinic

- Project Officer Coordinator (FEMA)

- Product of Conception (genetics testing)

- Preliminary Operational Capability

- Point of Correction

- Point of Care

- Proceeds of Crime (Canadian legal term)

- Proyectos de Obra Civil (Spanish)

What is a HUD-1 Settlement Statement?

The HUD-1 Settlement Statement is a standardized mortgage lending form in use in the United States of America on which creditors or their closing agents itemize all charges imposed on buyers and sellers in consumer credit mortgage transactions.

Why is POC not included in settlement statement?

Why are POC fees listed on the mortgage settlement statement?

What is POC in mortgage?

What does POC mean on a closing statement?

Charges paid outside of settlement by the borrower, seller, loan originator, real estate agent, or any other person, must be included on the HUD-1 but marked “P.O.C.” for “Paid Outside of Closing” (settlement) and must not be included in computing totals.

What is a POC item?

A proof of concept (POC) is a demonstration of a product, service or solution in a sales context. A POC should demonstrate that the product or concept will fulfill customer requirements while also providing a compelling business case for adoption.

Where may Items listed as POC paid outside closing appear on the HUD-1?

Charges that are paid outside of closing by any party must be included on the HUD, but they must be marked “P.O.C” and should not be included in the totals. P.O.C. items should be disclosed outside of the columns.

What is total reduction amount due seller?

Section 500, Reductions in Amount Due to Seller Line 501 is used when the seller's real estate broker or another party holds the borrower's earnest money deposit and will pay it directly to the seller.

What is the purpose of POC?

A Proof of Concept (POC) is a small exercise to test the design idea or assumption. The main purpose of developing a POC is to demonstrate the functionality and to verify a certain concept or theory that can be achieved in development.

Why is POC needed?

The proof of concept is so valuable because it's a pilot project to evaluate the feasibility of your plan before work begins, similar to a prototype or lean manufacturing “minimum viable product”. A POC verifies that concepts and theories applied to a project will result in a successful final product.

Is a settlement statement the same as a closing disclosure?

When you are in the process of closing, you will receive a settlement statement. They arrive three days before closing from your lender. This document is commonly known as the “closing disclosure.” Essentially, this is for buyers to review in advance before closing.

Is a settlement statement the same as a closing statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Which of the following fees Cannot increase at settlement?

Charges That Cannot Increase: The origination charge, credit charge, adjusted origination charges, and transfer taxes have a zero tolerance.

How do you show principal reduction on a closing disclosure?

The disclosure must contain the following elements: The amount of the principal reduction; • The phrase “Principal Reduction”; • The name of the payee (i.e., the person receiving the reduction); • The phrase “Paid Outside of Closing” or “P.O.C.”; and • The name of the party making the payment.

Does seller credit reduce basis?

As a Seller of a home, if you gave a credit to the buyer during the closing of a house, are you able to claim that on your taxes to reduce your adjusted cost basis? Yes, closing costs paid on your own behalf or for the buyer are costs of the sale.

What is principal reduction to client POC lender?

What Is a Principal Reduction? A principal reduction is a decrease in the amount owed on a loan, typically a mortgage. A lender may grant a principal reduction to provide financial relief for a borrower as an alternative to foreclosure on the property.

What does POC brand stand for?

VeloNews does not have any independent data on the helmet, though POC — it stands for piece of cake — is known for merging of safety and modern aesthetics. Its mountain bike and ski products are bright and burly, and the company's helmet does appear a bit bigger than its soon-to-be competitors.

What is POC in a project?

A proof of concept (POC) is an exercise in which work is focused on determining whether an idea can be turned into a reality. A proof of concept is meant to determine the feasibility of the idea or to verify that the idea will function as envisioned.

What is a POC in technology?

A proof of concept (POC) is how startups demonstrate to a corporation that their technology is financially viable. The startup essentially creates a prototype in a sandbox-environment to prove their technology is capable of handling real-world applications.

What does a proof of concept look like?

A POC typically involves a small-scale visualization exercise to verify the potential real-life application of an idea. It's not yet about delivering that concept, but showing its feasibility.

Why is POC not included in settlement statement?

If a fee is marked as POC, it is not included in the bottom line on the settlement statement because someone has already paid it (in the case of a paid appraisal) or the borrower does not owe it (in the case of a yield spread premium).

Why are POC fees listed on the mortgage settlement statement?

POC fees are listed on the Settlement Statement because the Real Estate Settlement Procedures Act (RESPA) states that all fees associated with a federally regulated mortgage must be shown on the Settlement Statement, regardless of whether they have already been paid or not.

What is POC in mortgage?

Paid Outside of Closing. POC stands for Paid Outside of Closing, and refers to any fee that is not being disbursed at the closing. The two most common POC charges are the appraisal fee (if it has been paid by the borrower before the closing) and the yield spread premium (the rebate that the lender pays the mortgage broker).

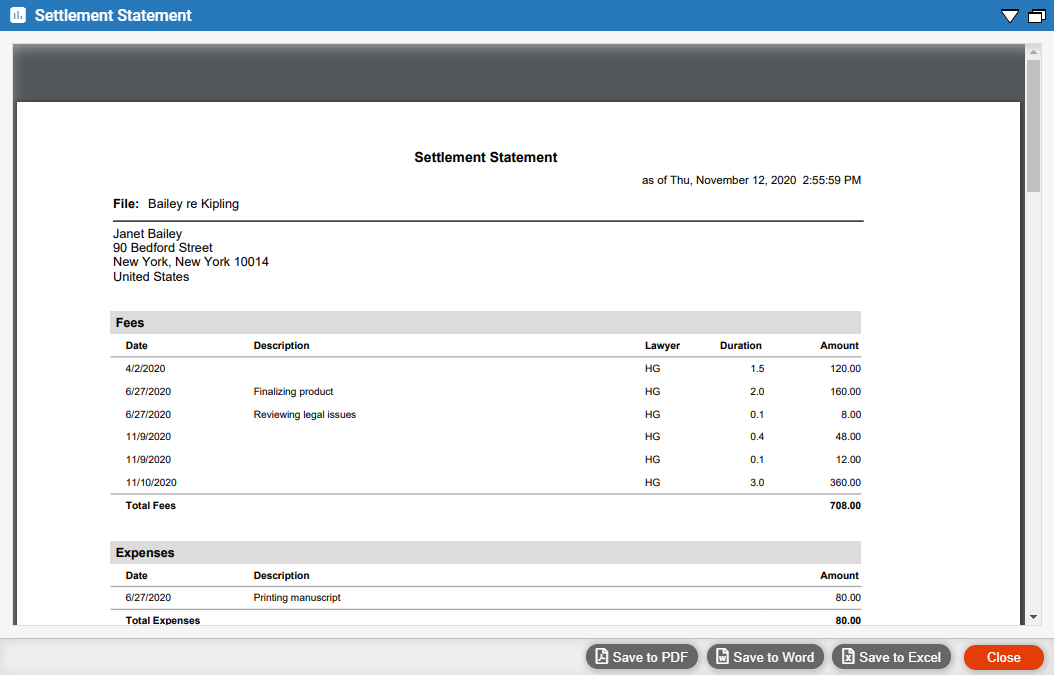

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Who is responsible for preparing the settlement statement?

Whoever is facilitating the closing — whether it be a title company, escrow firm, or real estate attorney — will be responsible for preparing the settlement statement.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

When are property taxes prorated?

For instance, say you get billed for property taxes in February to cover the previous year. If you’re closing on a sale on April 30, the yearly property tax is “prorated” or calculated for the first four months of the year, and it’s reflected in this section.

What is a settlement statement?

A settlement statement is a document summarizing all costs owed by or credits due to the homebuyer and seller (or borrower if refinancing). The document also includes the purchase price of the property, loan amount and other details.

How does a settlement statement work?

Every real estate transaction requires a settlement statement of some kind. It is used in home purchases and refinances, as well as all-cash transactions, reverse mortgages and commercial and investment property sales.

What can I expect to see on my settlement statement?

Several items are listed and organized within a settlement statement, including:

Next steps

Upon receipt of a closing disclosure or HUD-1 settlement statement, “it’s safe to say that you are at the tail end of the process,” Moreira says. It’s crucial to review this document carefully to ensure all costs are accurate.

What are POC fees?

Other than appraisal and inspection fees, POC costs could include fees for credit reports, mortgage insurance applications, the lender’s title policy, loan origination, loan commitment, title transfers, and anything paid by the lender to the mortgage broker. However, some of these fees could instead be included in your loan’s interest rate ...

What fees are considered paid outside of closing?

Other than appraisal and inspection fees , POC costs could include fees for credit reports, mortgage insurance applications, the lender’s title policy, loan origination, loan commitment, title transfers, and anything paid by the lender to the mortgage broker. However, some of these fees could instead be included in your loan’s interest rate or another settlement charge.

Do you have to include POC fees on closing statement?

Even though your POC fees will have already been taken care of by the time you close on a home , it’s still helpful to have them listed on your closing statement as an overview of all your expenses.

Do you pay fees after closing?

But some fees, like what you pay to the mortgage broker or settlement service provider, can be paid after closing. Fees like this are often included in the interest rate or as a separate settlement charge and are not added into the “Total Settlement Charges” on your HUD-1.

When are settlement statements created?

Beyond just loans, settlement statements can also be created whenever a large settlement has taken place, such as with a large business transaction or potentially in the legal, insurance, banking, and trading industries.

What Is a Settlement Statement?

A settlement statement is a document that summarizes the terms and conditions of a settlement, most commonly a loan agreement. A loan settlement statement provides full disclosure of a loan’s terms, but most importantly it details all of the fees and charges that a borrower must pay extraneously from a loan’s interest. Different types of loans can have varying requirements for settlement statement documentation. Generally, loan settlement statements can also be referred to as closing statements .

What is a RESPA?

The Real Estate Settlement Procedures Act (RESPA) govern s the formulation of both closing disclosures and HUD-1 statements for the mortgage lending market. RESPA has been revised and updated throughout history to help manage mortgage lending disclosures and protect borrowers. RESPA requires a HUD-1 settlement statement for borrowers involved in a reverse mortgage. For all other types of mortgage loans, RESPA requires the mortgage closing disclosure.

What is debt settlement?

Debt settlement: A debt settlement statement can provide a summary of debts written off, reduced, or otherwise amended after a debt settlement has completed. Lawyers and debt settlement companies work on behalf of borrowers with overwhelming amounts of debt, in order to help them reduce some or all of their obligations.

What is a settlement statement in stock trading?

Trading: In financial market trading, settlement statements provide proof of a security’s ownership transfer. Typically, stocks are transferred with a T+2 settlement date meaning ownership is achieved two days after the transaction is made.

What is insurance settlement?

Insurance settlement: An insurance settlement is most commonly documentation of the amount an insurer agrees to pay after reviewing an insurance claim. Banking: In the banking industry, settlement statements are produced on a regular basis for internal banking operations.

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

What is a Settlement Statement?

The settlement statement, also known as the closing statement, is a legal document that outlines what a buyer needs to pay to the seller or vendor on settlement. The statement also has a good faith estimate. The settlement statement lists all charges and credits to both the buyer and the seller in a property or real estate settlement.

Meet some of our Real Estate Lawyers

Possesses extensive experience in the areas of civil and transactional law, as well as commercial litigation and have been in practice since 1998. I addition I have done numerous blue sky and SEC exempt stock sales, mergers, conversions from corporations to limited liability company, and asset purchases.

How many sections are there in an ALTA settlement statement?

There are a total of 11 sections in the ALTA settlement statement. Each of them highlights a particular type of cost associated with closing. Note that the debit and credit sections are listed against the seller and buyer on their respective sides from the second section which is where the costs are highlighted. Let’s go through all the sections.

Who pays for personal property?

Personal Property. These costs are paid by the buyer provided they want to purchase appliances or any furnishings along with the property. The amount is credited to the seller’s account and debited from the buyer’s.

What are points in a mortgage?

Points. Mortgage points are given to the lender for which they reduce the interest rate for the buyers. This amount is paid upfront during closing.

What is the ALTA statement sheet?

One of the important documents in this pile is the ALTA statement sheet. The ALTA statement gives an itemized list of prices for the closing process. While the HUD-1 settlement statement used to serve this purpose before, it is now outdated.

What is an impound?

Impounds are nothing but a consolidated bundle of charges incurred to process the mortgage.

Where are miscellaneous costs debited?

Miscellaneous costs are debited from the buyer’s account most of the time. However, a lot of time the sellers may agree to pay apart as well, and the costs are debited from the seller’s side. Here is the list of all miscellaneous costs. Pest Inspection Fee.

What is flood determination fee?

Flood Determination Fee to. It is paid to get government approval on the property and that it is not located in an area prone to flooding.

Why is POC not included in settlement statement?

If a fee is marked as POC, it is not included in the bottom line on the settlement statement because someone has already paid it (in the case of a paid appraisal) or the borrower does not owe it (in the case of a yield spread premium).

Why are POC fees listed on the mortgage settlement statement?

POC fees are listed on the Settlement Statement because the Real Estate Settlement Procedures Act (RESPA) states that all fees associated with a federally regulated mortgage must be shown on the Settlement Statement, regardless of whether they have already been paid or not.

What is POC in mortgage?

Here's the answer: POC stands for Paid Outside of Closing , and refers to any fee that is not being disbursed at the closing. The two most common POC charges are the appraisal fee (if it has been paid by the borrower before the closing) and the yield spread premium (the rebate that the lender pays the mortgage broker).