The Securities Settlement Account is a separate, dedicated cash account used to cater to all of your Online Trading needs. Its intention is to separate monies required for trading and monies resulting from your Online Trading activities from your day to day cash requirements (such as credit card payments, utilities payments, etc).

Full Answer

What is a good settlement amount?

What is a good settlement amount? Very roughly, if you think that you have a 50% chance of winning at trial, and that a jury is likely to award you something in the vicinity of $100,000, you might want to try to settle the case for about $50,000.

What exactly is a cash settlement?

What is a Cash Settlement? A cash settlement is a settlement method used in certain futures and options contracts where, upon expiration or exercise, the seller of the financial instrument does not deliver the actual (physical) underlying asset but instead transfers the associated cash position.

What is quarterly settlement of account?

What is Quarterly Settlement/Running Account Settlement? SEBI mandates stockbrokers to settle (transfer available credit balance from Trading account to Bank account) the client’s funds lying in the trading accounts at least once in a quarter (90 days) or 30 days. This process of transferring unused funds back is called ‘Running Account ...

What are exchange settlement accounts?

Exchange Settlement Accounts (ESAs) are the means by which providers of payments services settle obligations that have accrued in the clearing process. This document outlines the Reserve Bank's policy on ESA eligibility; and provides additional information on management of an ESA and the application process. 1.

What Is an Account Settlement?

When does account settlement take place?

What is the account receivable department?

What is offset in insurance?

See 1 more

About this website

What is securities settlement system?

Securities settlement systems are entities that provide securities settlement services. Usually, all shares in a given security are safe-kept for their entire lifetime in a single place, the primary depository for the issue.

What is settlement of securities transactions?

In the context of securities, settlement involves their delivery to the beneficiary, usually against (in simultaneous exchange for) payment of money, to fulfill contractual obligations, such as those arising under securities trades. Nowadays, settlement typically takes place in a central securities depository.

What does settlement mean in stocks?

Purchasing a security involves a trade date, which signifies the day an investor places the buy order, and a settlement date, which marks the date and time the legal transfer of shares is actually executed between the buyer and the seller.

What is securities clearing and settlement?

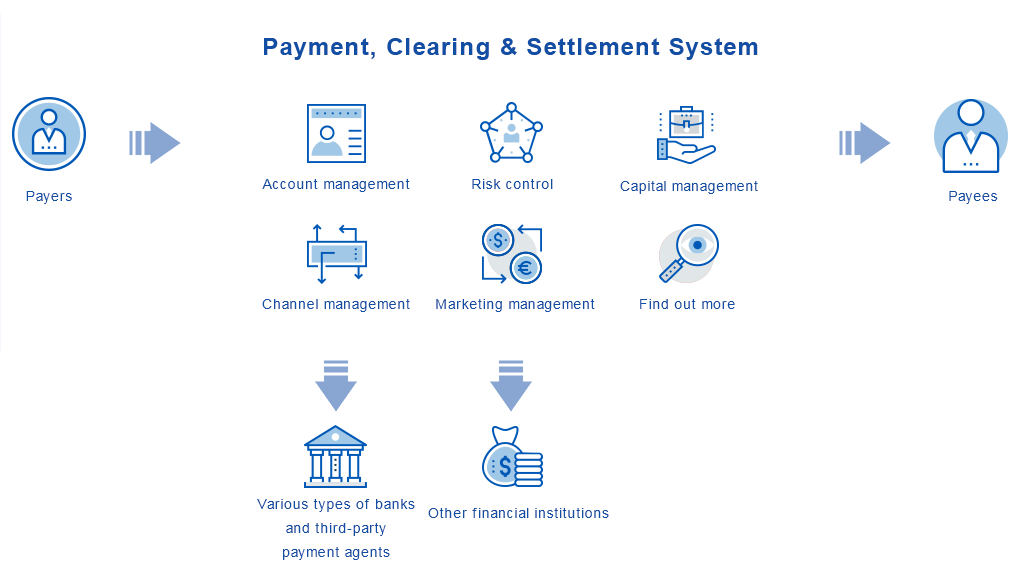

Settlement is the actual exchange of money, or some other value, for the securities. Clearing is the process of updating the accounts of the trading parties and arranging for the transfer of money and securities.

How long does it take for securities to settle?

two business daysFor most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday. For some products, such as mutual funds, settlement occurs on a different timeline.

What are the types of settlement?

The four main types of settlements are urban, rural, compact, and dispersed. Urban settlements are densely populated and are mostly non-agricultural. They are known as cities or metropolises and are the most populated type of settlement. These settlements take up the most land, resources, and services.

Can I sell a stock on settlement day?

Can you sell a stock before the settlement date? The key is knowing if you bought the stock using settled or unsettled cash. If you bought the stock (or other type of security) using settled cash, you can sell it at any time.

Can I sell shares on settlement date?

The Indian capital markets follow a T+2 settlement cycle. This means that if you buy a stock on Monday, it gets delivered to your demat account on Wednesday. However, you can sell your stock even before you receive it in your demat account.

How long after stock settlement date do I get paid?

There is a settlement period of up to two days for most stocks, mutual funds, and ETFs; bonds typically have a slightly longer settlement period.

What comes first settlement or clearing?

Clearing and settlement directly follows a trade. Clearing is what comes immediately after the trade, where all the terms of the deal are double-checked. Settlement is the final stage, in which the transfer of securities and money takes place.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What is the settlement process?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

What does settlement mean in banking?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What are the basic types of securities transactions?

The four types of security are debt, equity, derivative, and hybrid securities. Holders of equity securities (e.g., shares) can benefit from capital gains by selling stocks.

What is settlement in payment gateway?

What is “Settlement” in the Payment Processing World? Simply put, payment gateway settlement is when the bank transfers funds immediately with no waiting. It is the process where the money is transferred or routed from the customer's bank to the merchant's bank.

How to Remove Settled Accounts From A Credit Report?

Here’s how to remove settled accounts from a credit report. Learn the secret hacks used to remove settled accounts or speak to a debt relief expert today!

Settlement of Accounts Sample Clauses: 285 Samples | Law Insider

Settlement of Accounts. Upon resignation or removal of the Trustee and appointment of a successor Trustee, all assets shall subsequently be transferred to the successor Trustee. The transfer shall be ...

Settlement of Accounts: Meaning, Definition, Examples - BYJUS

Meaning of Settlement Account: Settlement account is an account that is used in Balance of Payment (BOP) accounting to keep track of central banks’ reserve asset dealings with one other. The official settlement A/c keeps track of transactions that involve foreign exchange reserves, bank deposits, special drawing rights (SDRs) and gold.

Settlement Account Definition: 867 Samples | Law Insider

Examples of Settlement Account in a sentence. When any payment to be made for any Transaction is in the currency ("Transaction Currency") other than the currency of the Settlement Account for that Transaction ("Account Currency"), the Bank shall be entitled to convert the sum in the Account Currency in that Settlement Account into the Transaction Currency at such exchange rate(s) as absolutely ...

What is a SCB securities settlement account and how does it work?

To trade online with SCB you need a securities settlement account to keep your day to day funds separate from the funds you intend to invest and trade with². This means that the settlement account is effectively a prepaid account you can top up in advance, and then use to trade with later.

Do I need a USD settlement account to invest shares in USD with SCB?

You need an SCB securities settlement account for each online trading account, and each currency you trade in. That means that if you want to trade in USD, you’ll need an SCB USD securities settlement account to get started.

Wise is the smart, new way to send money abroad

Planning on opening a OCBC multi-currency account in Singapore? Here’s an overview on ✓fees ✓rates ✓features and more. Read on »»»

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What is the account receivable department?

The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services. The ages of the receivables are broken down into intervals such as 1–30 days, 31–60 days, etc. Individual accounts will have amounts and days outstanding on record, and when the invoices are paid, the accounts are settled in the company's books.

What is offset in insurance?

Amounts receivable and payable to reinsurers are offset for account settlement purposes for contracts where the right of offset exists, with net insurance receivables included in other assets and net insurance payables included in other liabilities. 1.

What is Settlement Date Accounting?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

When is a settlement date recorded?

Under settlement date accounting, a transaction is recorded in the general ledger when it is "fulfilled" or "settled."

Does pending transactions go through the general ledger?

Under this method, any pending transactions that have not been finalized by the balance sheet date will not be recorded in the company's general ledger. Any transaction not recorded in the general ledger will also not flow through to the company's financial statements for that period. This causes issues when a large financial transaction occurs ...

Can you see the impact of planned transactions that have not yet been finalized?

However, it does not allow financial statement users to see the impact of planned transactions that have not yet been finalized.

Is settlement date accounting conservative?

It is a conservative accounting method, which means that it errs on the side of caution when recording journal entries in the general ledger.

What is settlement of securities?

Settlement of securities is a business process whereby securities or interests in securities are delivered, usually against ( in simultaneous exchange for) payment of money, to fulfill contractual obligations , such as those arising under securities trades.

How does electronic settlement work?

If a non-participant wishes to settle its interests, it must do so through a participant acting as a custodian. The interests of participants are recorded by credit entries in securities accounts maintained in their names by the operator of the system . It permits both quick and efficient settlement by removing the need for paperwork, and the simultaneous delivery of securities with the payment of a corresponding cash sum (called delivery versus payment, or DVP) in the agreed upon currency.

What is the largest immobilizer of securities?

The Depository Trust Company in New York is the largest immobilizer of securities in the world. Euroclear and Clearstream Banking, Luxembourg are two important examples of international immobilisation systems. Both originally settled eurobonds, but now a wide range of international securities are settled through them including many types of sovereign debt and equity securities.

What is immobilization of securities?

Securities (either constituted by paper instruments or represented by paper certificates) are immobilised in the sense that they are held by the depository at all times. In the historic transition from paper-based to electronic practice, immoblisation often serves as a transitional phase prior to dematerialisation.

What are the two goals of electronic settlement?

Immobilisation and dematerialisation are the two broad goals of electronic settlement. Both were identified by the influential report by the Group of Thirty in 1989.

How long does it take to settle a stock?

In the United States, the settlement date for marketable stocks is usually 2 business days or T+2 after the trade is executed, and for listed options and government securities it is usually 1 day after the execution. In Europe, settlement date has also been adopted as 2 business days after the trade is executed.

What is clearing in a settlement?

A number of risks arise for the parties during the settlement interval, which are managed by the process of clearing, which follows trading and precedes settlement. Clearing involves modifying those contractual obligations so as to facilitate settlement, often by netting and novation .

How does account based settlement work in Japan?

Japan is an example of how account-based settlement works. Japan has two CSDs, which also serve as SSSs. The Bank of Japan Financial Network System (BOJ-NET) settles trades in Japanese government bonds (JGBs) held in its book-entry system. BOJ-NET is also the real-time gross settlement system for Japanese yen. The second CSD/SSS is Japan Securities Depository Center (JASDEC). It is a CSD for debt and equity securities issued by the private sector. Whereas BOJ-NET transfers JGBs and cash within a single platform, settlement of securities held at JASDEC requires coordination with BOJ-NET for the transfer of cash ( Graph A2 ). This coordination is automated by locking securities to be delivered in accounts at JASDEC until final settlement of cash has occurred at BOJ-NET, after which the deliveries are completed. If the cash transfer fails to settle by a specified time, then the lock on the securities is removed so that the seller regains control of those securities. This ensures that securities delivery occurs if and only if the corresponding cash transfer occurs.

What is securities in financial terms?

Securities are tradable financial assets issued to raise funds from investors. Historically, securities were issued as paper certificates and the bearer was presumed to be the owner ( bearer securities ). However, moving paper certificates around is costly and risky. Therefore, central securities depositories (CSDs) were set up to immobilise paper certificates and eliminate the need to settle trades by physical transfers. Later, technological advancements enabled securities to be dematerialised - that is, to exist only in electronic book-entry form in an account at the CSD ( Box A ).

How are book entry and tokenized securities different?

The first distinction between book-entry and tokenised securities is how transfers are authorised. For book-entry securities, transfer authorisation ultimately depends on the CSD verifying the identity of the account holder. In contrast, for digital tokens authorisation depends on "validation" of the token. The analogy with bearer securities is instructive. For physical securities, holding a valid paper certificate bestowed certain rights. Bearer bonds had coupons attached that were submitted for interest payments, and the bond certificate itself was handed in at maturity for the principal amount. In a digital world, the holder has private knowledge in the form of a cryptographic key rather than a paper certificate. The private key permits the holder to "unlock" certain rights vis-à-vis the token ( Box B ).

What is settlement cycle?

The settlement cycle is the period between execution of a trade and final settlement. Currently, most securities are settled under a rolling cycle where trades are executed on day T and settled at a later date (typically one to three days later).

Which bank has the largest CSD/SSS?

By value of securities held, the largest CSD/SSS is the Fedwire Securities Service for US government and agency securities ( Graph A1, left-hand panel). By value of deliveries, the most active CSD/SSS is Euroclear Bank, based in Belgium (centre panel).

Do credit risk disappear?

Risks rarely disappear, but new technologies may transform them and the way they are managed. In a tokenised world, post-trade processes still need to manage credit risk and liquidity. There are two types of credit risk that arise in the clearing and settlement of securities: replacement cost risk (from the point at which a trade is executed until it settles); and principal risk, during the settlement process itself.

Does tokenisation change settlement cycle?

Tokenisation does not change the underlying risks in the settlement cycle, but it may transform some of them and change how they are managed. It may also have implications for the role of intermediaries in securities clearing and settlement.

How does SEBI regulate broker settlement?

As per SEBI regulation, broker need to settle unused funds and securities back to client at regular intervals. For example, I transferred 1L to my trading account to buy some shares. But I got busy in my job and didn’t do anything with the amount transferred. This amount sits in broker bank account. So it can be misused for any purpose. If someone is active, they will track the funds in their account. So to avoid any type of misuse by brokers, SEBI mandated brokers to transfer back unused funds to client bank accounts. You can select quarterly settlement.

Do brokers have to settle unused funds?

As per SEBI regulation, brokers need to settle unused funds and securities back to clients at regular intervals. For example, I transferred 1L to my trading account to buy some shares. But I got busy with my job and didn’t do anything with the amount transferred. This amount sits in the broker's bank account. So it can be misused for any purpose. If someone is active, they will track the funds in their account. So to avoid any type of misuse by brokers, SEBI mandated brokers to transfer back unused funds to client bank accounts. You can select quarterly settlement.

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What is the account receivable department?

The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services. The ages of the receivables are broken down into intervals such as 1–30 days, 31–60 days, etc. Individual accounts will have amounts and days outstanding on record, and when the invoices are paid, the accounts are settled in the company's books.

What is offset in insurance?

Amounts receivable and payable to reinsurers are offset for account settlement purposes for contracts where the right of offset exists, with net insurance receivables included in other assets and net insurance payables included in other liabilities. 1.