Full Answer

What is the difference between clearing and settlement?

What is the difference between clearing and settlement? Settlement is the actual exchange of money, or some other value, for the securities. Clearing is the process of updating the accounts of the trading parties and arranging for the transfer of money and securities. Central clearing uses a third-party — usually a clearinghouse — to clear ...

What is a bankcard settlement?

What is a bankcard settlement? A settlement is just another way of saying the transaction is complete and will be done as soon as the credit or debit card was swiped. Businesses can work with their credit card processing company to see if they are going to have any type of transactions that will settle immediately.

What are exchange settlement accounts?

Exchange Settlement Accounts (ESAs) are the means by which providers of payments services settle obligations that have accrued in the clearing process. This document outlines the Reserve Bank's policy on ESA eligibility; and provides additional information on management of an ESA and the application process. 1.

What is payment clearing and settlement?

What Is Clearing And Settlement In Payments? Payments between customers and payees are routed via the networks through the use of routing messages and other communication technologies. A debt is discharged directly from an Interbank account to an immediate recipient or on an accrual schedule by a single transaction.

What does settlements mean in banking?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What is a clearing and settlement bank?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

What is a settlement payment?

What is settlement? Settlement is the process where we ensure payments made to a merchant eventually end up in the merchant's bank account. There are several steps in this process, starting when the payer first confirms the payment and ending when the money is in the merchant's bank account.

Do banks settle payments?

Interbank clearing and settlement networks allow banks to settle USD payments within a day and international payments within two days.

What is the process of settlement?

Settlement is the process of paying the remaining sale price and becoming the legal owner of a home. At settlement, your lender will disburse funds for your home loan and you'll receive the keys to your home. Generally, settlement takes place around 6 weeks after contracts are exchanged.

How does the settlement process work?

A settlement agreement works by the parties coming to terms on a resolution of the case. The parties agree on exactly what the outcome is going to be. They put the agreement in writing, and both parties sign it. Then, the settlement agreement has the same effect as though the jury decided the case with that outcome.

What is loan settlement?

Loan settlement is the process of negotiating with your lender to pay off your loan for a lesser amount than what you originally borrowed. This can be done for various reasons, such as financial hardship or wanting to get out of debt quicker.

How is settlement done in bank?

The settlement bank will typically deposit funds into the merchant's account immediately. In some cases, settlement may take 24 to 48 hours. The settlement bank provides settlement confirmation to the merchant when a transaction has cleared. This notifies the merchant that funds will be deposited in their account.

What is the difference between settlement and payment?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

How are bank transfers settled?

The recipient's bank receives the information from the initiating bank and deposits its own reserve funds into the correct account. The two banking institutions then settle the payment on the back end after the money has been deposited.

How does a clearing bank work?

A clearing house ensures that there are sufficient funds to complete the purchase, and the transfer is recorded before the security or funds are delivered to the buyer's account. It's a multi-step procedure to settle financial trades, ensuring market orders remain in balance.

Is SWIFT a clearing or settlement system?

It also does not perform clearing or settlement functions. After a payment has been initiated, it must be settled through a payment system, such as TARGET2 in Europe....TypeCooperative societyProductsFinancial telecommunicationNumber of employees>3,000Websitewww.swift.com5 more rows

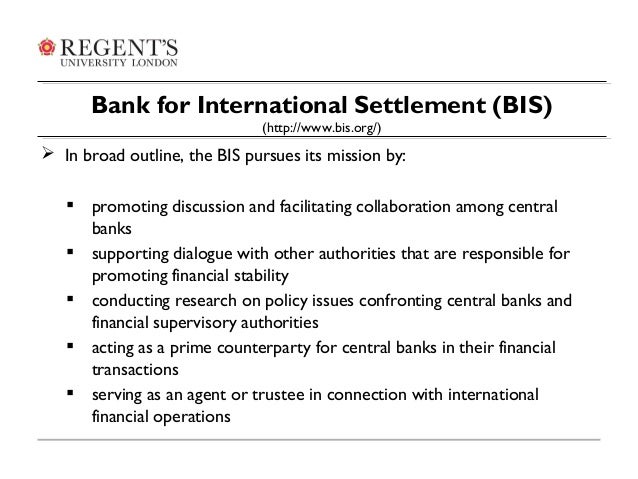

Bank for International Settlements Is a Financial Chameleon

The BIS was created out of the Hague Agreements of 1930 and took over the job of the Agent General for Repatriation in Berlin. When established, the BIS was responsible for the collection, administration and distribution of reparations from Germany—as agreed upon in the Treaty of Versailles—following World War I.

Bank for International Settlements Tackling Challenges

Given the continuously changing global economic structure, the BIS has had to adapt to many different financial challenges. However, by focusing on providing traditional banking services to member central banks, the BIS essentially gives the lender of last resort a shoulder to lean on.

How the Bank Operates

The BIS competes directly with other private financial institutions for global banking activities. However, it does not hold current accounts for individuals or governments. At one time, private shareholders, as well as central banks, held shares in the BIS.

The Bottom Line

The BIS is a global center for financial and economic interests. As such, it has been a principal architect in the development of the global financial market.

What is an approved settlement bank?

An approved settlement bank shall have a service agreement with Nasdaq Clearing specifying the terms and specifications of the cash settlement services provided by the settlement bank.

What is the credit score of a settlement bank?

An approved settlement bank shall have a credit rating of “A-“ or higher in accordance with Standard & Poor’s credit rating system, or a credit rating of “A3” or higher in accordance with Moody’s credit rating system.

Which bank is responsible for executing payments in SEK?

For payments in SEK and DKK the settlement bank must be connected to and be able to execute payments through the currency’s respective central bank, the Swedish Riksbank for SEK and the Danish Nationalbank for DKK. For payments in EUR the settlement bank must be connected and be able to execute payments through the TARGET2 settlement system.

Can an approved settlement bank send payment instructions?

An approved settlement bank shall be able to send and receive payment instructions and send payment confirmations and end-of-day statements through SWIFT Net according to the agreed specifications. All transactions for all message types shall be sent over SWIFT Net.