Full Answer

What is a settlement bank?

A settlement bank is the last bank to receive and report the settlement of a transaction between two entities. It is the bank that partners with an entity being paid, most often a merchant. As the merchant’s primary bank for receiving payment, it can also be referred to as the acquiring bank or the acquirer .

How long does it take to settle a credit card transaction?

If available funds are deducted and sent through the processing network to the settlement bank which settles the transaction for the merchant. The settlement bank will typically deposit funds into the merchant’s account immediately. In some cases, settlement may take 24 to 48 hours.

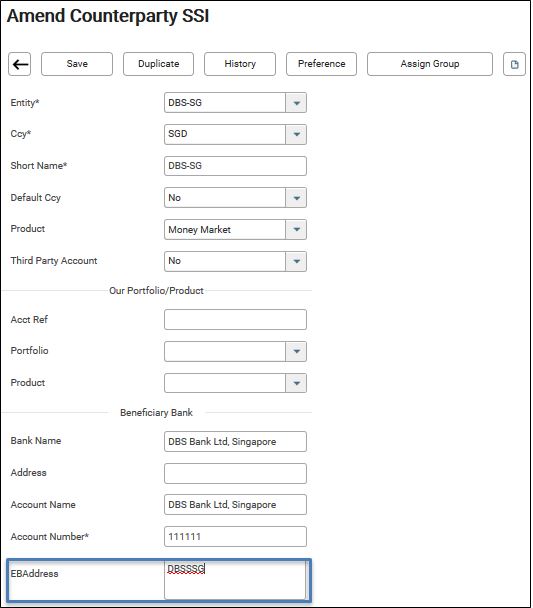

What is an approved settlement bank for Swift?

An approved settlement bank shall be able to send and receive payment instructions and send payment confirmations and end-of-day statements through SWIFT Net according to the agreed specifications. All transactions for all message types shall be sent over SWIFT Net.

What are transaction and settlement codes?

Transaction and Settlement Codes : Support Services Comprehensive listing of transaction status, response and settlement codes and ACH return codes. Transaction Status Codes The status of a transaction will change depending on the following factors: Was the transaction accepted or rejected for processing?

What are settlement codes?

The Balancing and Settlement Code (BSC) is a legal document which defines the rules and governance for the balancing mechanism and imbalance settlement processes of electricity in Great Britain.

What is settlement bank?

A settlement bank is the last bank to receive and report the settlement of a transaction between two entities. It is the bank that partners with an entity being paid, most often a merchant. As the merchant's primary bank for receiving payment, it can also be referred to as the acquiring bank or the acquirer.

What is bank payment code?

List of Purpose of Payment (PoP) Codes for International RemittanceCodeDescriptionACMAgency CommissionsAESAdvance Payment Against EOSAFAReceipts or payments from personal residents bank account or deposits abroadAFLReceipts or payments from personal non-resident bank account in the UAE108 more rows

What is settlement in transaction?

Transaction settlement is the process of moving funds from the cardholder's account to the merchant's account following a credit or debit card purchase. The issuer will route funds to the acquirer via the card network. For debit card payments, the funds will be withdrawn directly from the cardholder's bank account.

What is settlement account number?

An official settlement account is used to track and account for international balance of payments between central banks. It is used to settle transfers of assets and global monetary reserves that circulate among nations' central banks.

What is a settlement account?

an account containing money and/or assets that is held with a central bank, central securities depository, central counterparty or any other institution acting as a settlement agent, which is used to settle transactions between participants or members of a commercial settlement system.

What is payment code in wire transfer?

A wire transfer code is a string of numbers and letters that identify an account into which money should be transferred. Some common wire codes are IBAN, SWIFT or BIC. When performing a domestic wire transfer, the bank code, the routing number and the receiving account number is all that is needed.

What does purpose code mean?

purpose code means a code indicating the purpose of a transaction, referred to in Article 5(5) of the Commission Regulation and listed in Annex IX(1) to that Regulation; Sample 1.

What is POS merchant settlement?

Simply put, payment gateway settlement is when the bank transfers funds immediately with no waiting. It is the process where the money is transferred or routed from the customer's bank to the merchant's bank.

What does settlement mean in finance?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

What is difference between settlement and clearing?

Clearing involves network operators routing messages and other information among financial institutions to facilitate payments between payers and payees. Interbank settlement is the discharge of obligations that arise in connection with faster payments either in real-time or on a deferred schedule.

How does debit card settlement work?

Once a transaction has been approved, settlement is the second and final step. This is when the issuing bank transfers the funds from the cardholder's account to the payment processor, who then transfers the money to the acquiring bank. The business will then receive the authorized funds in its merchant account.

What does it mean when Forte says merchant has exceeded the maximum number of transactions per hour?

Merchant has exceeded the maximum number of transactions per hour, which may indicate a security problem. This error rarely occurs, but if you receive it, contact Forte by calling Customer Service at 800-337-3060 option 1.

What is the response code for Forte?

When a transaction is submitted for processing, Forte immediately returns one of the following responses. Transactions that are accepted for processing return the A01 response code. Transactions that are rejected for processing return the "U" response codes.

Can you find the original transaction you are attempting to void?

The original transaction that you are attempting to void or capture cannot be found. Ensure the original_transaction_idincluded in the request is correct.

What do the first two digits of a bank's code represent?

The first two digits represent the category of banks or financial institutions (For example 10 is the code used for the central bank, 11 for commercial banks, 12 for development banks, 13 for finance companies, etc.); the next three digits represent the bank code and last three digits represent the branch code.

What is the bank routing code?

Bank code and routing code of different countries. By. A.Sulthan, Ph.D., 7036. A bank code is a code assigned by a central bank of the country, a bank supervisory body or a Bankers Association in a country to all its licensed member banks or financial institutions. The rules vary to a great extent between the countries.

How many digits are in the código de entidad?

The Código de Entidad / Código de Plaza, used to clear funds and/or route payments in Argentina, consists of seven digits.

How many digits are in a bank number in Botswana?

The Bank/Branch Number, used to clear funds and/or route payments in Botswana consists of six digits.

How many digits are in Bolivia bank number?

The Bank/Branch Number used to clear funds and/or route payments in Bolivia consists of 9 digits.

How many digits are in the Armenian bank code?

The Armenian Bank Code, used to clear funds and/or route payments in Armenia, consists of five digits.

How many digits are in the bank code for Afghanistan?

The Bank/Branch codes used to clear funds and/or route payments in Afghanistan consist of 4 digits.

What is an approved settlement bank?

An approved settlement bank shall have a service agreement with Nasdaq Clearing specifying the terms and specifications of the cash settlement services provided by the settlement bank.

What is the credit score of a settlement bank?

An approved settlement bank shall have a credit rating of “A-“ or higher in accordance with Standard & Poor’s credit rating system, or a credit rating of “A3” or higher in accordance with Moody’s credit rating system.

Which bank is responsible for executing payments in SEK?

For payments in SEK and DKK the settlement bank must be connected to and be able to execute payments through the currency’s respective central bank, the Swedish Riksbank for SEK and the Danish Nationalbank for DKK. For payments in EUR the settlement bank must be connected and be able to execute payments through the TARGET2 settlement system.

Can an approved settlement bank send payment instructions?

An approved settlement bank shall be able to send and receive payment instructions and send payment confirmations and end-of-day statements through SWIFT Net according to the agreed specifications. All transactions for all message types shall be sent over SWIFT Net.

When do banks use SEPA codes?

These codes are used when transferring money between banks, in particular for international wire transfers or SEPA payments. Banks also use these codes to exchange messages between each other.

What is a SWIFT/BIC code?

A SWIFT code — sometimes also called a BIC number — is a standard format for Business Identifier Codes (BIC). It’s used to identify banks and financial institutions globally. It says who and where they are — a sort of international bank code or ID.

Where can I find my SWIFT/BIC code?

You can usually find your bank’s SWIFT/BIC code in your bank account statements. You also can use our SWIFT/BIC finder to get the right code for your transfer.

What does BIC stand for in SWIFT?

BIC stands for Bank Identifier Code. It's a set of digits that represents a bank branch for international payments on the SWIFT network. Find your BIC code here

Where are Swift codes used?

They're mostly used in Europe, but other countries around the world are starting to adopt the same system. SWIFT codes help to identify bank branches for international payments. They're used all over the world.

Do you need an IBAN to send money to the Eurozone?

It depends on the country you're sending money to. In the Eurozone, you'll always need an IBAN and a SWIFT/BIC code. Banks in the USA use SWIFT codes, but they don't use IBANs. It's the same in New Zealand too.

Is Swift the same as sort code?

SWIFT codes are not the same as sort codes, but they do a similar job. Sort codes help to identify bank branches for payments within a country, while SWIFT codes help to identify bank branches for international payments. Find your BIC code here. Is a SWIFT code same as a routing number?