Settling with a collection agency when they send you debt settlement offer in the mail. If the offer you receive to settle an old collection account for less than the balance owed is a good one, and the debt is still inside the statute of limitations to sue you, you should definitely consider taking advantage of it.

How to negotiate with collection agencies?

Steps Download Article

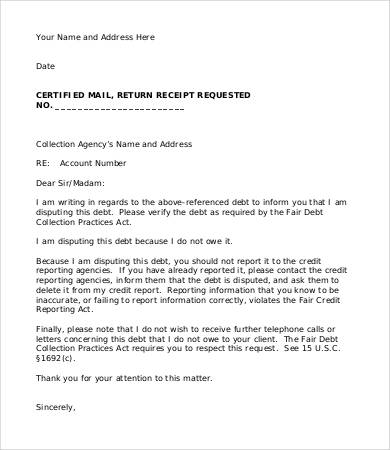

- Validate the debt collection agency claims. You should send the debt collection agency a letter requesting that it send you proof you owe the debt.

- Check the statute of limitations. Each state has a statute of limitations on how long a creditor has to collect on a debt.

- Know the method of payment. ...

- Know how much money to pay. ...

What is the best collection agency?

- Atradius Collection

- Summit Account Resolution

- PRA Group

- The Kaplan Group

- Rocket Receivables

- Rozlin Financial Group

- Encore Capital Group

- ACA International

- Consumers Financial Protection Bureau

- National Consumer Law Center

How much do collection agencies charge?

Most debt collection companies will charge a 20% to 25% commission of the debt collected. An agency may charge up to 50% commissions if the debt is older or more difficult to collect. If your invoice letters and calls are going unanswered then it might be time to hire a professional debt collection agency.

Do collection agencies negotiate?

Some debt collectors will agree to negotiate with you to score at least a partial repayment instead of nothing. Debtors may be able to negotiate an alternate repayment plan or repay a lump sum,...

What is a settlement in collections?

Debt collection settlement, or debt settlement, is a strategy for eliminating debt by offering to make a lump-sum payment to creditors in exchange for a reduction in the total amount you owe.

What if a collection agency offers a settlement?

Once you settle the account, the collection agency will contact the credit reporting companies and update the account to reflect that it has been settled, but for less than originally agreed. In most cases, your account will reflect the change within a month or two of the collection company receiving your payment.

How much will a collection agency settle a debt for?

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Will settling with a collection agency hurt my credit?

Yes, settling a debt instead of paying the full amount can affect your credit scores.

Is it good to accept a settlement offer?

It is not in your best interest to accept a settlement offer without speaking with an attorney. The initial settlement offer from the insurance company is probably not fair. The offer may be much lower than the value of your damages. If the insurance company sends you a check, do not cash the check.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

Will debt collectors settle for 30%?

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Can I get loan after settlement?

The bank or lender takes a look at the borrower's CIBIL score before offering him a loan and if the past record shows any settlement or non-payment, his loan is likely to get rejected.

How do I remove a settled account from my credit report?

Review Your Debt Settlement OptionsDispute Any Inconsistencies to a Credit Bureau.Send a Goodwill Letter to the Lender.Wait for the Settled Account to Drop Off.

What is the 11 word phrase to stop debt collectors?

If you need to take a break, you can use this 11 word phrase to stop debt collectors: “Please cease and desist all calls and contact with me, immediately.” Here is what you should do if you are being contacted by a debt collector.

How do I raise my credit score after a settlement?

How to Improve CIBIL Score After Loan Settlement?Build a Good Credit Repayment History. ... Clear off Pending Dues. ... Manage Credit Cards Better. ... Apply for a Secured Card. ... Credit Utilisation. ... Do Not Raise Frequent Loan Queries. ... Apply for a Secured Credit.

How many points does a settlement affect credit score?

Debt settlement practices can knock down your credit score by 100 points or more, according to the National Foundation for Credit Counseling. And that black mark can linger for up to seven years.

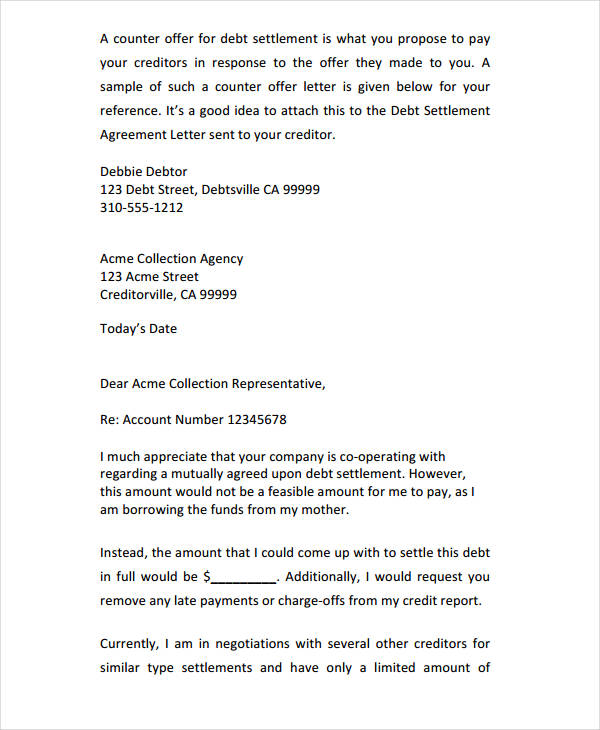

How do you respond to a settlement offer?

Steps to Respond to a Low Settlement OfferRemain Calm and Analyze Your Offer. Just like anything in life, it's never a good idea to respond emotionally after receiving a low offer. ... Ask Questions. ... Present the Facts. ... Develop a Counteroffer. ... Respond in Writing.

How do I remove a settled account from my credit report?

Review Your Debt Settlement OptionsDispute Any Inconsistencies to a Credit Bureau.Send a Goodwill Letter to the Lender.Wait for the Settled Account to Drop Off.

What percentage should I ask a creditor to settle for after a Judgement?

If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offer—about 15%—and negotiate from there.

Is settled in full good on credit report?

A settled account is considered a negative entry on your credit report since it indicates the lender agreed to accept less than the full amount owed. A settled account on your credit report tends to lower your credit scores, but its effect will lessen over time.

What does it mean when a debt is charged off in 2009?

A debt that was charged off in 2009 just means the original creditor followed the Generally Accepted Accounting Principles (GAAP), in order to account for the loss on their books. The account is still out there and collectable. You can be sued on unpaid debts after charge off, so settling is a good idea when it makes sense for you financially. A collection agency making an offer you did not solicit often means there is room to negotiate an even better outcome.

Is enforced collection a good experience?

Court enforced collections after a judgment are not ever a good experience , so avoiding that is a key consideration. In order to help you better evaluate the offer to settle the debt you received please answer the following questions using the comment box below:

Can you settle a collection account with a collection agency?

Settling with a collection agency when they send you debt settlement offer in the mail. If the offer you receive to settle an old collection account for less than the balance owed is a good one, and the debt is still inside the statute of limitations to sue you, you should definitely consider taking advantage of it.

Is it better to settle a debt now or later?

Sometimes it is better to make every effort to settle a debt now, while there is an offer on the table, when the collection agency or debt buyer has a history of using the courts in order to collect. Court enforced collections after a judgment are not ever a good experience, so avoiding that is a key consideration.

How does debt collection settlement work?

When you enroll in a debt settlement plan, your settlement agency will instruct you to stop making payments to your creditors, and to put money in a savings account instead. After a number of months, when your accounts are significantly overdue, and your creditors are getting worried they might not get any more money from you, the agency will make a debt collection settlement offer to each creditor, proposing to make a lump-sum payment for some portion of the amount owed. If your creditor accepts the offer, you’ll make the payment from the amount you have saved, and you’ll pay the debt collection settlement agency a fee, usually 25% of the amount saved. You’ll also have to pay tax on any debt that is forgiven. However, if your creditor refuses the debt collection settlement offer, you’ll still be liable for the amount due – plus penalties, interest, and potential legal fees if they decide to sue you.

What happens if a creditor accepts a settlement offer?

If your creditor accepts the offer, you’ll make the payment from the amount you have saved, and you’ll pay the debt collection settlement agency a fee, usually 25% of the amount saved . You’ll also have to pay tax on any debt that is forgiven. However, if your creditor refuses the debt collection settlement offer, ...

Is debt settlement bad for credit?

Is debt settlement bad for your credit rating? Definitely. Whether your debt collection settlement plan is successful or not , your credit rating will be damaged for years and you may have trouble applying for loans, taking out a credit card, getting a mortgage, or renting an apartment.

Two Types of Debt Collection Agencies - Internal and External

When a debtor falls sufficiently delinquent on a debt (typically after ninety days), a creditor’s internal collections department will initiate contact and pursue collections. Depending on the creditor, you may be able to arrange for flexible payment terms and prevent adverse items from being included in your credit report.

The Fair Debt Collection Practices Act (FDCPA)

The FDCPA is designed to prevent collection agencies from using deceptive or abusive tactics in their attempts to collect on debts. Under the FDCPA, within five days of initial contact, a collection agency is legally required to notify a debtor in writing of the right to dispute the debt.

Practical Tips on Dealing with Collection Agencies

For starters, don’t cave in to pressure following an initial contact. It is common for debtors to feel shame and embarrassment regarding unpaid debts, but acknowledging these feelings can prove both liberating and beneficial to a financial situation. Do not pay anything- even a small amount – and do not promise to pay anything.

Some Final Thoughts

It is not in your best interests to ignore debt collection agencies when they come calling, but rather, to know how to approach them on your terms. Avoid phone calls, insist on written verification of the debt, and insist on conducting business with them only in a written manner.

What to do if you are sued by a collection agency?

Any time you are sued, it is important that you consider consulting with an attorney to discuss your legal options. You could also hire a debt relief professional with experience in resolving debt collection efforts by creditors. Possible remedies to collection agency lawsuits include settling the debt and/or hiring an attorney to defend you.

What could happen if you do nothing after a collection agency law firm sues you?

If you don’t, the collector will likely ask the court to enter a default judgment against you. If the judge grants the collector’s request, you will probably not have an opportunity to appear in court and defend yourself.

Why did Client #21051 need debt consolidation?

Client #21051 needed debt consolidation help because they were sued by a creditor after losing their business and falling behind on paying their bills. The client did not want to file for Bankruptcy to stop the lawsuit from the creditor, so they looked for other options.

What happens if you owe a credit card company?

If you owe money to a credit card company, financial institution, or medical provider, and you fall behind on making the required payments, your creditor may eventually assign your debt to a collection agency. In these cases , your creditor will still own the debt - but you will likely stop hearing directly from the creditor. Instead, your friendly (or not-so-friendly) payment reminders will come from the collection agency acting on behalf of your creditor.

What is savings illustrated?

Savings illustrated is the difference between the total payments to CWDR and Total payments if just the MINIMUM monthly payments were being paid on the debts.

What can a collector do if he wins a judgment against you?

Although the rules that govern what (and how much) a collector can take vary by state, generally speaking collectors may attempt to: Take money out of your bank account. Garnish your wages.

Can a collection agency sue you?

Acting as an agent of your creditor, the collector may eventually sue you to recoup unpaid debts. Notice of a lawsuit from a collection agency can be an anxiety-inducing experience. Because of this, it’s best to seek guidance from a professional.

What to do if you agree to a settlement?

If you agree to a repayment or settlement plan, record the plan and the debt collector’s promises. Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed these payments. Get it in writing before you make a payment.

How to contact a debt collector?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: 1 The name of the creditor 2 The amount owed 3 That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How to talk to a debt collector about your debt?

Explain your plan. When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

How long does it take for a debt collector to contact you?

Any debt collector who contacts you to collect a debt must give you certain information when it first contacts you, or in writing within 5 days after contacting you, including: The name of the creditor. The amount owed. That you can dispute the debt or request the name and address of the original creditor, if different from the current creditor.

How long does a debt have to be paid before it can be sued?

The statute of limitations is the period when you can be sued. Most statutes of limitations fall in the three to six years range, although in some jurisdictions they may extend for longer.

When will debt collectors have to give notice of eviction moratorium?

All debt collectors must follow the Fair Debt Collection Practices Act (FDCPA). This can include lawyers who collect rent for landlords. Starting on May 3, 2021, a debt collector may be required to give you notice about the federal CDC eviction moratorium.

Can you settle debts in advance?

Be wary of companies that charge money in advance to settle your debts for you. Dealing with debt settlement companies can be risky. Some debt settlement companies promise more than they deliver. Certain creditors may also refuse to work with the debt settlement company you choose.

How do collections agencies collect past due bills?

Collection agencies usually attempt to collect past-due accounts through collection calls, notices in the mail and , depending on the stage of delinquency and creditor type associated with your past-due bill, your account could be credit reported or given to an attorney for litigation.

What is a third party collection agency?

Most agencies are “third-party” offices, meaning a creditor has hired the collection agency to recover past-due accounts. Third-party collectors are regulated by the FDCPA, which means they are obliged to follow the strict guidelines that prevent abusive, deceptive, or unfair debt collection practices. When a creditor uses their own “in-house” ...

What is the Fair Debt Collection Practices Act?

Foremost, the Fair Debt Collection Practices Act (FDCPA) is a consumer protection amendment that places restrictions on debt collection efforts at the federal and state level. Along with several other agencies, the Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB) are agencies that enforce the FDCPA by watching how ...

Can a collection agency threaten to put you in jail?

Collectors cannot misrepresent themselves on the phone, nor can they threaten to take any action that they do not intend to take (for example, because collection agencies cannot put you in jail, they cannot threaten jail time for an unpaid debt).