A closing statement, sometimes called a settlement statement or closing disclosure, ensures the seller and buyer both know exactly what they are agreeing to pay and for how long.

What happens after Closing Disclosure?

What happens after signing closing disclosure? After the lender receives the signed Closing Disclosure from all borrowers, they can begin preparing loan documents. Once the loan documents are prepared, they are delivered to the escrow company. Signing. Signing typically takes place 1-2 days before closing.

Who fills out the closing settlement statement?

The settlement statement is prepared by an impartial third party to the transaction, usually an officer with the title or escrow company that performs the closing. In California, both the buyer and the seller sign the HUD-1 settlement statement at closing.

Is the settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry. What’s the difference between a Closing Disclosure and settlement statement?

How early are you sending the Closing Disclosure?

The Closing Disclosure must be delivered to the borrower at least three business days prior to the consummation of the loan. If the Closing Disclosure is hand delivered, a waiting period commences which we’ll discuss further in a later post. If the Closing Disclosure is delivered by mail, email, courier, or fax a delivery period of three ...

What is closing disclosure form?

How much does closing cost for a home?

What is LE disclosure?

When is a HUD-1 settlement statement required?

When did the CD replace HUD 1?

Does realtor.com make commissions?

Do real estate agents have errors on CDs?

See 4 more

About this website

What is a closing disclosure settlement statement?

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

What is the purpose of the settlement statement provided to a buyer at closing?

A settlement statement provides a breakdown of all the closing costs and credits involved in a real estate transaction or refinance.

Is closing disclosure a good thing?

The closing disclosure is one of the most important documents you'll get during the mortgage process because it spells out all of the details of your home loan—including the money you'll need to bring to closing, your interest rate and your total monthly payment.

Is a closing disclosure the same as a settlement sheet?

While closing disclosures provide information about a borrower's loan, settlement statements do not include loan information. Settlement statements are used for commercial transactions and cash closings.

What is the difference between a closing statement and a closing disclosure?

A closing statement or credit agreement is provided with any type of loan, often with the application itself. A seller's Closing Disclosure is prepared by a settlement agent and lists all commissions and costs in addition to the net total to be paid to the seller.

Is a closing disclosure the same as clear to close?

A Closing Disclosure is not technically the same as being declared clear to close, but the disclosure typically comes after you have been cleared. After reviewing your Closing Disclosure, you can look forward to a final walkthrough of the home and closing day itself.

Can you be denied after closing disclosure?

Can a mortgage be denied after the closing disclosure is issued? Yes. Many lenders use third-party “loan audit” companies to validate your income, debt and assets again before you sign closing papers. If they discover major changes to your credit, income or cash to close, your loan could be denied.

What is the purpose of a closing disclosure?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

Why is there a 3 day waiting period after closing disclosure?

One of the important requirements of the rule means that you'll receive your new, easier-to-use closing document, the Closing Disclosure, three business days before closing. This will give you more time to understand your mortgage terms and costs, so that you know before you owe.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

How many days before the closing must the closing disclosure be delivered?

three business daysYour lender is required to send you a Closing Disclosure that you must receive at least three business days before your closing. It's important that you carefully review the Closing Disclosure to make sure that the terms of your loan are what you are expecting.

Which two items will appear on a closing disclosure?

Closing disclosure form sectionsLoan information. This section should match your loan estimate regarding the loan term, loan purpose and loan program (conventional, FHA, VA or USDA).Loan terms. ... Projected payments. ... Costs at closing. ... Late payment fee. ... Escrow account.

What is a settlement statement quizlet?

Uniform Settlement Statement. Under RESPA, a lender must use HUD's Form 1 Uniform Settlement Statement to disclose settlement costs to the buyer. This form covers all costs that the buyer will have to pay at closing, whether to the lender or to other parties.

Who should review the settlement statement before closing quizlet?

-gives buyer the right to review the completed settlement statement one business day prior to closing. -specifically prohibits any payment or receiving of fees or kickbacks when a service has not been rendered.

What is the difference between settlement and closing?

A closing is often called "settlement" because you, as buyer, along with your lender and the seller are "settling up" among yourselves and all of the other parties who have provided services or documents to the transaction.

Where does the buyer's new loan appear on a settlement statement?

Where does the buyers new loan appear on the settlement statement? Credit buyer- The buyers debit column lists all the charges to the buyer; the credit column shows how the buyer is going to pay the charges. The loan is not a charge; its source of money, so its a credit for the buyer.

Does receiving a Closing Disclosure mean the loan is approved?

The loan is approved prior to a lender issuing a Closing Disclosure. However, you’ll want to make sure your credit, income and debt are in check du...

Who gets a copy of the Closing Disclosure?

Typically, buyers and lenders will receive a copy of the Closing Disclosure. It’s recommended that buyers share a copy of their Closing Disclosure...

What happens after signing the Closing Disclosure?

After you sign the Closing Disclosure, you and your lender are not allowed to make any changes to the mortgage information.

Do I have to take on the loan after signing the Closing Disclosure?

No, signing the Closing Disclosure only signifies that you’ve reviewed the mortgage information sent by your lender. If you change your mind about...

What happens if I don’t receive a Closing Disclosure?

Your mortgage lender is required to send you a Closing Disclosure. If you haven’t received the document, reach out to your lender immediately.

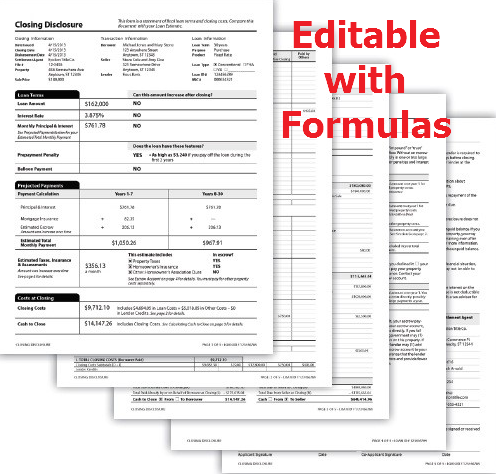

Closing Disclosure document with your Loan Estimate.

Projected Payments Loan Terms CLOSING DISCLOSURE PAGE 1 OF 5 • LOAN ID # 0000000000 Payment Calculation Principal & Interest Mortgage Insurance

Use your mortgage Closing Disclosure (CD) to get the deal you were ...

Page 4. Page 4 lays out more numbers and details concerning your escrow account. That includes whether you have one at all. If you don’t have one, you may (or may not) be paying an escrow-waiver ...

How long do you have to provide closing disclosure?

Lenders are required to provide your Closing Disclosure three business days before your scheduled closing. Use these days wisely—now is the time to resolve problems. If something looks different from what you expected, ask why.

What do you need to pay at closing?

Actual amount you will have to pay at closing. You will typically need a cashier's check or wire transfer for this amount. Ask your closing agent about how to make this payment. Depending on your location, this person may be known as a settlement agent, escrow agent, or closing attorney.

What is a lender rebate?

A rebate from your lender that offsets some of your closing costs. Lender credits are typically provided in exchange for a higher interest rate than you would have paid otherwise. Learn about lender credits.

What to do if your mortgage doesn't match what you were expecting?

It's very important these items match what you were expecting. If they don't, call your lender immediately and ask why they have changed.

How much down payment is required for mortgage insurance?

Mortgage insurance is typically required if your down payment is less than 20 percent of the price of the home.

What to do if closing costs change?

If there are significant changes in your closing costs, ask your lender to explain why.

Why is closing cost increased?

This reduces your upfront costs at closing, but adds to your overall costs because of the added interest you will pay.

What is closing disclosure?

The Closing Disclosure is a five-page form that describes, in detail, the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes and insurance, closing costs and other expenses. It’s important that you review it thoroughly – in fact, it’s one of the most important steps you can take ...

How long do you have to give closing disclosure?

Your lender is required by law to give you the standardized Closing Disclosure at least 3 days before closing. This is what is known as the Closing Disclosure 3-day rule. This requirement is thanks to the TILA-RESPA Integrated Disclosures guidelines, which went into effect on October 3, 2015.

What Is A Loan Estimate?

The Loan Estimate is a three-page document you receive three days after applying for a mortgage. It provides a summary of the loan terms, the costs associated with the mortgage, the loan size, interest rate and payments. It lays out whether there are any balloon payments, prepayment penalties or more. The document also includes a schedule of your payments and the estimated taxes and insurance payments. Closing costs are outlined in the Loan Estimate as well.

What to do if you find a discrepancy between closing disclosure and loan estimate?

If you find a discrepancy between the Loan Estimate and the Closing Disclosure, the first step is to contact your lender or real estate agent immediately to correct the errors. These mistakes can be as minor as misspelled names or as serious as a change in the interest rate.

Why is it important to read the closing disclosure?

The reason for this is that once you sign, you’re committing to the conditions presented, regardless of whether there are any mistakes in the paperwork. That means it’s crucial that you carefully read the Closing Disclosure your lender sends you.

How long does it take to get a loan estimate?

It should look similar to the Loan Estimate. You’re required by law to receive the Loan Estimate 3 days after you submit a loan application. Take the time to look over both your Loan Estimate and Closing Disclosure in detail to make sure everything you see makes sense.

What documents were used before the HUD-1 settlement?

Prior to these rules, home buyers received two documents, the HUD-1 Settlement Statement and the Truth in Lending Disclosure Statement (instead of the Closing Disclosure). There were two problems with these previous documents: they were confusing, and they were only provided at closing – which offered home buyers very little opportunity to review and make sense of them.

What is closing disclosure?

A Closing Disclosure is a five-page form that provides final details about the mortgage loan you have selected. It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs).

How long do you have to give closing disclosure?

The lender is required to give you the Closing Disclosure at least three business days before you close on the mortgage loan.

Do you get a closing disclosure on a reverse mortgage?

Note: You won't receive a Closing Disclosure if you're applying for a reverse mortgage. For those loans, you will receive two forms-a HUD-1 Settlement Statement and a final Truth in Lending Disclosure —instead of the Closing Disclosure.

Do you get a HUD-1 or Truth in Lending disclosure?

If you are applying for a HELOC, a manufactured housing loan that is not secured by real estate, or a loan through certain types of homebuyer assistance programs, you will not receive a HUD-1 or a Closing Disclosure, but you should receive a Truth-in-Lending disclosure.

What is the Closing Disclosure?

The closing disclosure is a 5 pager document that is given to the buyer by the lender. The closing disclosure shows the final closing costs for the mortgage along with some terms and conditions established by both parties for the transaction.

What is the closing cost section in a loan disclosure?

This section gives an itemized list of costs that changed compared to the loan estimate, making it an important block in the disclosure. This section includes total closing costs, seller credits, downpayment, adjustments, and many others. The column on the right says if the cost changed or not.

What is total cash to close?

Total Cash to Close consists of, total closing costs, closing costs to be financed, down payment and other funds from the borrower, deposits to seller or escrow for the borrower, Seller credits, adjustments and other credits paid by persons other than the originator, creditor, borrower or seller.

What is the H section of the escrow?

The second one is an itemized list of prepaid costs. There could be multiple parties that could show up in this section. The 3rd section includes an itemized list of aggregate costs included in the escrow. The subsection 'H' shows us an itemized list of costs the buyer owes to third parties for the home inspection, warranty fees, broker's commission, etc.

What is the 3 day rule for closing disclosure?

TheThe 3 day rule for closing disclosure means that the closing is scheduled in 3 days counted from the day they receive the closing disclosure. For example, closing disclosures delivered by hand or email will reach the same day. Hence, if they are Emailed or hand delivered on a Monday, the signing date will be scheduled on Thursday in the same week, and Friday will be the loan funding date.

How long does it take for a closing disclosure to be sent?

On the other hand, if they are sent by US mail (USPS), It will take 2-3 days for the closing disclosure to reach the buyer. For example, if the disclosure is mailed on a Thursday, it will possibly reach the buyer the next week Monday. According to the 3 day rule then, the closing will take place on Thursday.

How many sections are there in a mortgage closing disclosure?

In this post, we will help you understand the 13 sections of the document along with some other important details that may still put your mortgage on hold despite the lender has issued the closing disclosure.

Settlement Statements, Closing Disclosures, and HUD-1s

There are a number of different ways to finance a real estate purchase. Some buyers are able to pay cash, but many work with financial institutions to obtain the funds to buy the property. Even when working with a lender, there are multiple options available for financing.

Settlement Statements

At a high level, the settlement statement is a document reflecting all the ways that money will change hands between parties at closing.

Closing Disclosures

A closing disclosure (CD) is a document given specifically to buyers who are working with a lender to finance a transaction. The CD provides all the relevant information regarding the buyer’s loan. It is provided by the lender and typically includes, but is not limited to:

How long before closing do you have to give closing disclosure?

In the wake of the subprime crisis, the Consumer Financial Protection Bureau requires that buyers receive the Closing Disclosure, outlining loan costs among other fees and information pertinent to the borrower, no later than 3 days before closing for review.

What is a settlement statement?

A settlement statement is an itemized list of fees and credits summarizing the finances of an entire real estate transaction. It serves as a record showing how all the money has changed hands line by line.

Is a settlement statement the same as a closing statement?

Yes, a settlement statement is the same as a closing statement, though “settlement” is the formal term most likely to be used by the real estate industry.

What is an ‘excess deposit’ at closing?

A particular line item that causes confusion on the seller’s settlement statement is the “Excess Deposit.” What is an excess deposit, and who will receive the funds listed on that line?

What does an impound account do at closing?

At closing the buyer sets up an impound account that allows them to bundle the cost of their mortgage principal, taxes, mortgage insurance, and other monthly costs into one payment. The lender likes this because they can make sure the new owner will keep up to date with all the payments associated with the home.

What information is needed to complete a closing document?

At the top of the document (before you get to the portion that looks like a spreadsheet) you’ll see a few boxes for inputting information that records basic details about the transaction, such as the names of the buyer and seller, the property address, and the closing date.

What is a seller's net sheet?

The seller’s net sheet is not an official document but an organizational worksheet that your agent will fill out to estimate how much you’ll pocket from your home sale after factoring in expenses like taxes , your real estate agent’s commission, your remaining mortgage, and escrow fees.

What is closing disclosure form?

What is a closing disclosure form? Put simply, it’s a form outlining the terms and costs of your mortgage—and one of the most important pieces of paperwork to check before you close on a home.

How much does closing cost for a home?

But in general, home buyers can expect typical closing costs to amount to about 3% to 4% of the home’s sale price.

What is LE disclosure?

The LE outlined the approximate fees you would be expected to pay if you move forward with a lender to close on a home. But your closing disclosure is the real deal, which is all the more reason to scrutinize it carefully.

When is a HUD-1 settlement statement required?

Before Aug. 1, 2015, the CD was known by another name: the HUD-1 settlement statement. Yet this document was long and confusing, and required by federal law to be distributed to home buyers only on the day of closing—which didn’t give them much time to address any issues. This is why the settlement statement was replaced by the much more streamlined five-page closing disclosure, and laws were changed so that lenders are required to provide this document at least three business days before closing.

When did the CD replace HUD 1?

If this is your first time purchasing a home—or you purchased your last home before Aug. 1, 2015 (when the CD replaced the HUD-1)—sit down and review a sample CD from the CPFB. If you have any questions, ask your loan officer or real estate agent for a line-by-line explanation of the form. Trust us, this extra dose of oversight is well worth it!

Does realtor.com make commissions?

The realtor.com ® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission.

Do real estate agents have errors on CDs?

Think such errors aren’t common? A recent survey of real estate agents by the National Association of Realtors® found that half of agents have detected errors on CDs. In other words, it really pays to check this document carefully and ask your real estate agent for help.