What is Settlement Cycle and what is the difference between T+1 and T+2 settlement?

- Settlement in stock markets. When buying through exchanges, the term ‘Settlement’ refers to the conclusion of the trade after securities have been credited to the Demat Account of the buyer.

- Rolling Settlement. The Rolling Settlement refers to the mechanism of settling trades on consecutive days after the trade has been executed.

- T+2 settlement. ...

What is the settlement period in stock market?

The settlement period refers to the time window between the trade date and the settlement date in the stock market. Trade date refers to the date on which the market executes your order for securities, whereas settlement date refers to the date when your demat account is credited with the shares or money. What is T+1 settlement period?

What is the settlement period of Indian stock market in 2022?

The Indian stock exchanges implemented the new T+1 settlement period since 25th February 2022. Until now, India followed the T+2 settlement period. What is a settlement period in stock market? The settlement period refers to the time window between the trade date and the settlement date in the stock market.

What happens at the end of the settlement period?

During the settlement period, the buyer must pay for the shares, and the seller must deliver the shares. On the last day of the settlement period, the buyer becomes the holder of record of the security. The settlement period is the time between the trade date and the settlement date.

What is the settlement cycle for custom trades?

Settlement for trades is done on a trade-for-trade basis and delivery obligations arise out of each trade. The settlement cycle for this segment is same as for the rolling settlement viz:

What is stock settlement period?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days).

What is settlement process in stock market?

Settlement – where the shares are moved from the seller's account to the buyer's account and the money is moved from the buyer to the seller. This is done on T+2 Day.

Why do stocks take 2 days to settle?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

How does settlement cycle work?

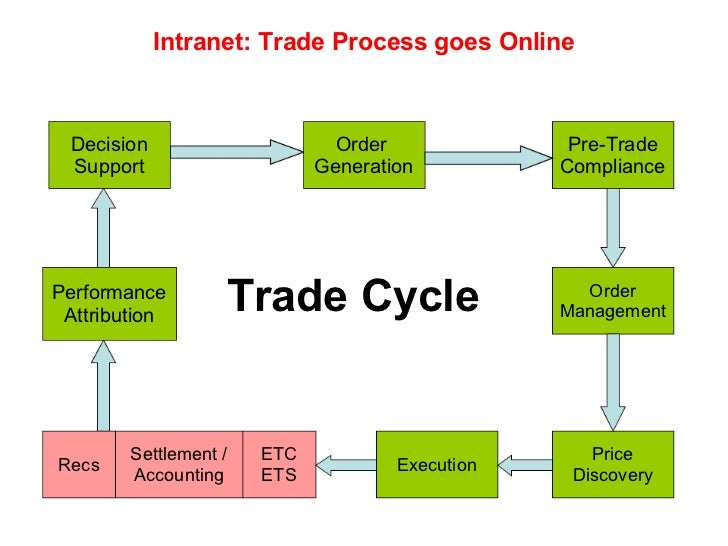

A Settlement Cycle refers to a calendar according to which all purchase and sale transactions done on T Day are settled on a T+2 basis. T = Trading Day and +2 means 2 consecutive working days after T (excluding all holidays).

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock's share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

Can I sell share before settlement?

The Indian capital markets follow a T+2 settlement cycle. This means that if you buy a stock on Monday, it gets delivered to your demat account on Wednesday. However, you can sell your stock even before you receive it in your demat account.

What is T1 T2 t3 in stock market?

T' is the transaction date. The abbreviations T+1, T+2, and T+3 refer to the settlement dates of security transactions that occur on a transaction date plus one day, plus two days, and plus three days, respectively. 1. As its name implies, the transaction date represents the date on which the actual trade occurs.

What is T1 and T2 in share market?

T1 shares are those shares that you've bought but the delivery of such shares is pending meaning it hasn't come to your demat account. T2 shares are shares present in your demat account. The settlement cycle in India is T+2, meaning, if you buy shares on Monday, those share come to your demat account on Wednesday.

Can I sell share before t 2 days?

In the normal trading process, delivery shares are credited in the demat account on T+2 days (T being the day of order execution). You cannot sell shares before delivery in normal trading. However, with BTST, you can sell shares on the same day or the next day.

What is the settlement cycle in Zerodha?

The settlement cycle for equity is T+2 days.

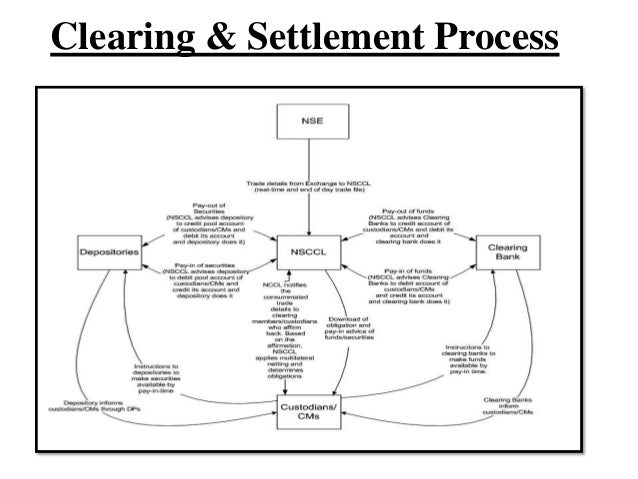

What is the settlement cycle of NSE?

NSE Clearing follows a T+2 rolling settlement cycle. For all trades executed on the T day, NSE Clearing determines the cumulative obligations of each member on the T+1 day and electronically transfers the data to Clearing Members (CMs).

What happens if we sell shares before delivery?

Hence it is very important that you short sell a stock for delivery only if you have it in your demat account or you could end up paying a considerable amount of money as Auction penalty. The entire process: a) On T Day Mr. X sells the stock.

Why does it take 3 days for stocks to settle?

The origins of settlement dates are rooted in trading practices which predate the modern electronic stock market. In the early days, a stock trade was executed by a buyer and a seller who had three days to deliver the securities and the money required to settle the transaction.

Can I purchase stock with unsettled funds?

Can you buy other securities with unsettled funds? While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade.

What is the meaning of T 2 settlement?

A T+2 settlement cycle means that the final settlement of transactions done on T, i.e., trade day by exchange of monies and securities between the buyers and sellers respectively takes place on second business day (excluding Saturdays, Sundays, bank and Exchange trading holidays) after the trade day.

What does awaiting settlement mean when selling stocks?

Stock Settlement This means that the stock trade must settle within three business days after the stock trade was executed. If you sell stock, the money for the shares should be in your brokerage firm on the third business day after the trade date.

What is settlement for trade?

Settlement for trades is done on a trade-for-trade basis and delivery obligations arise out of each trade. The settlement cycle for this segment is same as for the rolling settlement viz:

What type of settlement is settled in physical form?

Trades in the settlement type N, W, D and A are settled in dematerialized mode. Trades under settlement type O are settled in physical form. Trades under settlement type Z are settled directly between the members and may be settled either in physical or dematerialized mode.

What is rolling settlement?

In a rolling settlement, for all trades executed on trading day .i.e.T day the obligations are determined on the T+1 day and settlement on T+2 basis i.e. on the 2nd working day. For arriving at the settlement day all intervening holidays, which include bank holidays, NSE holidays, Saturdays and Sundays are excluded. A tabular representation of the settlement cycle for rolling settlement is given below:

How long does it take to dematerialize a stock?

The buyer must compulsorily send the securities for transfer and dematerialisation, latest within 3 months from the date of pay-out.

What is NSE clearing?

NSE Clearing follows a T+2 rolling settlement cycle. For all trades executed on the T day, NSE Clearing determines the cumulative obligations of each member on the T+1 day and electronically transfers the data to Clearing Members (CMs). All trades concluded during a particular trading date are settled on a designated settlement day i.e. T+2 day. In case of short deliveries on the T+2 day in the normal segment, NSE Clearing conducts a buy –in auction on the T+2 day itself and the settlement for the same is completed on the T+3 day, whereas in case of W segment there is a direct close out. For arriving at the settlement day all intervening holidays, which include bank holidays, NSE holidays, Saturdays and Sundays are excluded. The settlement schedule for all the settlement types in the manner explained above is communicated to the market participants vide circular issued during the previous month.

What is the settlement period?

What is Settlement Period? Settlement date is a term used in the securities industry to refer to the period between the transaction date when an order is executed to the settlement date when the security changes hands and payment is made. When the seller and the buyer enter into a trade, each party in the transaction must fulfill their part ...

What happens during the settlement period?

During the settlement period, the seller must initiate the transfer of ownership of the security to the buyer against the appropriate payment that both parties agreed during the execution of the contract.

What is the SEC clearance system?

The law authorized the SEC to establish a national clearance and settlement system to guide securities trading. The system provides guidance on the process of trading securities and the actual duration of the settlement period.

How long is the SEC's settlement period?

Initially, the SEC had set the settlement period to five business days. However, it was revised in 1993, when the SEC changed the settlement period from five business days to three business days. It means that a transaction executed on Monday would be completed on Thursday, as long as there were no holidays in between the week.

Why is there a two day waiting period for SEC settlements?

A two-day waiting period was necessitated by the improvements in technology, where parties could execute a trade and transfer ownership of securities quickly and conveniently.

What happens to the property on settlement date?

On the settlement date, the ownership of the real estate officially changes hands from the seller to the buyer. The buyer completes payment for the associated costs linked to the real estate transaction, whereas the seller receives the proceeds from the sale of the property.

What does T+ mean in trading?

When referring to the settlement period, brokers use the shorthand “T+” to refer to the number of business days the transaction will take to complete. For example, “T+1” means “transaction date plus one day.”. Sometimes, brokers may provide an extended settlement period for foreign stock exchange transactions.

Why is it important to know the settlement date of a stock?

Knowing the settlement date of a stock is also important for investors or strategic traders who are interested in dividend-paying companies because the settlement date can determine which party receives the dividend. That is, the trade must settle before the record date for the dividend in order for the stock buyer to receive the dividend.

Why is the settlement date a little trickier?

However, the settlement date is a little trickier because it represents the time at which ownership is transferred . It's important to understand that this doesn't always occur on the transaction date and varies depending on the type of security.

When Do You Actually Own the Stock or Get the Money?

If you buy (or sell) a security with a T+2 settlement on Monday, and we assume there are no holidays during the week, the settlement date will be Wednesday, not Tuesday. The 'T' or transaction date is counted as a separate day. 2

What does the transaction date mean?

As its name implies, the transaction date represents the date on which the actual trade occurs. For instance, if you buy 100 shares of a stock today, then today is the transaction date. This date doesn't change whatsoever, as it will always be the date on which you made the transaction.

Do all mutual funds have the same settlement period?

Not every security will have the same settlement periods. All stocks and most mutual funds are currently T+2. 3 However, bonds and some money market funds will vary between T+1, T+2, and T+3.

Understanding Settlement Periods

- In 1975, Congress enacted Section 17A of the Securities Exchange Act of 1934, which directed the Securities and Exchange Commission (SEC) to establish a national clearance and settlement system to facilitate securities transactions. Thus, the SEC created rules to govern the process o…

Settlement Period—The Details

- The specific length of the settlement period has changed over time. For many years, the trade settlement period was five days. Then in 1993, the SEC changed the settlement period for most securities transactions from five to three business days—which is known as T+3. Under the T+3 regulation, if you sold shares of stock Monday, the transaction would settle Thursday. The three …

New Sec Settlement Mandate—T+2

- In the digital age, however, that three-day period seems unnecessarily long. In March 2017, the SEC shortened the settlement period from T+3 to T+2 days. The SEC's new rule amendment reflects improvements in technology, increased trading volumes and changes in investment products and the trading landscape. Now, most securities transactions settle within …

Real World Example of Representative Settlement Dates

- Listed below as a representative sample are the SEC's T+2 settlement dates for a number of securities. Consult your broker if you have questions about whether the T+2 settlement cycle covers a particular transaction. If you have a margin accountyou also should consult your broker to see how the new settlement cycle might affect your margin agreement.