How long does it take to settle funds at Robinhood?

If you have executed a sale, the proceeds from that trade cannot be used until the settlement date. This is important to keep in mind so that you do not try to use or withdraw these funds before you are able to. How Long Does it Take to Settle Cash at Robinhood? It takes two business days to settle funds from stock trades at Robinhood.

How long does it take to sell a stock on Robinhood?

When you make a sale from your Robinhood account, it takes a while for the funds to settle before you can send them to your bank account. The average time for this stage of the process is two trading days. What happens after you sell a stock on Robinhood?

What is instant settlement on Robinhood?

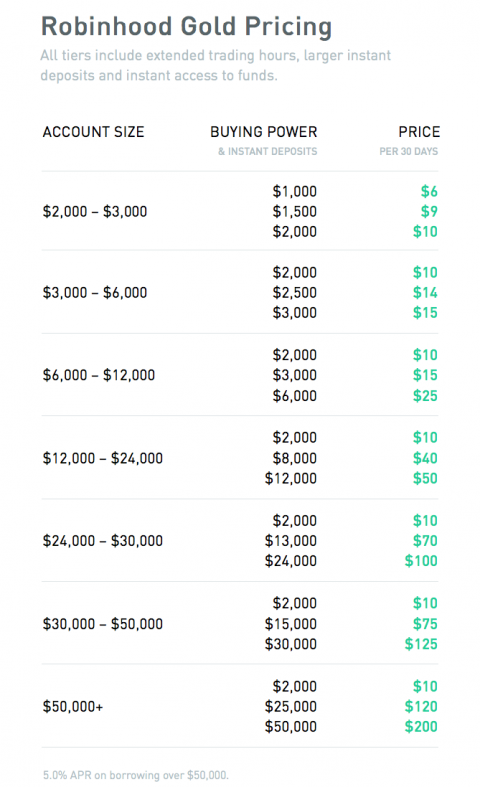

Instant Settlement. If you have a Robinhood Instant or Robinhood Gold account, you have instant access to funds from bank deposits and proceeds from stock transactions. This means that if you sell a stock today, you can use the funds right away, instead of waiting the typical two trading days for access to those funds.

What is stock settlement time frame?

Stock settlement is the process of transferring proceeds between a buyer and seller after a trade is executed. The regular-way stock settlement time frame is the trade date plus three trading days (T+3). This means when a trade is executed, the brokerage firm must deliver the stock or cash no later than three trading days after the trade date.

What is Robinhood instant settlement?

If you have a Robinhood Instant or Robinhood Gold account, you have instant access to funds from bank deposits and proceeds from stock transactions. This means that if you sell a stock today, you can use the funds right away, instead of waiting the typical two trading days for access to those funds.

What does it mean to have instant access to Robinhood?

This means that if you sell a stock today, you can use the funds right away, instead of waiting the typical two trading days for access to those funds.

What is a stock settlement?

Stock settlement is the time it takes stocks or cash to reach their new destination after a transaction is executed. Buying power is the amount of money you have available to make purchases in your app.

Can cash accounts be settled?

Cash accounts don’t have access to instant settlement, and banking holidays can affect settlement times.

How long does it take for a stock to settle?

Most stocks and bonds settle within two business days after the transaction date . This two-day window is called the T+2. Government bills, bonds, and options settle the next business day. Spot foreign exchange transactions usually settle two business days after the execution date.

What Is a Settlement Date?

The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date. Options contracts and other derivatives also have settlement dates for trades in addition to a contract's expiration dates .

What causes the time between transaction and settlement dates to increase substantially?

Weekends and holidays can cause the time between transaction and settlement dates to increase substantially, especially during holiday seasons (e.g., Christmas, Easter, etc.). Foreign exchange market practice requires that the settlement date be a valid business day in both countries.

How long does it take to settle a stock trade?

Historically, a stock trade could take as many as five business days (T+5) to settle a trade. With the advent of technology, this has been reduced first to T=3 and now to just T+2.

How far back can a forward exchange settle?

Forward foreign exchange transactions settle on any business day that is beyond the spot value date. There is no absolute limit in the market to restrict how far in the future a forward exchange transaction can settle, but credit lines are often limited to one year.

How did the two day settlement affect investors?

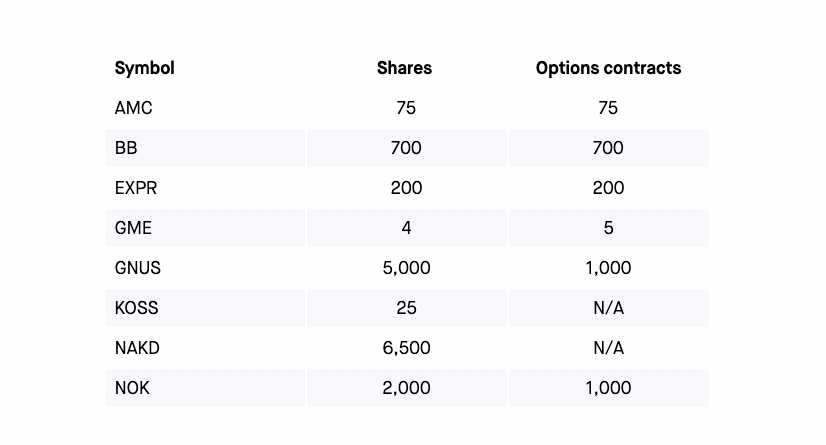

Last week we saw the impact the two-day trade settlement period has on investors and ultimately the entire American financial system. Clearinghouse deposit requirements skyrocketed overnight. People were unable to buy some of the securities they wanted. Investors were angry and concerned, an unintended byproduct of the antiquated settlement process.

Why can't we settle trades in real time?

There is no reason why the greatest financial system the world has ever seen cannot settle trades in real time. Doing so would greatly mitigate the risk that such processing poses. It’s been four years since the securities industry moved from a three-day to a two-day settlement period.

How long does it take to settle a stock?

The regular-way stock settlement time frame is the trade date plus three trading days (T+3). This means when a trade is executed, the brokerage firm must deliver the stock or cash no later than three trading days after the trade date.

How long do you have to hold your uninvested funds?

Before you can initiate a withdrawal of your uninvested funds, your deposits must remain in your account for a minimum of 5 trading days. On the 6th day, those uninvested funds will go into your cash available for withdrawal. This withdrawal holding period is for anti-money laundering and risk management purposes.

Does Robinhood give instant deposits?

With Robinhood and Robinhood Gold accounts, however, we give you access to instant deposits and instant settlement, allowing you to trade with your funds right away. Cash accounts, however, are still subject to the normal T+3 timeline.

Can a bank delay settlement?

Please note: Banking and market holidays may delay settlement by one trading day. This means the proceeds from sales executed before a holiday may not be available in buying power after the typical settlement time frame.

Does Robinhood have cash?

With a cash account, Robinhood requires customers to use settled funds (buying power) to purchase stock. The cash from a sale of stock will be received and credited to buying power on the settlement date.

When will Robinhood stock be available for trading?

As of July 29, 2021, Robinhood stock is available to the public for trading.

When will Robinhood stock go up in 2021?

July 29, 2021: Robinhood stock debuts on the Nasdaq stock exchange, raising nearly $2 billion. The shares fell 8% in price during the first week of trading. The stock did rise significantly above $38 the following week, when it jumped more than 100%.

What is Robinhood stock?

Robinhood stock is a stock that trades under the symbol HOOD on the Nasdaq stock exchange. When you buy stocks, you're buying fractional ownership in a company. Shareholders of stock get to share in the profit of the company through share price appreciation and dividends.

How many shares of Robinhood will be sold in 2021?

July 19, 2021: Robinhood released an amendment to its S-1 form, saying that it would be 52.4 million shares of stock and that its founders and CFO would be selling an additional 2.6 million shares, for a total of 55 million shares. It also includes an option to sell another 5.5 million shares.

Is Robinhood a brokerage?

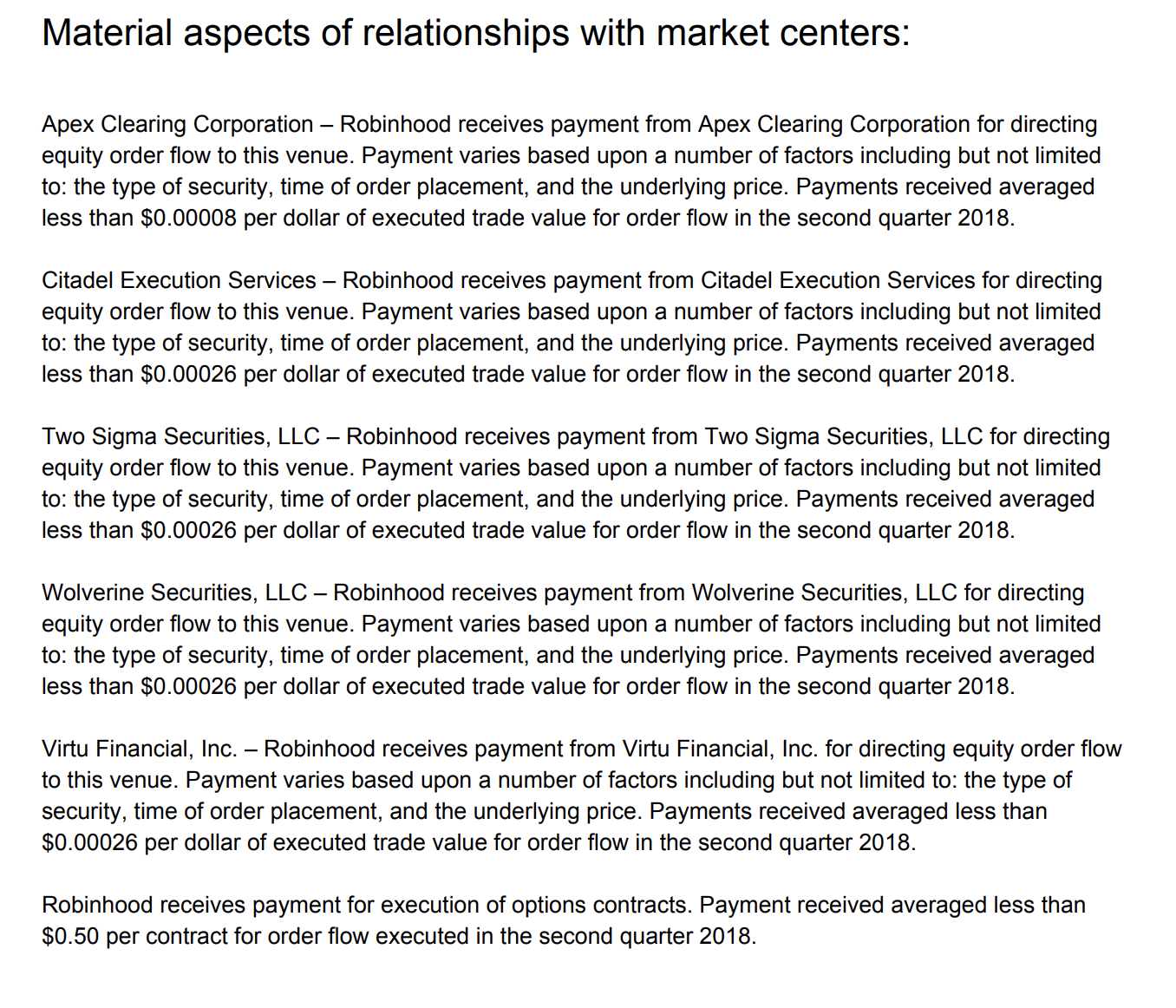

Robinhood Markets, Inc., at the time of its IPO in 2021, is an online brokerage that offers zero-commission trading of stocks, ETFs, and cryptocurrency. Although trading is free for its customers, Robinhood makes money from market makers and high-frequency trading firms who pay Robinhood for order flow from retail traders.

Who is Robinhood Markets?

Robinhood Markets, Inc. is a financial services company founded in April 2013 and headquartered in Menlo Park, CA. Headed by founders and co-CEOs, Vladimir Tenev and Baiju Bhatt, Robinhood is best known for its pioneering zero-commission trades of stocks, exchange-traded funds (ETF), and cryptocurrency via their mobile app, introduced in March 2015.

Is Robinhood a public company?

Robinhood Markets, Inc. is an online stock brokerage company with a stock-trading app aimed at young and newer investors. As the privately-held company grew in popularity, primarily from offering its zero-commission trades, Robinhood decided to "go public" through an initial public offering, or IPO, in July 2021.

What Is A Settlement Date?

- The settlement date is the date when a trade is final, and the buyer must make payment to the seller while the seller delivers the assets to the buyer. The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchang...

Understanding Settlement Dates

- The financial market specifies the number of business days after a transaction that a security or financial instrument must be paid and delivered. This lag between transaction and settlement datesfollows how settlements were previously confirmed, by physical delivery. In the past, security transactions were done manually rather than electronically. Investors would have to wait for the …

Settlement Date Risks

- The elapsed time between the transaction and settlement dates exposes transacting parties to credit risk. Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement riskbecause the currencies are not paid and received simultaneously. Furthermore, time zone differences inc…

Life Insurance Settlement Date

- Life insurance is paid following the death of the insured unless the policy has already been surrendered or cashed out. If there is a single beneficiary, payment is usually within two weeks from the date the insurer receives a death certificate. Payment to multiple beneficiaries can take longer due to delays in contact and general processing. Most states require the insurer pay inter…