What is a settlement discount and how is it recorded?

Settlement discounts can be recorded for both sales and purchase transactions - the discounts that you allow your customers and the discounts that your suppliers give you. In the UK, if the invoice is paid within the settlement discount period, then VAT is only charged on the discounted amount ( Goods value minus Discount value ).

What is discount received in accounting?

Discount Received. Discounts are common in both B2B and B2C transactions to push both credit and cash sales, they are usually given in lieu of some consideration which can be prompt payments, trade practices, recoveries, etc. While posting a journal entry for discount received “Discount Received Account” is credited.

What is the VAT on a settlement discount?

When an invoice that contains settlement discount is paid within the discount period, the VAT is only charged on the discounted invoice amount. VAT must be calculated and shown on the invoice at the full rate.

How do you record sales discount allowed and discount received?

Discount allowed and discount received. The entry to record the receipt of cash from the customer is a debit of $950 to the cash account, a debit of $50 to the sales discount contra revenue account, and a $1,000 credit to the accounts receivable account. Thus, the net effect of the transaction is to reduce the amount of gross sales.

What is a discount received?

What is Discount Allowed and Discount Received?

What is a discount in accounting?

About this website

Is settlement discount received an expense?

Settlement discount is the same as a cash discount and is a discount granted for paying off a debt early. Settlement discount granted is an expense (the opposite of this is settlement discount received , which is an income for your business).

How is settlement discount recorded?

Settlement discount A discount for payment within a certain time period Deduct settlement discounts received from the cost of inventories, such that the inventory and related liability are initially recorded at the net (lower) amount.

Where is settlement discount granted deducted from?

NB: The settlement discount received is deducted from the purchases figure and forfeited settlement discount received added to the purchases figure. Other income: This income that arises from transactions that are not connected to day- to-day activities of an entity.

What is a discount received?

A discount received is the reverse situation, where the buyer of goods or services is granted a discount by the seller. The examples just noted for a discount allowed also apply to a discount received.

What is the entry for discount received?

Discount Received: When at the time of purchase or paying cash, any concession is received from the seller, it is called discount received. Journal Entry: Example: Goods purchased for cash ₹20,000, discount received @ 20%.

Is discount received debited or credited?

Discount Received is an income of the buyer. Discount allowed is debited in the books of the seller. Discount Received is credited in the books of the buyer.

How do you record an allowance for settlement discount granted?

0:313:22How to record Discounts (Discounts allowed and received) - YouTubeYouTubeStart of suggested clipEnd of suggested clipFrom a business's point of view it is treated as an expense. Let's have a look at how I discountMoreFrom a business's point of view it is treated as an expense. Let's have a look at how I discount allowed is treated in their accounts Peter's pen shop gave 20 pounds discount to G meal a customer.

What is the difference between trade discount and settlement discount?

Trade Discount vs Settlement Discount Trade discounts are allowed to encourage customers to purchase products in larger quantities. Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

How do you treat discount received on an income statement?

Discount received can be defined as the reduction in price of goods and services to the buyer from the seller or the manufacturer. It is treated as an income for the buyer and hence it is credited to discount received and debited to the personal account of the supplier.

Why is discount received debited?

Discounts. 'Discounts allowed' to customers reduce the actual income received and will reduce the profit of the business. They are therefore an expense of the business so would go on the debit side of the trial balance.

How do you treat discount received in profit and loss account?

Discount allowed is the part of income which is sacrificed by the firm. It is the incentive given to the debtors for early payments. Since it is a reduction in the revenue of the year, it is shown on the debit side of the profit and loss account.

What type of account is allowance for settlement discount allowed?

The provision for discounts allowable is likely to be a balance sheet account that serves to reduce the asset account Accounts Receivable.

How do you record discounts in accounting?

Reporting the Discount Report the amount of total sales discounts for an accounting period on a line called “Less: Sales Discounts” below your sales revenue line on your income statement. For example, if your small business had $200 in discounts during the period, report “Less: Sales discounts $200.”

What type of account is allowance for settlement discount allowed?

The provision for discounts allowable is likely to be a balance sheet account that serves to reduce the asset account Accounts Receivable.

What is the difference between trade discount and settlement discount?

Trade Discount vs Settlement Discount Trade discounts are allowed to encourage customers to purchase products in larger quantities. Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

What is early settlement discount?

An early payment discount – also known as a prompt payment discount or early settlement discount – is a discount that buyers can receive in exchange for paying invoices early. It's typically calculated as a percentage of the value of the goods and services purchased.

How do you treat discounts allowed and received in the income ... - Answers

Discount allowed is an expense,take an example if one makes a cash sale and offers a cash discount,it reduces the cash paid and thus accounted for as an expense,a Discount received is treated as a ...

Discounts Allowed/Recieved on an Income Statement

It's fair to say there are valid reasons why discounts allowed could either belong both before or after gross profit. Before gross profit (part of cost of sales): If you consider that a discount allowed is either directly (or even indirectly) attributable to selling a product - and you wish to show the net revenue - then you could put it before gross profit.

What is a discount received?

A discount received is the reverse situation, where the buyer of goods or services is granted a discount by the seller. The examples just noted for a discount allowed also apply to a discount received.

What is Discount Allowed and Discount Received?

A discount allowed is when the seller of goods or services grants a payment discount to a buyer. This discount is frequently an early payment discount on credit sales, but it can also be for other reasons, such as a discount for paying cash up front, or for buying in high volume, or for buying during a promotion period when goods or services are offered at a reduced price. It may also apply to discounted purchases of specific goods that the seller is trying to eliminate from stock, perhaps to make way for new models.

What is a discount in accounting?

When the seller allows a discount, this is recorded as a reduction of revenues, and is typically a debit to a contra revenue account. For example, the seller allows a $50 discount from the billed price of $1,000 in services that it has provided to a customer. The entry to record the receipt of cash from the customer is a debit of $950 to the cash account, a debit of $50 to the sales discount contra revenue account, and a $1,000 credit to the accounts receivable account. Thus, the net effect of the transaction is to reduce the amount of gross sales.

What is settlement discount?

A settlement discount is where a business offers another business a discount when an invoice is paid early. This is usually a percentage discount if an invoice is paid within a specified number of days, for example, a 5% discount for invoices paid within 15 days. Settlement discounts can be recorded for both sales and purchase transactions - ...

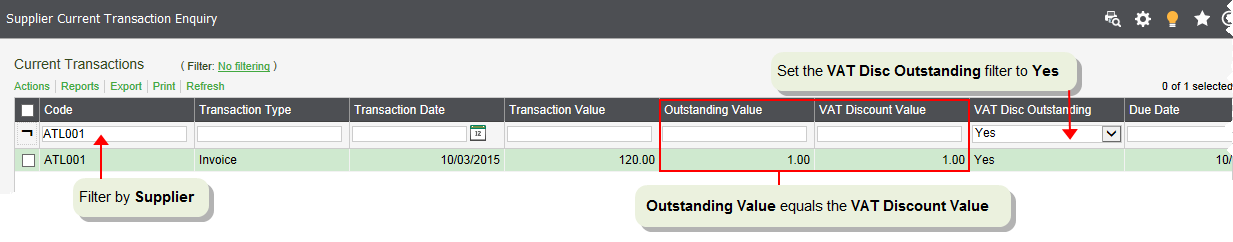

When an invoice is paid immediately, is the settlement discount automatically taken?

When an invoice is paid immediately, the settlement discount is automatically taken. The VAT is discounted on the invoice and no subsequent VAT adjustment is necessary.

How to make sure that the correct discounts are always entered?

To help make sure that the correct discounts are always entered, you can store the discount settings on your customer and supplier accounts. Each time an order or invoice is entered, the discount details are automatically entered on the transaction.

How to notify customers of VAT discount?

Businesses must: Notify their customers of the VAT discount available and the amounts the customer is due to pay. This can be done in one of two ways: Issue an invoice detailing the full net and VAT payable. If the invoice is paid within the discount period, issue a VAT only credit note to account for the VAT discount.

When an invoice contains settlement discount is paid within the discount period, is the VAT charged?

When an invoice that contains settlement discount is paid within the discount period, the VAT is only charged on the discounted invoice amount. VAT must be calculated and shown on the invoice at the full rate. If the customer pays within the settlement discount period, the VAT is discounted and a VAT adjustment must be processed. Businesses must:

When can you record a discount?

When the payment is received from a customer , you can record the discount amount. This is then posted to the Discounts Allowed nominal account. When the payment is paid to a supplier, you can record the discount amount. This then posted to the Discounts taken nominal account.

Can you enter discounts for each supplier account?

Enter discounts for each supplier account if they are different to the default.

What is crediting discount?

Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received. Consequently, payables are debited to reduce their balance to the amount that is expected to be paid to them, i.e. net of cash discount.

What are the two types of discounts?

Discounts may be classified into two types: Trade Discounts: offered at the time of purchase for example when goods are purchased in bulk or to retain loyal customers. Cash Discount: offered to customers as an incentive for timely payment of their liabilities in respect of credit purchases.

What is a $5 discount on BMX?

The 10% discount is a trade discount and should therefore not appear in Bike LTD’s accounting records. The $5 discount is a cash discount and must be dealt with accordingly.

How much discount does BMX offer?

BMX LTD as part of its purchases promotion campaign has offered to sell their bikes at a 10% discount on their listed price of $100. If customers pay within 10 days from the date of purchase, they get a further $5 cash discount. Bike LTD purchases a bike from BMX LTD and pays within 10 days of the date of purchase.

Why are trade discounts ignored?

Trade discounts are generally ignored for accounting purposes in that they are omitted from accounting records.

Do all purchases qualify for cash discounts?

Cash discounts result in the reduction of purchase costs during the period and the amount payable in respect of those purchases. However, not all purchases may qualify for the cash discount. It is therefore necessary to record the initial purchase and accounts payable at the gross amount (after deducting any trade discounts though!) and subsequently decreasing purchases and payables by the amount of discount that is actually received.

Why are settlement discounts allowed?

Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

Why do companies offer settlement discounts?

Therefore, the main purpose of offering settlement discount is to encourage customers to settle debts early.

What is the difference between Trade Discount and Settlement Discount?

Settlement discounts are allowed to ensure that customers settle debts within a short period of time.

Why do companies give discounts?

Companies grant discounts for customers in order to provide incentives for them to purchase more products. This is a widely utilized sales technique in all types of organizations and, trade discount and settlement discount are two main types of discounts granted.

What is a trade discount?

A trade discount is a discount given by the seller to the buyer at the time of making a sale. This discount is a reduction in the list prices of the quantity sold. The main objective of trade discount is to encourage customers to purchase company’s products in more quantities.

What is Company X discount?

E.g. Company X is a clothing retailer, and it grants a 15% discount for customers who buy clothing items within a selected date range in festive season.

What is discount allowed and received?

What is Discount Allowed and Discount Received? Discount allowed is a reduction in price of goods or services allowed by a seller to a buyer and is an expense for the seller. However, Discount received is the concession in price received by the buyer of the goods and services from the seller and is an income for the buyer .

What are the two types of discounts allowed by the seller?

Journal Entries. There are two types of discounts allowed by the seller. First is a Trade discount and another is Cash discount. Trade discount is not recorded in the books of accounts. It is generally given at the time of sales, like on bulk purchase. Hence, the Sales amount is shown net of trade discount in the books.

What is the difference between a discount and a buyer's expense?

For the buyer, the discount received is an income of the buyer, and the discount allowed is the seller’s expense.

Where is discount recorded in cash book?

The discount allowed by the seller is recorded on the debit side of the cash book.

Which side of the cash book is discount recorded?

are recorded on the debit side, and cash payments are recorded on the credit side. The discount allowed by the seller is recorded on the debit side of the cash book. Here is the format of the cash book –.

Why is offering discounts important?

Increased Sales – Offering discounts helps increase sales and attract new customers. As paying lesser money is an incentive for the buyer.

Is the debit and credit side of a trial balance equal?

The debit and credit side of the trial balance should be equal. The discount received is an income for the buyer. Hence, the balance of the discount received account is shown on the credit side.

Journal 1 Entry for Cash Paid

The accounting records will show the following bookkeeping entries when the cash is paid to the supplier after deduction of the cash discount received.

Cash Paid Bookkeeping Entries Explained

The amount owed to the supplier (500) would have been sitting as a credit on the accounts payable account. The debit above reduces the balance on the accounts payable account to the amount of the cash discount received (10).

The Accounting Equation

The Accounting Equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business. This is true at any time and applies to each transaction. For this transaction the accounting equation is shown in the following table.

Journal 2 Cash Discount Received Entry

The accounting records will show the following bookkeeping entries for the cash discount received when the discount is posted to clear the remaining balance on the suppliers account.

Cash Discount Received Bookkeeping Entries Explained

The balance of the amount owed to the supplier (500 – 490 = 10) would have been sitting as a credit on the accounts payable account. The debit above clears the amount due to the suppler and reduces the balance to zero.

The Accounting Equation

The Accounting Equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business, this is true at any time and applies to each transaction. For this transaction the accounting equation is shown in the following table.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

What does discounting increase?

Discount received ↑ increases the income for a buyer , on the other hand, it also ↓ decreases the actual amount to be paid for purchases.

What is journal entry for discount received?

Journal entry for discount received is essentially booked with the help of a compound journal entry.

Is discount received credited?

While posting a journal entry for discount received “Discount Received Account” is credited . Discount received acts as a gain for the business and is shown on the credit side of a profit and loss account.

Is discount allowed in books of the seller?

Discount received by a buyer is discount allowed in the books of the seller. Following examples explain the use of journal entry for discount received in the real-world scenarios.

What is a discount received?

A discount received is the reverse situation, where the buyer of goods or services is granted a discount by the seller. The examples just noted for a discount allowed also apply to a discount received.

What is Discount Allowed and Discount Received?

A discount allowed is when the seller of goods or services grants a payment discount to a buyer. This discount is frequently an early payment discount on credit sales, but it can also be for other reasons, such as a discount for paying cash up front, or for buying in high volume, or for buying during a promotion period when goods or services are offered at a reduced price. It may also apply to discounted purchases of specific goods that the seller is trying to eliminate from stock, perhaps to make way for new models.

What is a discount in accounting?

When the seller allows a discount, this is recorded as a reduction of revenues, and is typically a debit to a contra revenue account. For example, the seller allows a $50 discount from the billed price of $1,000 in services that it has provided to a customer. The entry to record the receipt of cash from the customer is a debit of $950 to the cash account, a debit of $50 to the sales discount contra revenue account, and a $1,000 credit to the accounts receivable account. Thus, the net effect of the transaction is to reduce the amount of gross sales.