Does Vanguard have a gold ETF?

Vanguard gold ETF is a fund that invests in shares of companies, governments, and other securities related to the mining industry. It’s managed by Vanguard Group, an investment company with over $3 trillion in assets under management (AUM).

Which Vanguard ETFs should I invest in?

Vanguard Russell 2000 Value ETF holds a Zacks ETF Rank of 2 (Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, VTWV is an outstanding option for investors seeking exposure to the Style Box - Small Cap Value segment of the market.

How to withdraw money from Vanguard?

To withdraw money from Vanguard, you need to go through the following steps: Log in to your account Select ‘Withdrawal’ or ‘Withdraw funds’ from the appropriate menu Select the withdrawal method and/or the account to withdraw to Enter the amount to be withdrawn, and, if prompted, a short reason or description Submit your request

What is a vanguard small cap index fund?

Vanguard Small-Cap Index Fund offers a well-diversified, low-turnover portfolio that is representative of the U.S. small-cap market. Despite having a well-constructed portfolio, small-cap stocks ...

What is a Vanguard settlement fund?

Your settlement fund is used to pay for and receive proceeds from brokerage transactions, including Vanguard ETFs®, in your Vanguard Brokerage Account.

What is a Vanguard settlement fund in Roth IRA?

Your money gets transferred to a “settlement fund” inside of your traditional IRA. The settlement fund is in the Vanguard Federal Money Market Fund. This settlement fund will hold your money (i.e. prevent you from using it) that you wired from your bank account for up to 7 days.

Can I withdraw money from settlement fund?

If you have a structured settlement in which you receive your personal injury lawsuit award or settlement over time, you might be able to "cash-out" the settlement. To do this, you sell some or all of your future payments in exchange for getting cash now.

Can you withdraw from settlement fund Vanguard?

Once the proceeds from your sale settle in the settlement fund, you can transfer the money to your linked bank account. From the Vanguard homepage, search "Sell funds" or go to the Sell funds page. Select your bank account from the drop-down menu in step two under Where is your money going?

Can you withdraw from a Roth IRA settlement fund?

The early withdrawal penalty for a Roth or traditional IRA is 10% of the amount you withdraw before age 59½. You may also owe income tax in addition to the penalty. You can withdraw contributions (but not earnings) at any time from a Roth IRA, without being subject to tax and the penalty.

What is the interest rate on Vanguard settlement fund?

The fund's current 7-day SEC yield (August 21, 2020) is 0.09%. The fund's expense ratio is 0.11%. The performance of the fund's benchmark (US Government Money Market Funds Average) is as follows: 1 year, 0.93%; 5 years, 0.68%; 10 years, 0.34%. Performance data as of June 30, 2020.

What to do with a $100000 settlement?

What to Do with a $100,000 Settlement?Sort Out Tax Implications.Find a Financial Advisor.Pay Off the Debts.Invest in a Retirement Home.Start a Business or Help Friends and Family.Donate the Money to the Needy.Final Words.

What are settlement funds?

This holds the money you use to buy securities, as well as the proceeds whenever you sell.

How long does it take for funds to settle Vanguard?

Each trade settles in 2 business days, so you'll be late paying for stock X, which you bought on Monday. Any 3 violations in a rolling 52-week period trigger a 90-day funds-on-hand restriction. During this time, you must have settled funds available before you can buy anything.

Why can't I withdraw my money from Vanguard?

When you sell funds you'll need to wait for the trade to settle before you can withdraw the cash. This normally happens 2 business days after the trade completes.

What happens when you trade with unsettled funds?

When you use unsettled sale proceeds to purchase another security, you agree in good faith to hold the new purchase until the funds from the original sale settle. For example: Consider you sold stock XYZ for $5,000 on Monday. Then, on Tuesday, you used the unsettled funds to purchase stock ABC for $4,000.

Are Vanguard funds safe?

The company is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Vanguard is considered safe because it has a long track record and it is overseen by top-tier regulators.

Does a settlement fund earn interest?

The plaintiff receives all interest earned while the money remains in the fund. In the case of a settlement for millions of dollars, daily interest payments can mean thousands of dollars in additional money in the plaintiff's pocket.

What are settled funds?

What are settled funds or settled cash? You guessed it: Settled funds are basically the inverse of unsettled funds. Proceeds from selling a security become settled funds after the settlement period has ended. Similarly, cash you deposit or wire into your brokerage account to use for trading is considered settled.

How long does it take for funds to settle Vanguard?

Vanguard - settlement date. The date by which a broker must receive either cash or securities to satisfy the terms of a security transaction. The settlement date for stocks and bonds is three business days following the execution of the trade.

How do I transfer money from Vanguard to Roth IRA?

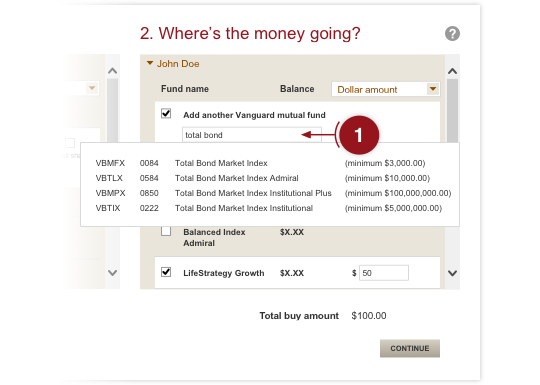

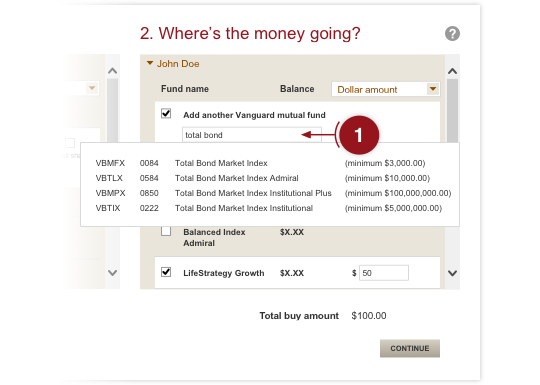

How do I send money from my bank to Vanguard?From the Vanguard homepage, search "Buy funds" or go to the Buy funds page. ... Select the checkbox next to an existing fund. ... Once you select a checkbox, a textbox will appear below it. ... When you enter fund information in the text box, fund choices will appear.More items...

What Is A Settlement Fund?

A settlement fund is a fund where your money sits after you sell your investments or receive dividends. You can withdraw that money and transfer it to your regular checking account.

How much investment is required for Vanguard Total Stock Market Index fund?

The minimum investment requirement for that fund is $3,000.

How long does it take to transfer money to Vanguard?

A transfer from your bank to your Vanguard account can take a few days before the money is cleared and ready to use. So having that money ready is crucial.

Where do dividends go?

Dividends you receive from your stocks or other securities go directly to your settlement fund. So if you want to grow your investments, set your account to “reinvest” so that the dividends can automatically be used to buy more shares.

Does a settlement fund earn interest?

Your settlement fund will earn you some interest on the money it contains , but not a lot. To learn more about the interest, visit Vanguard.