The PRICE Formula in Excel has 7 segments: Settlement: This refers to the calendar day on which the deal is settled. The argument passed to this bracket is the date following the date of issue when the security or bond is traded on the market to the entity who is the buyer of said security bond.

Full Answer

How do you find the price of a bond in Excel?

The PRICE Function Calculates the price of a bond. To use the PRICE Excel Worksheet Function, select a cell and type: settlement – It’s the settlement date of the security or the date at which the security is purchased. It’s the date that comes after the issuing date of the security.

Where do I enter settlement and maturity dates in Excel?

It is recommended that the settlement and maturity dates should be entered in the YIELD function as references to cells containing the dates or dates returned from formulas. You can also use the PRICE function in VBA. Type:

What is the settlement error in Excel?

Error occurs if the dates of the settlement or the maturity arguments are not valid Excel dates. It is recommended that the settlement and maturity dates should be entered in the YIELD function as references to cells containing the dates or dates returned from formulas. You can also use the PRICE function in VBA. Type:

How do you determine the settlement date of a bond?

Settlement (required argument) – The bond’s settlement date or the date that the coupon is purchased. The bond’s settlement date should be after the issue date. Maturity (required argument) – This is the bond’s maturity date or the date when the bond expires.

What is settlement in bond?

How to Use the PRICE Function in Excel?

What happens if the value passed as a frequency in the formula of the price function is anything other than 4, 2,?

What is the bracket rate?

See 1 more

About this website

What is settlement in price function Excel?

Explanation of Price in Excel Settlement: Settlement is referred to as the date on which the bond is settled. The value mentioned as the settlement is the date after the issuing date when the bond/security is traded to the security buyer.

What is settlement in Excel formula?

The settlement date is the date a buyer purchases a coupon, such as a bond. The maturity date is the date when a coupon expires. For example, suppose a 30-year bond is issued on January 1, 2008, and is purchased by a buyer six months later.

What is settlement in duration Excel?

The DURATION function uses the following arguments: Settlement (required argument) – This is the security's settlement date or the date on which the coupon is purchased. Maturity (required argument) – The security's maturity date or the date on which the coupon expires.

How do you price a bond using Excel?

Calculate price of an annual coupon bond in Excel You can calculate the price of this annual coupon bond as follows: Select the cell you will place the calculated result at, type the formula =PV(B11,B12,(B10*B13),B10), and press the Enter key.

How is settlement date calculated?

The settlement date for stocks and bonds is usually two business days after the execution date (T+2). For government securities and options, it's the next business day (T+1). In spot foreign exchange (FX), the date is two business days after the transaction date.

How do I calculate bond duration in Excel?

0:022:56Bond Duration Calculation in Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipBy one plus the semi-annual discount factor raised to the power. So the fourth period is raised toMoreBy one plus the semi-annual discount factor raised to the power. So the fourth period is raised to the fourth. Period.

What is settlement in Mduration?

settlement - The settlement date of the security, the date after issuance when the security is delivered to the buyer. maturity - The maturity or end date of the security, when it can be redeemed at face or par value. rate - The annualized rate of interest. yield - The expected annual yield of the security.

How do you use the duration function in Excel?

The DURATION function, one of the Financial functions, returns the Macauley duration for an assumed par value of $100. Duration is defined as the weighted average of the present value of cash flows, and is used as a measure of a bond price's response to changes in yield....Syntax.BasisDay count basis4European 30/3604 more rows

How do you calculate the modified duration of a bond in Excel?

Enter "Modified Duration" into cell A8 and the formula "=MDURATION (B2, B3, B4, B5, B6, B7)" into cell B8. The resulting modified duration is 7.59.

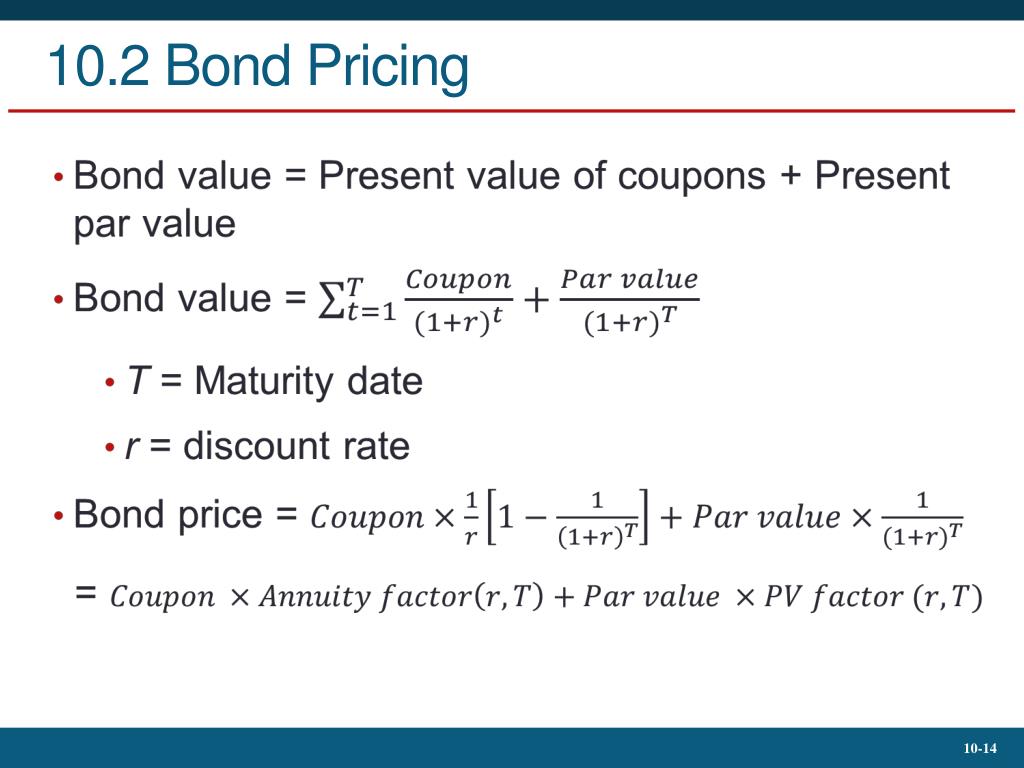

How do you calculate bond price?

Bond Price = C* (1-(1+r)-n/r ) + F/(1+r)nF = Face / Par value of bond,r = Yield to maturity (YTM) and.n = No. of periods till maturity.

How do I calculate the future value of a bond in Excel?

Excel FV FunctionSummary. ... Get the future value of an investment.future value.=FV (rate, nper, pmt, [pv], [type])rate - The interest rate per period. ... The future value (FV) function calculates the future value of an investment assuming periodic, constant payments with a constant interest rate.

How do I calculate present value in Excel?

0:334:36How to calculated Present Value in Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipLike the future value calculations when you're calculating. Present. Value you need to ensure thatMoreLike the future value calculations when you're calculating. Present. Value you need to ensure that the time periods are all consistent. This means that you will need to divide an annual interest rate

How do you calculate remaining balance in Excel?

=SUM(C5:C11)-SUM(D5:D11) Here the SUM function adds all the earnings and expenses and then we just simply subtract the total expenses from the total earnings. Now hit ENTER and you will see the remaining balance for that week.

How do you calculate using Excel?

How to do calculations in ExcelType the equal symbol (=) in a cell. This tells Excel that you are entering a formula, not just numbers.Type the equation you want to calculate. For example, to add up 5 and 7, you type =5+7.Press the Enter key to complete your calculation. Done!

How do you set Excel to calculate automatically?

How to turn on auto calculate in ExcelNavigate to the Excel calculation options menu. ... Select the auto calculate option. ... Set up your data. ... Ensure auto calculate is active for formulas. ... Select your formula. ... Insert your formula.

How do you solve Iteratives in Excel?

2:113:25Iterative Solutions/Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipThis and if you don't have that iterative solver enabled. This won't work it'll give you an error.MoreThis and if you don't have that iterative solver enabled. This won't work it'll give you an error. So I press Enter now the iterations. I've set to 1.

PRICE Function - Formula, Examples, How to Price a Bond

What is the PRICE Function? The PRICE Function is categorized under Excel FINANCIAL functions.It will calculate the price of a bond per $100 face value that pays a periodic interest rate. In financial analysis, the PRICE function can be useful when we wish to borrow money by selling bonds instead of stocks.If we know the parameters of the bond to be issued, we can calculate the breakeven price ...

What is settlement in bond?

Settlement: This refers to the calendar day on which the deal is settled. The argument passed to this bracket is the date following the date of issue when the security or bond is traded on the market to the entity who is the buyer of said security bond.

How to Use the PRICE Function in Excel?

PRICE Function in Excel is very simple and easy to use. Let’s understand the working of the PRICE Function in Excel with some examples.

What happens if the value passed as a frequency in the formula of the price function is anything other than 4, 2,?

If the value passed as a frequency in the formula of the PRICE function is anything other than 4, 2, or 1, then the PRICE function would return the #NUM! error as the end result.

What is the bracket rate?

Rate: This bracket refers to the annual interest rate of the security or bond at which coupon payments are processed or made.

What is a European bond option?

A European bond option gives the holder the right (but not the obligation) to trade a bond at a predetermined date at a predetermined price (the strike price). The bond option is in-the-money if the trade is profitable. If not, the holder does not have to trade the bond and only loses the initial premium.

What happens when interest rates fall on a bond?

If interest rates fall, the issuer has the privilege of exercising the option. The issuer then refinances and reissues the bonds at a lower interest rates.

What is puttable bond?

A puttable bond consists of an interest-bearing bond and an associated put option. Puttable bonds allows the holder to force the issuer to buy the bond back. These are often exercised if interest rates rises; the holder forces the issuer to repurchase the bonds, and then buys a bond with a higher coupon.

What is the Schaefer and Schwartz method?

The Schaefer & Schwartz (1987) method uses a one-factor duration model to generate bond volatilities. It assumes that a longer bond results in greater price volatility.

What is formulas in Excel?

In this accelerated training, you'll learn how to use formulas to manipulate text, work with dates and times, lookup values with VLOOKUP and INDEX & MATCH, count and sum with criteria, dynamically rank values, and create dynamic ranges. You'll also learn how to troubleshoot, trace errors, and fix problems. Instant access. See details here.

What is the value of an asset?

The value of an asset is the present value of its cash flows. In this example we use the PV function to calculate the present value of the 6 equal payments plus the $1000 repayment that occurs when the bond reaches maturity. The PV function is configured as follows:

What is the settlement date of a security?

settlement – It’s the settlement date of the security or the date at which the security is purchased. It’s the date that comes after the issuing date of the security. maturity – It’s the date at which the bond or security expires, and the principal amount is paid back to bond or security holder.

What is YLD in bond?

yld – It’s the annual yield of bond or security.

What is the price function?

The PRICE Function Calculates the price of a bond.

Community Q&A

Include your email address to get a message when this question is answered.

About This Article

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time. This article has been viewed 95,800 times.

What is the basis of a bond?

Basis (optional argument) – Specifies the financial day count basis that is used by the bond.

How to use the PRICE Function in Excel?

As a worksheet function, PRICE can be entered as part of a formula in a cell of a worksheet. To understand the uses of the function, let’s consider an example:

What is the required argument for a bond?

Settlement (required argument) – The bond’s settlement date or the date that the coupon is purchased. The bond’s settlement date should be after the issue date. Maturity (required argument) – This is the bond’s maturity date or the date when the bond expires. To understand settlement and maturity, let’s take an example: a 30-year bond ...

What does YLD mean in bond?

Yld (required argument) – The annual yield of the bond.

When we provide invalid numbers for the arguments rate of interest, redemption, frequency, or basis?

That is, if the interest rate is less than zero, the yield is less than zero, redemption value is less than or equal to zero, or frequency is any number other than 0,1,2,3,4, or basis is any number other than 0,1,2,3,4.

When will 30-year bonds maturity?

The issue date would be January 1, 2017, the settlement date would be July 1, 2017, and the maturity date would be January 1, 2047, which is 30 years after the January 1, 2017 issue date.

When to use the price function?

In financial analysis, the PRICE function can be useful when we wish to borrow money by selling bonds instead of stocks . If we know the parameters of the bond to be issued, we can calculate the breakeven price of a bond using this function.

What is settlement in bond?

Settlement: This refers to the calendar day on which the deal is settled. The argument passed to this bracket is the date following the date of issue when the security or bond is traded on the market to the entity who is the buyer of said security bond.

How to Use the PRICE Function in Excel?

PRICE Function in Excel is very simple and easy to use. Let’s understand the working of the PRICE Function in Excel with some examples.

What happens if the value passed as a frequency in the formula of the price function is anything other than 4, 2,?

If the value passed as a frequency in the formula of the PRICE function is anything other than 4, 2, or 1, then the PRICE function would return the #NUM! error as the end result.

What is the bracket rate?

Rate: This bracket refers to the annual interest rate of the security or bond at which coupon payments are processed or made.