What is the new SEC T2 settlement cycle?

SEC Adopts T+2 Settlement Cycle for Securities Transactions. The Securities and Exchange Commission today adopted an amendment to shorten by one business day the standard settlement cycle for most broker-dealer securities transactions. Currently, the standard settlement cycle for these transactions is three business days, known as T+3.

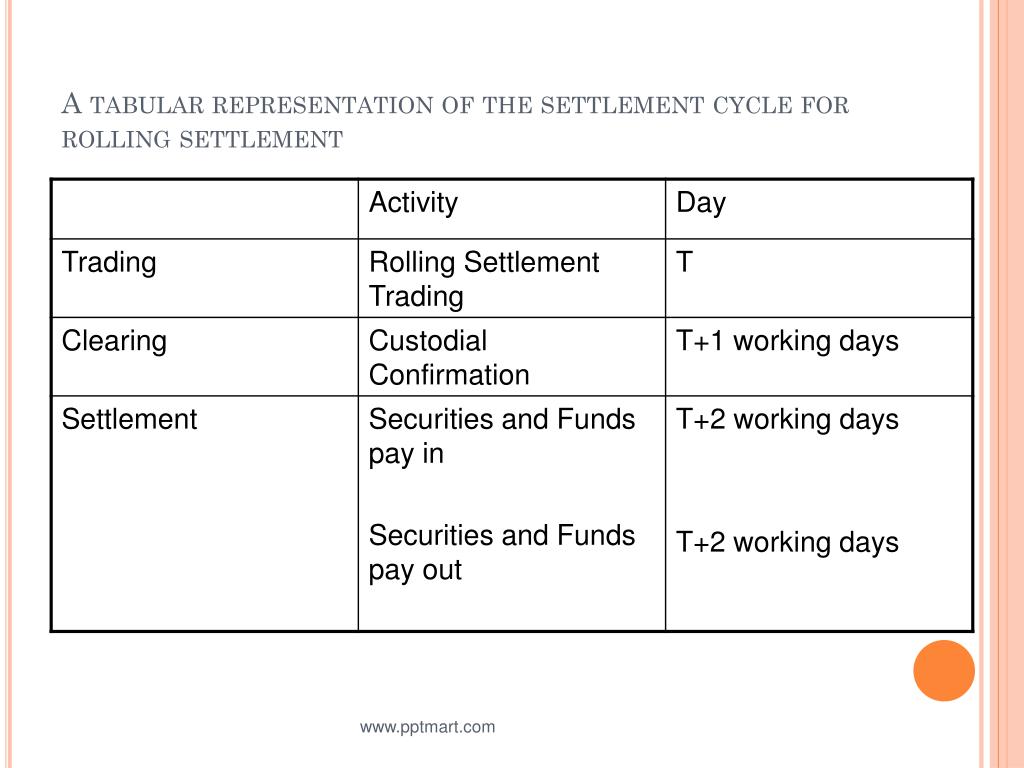

What does T+2 mean in trading?

Settling Securities Transactions, T+2 Investors must complete or "settle" their security transactions within two business days. This settlement cycle is known as "T+2," shorthand for "trade date plus two days."

How long does it take to settle a T+3 transaction?

The Securities and Exchange Commission today adopted an amendment to shorten by one business day the standard settlement cycle for most broker-dealer securities transactions. Currently, the standard settlement cycle for these transactions is three business days, known as T+3.

What is the standard settlement cycle for broker-dealers?

The Securities and Exchange Commission today adopted an amendment to shorten by one business day the standard settlement cycle for most broker-dealer securities transactions. Currently, the standard settlement cycle for these transactions is three business days, known as T+3. The amended rule shortens the settlement cycle to two business days, T+2.

Why is the settlement cycle T 2?

This settlement cycle is known as "T+2," shorthand for "trade date plus two days." T+2 means that when you buy a security, your payment must be received by your brokerage firm no later than two business days after the trade is executed.

What is t1 and t2 settlement?

T' is the transaction date. The abbreviations T+1, T+2, and T+3 refer to the settlement dates of security transactions that occur on a transaction date plus one day, plus two days, and plus three days, respectively. 1. As its name implies, the transaction date represents the date on which the actual trade occurs.

Can we sell shares on t2 day?

The day you sell the stocks is again called the trading day, represented as 'T Day'. The moment you sell the stock from your DEMAT account, the stock gets blocked. Before the T+2 day, the blocked shares are given to the exchange.

Does t2 settlement include weekends?

It is the date when the buyer becomes a shareholder of the company. Similarly, if the buyer initiates a trade with the seller on Friday with a T+2 settlement date, the transaction will be settled on Tuesday. The settlement date excludes weekends, and only Monday and Tuesday will be considered as business days.

What if I sell my shares on T1 day?

While you can now sell your T1 holdings on the app, the sell amount will be credited to your account only on T+1 day. However, due to settlement issues from the Exchange, the amount for holdings bought this week & sold today, 3rd September 2020, will not be credited to your account today.

What is the 3 day rule in stocks?

In short, the 3-day rule dictates that following a substantial drop in a stock's share price — typically high single digits or more in terms of percent change — investors should wait 3 days to buy.

Can you sell before T 2?

Yes. Intersettlement (IS) product allows you to sell the shares bought under 'Cash' before getting delivery of shares. The benefits of Inter settlement (IS) is that you can sell the shares bought under 'Cash' on T+1 or T+2th day without waiting for it to get credited in Demat account.

Can I sell T2 holdings?

Yes, you can Sell the T1 & T2 Shares if the same is not in Trade to trade category.

Can I sell a stock before T 2?

In the normal trading process, shares are credited in T+2 days with T being the day of order execution. You cannot sell shares before delivery in normal trading. However, with BTST, you can sell shares the same day or with T+2 days. This helps traders to benefit from short-term price surge in the stocks.

What time of day does T 2 settle?

When does settlement occur? For most stock trades, settlement occurs two business days after the day the order executes, or T+2 (trade date plus two days). For example, if you were to execute an order on Monday, it would typically settle on Wednesday.

Can I use funds on settlement date?

While your funds remain unsettled until the completion of the settlement period, you can use the proceeds from a sale immediately to make another purchase in a cash account, as long as the proceeds do not result from a day trade.

What happens if you buy shares today and sell tomorrow?

If you buy shares today, but instead of selling them by the end of the day (intraday trading) or after several days, you hold onto those shares till the market opens the next day and then sell it by the end of the next day (tomorrow) that is called BTST trading.

What is T1 settlement?

T+1 means that trade-related settlements must be done within one day of the transaction's completion. Trades on Indian stock exchanges are currently settled in two working days after the transaction is completed (T+2).

What is settled T1?

T+1 stock settlement allows you to purchase replacement shares to use against an assignment and potentially preclude capital gains and a higher tax liability. This strategy may be appropriate if you wish to continue to hold shares in your account that were subject to the option assignment.

What is t3 settlement?

T+3. The settlement date for securities transactions such as a stock sale. It refers to the obligation in the brokerage business to settle securities trades by the third day following the trade date.

What is t3 settlement type?

Investors must settle their security transactions in three business days. This settlement cycle is known as "T+3" — shorthand for "trade date plus three days." This rule means that when you buy securities, the brokerage firm must receive your payment no later than three business days after the trade is executed.

What is the two day settlement date?

The two-day settlement date applies to most security transactions, including stocks, bonds, municipal securities, mutual funds traded through a brokerage firm, and limited partnerships that trade on an exchange. Government securities and stock options settle on the next business day following the trade.

How long does it take to settle a security?

Investors must complete or "settle" their security transactions within two business days. This settlement cycle is known as "T+2," shorthand for "trade date plus two days.". T+2 means that when you buy a security, your payment must be received by your brokerage firm no later than two business days after the trade is executed.

How long is the standard settlement cycle?

Currently, the standard settlement cycle for these transactions is three business days, known as T+3.

When is 15c6-1 a compliance date?

The compliance date for the amendment to Rule 15c6-1 (a) is Sept. 5, 2017 , which is consistent with the target implementation date set by the Industry Steering Committee.

Why is the settlement date a little trickier?

However, the settlement date is a little trickier because it represents the time at which ownership is transferred . It's important to understand that this doesn't always occur on the transaction date and varies depending on the type of security.

Why is it important to know the settlement date of a stock?

Knowing the settlement date of a stock is also important for investors or strategic traders who are interested in dividend-paying companies because the settlement date can determine which party receives the dividend. That is, the trade must settle before the record date for the dividend in order for the stock buyer to receive the dividend.

How to clear a security transfer?

In order to clear the transfer of a security from a seller to a buyer, it must go through a settlement process, which creates a delay between the time a trade is made ('T') and when it settles.

Do all mutual funds have the same settlement period?

Not every security will have the same settlement periods. All stocks and most mutual funds are currently T+2. 3 However, bonds and some money market funds will vary between T+1, T+2, and T+3.

What is a two day settlement period?

The two-day settlement period applies to most security transactions, including stocks, bonds, municipal securities, mutual funds traded through a brokerage firm, and limited partnerships that trade on an exchange. Two-day settlement has also been the convention in the off-exchange foreign exchange market well before exchanges moved to this convention.

When does the T+2 start?

The first day of a two-day settlement period (T+2) starts on the business day following the day that a security was purchased or sold. For example, if a stock is purchased on Friday at any time before the close of trade on that day, Saturday, Sunday and public holidays are not considered business days, so the two-day clock starts running on ...

Why is T+2 delayed?

The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. T+2 is the standard settlement period for normal trades on a stock exchange, and any other conditions need to be handled on an "off-market" basis.

What is the settlement period in stock market?

There were two main types of settlement period used by different countries, either a fixed number of days after the transaction known as fixed settlement lag or periodically on a fixed date when all transactions up to that date are settled known as fixed settlement date. In France, Italy, and, to some extent, Switzerland and Belgium, as well as some developing countries, the settlement of all transactions took place once a month on a fixed date. This system was instituted by Napoleon. The last day of trading on which all trades are settled was called the liquidation. The liquidation took place on the seventh business day preceding the end of the calendar month.

What is T+2 in financial markets?

In financial markets T+2 is a shorthand for trade date plus two days indicating when securities transactions must be settled. The rules or customs in financial markets are for securities transactions to be settled within a commonly understood 'settlement period'.

How long is a T+2 trade date?

In 2017, the move by most stock exchanges is towards adoption of T+2 (trade date plus two days). For example, the United Kingdom adopted T+2 in October 2014 and the United States adopted T+2 in September 2017.

How long did it take to settle a trade in the 1700s?

This led to a standard settlement period of 14 days which was the time it usually took for a courier to make the journey on horseback and by ship. Most exchanges continued to use the same model over the next few hundred years.

What is the settlement cycle?

The settlement cycle, or period, is the time between the transaction date and the settlement date. 2. The transaction date marks the date that the buyer and seller agree to trade, whereas the settlement date marks the date the seller delivers the security’s certificate and the buyer transfers the appropriate funds.

How long is the stock settlement cycle?

In September 2017, the Security and Exchange Commission (SEC) shortened the standard settlement cycle for broker-dealer stock transactions from three days to two. This change was made to reduce risks to market participants, but it was unclear what the exact effects would be on financial markets.

What is the first proxy for borrowing constraints?

Our first proxy for borrowing constraints is average pre-event market capitalization. Geczy, Musto, and Reed (2002) show that small-cap securities are associated with higher lending fees than large-cap securities. Therefore, we rank securities into quartiles based on their average pre-event MCAP, where Q1 refers to small-cap securities (hardest to borrow) and Q4 refers to large-cap securities (easiest to borrow). We then estimate specifications of the following regression equation on security-day observations:

How does average daily trading activity change after settlement cycle?

In our first set of tests, we find that average daily trading activity increases and average daily trading costs decrease after the change in the settlement cycle, other factors held constant. For instance, we find that average daily dollar volume increases by 14.25 percentage points after the change and the number of trades increases by 11.25 percentage points. We also show that average daily quoted and effective bid-ask spreads narrow around the time of the change. The decrease in transaction costs appears to be driven by a lowering of fees by financial intermediaries, as realized spreads decline but price impacts remain constant. To the extent that trading activity and bid-ask spreads proxy liquidity, our results indicate a significant improvement in security-level liquidity after the settlement cycle is altered to T+2.

How does a shortened settlement cycle affect liquidity?

When the SEC initially proposed the shortened settlement cycle, it argued that it would increase liquidity by improving financial intermediaries’ access to funds, and decreasing their default risk. This, in turn, could decrease bid-ask spreads and increase trade volume. Some financial scholars disagreed, arguing that a shortened settlement cycle might hinder intermediaries’ borrowing capacity, leading to decreased liquidity.

How does the change in settlement cycle affect trading activity?

The average $Volume (# of Trades) for securities in increases by 2.11 (3.26) percentage points more than for securities in after the change. The average $Volume (# of Trades) for securities in increases by 1.61 (1.66) percentage points more than for securities in after the change. Therefore, if a security’s market capitalization proxies borrowing constraints, the smaller and more difficult-to-borrow securities experience a greater increase in trading activity after the change.

What is settlement in financial markets?

In financial markets, settlement refers to the seller’s obligation to produce a certificate and executed share-transfer form to exchange with the buyer for a corresponding payment. 1#N#Settlement cycles have evolved from delivering physical security certificates to delivering electronic share-transfer forms via an electronic settlement system. Clearing a transaction occurs between the trade date and settlement date, which involves any modifications needed to facilitate settlement.#N#The settlement cycle, or period, is the time between the transaction date and the settlement date. 2#N#The transaction date marks the date that the buyer and seller agree to trade, whereas the settlement date marks the date the seller delivers the security’s certificate and the buyer transfers the appropriate funds.#N#The Securities and Exchange Commission (SEC) dictates the allowable time within which to settle a transaction in US financial markets. The settlement cycle is widely referred to as T+x, representing the trade date (T) plus the number of business days (x). For over two decades, the SEC has required equity transactions to be settled on a T+3 basis. However, the global credit-and-liquidity crisis of the late 2000s led the SEC and the Depository Trust and Clearing Corporation (DTCC) to rethink the risks and costs associated with a prolonged settlement cycle. On September 5, 2017, the SEC adopted Rule 15c6-1 (a), which shortened the standard settlement cycle for nearly all broker-dealer equity transactions from T+3 to T+2.