While the settlement amount is large, the amount any individual gets depends on the number of people who participate in the class action. It’s typically cents on the dollar. One calculation 5 On Your Side saw estimates that anyone who qualifies and had BCBS for five years would get less than $14.

Full Answer

Does BCBS have a settlement?

The Blue Cross Blue Shield Class Action Settlement is not a scam. After eight years of litigation, the Blue Cross Blue Shield Association did not admit fault, but they agreed to a settlement to end litigation. In the settlement, BCBS agreed to make operational changes as well as to provide payment to members of the class involved in the case.

What is BCBS settlement?

The proposed settlement resolves claims that Blue Cross Blue Shield companies conspired to limit competition, in turn boosting costs for policyholders. A judge still needs to approve the settlement. If that happens, a $2.67 billion settlement fund will be established.

Why is BCBS being sued?

The lawsuit claims that Blue Cross violated antitrust laws by reducing competition in their areas, allowing for higher rates on some plans. However, Blue Cross denies allegations of wrongdoing, claiming its actions resulted in lower health care costs and greater access to customers and has agreed to a settlement. Here’s what you should know:

When will the BCBS settlement be paid?

The case will most likely gain final approval in late 2022 and distribute payments in early 2023 if we are lucky. This was a lot to read, so if you made it this far and need any help navigating the settlement, please call us at (312)-204-6969.

What is a settlement with Blue Cross Blue Shield?

Class Representatives (“Plaintiffs”) reached a Settlement on October 16, 2020 with the Blue Cross Blue Shield Association (“BCBSA”) and Settling Individual Blue Plans. BCBSA and Settling Individual Blue Plans are called “Settling Defendants.”. Plaintiffs allege that Settling Defendants violated antitrust laws by entering into an agreement not ...

What is this Settlement about?

This settlement, arising from a class action antitrust lawsuit called In re: Blue Cross Blue Shield Antitrust Litigation MDL 2406, N.D. Ala. Master File No. 2:13-cv-20000-RDP (the “Settlement”), was reached on behalf of individuals and companies that purchased or received health insurance provided or administered by a Blue Cross Blue Shield company. Class Representatives (“Plaintiffs”) reached a Settlement on October 16, 2020 with the Blue Cross Blue Shield Association (“BCBSA”) and Settling Individual Blue Plans. BCBSA and Settling Individual Blue Plans are called “Settling Defendants.”

How do I participate in the Settlement?

To make a claim and receive a payment, you must file a claim form online or by mail postmarked by November 5, 2021. Claims may be submitted online or by mail to:

Who decides whether to approve a settlement?

The Court in charge of this case still has to decide whether to approve the Settlement. Payments will be made if the Court approves the Settlement and after any appeals are resolved. Please be patient.

How did settlement defendants violate antitrust laws?

Plaintiffs allege that Settling Defendants violated antitrust laws by entering into an agreement not to compete with each other and to limit competition among themselves in selling health insurance and administrative services for health insurance. Settling Defendants deny all allegations of wrongdoing and assert that their conduct results in lower healthcare costs and greater access to care for their customers. The Court has not decided who is right or wrong. Instead, Plaintiffs and Settling Defendants have agreed to a Settlement to avoid the risk and cost of further litigation.

How much did the Blue Cross Blue Shield settlement cost?

OLYMPIA, Wash. – A $2.67 billion settlement to resolve antitrust charges against health insurer Blue Cross Blue Shield will result in payments to some consumers of Premera and Regence health plans in Washington.

What states are covered by the Blue Cross Blue Shield settlement?

The settlement signed in U.S. District Court for the Northern District of Alabama affects the 36 Blue Cross Blue Shield insurers nationwide. In Washington, this includes Premera Blue Cross, Regence BlueShield, Regence BlueShield of Oregon, and Regence BlueShield of Idaho, Inc.

How many people does Blue Cross Blue Shield cover?

Blue Cross Blue Shield member companies cover more than 100 million Americans, or roughly a third of the nation’s population.

Who is the Commissioner of Insurance for Blue Cross Blue Shield?

But Insurance Commissioner Mike Kreidler said the greater benefit will be increased competition among health insurers, especially those in other states that historically have had fewer choices in markets dominated by Blue Cross Blue Shield companies.

When is the Blue Cross Blue Shield settlement?

The final hearing on the settlement will be held on October 20, 2021. Multiple different damages classes including fully insured and self-funded plans are eligible to receive payment under the settlement.

What is a proposed settlement?

The Notice of Proposed Settlement was issued to inform employers and individuals who are eligible for payment (the damage class) about the proposed settlement and give them time to decide what action (if any) they wish to take and the deadlines for doing so. If the settlement is approved, class members will be bound by the terms of the settlement unless they affirmatively opt out of the settlement. The following table describes the options these class members have.

What is total premiums paid?

The total premiums paid will be the sum of premiums paid for commercial health benefit products (including medical, pharmacy, vision, and dental plans) to any of the defendants for coverage during the class coverage periods described above (pro -rated for the partial months of February 2008 and October 2020). This amount will be calculated based on data provided by the Blue Cross member plans. Claimants will not have to submit any premium data unless it is specifically requested.

When are self funded accounts due for Blue Cross?

Self-Funded Accounts [2] (and their employees) that purchased or were enrolled in a Blue Cross or Blue Shield health insurance or administrative services plan between September 1, 2015 – October 16, 2020.

Can an employer ask for settlement information?

Employers may receive questions from their employees about this settlement, including advice on whether to file a claim or requests for information the employee needs to submit as part of their claim submission. While employers do not have any formal obligations to provide any notice/information, it may be helpful to provide some type of notice explaining the settlement to employees and informing them that they may have the right to file their own claims. Employees may also request certain information from employers (e.g., group numbers, policy numbers, coverage dates, etc.) that they need to file their claims. If employers have this information readily available, they may wish to provide it to employees (although again, there is no specific requirement to do so). Employers should be cautious in any communications with employees and should avoid saying or doing anything that appears to dissuade employees from filing their own claims.

How much is the BCBS settlement?

The settlement amount is $2.67 billion.

When did the BCBS settle the class action lawsuit?

In the settlement, reached on October 30, 2020, BCBS did not admit fault, but they did agree to make operational changes ...

How much money might an individual or employer receive?

The final calculation will be based on the number of respondents that join the lawsuit as class members. Sample calculations for individuals and employers are listed below.

What is the unweighted medium claimant per class action suit?

Unweighted medium claimants per class action suit = 8%. However, most potential class members in class action lawsuits are simply just letter or postcard. This suit is a very high profile one with lots of media coverage. Also, the bulk is employer based, so single employers will be collecting for groups of employees.

Is bulk insurance employer based?

Also, the bulk is employer based, so single employers will be collecting for groups of employees. Add to that the reality that essentially all large plans with significant potential settlements will certainly file, thus bringing up the both the average and the medium numbers.

How many members of large, geographically dispersed, self-funded national Employers are eligible for the second blue?

The Second Blue Bid provision of the Settlement Agreement was designed to enable 33 million Members of large, geographically dispersed, self-funded national Employers to have the opportunity to receive a Second Blue Bid.

Why is the Court approving the settlement notice?

The Court authorized the Notice because Class Members have a right to know about the proposed Settlement of certain claims against Settling Defendants in this class action lawsuit and about Class Members' options before the Court decides whether to approve the Settlement. If the Court approves the Settlement, and after objections ...

What is a class action lawsuit?

In a class action lawsuit, one or more people or businesses called class representatives sue on behalf of others who have similar claims. All of the people or businesses who have similar claims together are a “class” or “class members” if the class is certified by the Court. Individual class members do not have to file a lawsuit to participate in ...

Is Blue Cross Blue Shield a class member?

If you were covered by certain Blue Cross Blue Shield health insurance or administrative services plans between February 2008 and October 2020, you may be a Class Member. The Court certified two Settlement Classes in this case, a Damages Class and an Injunctive Relief Class. You may be included in both Settlement Classes.

Can you sue a settlement defendant?

This means that you cannot sue, continue to sue, or be part of any other lawsuit against Settling Defendants that makes claims based on the facts and legal theories involved in this case or any of the business practices the Settling Defendants adopt pursuant to the Settlement Agreement.

Did the court decide in favor of the plaintiffs or settlement defendants?

The Court did not decide in favor of the Plaintiffs or Settling Defendants. Instead, both sides have agreed to the Settlement. Both sides want to avoid the risk and cost of further litigation. The Plaintiffs and their attorneys think the Settlement is best for the Settlement Classes. 5.

Is Medicare Supplemental covered by Settlement?

Medicare Advantage policies are not within the scope of products included in the Settlement classes. However, Medicare Supplemental policies are within the scope of products included in the Settlement classes, so long as they meet the other criteria (e.g., dates of coverage).

What is the proposed settlement for Blue Cross Blue Shield?

The proposed settlement resolves claims that Blue Cross Blue Shield companies conspired to limit competition, in turn boosting costs for policyholders.

How long does it take to fill out a claim form?

Filling out the claim form takes only a few minutes. You will need your insurance subscriber information.

How much did the Blue Cross Blue Shield settlement cost?

A tentative settlement was reached with Blue Cross Blue Shield agreeing to pay settlement class members. This $1.9 billion settlement applies to individuals who have branded BCBS individual policies, some self-insured groups, fully insured groups and the employees of these companies.

When did the BCBS settlement come into effect?

After eight years of litigation, the Blue Cross Blue Shield Association companies reached an agreement on October 30, 2020, pertaining to their alleged national anti-competitive policies.

What is the Blue Cross Blue Shield agreement?

After eight years of litigation, the Blue Cross Blue Shield Association companies reached an agreement on October 30, 2020, pertaining to their alleged national anti-competitive policies. The legal dispute claimed a violation of antitrust law by splitting insurance markets to avoid competition among its member companies.

Introduction

Background

- In 2012, plaintiffs alleged that the Blue Cross Blue Shield Association and its 35 member companies violated the Sherman Antitrust Act by agreeing not to compete in selling health insurance and administration of commercial health benefit products in the United States and Puerto Rico, as well as agreeing to other means of limiting competition in the health insurance m…

Key Provisions of The Settlement

- Under the terms of the settlement, the Blue Cross Blue Shield Association and its member plans would agree to: 1. Make changes to the way they do business to increase opportunities for competition in the health insurance market; and 2. Allow qualified national self-funded accounts to request a second bid for coverage from a member plan of their choice (“Second Blue Bid”). As p…

Damages Classes

- The following classes may be eligible for payment from the settlement amount: 1. Individuals that purchased or were enrolled in a Blue Cross or Blue Shield health insurance or administrative services plan between February 7, 2008 – October 16, 2020; 2. Insured Groups (and their employees) that purchased or were enrolled in a Blue Cross or Blue Shield health insurance or …

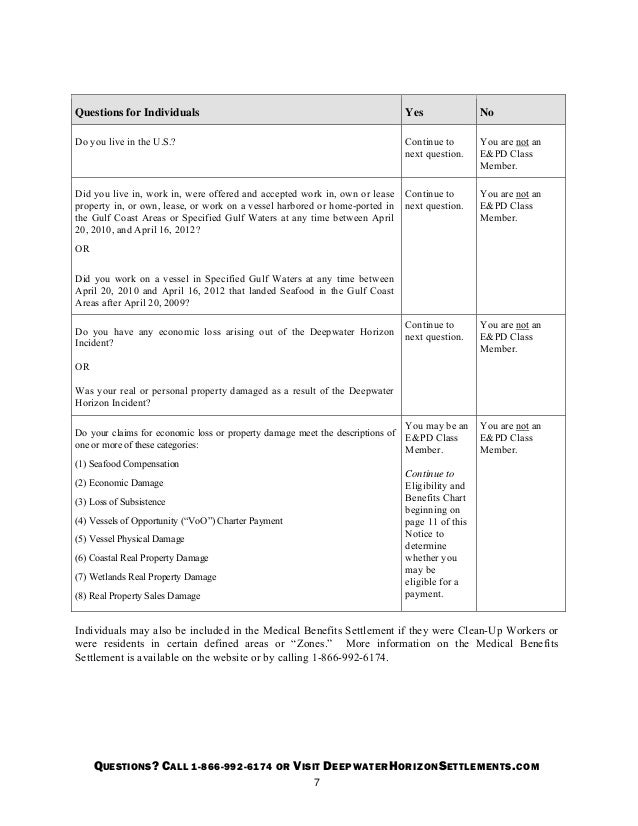

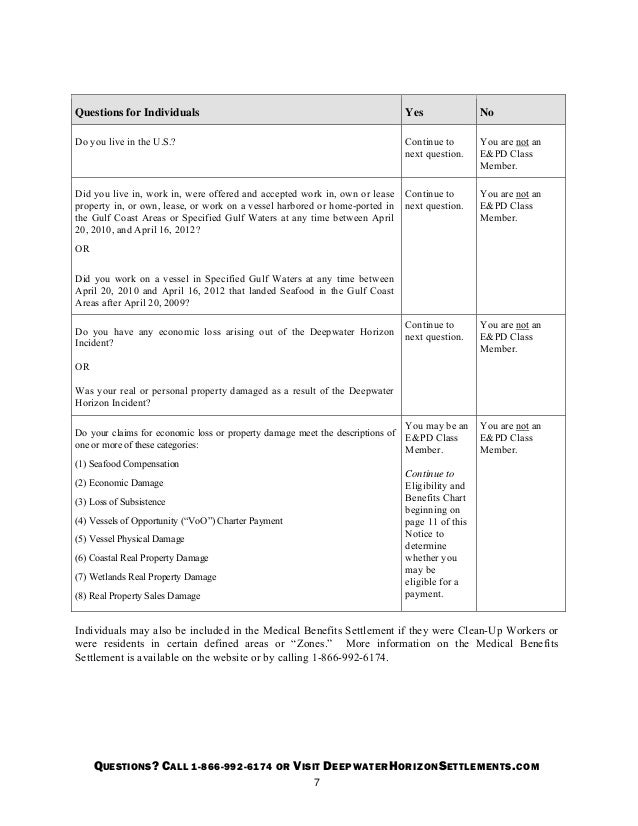

Options For Damage Class Members

- The Notice of Proposed Settlementwas issued to inform employers and individuals who are eligible for payment (the damage class) about the proposed settlement and give them time to decide what action (if any) they wish to take and the deadlines for doing so. If the settlement is approved, class members will be bound by the terms of the settlement unless they affirmatively …

What Can/Should Employers do?

- Employers may receive questions from their employees about this settlement, including advice on whether to file a claim or requests for information the employee needs to submit as part of their claim submission. While employers do not have any formal obligations to provide any notice/information, it may be helpful to provide some type of notice explaining the settlement to e…

Next Steps

- Next steps for employers who are eligible to file a claim: 1. Decide whether to: 1.1. File Claim 1.1.1. If filing a claim, determine whether to use default assumptions or elect an alternative option for calculating allocation. 1.2. Do Nothing 1.3. Opt Out 1.4. Object 1.5. Speak at Hearing 2. Decide whether to communicate to employees 2.1. If communicating upfront, determine what informatio…

Conclusion

- It is important for employers to keep in mind that any individual settlement amount is likely to be relatively small – e.g., a few hundred dollars for a large employer, and under $100 for any individual employee. So, while it will be important to understand the allocation methods and the filing options, perspective is needed when determining whether to propose an alternative allocati…