List of Claim Settlement Ratio of Health Insurance Companies (2019-2020)

| Insurer Name | Claim Settlement Ratio | Incurred Claim Ratio |

| Aditya Birla Health Insurance | 94% | 49.08% |

| Bajaj Allianz Health Insurance | 98% | 81.96% |

| Bharti AXA Health Insurance | N/A | 77.50% |

| Care Health Insurance (Formerly known as ... | 95% | 55% |

How to calculate settlement ratio in health insurance?

Health Insurance Settlement Ratio has been Calculated as = (Total Claims Settled)/ (Total Reported Claims + Outstanding Claims at Start of Year – Outstanding Claims at End of Year) This is thus the proportion of claims (by number) accepted and paid by the insurance company during the year.

What is the claim ratio in health insurance?

There are two claim ratio that you should be aware of before investing in health insurance. They include Claim Settlement Ratio and Claim Incurred Ratio. Claim Settlement Ratio or CSR is the ratio of claims settled by a health insurance company against the total claims filed in a particular financial period.

What is CSR (claim settlement ratio)?

Claim Settlement Ratio (CSR) is the ratio of the total number of claims settled by an insurance company against the total number of claims available for processing for a financial year. CSR is a good indicator of the claim settlement rate of an insurance company.

What does a lower Claim Settlement Ratio Mean?

A lower claim settlement ratio indicates that more claims have been rejected by the insurance company than have been accepted. This is of course not an ideal statistic. Therefore, make sure to take a look at the claim settlement ratio before settling on a plan. It is released by the Insurance Regulatory and Development Authority of India (IRDAI).

What is the claim settlement ratio?

What should be the incurred claims ratio?

What does lower incurred claim ratio mean?

What does 90% mean in insurance?

What is net claims incurred?

How long is the health insurance ratio?

Is a incurred claims ratio of more than 100% good?

See 4 more

About this website

Which health insurance has best claim settlement ratio?

Among all private insurance companies, HDFC ERGO General Insurance has the best health insurance claim settlement ratio (99.80%) in the financial year 2019-2020.

Which health insurance company is best in claim settlement in India?

Best Health Insurance Companies in IndiaRankHealth Insurance CompanyHealth Claim Settlement Ratio1IFFCO Tokio General Insurance96.33%2Care Health Insurance95.47%3Magma HDI Health Insurance95.17%4The Oriental Insurance Company93.96%24 more rows

What is claim ratio in health insurance?

The incurred claim ratio is equal to the value of all the claims the company has paid divided by the total premium collected during the same period. On the other hand, claim settlement ratio is the total settled claims divided by the total claims filed.

Which insurance company has highest settlement ratio?

The highest claim settlement ratio is of the public insurance company LIC at 98.31%.

Which health insurance is best in India 2022?

Best Health Insurance Policies For September 2022Best Health Insurance Policies.Aditya Birla Activ Health Platinum Enhanced Plan.ICICI Lombard- Complete Health Insurance Policy.STAR Health's Senior Citizens Red Carpet Health Policy.HDFC ERGO My: Health Women Suraksha.Care Youth Health Insurance plan.More items...•

Which health insurer is best?

Top 10 Best Health Insurance Companies in IndiaCare Health Insurance (Formerly Religare Health Insurance)Manipal Cigna Health Insurance Company Limited.Bajaj Allianz Health Insurance Company Limited.New India Assurance Company Limited.Oriental Insurance Company Limited.National Insurance Company Limited.More items...•

Which health insurance has highest claim settlement ratio 2021?

Oriental Insurance is at top with 92.71% and New India Insurance with 91.99% claim settlement ratios.

What is a high claim ratio?

A ratio higher than 100% indicates that the company is incurring losses because the premium collection is insufficient to pay the claims and so the insurer is probably utilizing its reserves to settle claims which is bad news.

What is the claim ratio of Aditya Birla health insurance?

Aditya Birla Health Insurance Co. Ltd has a claim settlement ratio of is 94%.

Which insurance is easy to claim?

Insurance CompaniesClaim Settlement RatioIncurred Claim Ratio ( 2019-2020)Reliance Health Insurance100%89.36%Star Health Insurance90%65.91%SBI Health InsuranceN/A50.54%Tata AIG Health Insurance96%66.61%20 more rows

Which health insurance is best in India 2021?

The Best 5 Health Insurance Plans in India in 2021Aditya Birla Activ Assure Diamond.Aditya Birla Group Activ Health Plan.Aditya Birla Super Top-up.Bajaj Allianz Health Guard.Niva Bupa Health Plus.Manipal Cigna Pro-Health Group.Manipal Cigna Super Top-up Group.Bajaj Allianz Global Personal Guard Policy.

Which is the No 1 general insurance company in India?

General Insurance Corporation of IndiaTop General Insurance Companies in India 2020NoCompanies NameSecurity Code1General Insurance Corporation of India5407162ICICI Lombard General Insurance Company Ltd5407553The New India Assurance Company Ltd540769Apr 18, 2022

Which health insurance is best in India 2021?

The Best 5 Health Insurance Plans in India in 2021Aditya Birla Activ Assure Diamond.Aditya Birla Group Activ Health Plan.Aditya Birla Super Top-up.Bajaj Allianz Health Guard.Niva Bupa Health Plus.Manipal Cigna Pro-Health Group.Manipal Cigna Super Top-up Group.Bajaj Allianz Global Personal Guard Policy.

What is claim settlement ratio of HDFC Ergo?

Among the private general insurance companies, HDFC Ergo General Insurance tops the chart with 99.8% claims settled in first 3 months of making the claim. This is closely followed by Edelweiss General and Go Digit with 99.72% and 99.65%, respectively, within the first 3-month period.

What is the claim settlement ratio of Aditya Birla health insurance?

When buying health insurance cover there is one important factor that you need to check that is. Aditya Birla Health Insurance Co. Ltd has a claim settlement ratio of is 94%.

What is the claim settlement ratio of Max Bupa?

List of Claim Settlement Ratio of Health Insurance Companies (2019-2020)Insurer NameClaim Settlement RatioIncurred Claim RatioLiberty Health Insurance88%87.78%Niva Bupa Health Insurance (Formerly known as Max Bupa Health Insurance)96%53.51%ManipalCigna Health Insurance91%61.64%National Health InsuranceN/A103.30%20 more rows

1. What is a claim number in an insurance claim?

After registering the claim, you will be given a number, which is called a claim number. You can use the claim number as a reference number for fut...

2. How do I apply for an insurance claim?

You need to intimate us to raise a claim. ACKO customers can log in here to initiate a claim or download our mobile app.

3. What is the first step in processing an insurance claim?

The first step in processing an insurance claim is to intimate ACKO and apply for a claim online or by downloading the mobile app.

4. What are the two most common mistakes made while submitting a claim?

Incorrect/Incomplete claim form and claiming the exclusions are the two common mistakes made while filing a claim.

1. What all documents do I need to submit to file a claim with the insurance company?

The need for documents differs for the type of claim and processes of an insurance company. Some of the commonly required documents are:A medical c...

2. From where can I get the claim form and list of documents required to file a claim?

Normally, the claim process is cumbersome and lengthy. However, ACKO aims to make this process simple and faster. The entire process is digital, to...

1. Why does the insurance company reject the claim?

ACKO will reject the claim because of the following reasons:Incomplete claim form/Claim form with wrong informationClaim raised against exclusions...

2. What is a settlement letter in an insurance claim?

A settlement letter is nothing but the request letter to settle the claim. You need to submit the claim settlement letter to ACKO while applying fo...

3. What is a cashless claim settlement in an insurance claim?

Cashless claim settlement is a facility offered by ACKO wherein ACKOsettles the claim directly with the network hospitals (health insurance claims)...

4. How to submit the claim settlement documents to the insurance company?

You can upload the soft copies of the document on the ACKO’s website/app.

What is claim settlement ratio (CSR)?

Claim Settlement Ratio (CSR) is the ratio of the total number of claims settled by an insurance company against the total number of claims that the...

What is a good claim settlement ratio in health insurance?

Claim Settlement Ratio (CSR) is the ratio of the total number of claims settled by an insurance company against the total number of claims that the...

Which health insurance company has best claim settlement?

Health insurance companies in India in the year 2022 with best Claim Settlement Ratio are: IFFCO Tokio General Insurance (96.57%) Magma HDI (96.41%...

Which are the top 5 health insurance companies on the basis of claim settlement ratio CSR?

The top health insurance companies on the basis of Claim Settlement Ratio (CSR) are: IFFCO Tokio health insurance Aditya Birla Health Insurance Baj...

How is health insurance claim ratio calculated?

The formula to calculate health insurance claim ratio is: Incurred Claim Ratio = Net claims incurred / Net Premiums collected. Thus, health insuran...

Why do insurance claims get rejected?

Insurance claims might get rejected if the information offered is wrong or if you miss to add any information. Thus, wrong information is the most...

Best Claim Settlement Ratio Health Insurance Companies In India

Name of the insurer. Health Incurred Claim Ratio (ICR) Claim Settlement Ratio (CSR). Acko General Insurance Limited. 84.64%. 97%. Aditya Birla Health Insurance Company Limited

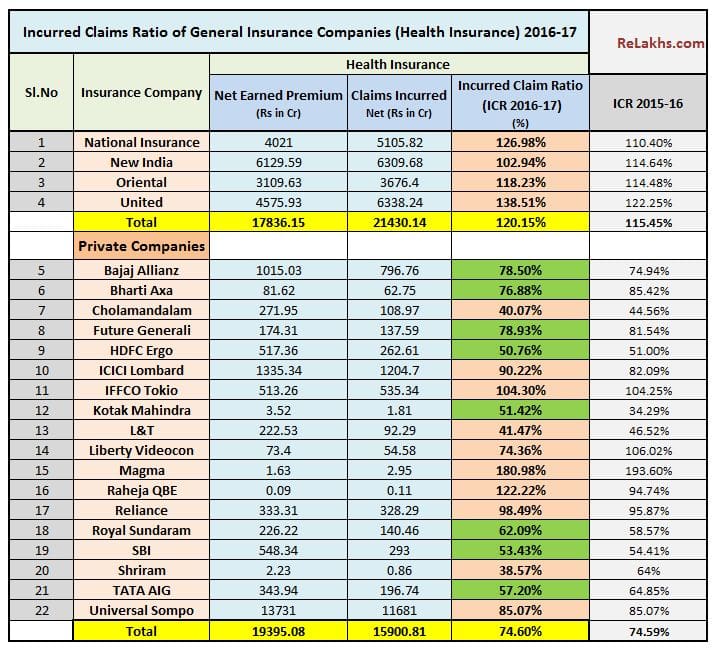

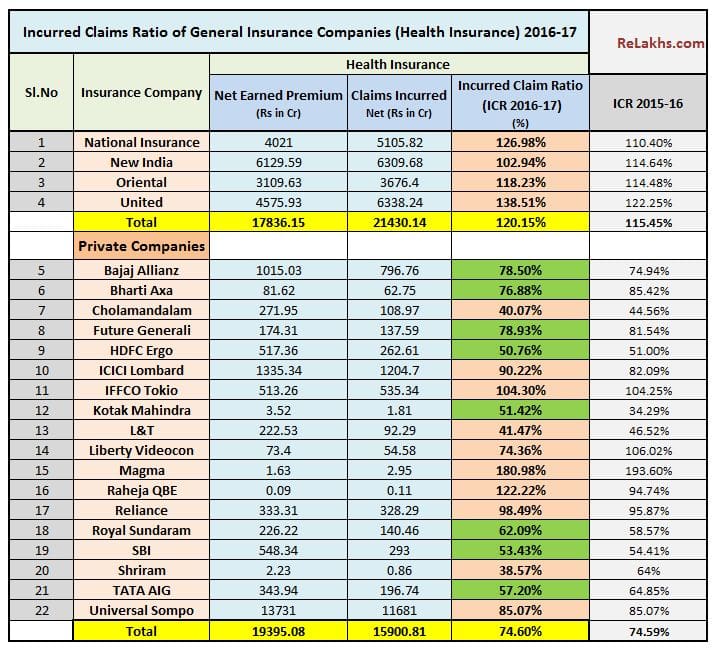

IRDAI Incurred Claims Ratio of Health Insurance Companies

It is suggested to research an insurance company’s service quotient, social medial reviews, and Claim Settlement Ratio (CSR) before making a purchase decision. People also speak with friends and family, and compare health policies online to find the best deal. But there’s one more parameter that is often not looked at – the Incurred Claims Ratio (ICR).

What is a Claim Settlement Ratio in Health Insurance?

Claim Settlement Ratio or CSR in health insurance is the ratio of the number of claims settled against the total number of claims filed during a financial year. It helps in weighing the capability of the insurer to handle customer’s claims. For example, if 100 claims were registered during a financial year, and the insurer was able to settle 94 claims out of them, then the health claim settlement ratio of that health insurance company will be 94% for that particular year.

How to calculate health insurance settlement ratio?

Health Insurance Settlement Ratio has been Calculated as = (Total Claims Settled)/ (Total Reported Claims + Outstanding Claims at Start of Year – Outstanding Claims at End of Year)

Why is health claims ratio important?

Health claims ratio data helps you understand the history of an insurance company’s claim settlement records. It should also be noted that new insurers typically would have a lower settlement ratio. That is because claims filed so early could probably mean a fake ratio.

Why are health insurance claims outstanding?

Health insurance claims could remain outstanding as a result of unfurnished information like doctors certificate. The insurer takes time to validate the expenses incurred during hospitalization.

What is a claim settlement ratio?

The Claim Settlement ratio tells us about the claim solving ability of the insurer. If claims are intimated and the insurer solves those, the claim settlement ratio would be good. A higher claim settlement ratio implies that the majority of claims are getting solved.

What is the ICR in insurance?

Incurred Claim Ratio (ICR) is basically the overall value of every claim a company has paid divided by the total sum of premium collected during the same period.

What are the reasons for rejection of a health insurance policy?

The reasons for rejection could be false claims, untimely intimation, coverage not covered under the policy, etc.

What is Claim Settlement Ratio?

Claim Settlement Ratio (CSR) is the ratio of the total number of claims settled by an insurance company against the total number of claims available for processing for a financial year.

Why is my insurance claim rejected?

Here are some of the reasons that can lead to a rejection of a claim: Claim raised after the insurance policy has lapsed. Claim raised against a disease/damage that is not covered by the insurance policy. Misrepresentation or wrong information in the claim form.

What is cashless settlement?

Cashless claim settlement is a facility offered by ACKO wherein ACKOsettles the claim directly with the network hospitals (health insurance claims)/network garages (motor insurance claims). This means you don’t have to pay anything except for the deductibles as per the policy document.

What does CSR mean in insurance?

CSR is a good indicator of the claim settlement rate of an insurance company. Example: If a company has a Claim settlement ratio of 99%. It means that the insurance company has successfully settled 99% of the claims it received. It should give some comfort to you as to how your claim will get handled in the future.

Why do you need health insurance?

Buying a health insurance policy is not a luxury anymore. It has become a necessity, especially amidst the ongoing pandemic. You buy health insurance to get compensated for the medical expenses incurred due to various health disorders, which are covered by the policy. Before buying a health insurance policy, go through the insurer's after-sales service policies, claim settlement ratio, and also the Incurred claims ratio (ICR). For more information, you can read about the Incurred Claims Ratio for Health Insurance .

What is insurance promise?

Insurance is essentially a promise to help when you incur a financial loss. It’s only natural to verify whether the insurance company will honour that promise or not.

Is it confusing to choose the right insurance provider?

If you are someone who is purchasing an insurance policy for the very first time, then you will find it confusing to choose the right insurance provider. Below are the most commonly asked questions related to insurance claims and claim settlement ratio.

What is the settlement ratio for health insurance?

Note that the Claim Settlement Ratio for a health insurance company cannot be more than 100%.

What does higher settlement ratio mean?

A higher claim settlement ratio incurred by an insurance company is excellent information for all the policyholders as it means that the company is successfully paying for the claims registered by the policyholders. Henceforth, a policyholder can put a higher degree of trust on all the insurance companies that have a higher incurred claim ...

What does a high incurred claim ratio mean?

While, seeing from the point of view of an insurance company a high incurred claim ratio means lower profit margin.

What does it mean when your insurance has a low ICR?

A low Incurred Claim Ratio indicates that the health insurance company’s claim settlement process is highly rigorous. Take note that a health insurance company with a high ICR or more than 100% ICR becomes a doubt for many. The reason behind is simple. ICR depicts the ability of an insurance company to make payments towards claims. If a health insurance company gives away more amount of money as claim than the amount collected as premium, it would find it hard to sustain, which in turn, will end in rejection of some claims, increased prices or changes in product.

What are the two claim ratios?

There are two claim ratio that you should be aware of before investing in health insurance. They include Claim Settlement Ratio and Claim Incurred Ratio.

What happens if a health insurance company gives away more money as claim than the amount collected as premium?

If a health insurance company gives away more amount of money as claim than the amount collected as premium, it would find it hard to sustain, which in turn, will end in rejection of some claims, increased prices or changes in product .

What are the factors that determine the ideal health insurance?

When it comes to buying an ideal health insurance, there are multiple factors such as sum insured, medical history, network hospitals, claim process and others that one considers. Out of all, one of the most significant elements is Claims Ratio.

What is the claim settlement ratio?

Claim settlement ratio is the percentage of claims settled by the insurance company against the total number of claims made against it. So, if an insurance company settles 95 out of 100 claims made on it in one financial year, its claim settlement ratio would be 95%.

What is claim ratio?

Claim ratio in health insurance is equal to the claim settlement ratio of an insurance company. It shows the percentage of claims settled by the health insurance company against the total claims made on it in one financial year.

How to choose the best health insurance policy?

To choose the best health insurance policy, the incurred claims ratio or the best health insurance claim settlement ratio of the health insurance company should not be the sole parameter. You should judge the policies on the following parameters too –

What is incurred claims ratio?

So, if an insurance company earns INR 100 in premium and pays INR 75 in claims, the incurred claims ratio would be 75%.

What does it mean when a company has a ratio of more than 100%?

If the ratio is more than 100%, it shows the company is paying more in claims compared to the premiums collected. This shows that the company is making a loss and might face a problem in paying future claims.

Why is health insurance important?

When you have a health insurance policy you are assured of availing quality healthcare facilities as the policy promises to pay for the hospital bills which would incur. It, therefore, spares you the financial horror of a medical contingency and safeguards your savings.

What happens if a health insurance company doesn't pay your medical bills?

Though health insurance policies promise settlement of your medical bills, if the company does not pay the claim, the policy would not fulfil its promise. That is why the medical claim settlement ratio of the company is required to be checked.

What is the Claim Settlement Ratio?

The claim settlement ratio tells about the number of claims that have been filed against the insurance policy. It indicates the number of claims that have been rejected (or accepted) by the insurance company. The higher the ratio, the more claims have been approved by the insurance company and the better is the plan.

What is the right choice of insurance?

The right choice of an insurance plan is a carefully thought-out decision that must be handled with the utmost care. Not only does it involve much of your finances but also covers situations and provides benefits that the policyholder would have to suffer otherwise.

What is the claim settlement ratio?

One ratio that can help you is the claims settlement ratio; this ratio gives you an idea as to how reliable the health insurance company can be in case you need to make a claim. The Insurance Regulatory and Development Authority of India ( Irdai) has released the claims settlement details of general and health insurance companies for the financial year 2019-20.

What should be the incurred claims ratio?

Ideally incurred claims ratio should be in the range of 75-90%, " suggests Goyal.

What does lower incurred claim ratio mean?

A lower incurred claim ratio means that the insurers has very strict claim processing or tough underwriting parameters against which a good number of polices are getting rejected. It also shows that it is charging much a higher premium in comparison to the benefit it is providing to its policyholders.

What does 90% mean in insurance?

If the claims settlement ratio is 90%, it means that insurer made payments against 90 claims out of 100 claims and did not pay for the remaining 10 claims during the specified period. A good insurance company should not only honour all eligible claims but it should also process these in the swiftest possible manner.

What is net claims incurred?

Net claims incurred are gross incurred claims less all claims recovered from reinsurers related to those gross incurred claims" says Goyal.

How long is the health insurance ratio?

For health insurance companies this ratio is published for different period of times such as less than 3 months, 3 months to 6 months etc. However, the most critical data is for the period less than 3 months.

Is a incurred claims ratio of more than 100% good?

Here is why. "An incurred claims ratio of more than 100% is not good for insurance companies as it shows that the insurance company has spent more money on settling claims than it received as insurance premium. Which basically means that insurance is making a loss if the incurred claims ratio is more than 100%," says Goyal.