How is the claim settlement ratio of health insurance companies Calculated?

| Rank | Insurer | Claim Settlement Ratio | Claim Settlement Ratio | |

| 4 | Max Bupa | 89.26% | 83.92% | 88.06% |

| 5 | Star Health | 78.27% | 78.15.% | 79.34% |

| 6 | Aditya Birla Health | 70.32% | 72.80% | 85.34% |

| Features | Specifications |

|---|---|

| Claim Settled within 2 hours | 90% |

| Pre-existing diseases waiting period | 4 years |

| Incurred Claim Ratio* | 63% |

| Policy Renewability | Lifetime |

What is the settlement ratio for Star Health Insurance?

How to process reimbursement claims under Star Health Insurance?

What is Star Health?

How long does Star Health Insurance have to notify you of an emergency?

How long does it take for Star Health to reimburse?

What is the CSR of Star Health Insurance?

Can you file a cashless claim after discharge?

See 2 more

Which health insurance has best claim settlement ratio?

Among all private insurance companies, HDFC ERGO General Insurance has the best health insurance claim settlement ratio (99.80%) in the financial year 2019-2020.

What is claim settlement ratio of Star Health?

The Incurred Claim Ratio for Star Health Insurance for the FY 2018-19 is 63%.

How is the performance of Star Health Insurance?

PE Ratio of Star Health is -68.96. Earning per share of Star Health is -10.72. Price/Sales ratio of Star Health is 3.86. Price to Book ratio of Star Health is 9.30.

What is highest claim settlement ratio?

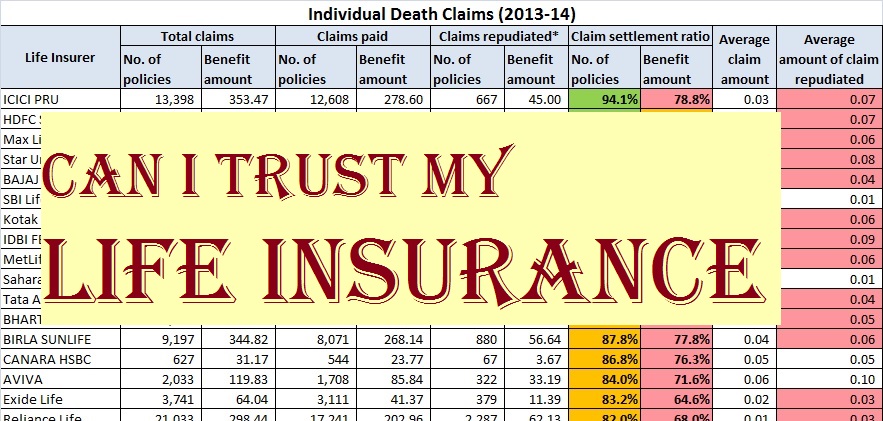

The highest claim settlement ratio is of the public insurance company LIC at 98.31%.

Why Star Health Insurance is best?

Cashless Benefit This reduces your financial burden and so Star Health has tied-up with more than 9,800 hospitals in India to offer you cashless coverage. Moreover, the company has an in-house claim settlement department that eliminates the hassles of getting the claim settled through TPAs.

Which is the No 1 health insurance in India?

Best Health Insurance Companies in IndiaRankHealth Insurance CompanyNetwork Hospitals1IFFCO Tokio General Insurance14162Care Health Insurance25003Magma HDI Health Insurance50164The Oriental Insurance CompanyNA24 more rows

Why is Star Health going down?

Star Health, the largest private-sector health insurance company, had received a poor response for its Rs 7,250-crore initial public offering (IPO), due to expensive valuations, dent in profitability on account of Covid-19.

Is Star health insurance a loss?

Star Health & Allied Insurance Company reports standalone net loss of Rs 578.37 crore in the December 2021 quarter.

Why is Star Health Insurance down?

Sharing Star Health share listing range; Manoj Dalmia, Founder & Director at Proficient Equities Limited said, "Star Health Insurance is suffering from losses due to huge claims post-Covid-19 pandemic.

What is the claim settlement ratio of Tata AIG?

Tata AIG has a claim settlement ratio of 96.43% for FY 2020-21. Tata AIG offers a variety of health insurance plans: Individual health insurance plans. Family health insurance plans.

What is final claim ratio?

Definition of 'claims ratio' The claims ratio is the percentage of claims costs incurred in relation to the premiums earned. There are two main reasons why this business is profitable: the premiums are not cheap, and the claims ratio is low. The claims ratio is equal to the claims rate divided by the risk premium rate.

What is the claim ratio of SBI Life Insurance?

SBI Life Insurance has a simple, quick, and hassle-free claim intimation and settlement process. SBI Life featured a high claim settlement ratio of 93.09% FY 2020-21. The insurer makes sure that the amount of claim is received to the entitled person/family quickly and easily.

How long does a star health insurance claim take?

When the Insured gives prior intimation about the treatment and the insured pays the expenses himself with the hospital and then claims for a reimbursement of those expenses within 15 days from the date of discharge.

Which is the best mediclaim company in India?

Which is the Best Health Insurance Company in India?Health Insurance CompaniesNetwork HospitalsIncurred Claim RatioStar Health Insurance9900+63%SBI Health Insurance6000+52%Tata AIG Health Insurance3000+78%United India Health Insurance7000+110.95%20 more rows

What is claim settlement ratio?

What is a claim settlement ratio? Claim settlement ratio (CSR) is the % of claims that an insurance provider settles in a year out of the total claims. It acts as an indicator of their credibility. As a general rule, the higher the ratio, the more reliable the insurer is.

How do I claim reimbursement for Star health insurance?

How does a cashless claim work?Star health insurance has a qualified in-house claim settlement team without any third party involvement.Approach the insurance desk at a network hospital.Intimation can be given either through contacting us at 1800 425 2255 / 1800 102 4477 or e-mail us at [email protected] items...•

What is the process for cashless claim settlement in Star Health?

Follow the steps given below to make a cashless claim in Star Health Insurance Policies: Visit the hospital desk. Show your ID for verification. Th...

What is the process for reimbursement clam in Star Health?

You are assigned a field doctor who makes the hospitalisation process easy for you. Pay all the hospital bills at the time of discharge. Collect al...

What are the documents required to make a claim?

Following documents are essential to make a claim: Completed claim form. Original receipts, bills and discharge certificate or card from the hospit...

I have lost my card. What should I do to make a claim?

Kindly inform Star Health by contacting them on the toll free number-1800 425 2255 or drop an e-mail to them.

What is the Claim Settlement Ratio of Star Health Insurance?

As per the IBAI’s General Insurance Claim Insights Handbook For Policyholders - 5th Edition, the Claim Settlement Ratio of Star Health insurance fo...

How to calculate the Claim Settlement Ratio (CSR) of Star health Insurance?

CSR or Claim Settlement Ratio is an important factor to determine the credibility of a health insurance company. The Claim Settlement Ratio of Star...

How to process cashless insurance claim settlement of Star Health Insurance?

To process cashless claims under Star Health Insurance plans, you must follow the steps given below: Visit a network hospital of your choice and in...

How to make reimbursement claims under health insurance plans offered by Star Health Insurance?

To process reimbursement claims under Star Health Insurance plans, you must follow the steps given below: Get hospitalised at a non-network hospita...

What is the time frame within which the hospitalisation must be reported to Star Health Insurance?

In case of emergency hospitalisation, Star Health Insurance should be informed within 24 hours of the hospitalisation whereas, in case of planned h...

Star Health Claims Services, Cashless Medical Policy

Claims Form Download, Claims FAQS. Health Policy Claims Star Health Claims Services is a hassle-free and a customer-friendly process which ensures that all settlements are processed in a timely manner.

Star Health Insurance Claim Settlement Ratio - Policybazaar

Claim Process of Star Health Insurance Plans. Claims filed for Star Health insurance plans can be settled in a hassle-free manner. You can file a claim in two ways- cashless and reimbursement claim. Both the claim processes are mentioned below:

STAR HEALTH AND ALLIED INSURANCE COMPANY LIMITED

CLAIM FORM - PART - B h) Email ID: Star’s Hospital ID: STAR HEALTH AND ALLIED INSURANCE COMPANY LIMITED Corporate Office - Claims Dept. : No.15, Balaji Complex, Whites Lane, 1st Floor, Royapettah, Chennai - 600 014.

What is claim ratio?

An insurer’s claim ratio defines the percentage of claims it has settled for that fiscal year. Simply put, the health claim ratio is the percentage of insurance claims settled against the total number of claims received.

How to claim cashless Star Health?

To avail of Star health cashless claim, follow the below-mentioned steps: 1 Approach the health insurance desk at the network hospital 2 Present the Identity proof 3 Your identity will be verified and then the pre-authorization form will be submitted to the insurer 4 The doctors will analyze the documents and process the claim as per the terms and conditions of the policy 5 You can also approach a field doctor to ease the process 6 Once all the formalities are completed and verification is done, Star health will settle your hospital bills directly.

How many hospitals in India have cashless healthcare?

Moreover, you can avail cashless healthcare facilities in more than 10,200 hospitals across India.

What is the cooling off period for health insurance?

Cooling off Period in Health Insurance The Cooling-off period is the duration during which a Covid-19 affected person cannot buy health insurance coverage. This ‘cool off’ period can range from a few days to a couple of months. During this ...

Who will verify the documents and settle the claim?

The insurer will verify the documents and settle the claim as per the terms and conditions of the policy.

Does Star Health pay hospital bills?

Once all the formalities are completed and verification is done, Star health will settle your hospital bills directly.

Can you file a claim with Star Health?

Claims filed for Star Health insurance plans can be settled in a hassle-free manner. You can file a claim in two ways- cashless and reimbursement claim. Both the claim processes are mentioned below:

What is the highest claim settlement ratio?

Among all private insurance companies, HDFC ERGO General Insurance has the highest claim settlement ratio (99.80%) in the financial year 2019-2020.

What is the claim ratio?

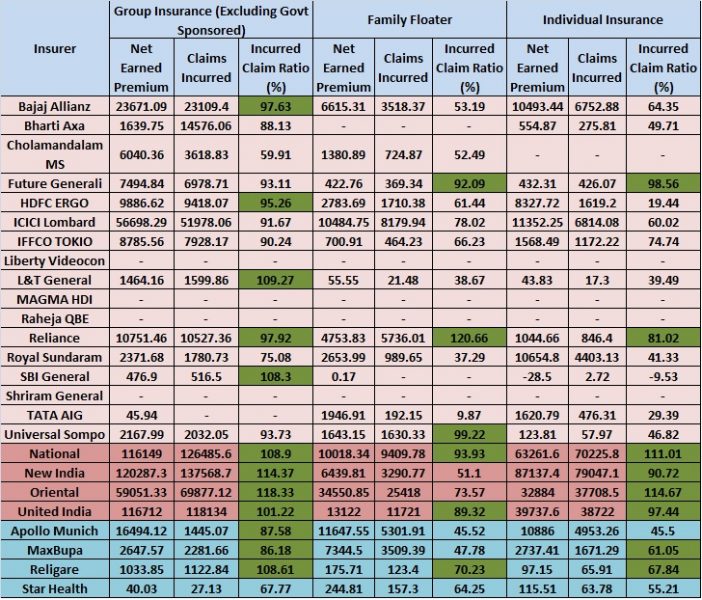

Incurred Claim Ratio: This ratio indicates the total amount of claims paid by an insurer against the total amount of premiums earned in a year.

What does it mean when an insurance company has a higher incurred claim ratio?

A policyholder may not choose a company that has a higher incurred claim ratio. The insurance companies that have more than 100% incurred claim ratio indicate s the insurer has spent more money on settling claims than it received as insurance premiums from policyholders. This means the company is running at a loss. So, purchasing a health policy from this company could be a risker for policyholders.

Why is incurred claim ratio low?

A lower incurred claim ratio suggests that the insurance company has stringent claim processing or tough underwriting parameters. That’s why the company has rejected most of the claims of policyholders. It also portrays that the company is charging much a higher premium as compared to the benefits to its policyholders. So, you should discard a company that has a low incurred claim ratio.

What is CSR in insurance?

The claim settlement ratio (CSR) indicates the number of claims settled by the insurer against the total claims made in a year. On the other hand, incurred claims ratio measures the total amount of claims paid by the insurance company against the collected premiums.

What is the difference between CSR and ICR?

The CSR depicts the goodwill and trustworthiness of the insurer in paying its claims, and ICR portrays the financial position of the company.

What does it mean when an insurer has a high ICR?

This means the financial position of the company is not stable.

What is the settlement ratio for Star Health Insurance?

As per the IBAI’s General Insurance Claim Insights Handbook For Policyholders - 5th Edition, the Claim Settlement Ratio of Star Health insurance for the financial year 2019-2020 is 78.62%.

How to process reimbursement claims under Star Health Insurance?

To process reimbursement claims under Star Health Insurance plans, you must follow the steps given below: Get hospitalised at a non-network hospital of your choice and inform the insurance company within the stipulated time. Avail the required treatment and pay for the same at the hospital.

What is Star Health?

Star Health makes sure a customer-friendly insurance claim process. It strives for making all settlements on time. The company has a dedicated claim settlement team that ensures that the claim settlement process remains simple and transparent, minimizing customer efforts . The first stand-alone health insurance company in India, Star Health lets you raise claims in two scenarios: cashless hospitalisation and reimbursement process.

How long does Star Health Insurance have to notify you of an emergency?

In case of emergency hospitalisation, Star Health Insurance should be informed within 24 hours of the hospitalisation whereas, in case of planned hospitalisation, the insurer should be informed within 48 hours of admission.

How long does it take for Star Health to reimburse?

The steps for the reimbursement process is as follows: Intimate Star Health within 24 hours of hospitalisation. A field doctor is assigned by Star Health to make hospitalisation easier. At the time of discharge, settle all hospital bills and collect all original documents such as discharge reports, prescription copies, medical bills, ...

What is the CSR of Star Health Insurance?

CSR or Claim Settlement Ratio is an important factor to determine the credibility of a health insurance company. The Claim Settlement Ratio of Star Health Insurance is calculated by dividing the total number of claims received by the company during a financial year by the total number of claims settled by it during that period.

Can you file a cashless claim after discharge?

Thus, you will be able to proceed with the cashless treatment at the hospital. If a cashless claim denied, then the insured can file for a reimbursement claim after discharge.