What is FHA settlement certification? It’s a standard document that must be signed by all borrowers on or before closing day. It discloses information about the loan, such as the amount being borrowed and the mortgage insurance premiums.

How do I get FHA certification for my loan?

Meeting these guidelines according to FHA will reduce risk of default on home loans which it insures, making such loans safer for banks and for the FHA. FHA certification may be obtained through two methods: (1) “HRAP” (the HUD review process), or (2) “DELRAP” (the direct endorsement lender review and approval process).

What is a Mortgage Settlement certificate?

It discloses information about the loan, such as the amount being borrowed and the mortgage insurance premiums. The Settlement Certification is a document that must be signed by both the home buyer (borrower) and the seller.

What does it mean to be FHA certified?

Being FHA certified means a condominium community meets the minimum guidelines established by FHA. Meeting these guidelines according to FHA will reduce risk of default on home loans which it insures, making such loans safer for banks and for the FHA.

What is a settlement certification and when do I sign it?

The Settlement Certification is often signed during the FHA closing process, but it can be handled before that in some cases. It is your mortgage lender’s responsibility to have you sign these documents. But as a borrower, it’s always good to be proactive.

What is FHA loan?

How many units are needed for a condo?

How many methods exist for certification?

What does higher demand mean in real estate?

Do the pros outweigh the cons of FHA?

Do condos need to be FHA certified?

What percentage of the space is used for non-residential use?

See 2 more

What is FHA loan?

It is the government-owned insurance company that insures home loans for buyers who can’t afford a conventional down payment or who choose to use their funds in other ways. FHA backed loans allows home buyers to purchase a home with a lower down payment and often with a lower interest rate. The lower down payment requirements attract new home buyers.

How many methods exist for certification?

Two methods exist for the certification process:

Do condos need to be FHA certified?

The FHA requires an entire condominium project to be FHA certified before certifying loans. In other words, no single unit is eligible for FHA financing unless the entire condominium community is FHA certified.

Do condo associations need to be certified for FHA loans?

Condominium associations considering FHA certification must understand the FHA organization and what constitutes eligible projects. Equally important is understanding the truth regarding common FHA misconceptions.

Do the pros outweigh the cons of FHA?

For condominium associations considering the FHA certification process, do the pros outweigh the cons? Most industry experts say yes . The biggest hurdle between associations and certification is the misconception that the FHA attracts low-income buyers. This conception is 100% false as the FHA is not associated in any way with affordable housing programs. Another misconception is that the FHA is a lender when in fact, the FHA provides mortgage insurance to banks, credit unions, and other lenders. Here are a few key reasons why industry experts rate FHA certification as a pro-choice:

When is a settlement certificate signed?

The Settlement Certification is often signed during the FHA closing process, but it can be handled before that in some cases.

What is the final step in the FHA home buying process?

Closing is the final step in the FHA home buying process. This is when the buyers sign all remaining paperwork, pay their closing costs and fees, and get the keys to their new house. Hooray!

What is HUD title?

The Department of Housing and Urban Development (HUD) requires mortgage lenders to take certain title-related actions leading up to, and during, the FHA closing process. For instance, HUD’s Single Family Housing Policy Handbook states:

Where does the FHA closing process take place?

They usually occur at the title company’s office, a real estate attorney’s office, or your mortgage lender’s office.

What is title research?

In real estate, a title is a legal document that shows ownership of a home. The Department of Housing and Urban Development (HUD) ...

Who releases funds from a mortgage loan?

Your mortgage lender will release the funds covering your home loan amount to the closing agent.

Can there be any disputes with a FHA title?

In other words, there cannot be any disputes or issues relating to the property title. If there are, the FHA closing process might be delayed until those issues are resolved. HUD refers to this as having a “good and marketable” title.

How does FHA certification work?

There are two ways to obtain certification: (1) the DELRAP process or (2) HRAP process.

What does it mean to be FHA certified?

Being FHA certified means a condominium community meets the minimum guidelines established by FHA. Meeting these guidelines according to FHA will reduce risk of default on home loans which it insures, making such loans safer for banks and for the FHA.

What is FHA condo certification?

The Federal Housing Administration (“FHA”) is a government-owned insurance company that insures home loans for buyers who cannot afford a conventional down payment or prefer to use their available funds in other ways.

What is the FHA requirement for commercial space?

In addition to the restriction concerning commercial space, FHA also requires the commercial portion of the project be of a nature that is “homogenous” with residential use and free of adverse conditions to the occupants of the individual condominium units.

How much of the floor area does FHA approve?

Exceptions may be requested on a case-by-case basis and FHA could hypothetically approve as much as 35% of the total floor area for commercial space. In order to qualify for such exception, a condominium community must comply with the following requirements:

How much of a condominium project is encumbered by FHA?

A. Concentration of Loans. As a general rule, no more than 50% of the total units in a condominium project may be encumbered by FHA insured loans for the community to obtain FHA certification. However, in a condominium project with three or less units, no more than one unit may be encumbered with an FHA insured loan.

What is required to be certified for FHA?

When applying for FHA certification, a condominium community must make certain “certified” representations. These certified representations must be submitted on company letterhead and must be signed by an association representative, or its authorized representative (i.e. management company, project consultant, or attorney).

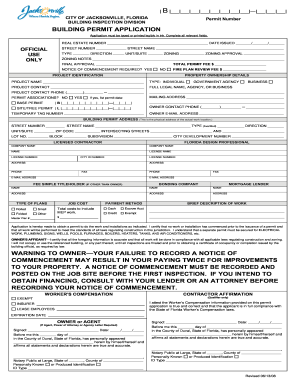

Real estate certification form

The borrower, seller, and the selling real estate agent or broker involved in the sales transaction certify that the terms and conditions of the sales contract are true to the best of their knowledge and belief and that any other agreement entered into by any of the parties in connection with the real estate transaction is part of, or attached to, the sales agreement..

Frequently Asked Questions About The FHA Amendatory Clause

Q. Is the FHA amendatory clause required? A. The amendatory clause is required for an FHA home loan that does not meet the allowable exceptions.

What is FHA loan?

It is the government-owned insurance company that insures home loans for buyers who can’t afford a conventional down payment or who choose to use their funds in other ways. FHA backed loans allows home buyers to purchase a home with a lower down payment and often with a lower interest rate. The lower down payment requirements attract new home buyers.

How many units are needed for a condo?

Condominium projects must consist of two or more units.

How many methods exist for certification?

Two methods exist for the certification process:

What does higher demand mean in real estate?

More buyers + higher demand = higher property values for all units within the community.

Do the pros outweigh the cons of FHA?

For condominium associations considering the FHA certification process, do the pros outweigh the cons? Most industry experts say yes . The biggest hurdle between associations and certification is the misconception that the FHA attracts low-income buyers. This conception is 100% false as the FHA is not associated in any way with affordable housing programs. Another misconception is that the FHA is a lender when in fact, the FHA provides mortgage insurance to banks, credit unions, and other lenders. Here are a few key reasons why industry experts rate FHA certification as a pro-choice:

Do condos need to be FHA certified?

The FHA requires an entire condominium project to be FHA certified before certifying loans. In other words, no single unit is eligible for FHA financing unless the entire condominium community is FHA certified.

What percentage of the space is used for non-residential use?

Projects where more than 25% of total space is used for non-residential use

FHA Defined

- FHA stands for the Federal Housing Administration. It is the government-owned insurance company that insures home loans for buyers who can’t afford a conventional down payment or who choose to use their funds in other ways. FHA backed loans allows home buyers to purchase a home with a lower down payment and often with a lower interest rate. The low...

FHA, Condominium Associations, and Certification

- The FHA requires an entire condominium project to be FHA certified before certifying loans. In other words, no single unit is eligible for FHA financing unless the entire condominium community is FHA certified.

Eligible Projects

- Only condominium communities are eligible for FHA certification.

- Condominium projects must consist of two or more units.

- Projects must be 100% built-out (completed construction) and over one year old.

- Phased condominium units must have phase one completed and be over one year old

Ineligible Projects

- Condominium hotels

- Timeshares

- Houseboats

- Multi-dwelling units

Certification Representations

- When applying for certification, a condominium association must make certain declaration statements relating to certification requirements. These statements must be submitted on company letterhead and are often signed by an attorney. The condominium management team may sign the document themselves, however, it is highly recommended an attorney review it firs…

The Pros and Cons of FHA Certification

- For condominium associations considering the FHA certification process, do the pros outweigh the cons? Most industry experts say yes. The biggest hurdle between associations and certification is the misconception that the FHA attracts low-income buyers. This conception is 100% false as the FHA is not associated in any way with affordable housing programs. Another …

The FHA Closing Process at A Glance

- The FHA loan closing process can be held in one of several locations. They usually occur at the title company’s office, a real estate attorney’s office, or your mortgage lender’s office. There could be some other agreed-upon location as well, but those are the three most common locations. Here’s an overview of what happens during an FHA closing process: 1. You (as the home buyer / …

A “Good and Marketable” Title

- Title research is another important part of this process. The title search usually starts before closing, and the paperwork relating to the search gets finalized and signed the day you close on the loan (in most cases). In real estate, a title is a legal document that shows ownership of a home. The Department of Housing and Urban Development (HUD) requires mortgage lenders to …

Settlement Certification at The Closing

- Home buyers who use FHA loans must also sign the borrower’s portion of form HUD-92900-A, as well as a Settlement Certification. The 92900-A is an FHA-specific addendum that goes along with the Uniform Residential Loan Application (described in detail here). It’s a standard document that must be signed by all borrowers on or before closing day. It d...

Monthly Escrow Obligations For FHA Borrowers

- During your FHA mortgage closing, you might be required to set up an escrow account to pay for certain housing-related costs, such as property taxes and homeowners insurance. According to HUD Handbook 4000.1, the Mortgagee (or lender) “must collect a monthly amount from the Borrower that will enable it to pay all escrow obligations…” There must be enough money in the e…