Journal Entry for Full Settlement Full Settlement is the payment that company made to the supplier to clear all the outstanding accounts payable of one specific invoice. When company makes a purchase, the seller may offer you the option to pay for the item over time.

What is the journal entry for full settlement of accounts payable?

This journal entry will make full settlement of the accounts payable that ABC has with the supplier. When ABC make a full settlement, it means they will pay off the $ 10,000 accounts payable with the supplier. The journal entry is debiting accounts payable of $ 10,000 and credit cash at bank $ 10,000.

What is an'account settlement'?

Account Settlement. What is an 'Account Settlement'. An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero.

What does it mean to settle an account with a company?

It's also important to understand what settlement means. A settlement (or when you settle an account ) means paying an account off in full. Remember also that a person who has an account with the business is a person who owes the business, in other words, a debtor or receivable .

What is full settlement in accounting?

Full Settlement is the payment that company made to the supplier to clear all the outstanding accounts payable of one specific invoice. When company makes a purchase, the seller may offer you the option to pay for the item over time.

Which is the journal entry to record the payment settlement of an accounts payable?

When the company makes payment to settle the payables, it will debit the accounts payable to clear the liability and credit the cash account as the payment results in the cash outflow from the company.

What is settlement of account?

What Is an Account Settlement? An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts.

What is the journal entry for accounts payable?

When recording an account payable, debit the asset or expense account to which a purchase relates and credit the accounts payable account. When an account payable is paid, debit accounts payable and credit cash.

What is the journal entry of received from Dev in full settlement of his account?

Journal In the Books of GaneshParticularsDebit Amount (Rs)To Dev's A/c(Cash received from Dev in full settlement of his account)Manmohan's A/cDr.80,00035 more rows

How is a settlement recorded in accounting?

Settlement date accounting is an accounting method that accountants may use when recording financial exchange transactions in the company's general ledger. Under this method, a transaction is recorded on the "books" at the point in time when the given transaction has been fulfilled.

How do I record settlement payments?

The check should include the client's name and matter number. Be sure to record the transaction in your client's account ledger, then deposit the payment in your firm's operating account. Write any other checks to your client and third parties as required by the settlement statement. Finally, check for a zero balance.

What are the 3 journal entries?

There are three main types of journal entries: compound, adjusting, and reversing.

What are the 5 types of journal entries?

They are:Opening entries. These entries carry over the ending balance from the previous accounting period as the beginning balance for the current accounting period. ... Transfer entries. ... Closing entries. ... Adjusting entries. ... Compound entries. ... Reversing entries.

What is the adjusting entry for accounts payable?

The entry is Accounts Payable (credit) and Rent Expense (Debit).

What is the journal entry of commission received?

The Commission received is income and is credited in the journal entry with a corresponding debit to accounts receivable or Bank if no credit period is allowed for this transaction.

What is the journal entry for cash received from Mohan in a full settlement of his account?

To Mohan A/c As given in the question, payment is made in full to Mohan therefore the given entry would be correct. As current asset is reducing, i.e. cash is reducing, according to the accounting rule, 'debit the receiver, credit the giver', we should credit as it's reducing.

What is the meaning of full settlement?

Full and final settlement means that you ask your creditors to let you pay a lump sum instead of the full balance you owe on the debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt.

What does settlement mean in banking?

Settlement involves the delivery of securities or cash from one party to another following a trade. Payments are final and irrevocable once the settlement process is complete. Physically settled derivatives, such as some equity derivatives, require securities to be delivered to central securities depositories.

What is a settlement?

1 : a formal agreement that ends an argument or dispute. 2 : final payment (as of a bill) 3 : the act or fact of establishing colonies the settlement of New England. 4 : a place or region newly settled. 5 : a small village.

What is the difference between payment and settlement?

Settlement in "real time" means payment transaction is not subjected to any waiting period. "Gross settlement" means the transaction is settled on one to one basis without bunching or netting with any other transaction. Once processed, payments are final and irrevocable.

Is it better to settle or pay in full?

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you have—such as late payments or settled debts—the better.

When does account settlement take place?

In cases of two or more parties, related or unrelated, account settlement would take place when one set of agreed-upon goods is exchanged for another, even if a zero balance is not required.

What Is an Account Settlement?

An account settlement generally refers to the payment of an outstanding balance that brings the account balance to zero. It can also refer to the completion of an offset process between two or more parties in an agreement, whether a positive balance remains in any of the accounts. In a legal agreement, an account settlement results in the conclusion of a business dispute over money.

What is the account receivable department?

The accounts receivable department of a company is charged with the account settlement process of collecting money owed to the firm for providing goods or services. The ages of the receivables are broken down into intervals such as 1–30 days, 31–60 days, etc. Individual accounts will have amounts and days outstanding on record, and when the invoices are paid, the accounts are settled in the company's books.

What is offset in insurance?

Amounts receivable and payable to reinsurers are offset for account settlement purposes for contracts where the right of offset exists, with net insurance receivables included in other assets and net insurance payables included in other liabilities. 1.

What is account receivable?

Account receivable is the amount which the company owes from the customer for selling its goods or services and the journal entry to record such credit sales of goods and services is passed by debiting the accounts receivable account with the corresponding credit to the Sales account.

What is accrual accounting?

Accrual Accounting Method Accrual Accounting is an accounting method that instantly records revenues & expenditures after a transaction occurs, irrespective of when the payment is received or made. read more.

Is an account receivable an asset or liability?

Accounts Receivables are asset accounts in the books of the seller because the customer owes him an amount of money to pay against the goods and services already delivered by the seller. Conversely, it creates a liability account.

Can a seller charge an account receivable against a bad debt?

However, if payment is not received or is not expected to be received in the near future, then considering it to be losses, the seller can charge it as expenses against bad debts.

What Is An Account Settlement?

Account Settlements and Clearing Accounts

- Settling an account often occurs with clearing accounts. What is a clearing account? A clearing account is either a: 1. Bank account used to hold funds until payments can move to another account (e.g., payroll accounts to employee bank accounts), OR 2. Temporary account used to record transactions in the general ledger until the funds can be accurately or completely classifie…

Examples of Account Settlements

- Settling your accounts can be confusing, especially since there are several different ways you can do so. Here are some examples of account settlements.

Settlement Accounts vs. Account Settlements

- So, what is the difference between settlement accounts and account settlements? Despite the names being so similar, there is quite a difference between the two. Again, account settlements are when you settle outstanding balances either through payments or offsets. But, settlement accounts are bank accounts used to track the balances of payments between banks. Internation…

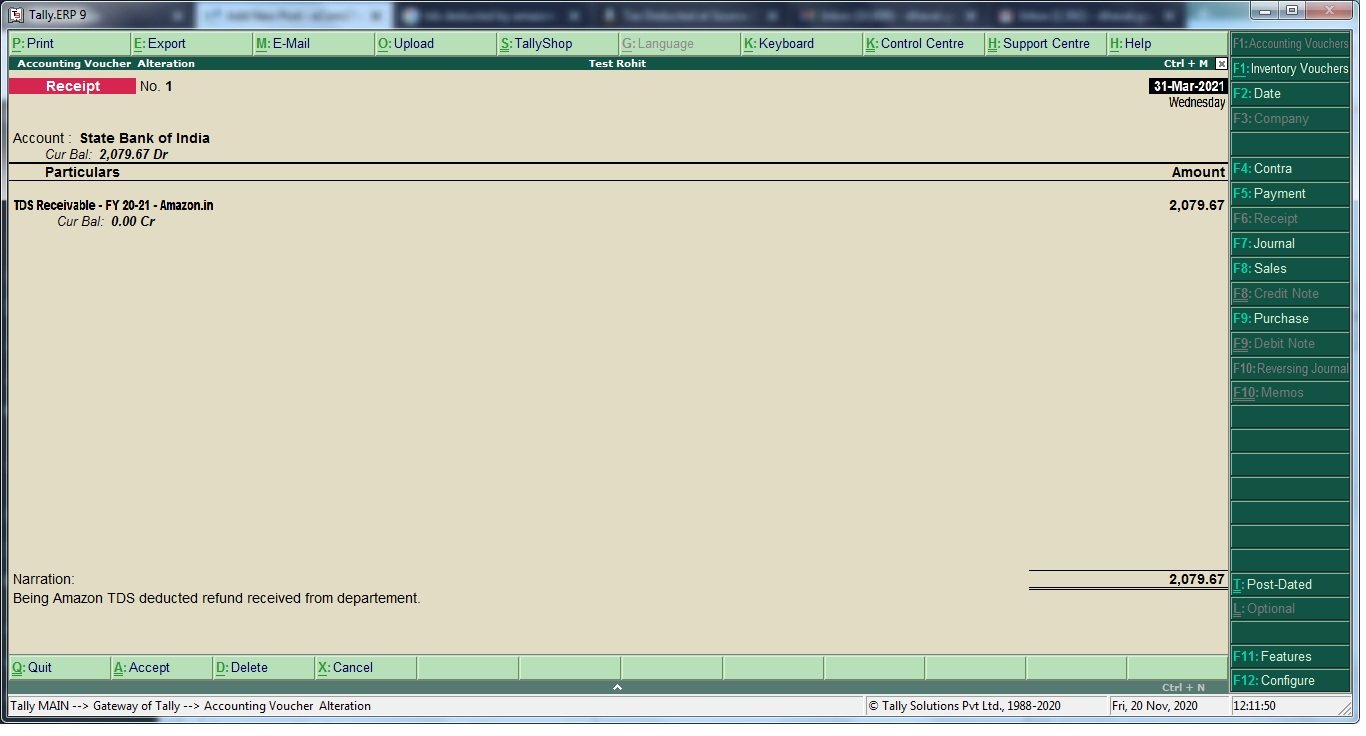

Settlement Date Accounting

- When you settle your accounts, you are typically doing so because you recorded transactions in anticipation of receiving funds or making payments. However, settlement date accounting is a method you can use to enter the information in your books onlywhen you fulfill the transaction. With settlement date accounting, enter the transactions into your general ledger when the transa…