What is the extrajudicial settlement of estate in the Philippines?

Extrajudicial Settlement of Estate in the Philippines. Settlement of an estate need not undergo judicial proceedings all the time. Rule 74, Section 1 of the Rules of Court allows the extrajudicial settlement of estate by agreement among the heirs. Said Rule states: Sec. 1. Extrajudicial settlement by agreement between heirs.

What is an extrajudicial settlement?

A: An extrajudicial settlement is the settling of an estate via the drafting of a contract, which indicates how a deceased owner’s properties will be divided among the heirs as they see fit. The properties left by the deceased listed in the contract is collectively recognized as the “estate.”

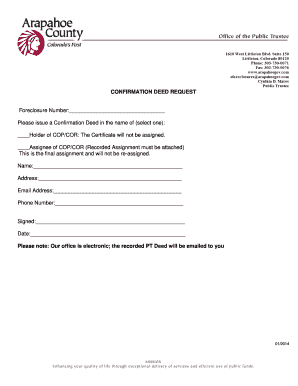

When to execute a deed of extrajudicial settlement of estate with sale?

If the heirs are selling a real property to a third-party buyer, the heirs may execute a deed of extrajudicial settlement of estate with sale. Other documents which may be executed are deed of extrajudicial settlement of estate with waiver of rights and/or deed of extrajudicial settlement of estate with donation. Main image via Shutterstock

What is an out of court settlement?

It is called extrajudicial or out of court settlement because the heirs no longer go to trial to divide the properties, which the deceased property owner left. 1. Absolute absence of a will; 2. Proof that the decendent's estate has no existing debts; 3. A legal representative or judicial for heirs who are minors; 4. Affidavit of self adjudication;

What is the process of extra judicial settlement in the Philippines?

Register the Deed of Extrajudicial Settlement of Estate with the Register of Deeds where the land is located, simultaneously filing the bond. Publish the Deed of Extrajudicial Settlement of Estate in a newspaper of general circulation once a week for three (3) consecutive weeks.

Who can execute extrajudicial settlement?

THE SOLE HEIRWHO MAY EXECUTE AN EXTRAJUDICIAL SETTLEMENT? 1. THE SOLE HEIR. The one and only heir may adjudicate the entire estate to himself by means of an affidavit (called an “Affidavit of Self- Adjudication”) filed in the Register of Deeds of the place where the decedent resided.

Where can I get a Deed of Extrajudicial settlement?

It must be noted that the Deed of Extrajudicial Settlement must be published in a newspaper of general circulation once a week for 3 consecutive weeks. Kindly consult with the Register of Deeds where the property is located for the listing of these newspapers.

How do I transfer a title with an extra judicial settlement?

Deed of Extrajudicial Settlement of Estate. Deed of Sale (if the property has been sold to a third party)...Supporting Documents:BIR CAR/tax clearance certificate.Owner's Duplicate Copy of Title.Realty Tax Clearance.Tax Declaration (Certified Copy)Transfer Tax Receipt/Clearance.Affidavit of Publication of Settlement.

What are the requirements for extrajudicial settlement?

Extrajudicial Settlement of the estate can be done if: i) the decedent did not leave a will; (ii) there are no debts (or the debts have been fully paid); and (iii) all of the heirs agree on the manner of the division and distribution of the estate.

Where do I file a judicial settlement of an estate?

The Estate Tax Return is filed in the Revenue District Office (RDO) having jurisdiction over the place of residence of the deceased at the time of his death.

How much does it cost to transfer land title to heirs in the Philippines?

Average Title transfer service fee is ₱20,000 for properties within Metro Manila and ₱30,000 for properties outside of Metro Manila.

How long does it take to transfer land title Philippines?

three to four monthsTransferring the land title from the owner to the buyer usually takes at least three to four months. Given that you need to go to different agencies like the BIR, Registry of Deeds, Treasurer's Office, and Assessor's Office, just to transfer the land title document under your name.

How much is the penalty for late title transfer in the Philippines?

Penalties for Late Payment: Late payment of the CGT shall result to surcharge of 25%, pro-rated 12% annual interest,and other compromise penalties. DST is a tax on documents, instruments, loan agreements and papers evidencing the acceptance, assignment, sale or transfer of an obligation, right or property.

How do you transfer land title if one of the owner is deceased?

Make sure all mandatory documents are complete as this will be submitted to the BIR:Photocopy of the death certificate (bring the original copy too for verification)Proof of payment (official receipt or deposit slip and duly validated return)TIN of Estate.Affidavit of Self Adjudication.More items...•

How can I transfer property after death of parents without will Philippines?

If there is no will, the heirs must execute an Extra-Judicial Settlement of estate (EJS), a notarized legal document signed by all the heirs listing the properties comprising the estate of the decedent and the agreed manner of distribution of the estate among the legal heirs.

What is the process of transfer of land title in the Philippines?

What are the Transfer of Title Requirements and Steps?Step 1: Prepare the Requirements for Transfer of Title. ... Step 2: Submit all the Required Documents for Tax Computation. ... Step 3: Pay the Required Taxes. ... Step 4: Get a Certificate Authorizing Registration (CAR) ... Step 5: Submit the CAR to the Local Treasurer's Office.More items...•

How do you force a settlement?

Courts can require parties to participate in the settlement process, but they cannot pressure parties to settle.You cannot be coerced to settle by threat of sanctions. ... You cannot be coerced to settle by threat of other consequences. ... You cannot be forced to make a settlement offer against your will.

Can a settlement offer be withdrawn?

Can a settlement agreement be withdrawn or cancelled? The settlement agreement will not be legally binding until it has been signed by both parties. This means that, prior to both parties signing, it would be possible for either side to change their mind or withdraw from the process.

How do I revoke a settlement agreement?

A settlement agreement can also be challenged in a court of law although it cannot be revoked except with a court decree. A settlement agreement can be challenged if it involves fraud or coercion, misrepresentation or improper execution.

How do you enforce a compromise agreement?

If the amicable settlement is repudiated by one party, either expressly or impliedly, the other party has two options, namely, to enforce the compromise in accordance with the Local Government Code or Rules of Court as the case may be, or to consider it rescinded and insist upon his original demand.

What is an extrajudicial settlement?

An undertaking that the deed of extrajudicial settlement will be published in a newspaper of general circulation. Depending on the intention of the heirs, the deed of extrajudicial settlement may be executed simultaneously with other contracts involving donation, waiver of rights, and/or sale.

Who can execute an affidavit of self adjudication?

If there is one surviving heir, the heir may execute an affidavit of self-adjudication, which adjudicates the entire estate to him/herself.

What is the name of the agency that pays estate taxes?

1. Payment of estate taxes with the Bureau of Internal Revenue (BIR)

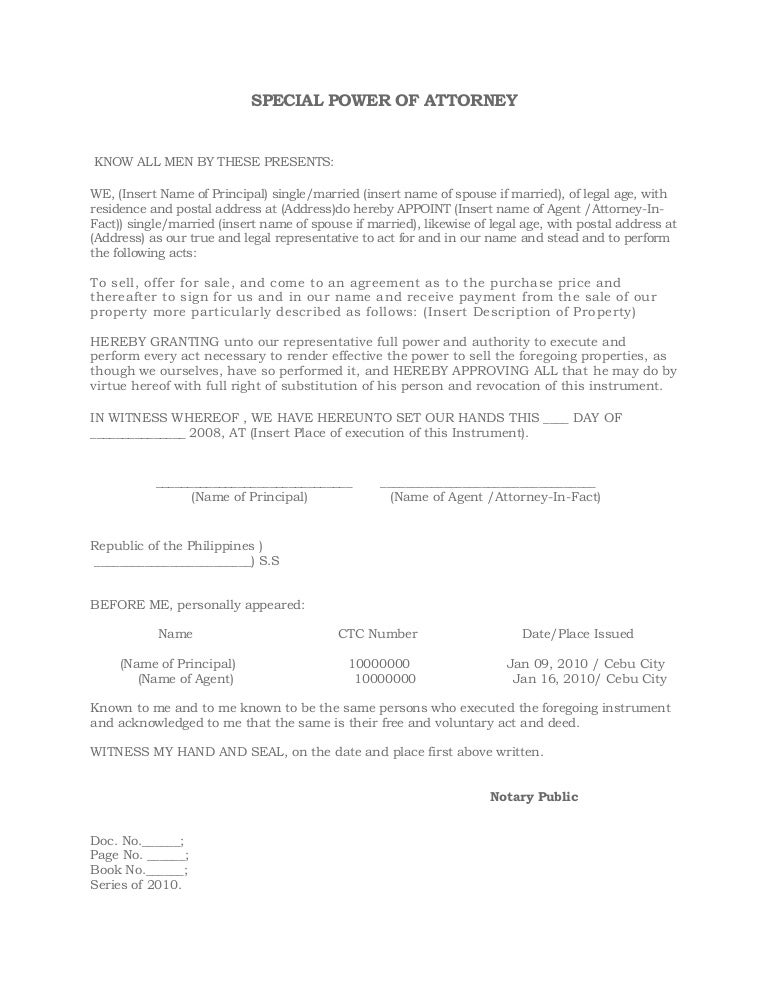

Can a deed of extrajudicial settlement be executed with a power of attorney?

Likewise, it may be executed simultaneously with a special power of attorney authorizing representative/ s such as lawyers, to settle the estate for ease of transactions with the relevant government agencies and private entities (i.e., banks, corporations).

Is extrajudicial settlement more convenient?

While judicial settlement of estate applies to certain cases, our law allows extrajudicial settlement of estate, which is undoubtedly more convenient.

Does an estate settlement include capital gains tax?

If estate settlement includes taxable donations or sale, applicable donor’s tax or capital gains tax shall also be paid.

Can heirs execute deeds of extrajudicial settlement?

For instance, the heirs may execute a deed of extrajudicial settlement of estate with sale if the heirs are selling a real property to a third-party buyer. Other documents which may be executed are deed of extrajudicial settlement of estate with donation, and/or deed of extrajudicial settlement of estate with waiver of rights.

What are the requirements for extrajudicial settlement of estate in the Philippines?

Apart from this, the other requirements for an extrajudicial settlement of estate in the Philippines are the following: 1. The decedent’s estate must have no existing debts. If there are, these must first be satisfactorily paid. The estate can be used for payment, with the remainder being what is subject to division among the heirs.

What is extrajudicial settlement?

A: An extrajudicial settlement is the settling of an estate via the drafting of a contract, which indicates how a deceased owner’s properties will be divided among the heirs as they see fit. The properties left by the deceased listed in the contract is collectively recognized as the “estate.”. The settlement is considered “extrajudicial,” ...

What is an affidavit of self adjudication?

2. A judicial or legal representative for heirs who are minors. 3. An “Affidavit of Self Adjudication.”. These are for sole heirs who wish to adjudicate the entire estate to him- or herself, filing the affidavit at the Register of Deeds of the locale where the decedent resided. 4.

What is estate in court?

The term “estate” refers to the real estate and/or personal properties left by the deceased. It is considered “extrajudicial,” or “out of court,” as the heirs do not go to trial to divide the properties left by the deceased property owner. Photo via Shutterstock.

What is the first requirement for an extrajudicial settlement?

A: It should be noted that the very first requirement for an extrajudicial settlement is the absolute absence of a will, as this is what the settlement process was made to address. In the event that there is a will, an extrajudicial settlement can still be used to address properties not included in it. Apart from this, the other requirements ...

Is a settlement considered extrajudicial?

The settlement is considered “extrajudicial,” or “out of court,” as the heirs do not go to trial to divide the properties left by the deceased property owner.

Can heirs execute deeds of extrajudicial settlement of estate with sale?

If the heirs are selling a real property to a third-party buyer, the heirs may execute a deed of extrajudicial settlement of estate with sale.

What is an out of court settlement?

The properties indicated in the contract are referred to as estate. It is called extrajudicial or out of court settlement because the heirs no longer go to trial to divide the properties, which the deceased property owner left.

Why is there a problem with dividing property between legal heirs?

The most common reason is the lack of basic understanding of the process of extrajudicial settlement of estate.

Where is the order of partition recorded?

The court shall make such order as may be just respecting the costs of the proceedings, and all orders and judgments made or rendered in the course thereof shall be recorded in the office of the clerk, and the order of partition or award, if it involves real estate, shall be recorded in the proper register's office.

Is extrajudicial settlement binding?

The fact of the extrajudicial settlement or administration shall be published in a newspaper of general circulation in the manner provided in the nest succeeding section; but no extrajudicial settlement shall be binding upon any person who has not participated therein or had no notice thereof.

What is extrajudicial settlement?

What is an extrajudicial settlement of estate? “Extrajudicial” means “outside of court”; hence, an extrajudicial settlement of estate means heirs do not need go to court to partition the properties left by a deceased decedent. It is settling an estate by drafting a contract where the properties are divided among the heirs as they see fit.

What is an affidavit of self adjudication?

Called an “Affidavit of Self Adjudication,” this is filed in the Register of Deeds of the locale where the decedent resided.

What is an inventory of the decedent's property?

Each heir’s relationship to the decedent. That they are the decedent’s only surviving heirs. An inventory with individual descriptions of the decedent’s properties, both real and personal, that the heirs have agreed to divide among themselves.

What happens when heirs are not able to reach an agreement on the division of the property?

When heirs are not able to reach an agreement on the division of the properties, they are relegated to having to filing a standard action for partition instead. All heirs must also be of legal age. Should one be a minor, he or she must be duly represented by judicial or legal representative.

What happens when an estate is solitary?

This often occurs when an estate consists of solitary property that the heirs use and/or maintain together, and don’t feel the need to divide and transfer in an official capacity. The non-transfers eventually prove to be cumbersome, particularly when the heirs finally wish to sell the property or receive their rightful share of an estate.

What is the term for a group of heirs to divide an estate among themselves?

A group of heirs, on the other hand, must reach an agreement and subsequently divide the estate among themselves by way of a “Deed of Extrajudicial Settlement of Estate and Adjudication of Estate. ”. This must be signed by all heirs, notarized before a Notary Public, and contain the following information:

How to divide an estate?

A group of heirs, on the other hand, must reach an agreement and subsequently divide the estate among themselves by way of a “Deed of Extrajudicial Settlement of Estate and Adjudication of Estate.” This must be signed by all heirs, notarized before a Notary Public, and contain the following information: 1 The decedent left no will and no debt 2 Each heir’s relationship to the decedent 3 That they are the decedent’s only surviving heirs 4 An inventory with individual descriptions of the decedent’s properties, both real and personal, that the heirs have agreed to divide among themselves 5 The exact manner which the properties are to be divided