Full Answer

What are the payment schedules for Form 941?

The IRS allows two payment schedules, semiweekly or monthly, for employment taxes covered by Form 941. Employers decide before the start of a calendar year which of these schedules they want to follow. Wednesday is the deposit due date for payments made on Wednesday, Thursday, or Friday.

What is the deadline to file Form 941?

The deadline to file 941 will be the last day of the month following the end of the quarter. For 2020, Form 941 is due by April 30, July 31, November 2, & February 1.

When does the 941 tax look-back period start and end?

The look-back period begins July 1st and ends June 30th. If you reported $50,000 or less of Form 941 taxes for the look-back period, you’re a monthly schedule depositor; if you reported more than $50,000, you’re a semiweekly schedule depositor.

What is the difference between Form 941&form 944?

Both forms report federal income tax withheld from your employees, along with the employer's and employees' shares of social security and Medicare tax. The amount of employment taxes you reported on your Forms 941 or 944 determines which deposit schedule you must use, monthly or semiweekly.

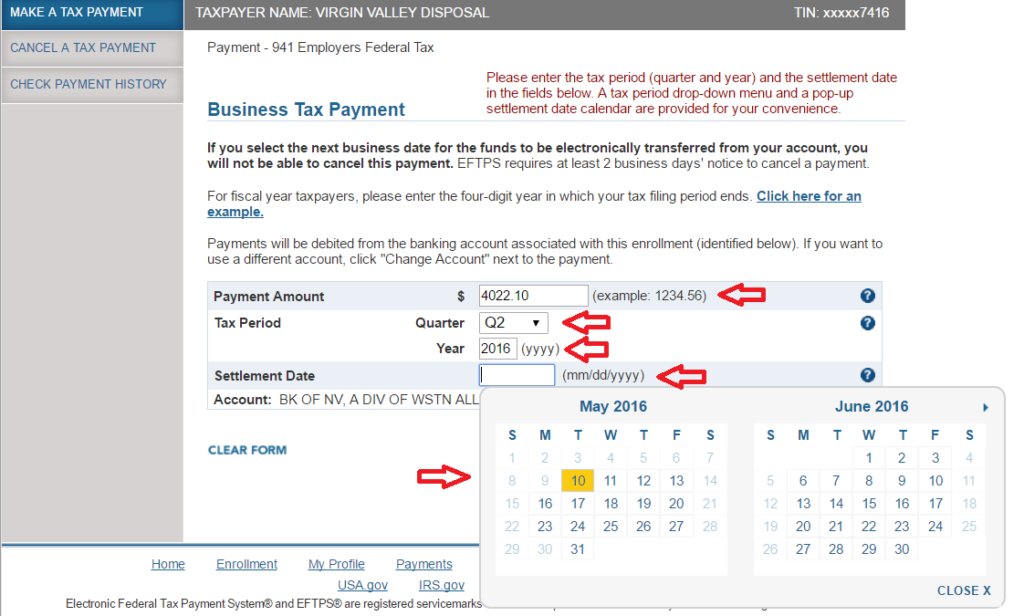

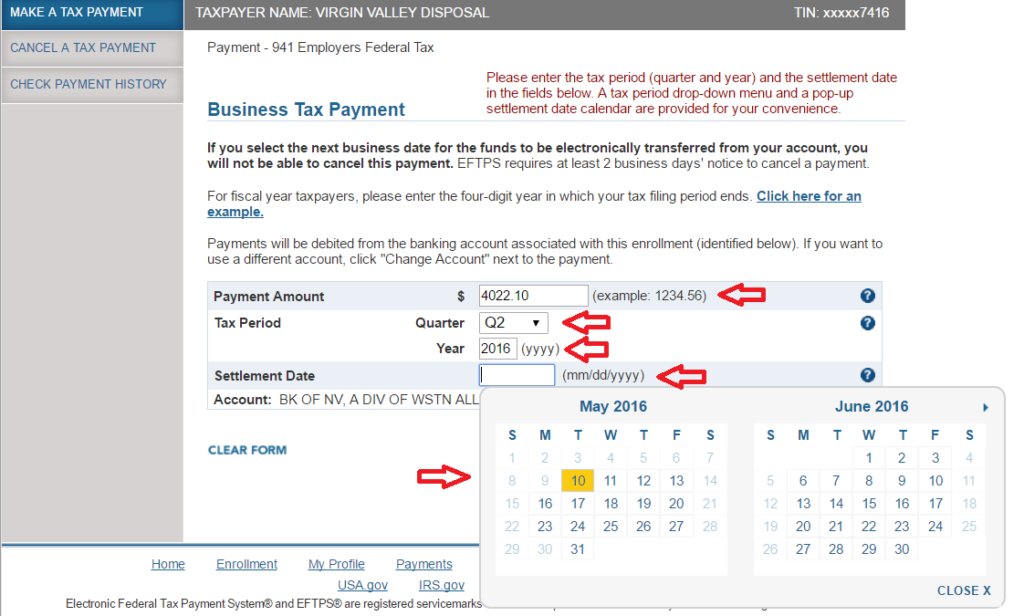

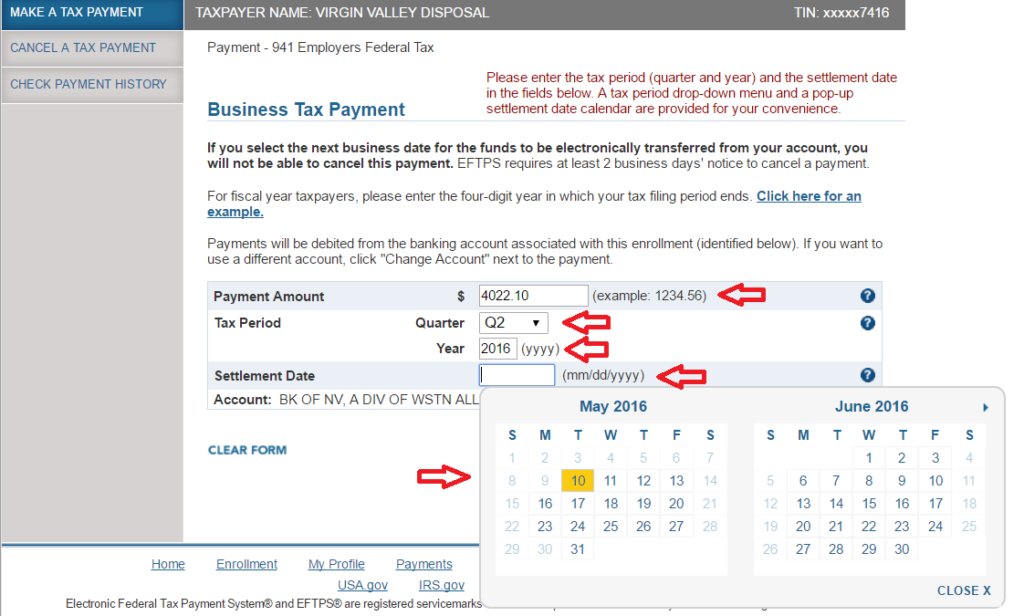

What is settlement date in EFTPS?

Timeliness. We use the date the payment is received (known as the settlement date) to determine if your payment is on time. The settlement date is the date the funds are credited to the State's bank account. ACH Debit payments that are completed before 3 p.m. (Pacific time) can settle the next business day.

What is the settlement date when paying taxes?

The trade date, which is the date that the order was executed, is the one that counts for tax purposes. The settlement date is just the date when the cash or securities from the transaction are plunked into your account. You're smart to ask a tax question in February, by the way.

Is 941 a federal tax deposit?

Generally, employers must report wages, tips and other compensation paid to an employee by filing the required Form 941, Employer's QUARTERLY Federal Tax Return.

What are the quarter dates for 941?

Form 941 - Quarterly due dates: ist April 30th , 2nd July 3l5t , 3rd October 3i5t and 4th January 31st . Form 943 - Deposits must be in by January 31st and the return must be filed by the 10th of February. Form 944 - Due date is by January 31st and the return must be filed by the 10th of February.

Is settlement date the same as closing date?

"Settlement date" and "closing date" are synonymous terms referring to the date when a property's seller and buyer meet to finalize the deal. At this time, the deed to the property is transferred from the seller to the buyer and all pertinent paperwork is completed.

What is settlement day?

What is 'settlement day'? Settlement day is the contractually agreed date on which the sale of the property is finally settled. It's the day the buyer pays the balance of the sale price to the seller and ownership changes hands.

How does a business deposit federal payroll taxes?

The tax must be deposited by the end of the month following the end of the quarter. You must use electronic funds transfer (EFTPS) to make all federal tax deposits. See the Employment Tax Due Dates page for information on when deposits are due.

What taxes are included in a 941 deposit?

Completing Form 941 includes reporting:Wages you paid.Tips your employees reported to you.Federal income tax you withheld from your employees' paychecks.Employer and employee shares of Social Security and Medicare taxes.Additional Medicare tax withheld from employee paychecks.More items...

What is 941 employer's federal tax?

What is IRS Form 941? IRS Form 941 is more commonly known as the Employer's Quarterly Federal Tax Return. This is the form your business uses to report income taxes and payroll taxes that you withheld from your employees' wages. It also provides space to calculate and report Social Security and Medicare taxes.

What dates are quarterly taxes due 2022?

When are estimated taxes due in 2022?First-quarter payments: April 18, 2022.Second-quarter payments: June 15, 2022.Third-quarter payments: Sept. 15, 2022.Fourth-quarter payments: Jan. 17, 2023.

Who is a semi weekly depositor for 941?

Go to Line 12 (total taxes after adjustments and credits). If you reported $50,000 or less of taxes for the lookback period, you're a monthly schedule depositor. If you reported more than $50,000, you're a semiweekly schedule depositor.

What is the due date for semi monthly 941 deposits?

Semi-weekly depositors must deposit the shortfall by the earlier of the due date of Form 941 or the first Wednesday or Friday on or after the 15th of the month after the month in which the original deposit was due.

Do you pay tax settlement agreement?

Usually a settlement agreement will say that you will be paid as normal up to the termination date. These wages are due to you as part of your earnings and so they will be taxed in the normal way.

Are 1099 required for settlement payments?

The IRS requires the payer to send the recipient a 1099-MISC, as long as the settlement meets the following conditions: The payee received more than $600 in a calendar year. The settlement money is taxable in the first place.

Where do you report settlement income on 1040?

Attach to your return a statement showing the entire settlement amount less related medical costs not previously deducted and medical costs deducted for which there was no tax benefit. The net taxable amount should be reported as “Other Income” on line 8z of Form 1040, Schedule 1.

Is a settlement payment tax deductible?

Generally, if a claim arises from acts performed by a taxpayer in the ordinary course of its business operations, settlement payments and payments made pursuant to court judgments related to the claim are deductible under section 162.

What is a 941 deposit?

The amount of employment taxes you reported on your Forms 941 or 944 determines which deposit schedule you must use, monthly or semiweekly. The terms "monthly schedule depositor" and "semiweekly schedule depositor" don't refer to how often your business pays its employees or even how often you’re required to make deposits.

When does the look back period end on 941?

If you've filed only Form 941, the lookback period is the 12 months (covering four quarters) ending on June 30th of the prior year. If you filed Form 944 in either of the two previous years or you're filing Form 944 in the current year, the lookback period is the calendar year two years prior to the year for which you’re depositing ...

How much tax liability do you have to deposit?

Liability of $2,500 or more: Unless you're eligible to make payments with your return, you must deposit your taxes. If you're a Form 941 filer and you're not sure your total tax liability for the current quarter will be less than $2,500, (and your liability for the preceding quarter wasn't less than $2,500), make deposits using the semiweekly or monthly rules so you won't be subject to failure-to-deposit penalties.

What happens if you fail to deposit on EFTPS?

Eastern Standard Time the day before the date a deposit is due, you can still make your deposit on time by using the Federal Tax Collection Service (FTCS) for a same-day payment.

What time do you have to schedule an EFTPS deposit?

For your EFTPS deposit to be on time, you must schedule the deposit by 8 p.m. Eastern Standard Time the day before the date the deposit is due. Visit EFTPS.gov or call 800-555-4477 to enroll.

How much is a 4th quarter 944?

If you're required to file Form 944 and your employment tax liability for the fourth quarter is less than $2,500, you may pay your fourth quarter liability with your timely filed return, as long as you've made deposits for the first, second, and third quarters according to the applicable deposit rules. Employers below the $2,500 threshold who ...

How many days do you have to deposit semi weekly?

Semiweekly schedule depositors have at least 3 business days following the close of the semiweekly period to make a deposit. If any of the 3 weekdays after the end of a semiweekly period is a legal holiday in the District of Columbia, you'll have an additional day for each of those days to make the required deposit.

When do you file Form 941?

For example, you may file Form 941 by May 10 if you made timely deposits in full payment of your taxes for the first quarter.

When is the deadline to file Form 941 for 2021?

The deadline to file Form 941 for 2021 will be the end of the month following the close of the quarter: Note: If your taxes have been deposited on time and in full, the deadline is extended to the 10th day of the second month following the end of the quarter.

What is a 941 form?

Form 941 Worksheets are used to calculate the refundable and non-refundable portions of sick and family leave wages and employee retention credits.

What is 941 Worksheet 4?

941 Worksheet 4 is used for calculating the employee retention credit. Previously, for the second quarter of 2021, Worksheet 2 was used.

How to efile a 941?

Just follow the simple steps to complete and e-file your form 941 to the IRS. Choose the right authorized e-file provider from the IRS and easily complete the form. You will get instant filing status notification from the IRS.

Do you have to file Form 941 if you have no taxes?

Form 941 must be filed even if you have no taxes to report, with the exception of seasonal employers and those who are filing their final return. To calculate the refundable and nonrefundable portion of the qualified family & sick leave and employee retention credits, Form 941 Worksheet 1 can be used. What is the deadline to File Form 941 ...

When are 2022 taxes due?

January 31, 2022. Note: If your taxes have been deposited on time and in full, the deadline is extended to the 10th day of the second month following the end of the quarter. For example, you must generally report wages you pay during the first quarter - which is January through March - by April 30.

When is the 941 look back period?

The look-back period begins July 1 and ends June 30. If you reported $50,000 or less of Form 941 taxes for the look-back period, you’re a monthly schedule depositor; if you reported more than $50,000, ...

When do you have to deposit 100% of your taxes?

You’re required to deposit 100% of your tax liability on or before the deposit due date. However, penalties won't be applied for depositing less than 100% if both of the following conditions are met.

How many deposit schedules are there?

Two Deposit Schedules. There are two deposit schedules (monthly or semiweekly) for determining when you deposit social security and Medicare taxes and withheld federal income tax. These schedules tell you when a deposit is due after a tax liability arises (for example, when you have a payday).

How much can you pay for a shortfall on your tax return?

Deposit or pay the shortfall with your return by the due date of the return. You may pay the shortfall with your return even if the amount is $2,500 or more.

What is EFT for taxes?

You must use EFT to make all federal tax deposits. Generally, an EFT is made using the Electronic Federal Tax Payment System (EFTPS). You can arrange for your tax professional, financial institution, payroll service, or other trusted third party to make electronic deposits on your behalf. Also, you may arrange for your financial institution to initiate a same-day wire payment on your behalf.

What is the maximum amount of tax shortfall?

1. Any deposit shortfall doesn't exceed the greater of $100 or 2% of the amount of taxes otherwise required to be deposited.

What is the look back period on a tax return?

For annual returns (Forms 943, 944, 945, and CT-1), the look-back period is the calendar year preceding the previous year. For example, the look-back period for 2021 is 2019.

What is a 941 form?

According to the Internal Revenue Service, federal tax deposits using Form 941 are made up mostly of withholding taxes or payroll deductions for Social Security and Medicaid. The due date for these IRS tax deposits depends on the amount of wages that you typically pay to your employees.

When do you deposit your taxes?

If your annual tax liability is less than $50,000, you must deposit your federal payroll taxes on the fifteenth day of the month following the month when the taxes were incurred . If the fifteenth falls on a holiday or weekend, you may deposit your taxes on the next business day.

When do you have to deposit semi weekly taxes?

If you write your paychecks on Saturday, Sunday, Monday or Tuesday, you must make your payroll tax deposits by the following Friday.

When are payroll taxes due?

This form and payment is due on the last day of the month following the end of the quarter: Apr. 30 for the first quarter, Jul. 31 for the second quarter, Oct. 31 for the third quarter, and Jan. 31 for the fourth quarter.

Do you have to deposit 941?

You must make 941 payroll-tax deposits directly by using the Federal Tax Deposit Payment System or by using your bank's online federal payroll-tax deposit system.

How often do you file a 941?

The IRS requires employers to file Form 941 for each quarter of the year. These quarterly schedules are as follows:

Who Are Exempt from 941 Late Payment Penalties?

The IRS allows the waiver of certain penalties by way of First-Time Penalty Abatement (FTA). This waiver may be applied to cases pertaining to failure to file, failure to pay, and in case of employment taxes, failure to deposit.

What Is the Employer’s Quarterly Federal Tax Return?

The Employer’s Quarterly Federal Tax Return, or Form 941, reports the following:

How Are Employment Taxes Paid?

The IRS allows two payment schedules, semiweekly or monthly, for employment taxes covered by Form 941. Employers decide before the start of a calendar year which of these schedules they want to follow.

Where Could One Reach Out for Penalty Abatement?

Alternatively, taxpayers can reach out to the toll-free number or address specified on the demand for payment notice they have received to file an over-the-phone or in-writing FTA request.

What is FTD penalty?

The IRS is quick to hand out Failure to Deposit (FTD) penalties to employers who have not deposited their employment tax dues on schedule. FTD penalties take effect the day after the deposit is due. 10% of the amount deposited within 10 days of receipt of an IRS request for payment notice.

What is the penalty for not transferring funds to IRS?

The IRS expects deposits via electronic funds transfer. Failure to abide by this rule constitutes a 10% penalty.

What is electronic federal tax payment system?

The Electronic Federal Tax Payment System® tax payment service is provided free by the U.S. Department of the Treasury. After you've enrolled and received your credentials, you can pay any tax due to the Internal Revenue Service (IRS) using this system. MAKE A PAYMENT. ENROLL.

Do tax payers get emails from EFTPS?

Taxpayers will only receive an email from EFTPS if they have opted in for email notifications when they sign up for email through EFTPS. Report all unsolicited email claiming to be from the IRS or an IRS-related function to [email protected].