Why does the Treasury issues callable bonds?

Treasury should issue callable debt in order to protect itself from the interest rate drops. If the callable debt is issued at a higher rate and after that the interest rate decreases, then the Treasury can call the debt and refinance it at a lower interest rate.

Is Treasury bill a good investment?

U.S. Treasury bills are a good investment option too for those who aren’t looking to have their money tied up for long periods of time. The biggest benefit though of T-bills, is that there is virtually no risk attached.

How to buy Treasury bonds in the secondary market?

Secondary Market

- Interdealer Brokers. Primary dealers trade among themselves by using an electronic platform provided by an interdealer broker, which lists the best bid/ask prices and the quantity.

- Federal Reserve. ...

- On-The-Run, Off-The-Run, and When-Issued Treasury Securities. ...

Can Treasury bonds lose value?

Yes. If interest rates rise, Treasury Bonds lose value. Treasury bonds can also lose value in terms of other currencies, or when the U.S. Government does something stupid enough to lower its credit rating. , Investing for over 25 years. Every investment can lose value. Even cash under the mattress can lose value to inflation.

What is a Treasury bond?

Treasury bonds are part of U.S. Treasury securities, which include Treasury bills. Treasury Bills (T-Bills) Treasury Bills (or T-Bills for short) are a short-term financial instrument issued by the US Treasury with maturity periods from a few days up to 52 weeks. and Treasury notes.

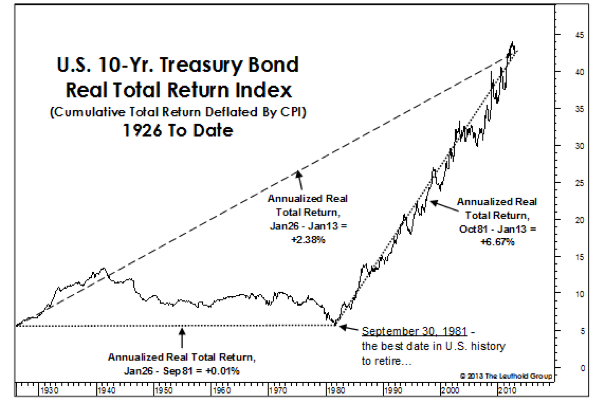

When did the 30-year Treasury bond yield go down?

The trajectory of 30-year Treasury bond yields since 1981 shows a downward trend. The yields reached an all-time high of 15.21% in October 1981. There was a four-year suspension of the issuance of 30-year Treasury bonds from February 18, 2002 to February 9, 2006.

How to Buy Treasury Bonds?

Treasury bonds can be bought directly from the U.S. Treasury or indirectly through a bank, broker, mutual fund company, or an exchange-traded fund (ETF). Investors can apply and purchase securities as individuals, corporations, partnerships, limited liability companies (LLCs), trusts, or estates. However, institutional investors make up most of the market for Treasuries.

What are the disadvantages of a T bond?

Disadvantages of Treasury Bonds 1 They are exposed to inflation risk, which can erode real returns on a bond. A T-bond return of 4% against an inflation rate of 2% effectively reduces the investor net return to 2%. 2 T-bonds are exposed to interest rate risk#N#Interest Rate Risk Interest rate risk is the probability of a decline in the value of an asset resulting from unexpected fluctuations in interest rates. Interest rate risk is mostly associated with fixed-income assets (e.g., bonds) rather than with equity investments.#N#. They carry an opportunity cost where the fixed rate of return might underperform in a rising interest rate environment, at the same time making new bond issues more attractive. 3 The long investment horizon of up to 30 years is too long to realize the full payment of the principal. 4 The bondholder is subject to restrictions and penalties associated with redeeming Treasury bonds before maturity. They may include broker markdowns, which reduce a bond sale price to cover transaction costs. 5 Coupon interest payments may be exempt from local and state income taxes, but they are still subject to federal income tax. 6 Buying limits of $5 million on non-competitive bids and 35% of the initial offering amount on competitive bids can restrict other investors. 7 An investor may incur a loss if he redeems a bond before maturity, i.e., redemption price less than the purchase price.

How long are T bonds risk free?

The highest bid allowable is $5 million for a non-competitive bid. T-bonds are issued for periods between 20 to 30 years and are virtually risk-free because of the U.S government guarantee. Treasury bonds are traded in the bond market, a highly liquid secondary market.

Why do T bonds fall?

Periods of market volatility have caused demand for Treasury bonds to rise, resulting in reduced yields. When demand drops in periods of relative stability, the yield for T- bonds tends to increase. The T-bond yield also experiences inflation adjustment, which causes it to continue falling.

Why do Treasury bills have the lowest yield?

An upward sloping yield curve is considered normal. Treasury bills offer the lowest yield because they come with the lowest risk. In the middle are Treasury notes, whose yields increase gradually within their maturity spectrum. Longer maturities, such as Treasury bonds, provide the highest yield to compensate for the longer tenure.

How long does it take for a bond to settle?

Bonds and stocks are settled within two business days, whereas Treasury bills and bonds are settled within the next business day. Where the period between the transaction date and the settlement date falls on a holiday or weekend, the waiting period can increase substantially.

What is settlement date?

Settlement date is an industry term that refers to the date when a trade or derivative contract is deemed final, and the seller must transfer the ownership of the security to the buyer against the appropriate payment for the asset. It is the actual date when the seller completes the transfer of assets, and the payment is made to the seller.

When Does Settlement Occur?

The settlement date is the number of days that have elapsed after the date when the buyer and seller initiated the trade. The abbreviations T+1, T+2, and T+3 are used to denote the settlement date. T+1 means the trade was settled on “transaction date plus one business day,” T+2 means the trade was settled on “transaction date plus two business days,” and T+3 means the trade was settled on “transaction date plus three business days.”

What are the risks of a lag between a transaction date and a settlement date?

The lag between the transaction date and the settlement date exposes the buyer and the seller to the following two risks: 1. Credit risk . Credit risk refers to the risk of loss resulting from the buyer’s failure to meet the contractual obligations of the trade. It occurs due to the elapsed time between the two dates and the volatility of the market.

What is the difference between settlement date and transaction date?

Transaction date is the actual date when the trade was initiated. On the other hand, settlement date is the final date when the transaction is completed. That is, the date when the ownership of the security is transferred from the seller to the buyer, and the buyer makes the payment for the security to the seller.

What is the date on which a trade is deemed settled?

The settlement date is the date on which a trade is deemed settled when the seller transfers ownership of a financial asset to the buyer against payment by the buyer to the seller.

Why does a buyer fail to make the agreed payment?

The buyer may fail to make the agreed payment by the settlement date, which causes an interruption of cash flows. 2. Settlement risk.

How long does it take for a securities transaction to settle?

The settlement date is different for different types of securities, but it typically occurs within three business days of the transaction or trade date. This article will review the settlement dates for different securities and explain why it is important.

What is the settlement date for a stock?

Settlement date refers to the date on which payment is made to settle the purchase or sale of a security such as a stock , bond, mutual fund, or exchange-traded fund (ETF). If you purchase a security, the settlement date is the day you must pay for your purchase. If you sell a security, it is the date you will receive money for the sale.

What is a settlement violation?

Settlement violations occur when purchases go through and there is not sufficient settled cash in the investor’s account to pay for the trade on settlement day. A brokerage firm is responsible for settling a trade if the investor has not provided the funds by the settlement date. If payment for a purchase is not provided by the settlement date, a brokerage may sell the security (thereby canceling the transaction), and charge the investor for any loss resulting from a drop in the market value of the security. A brokerage may also charge interest or impose fees.

How long does it take to settle a stock on a Monday?

The settlement date for stocks specifically is two days after a trade is executed. 1

Why is the settlement date important?

In addition, the settlement date may be important for tax, accounting, and other purposes, including:

Why is it important to settle trades?

It has always been important to settle trades in financial markets as quickly as possible. Unsettled trades pose risks, particularly if market prices drop steeply and trading volume soars. A long period between trade and settlement in this situation increases the risk that investors could no longer pay for their transactions .

How long does it take for a certificate of sale to settle?

The settlement date was originally longer to make up for the time it would take for a certificate of sale to arrive manually, but since the introduction of electronic trades, the period between the trade date and the settlement date has shrunk to as little as one or two days for most securities.

Why is it important to know the settlement date of a stock?

Knowing the settlement date of a stock is also important for investors or strategic traders who are interested in dividend-paying companies because the settlement date can determine which party receives the dividend. That is, the trade must settle before the record date for the dividend in order for the stock buyer to receive the dividend.

Why is the settlement date a little trickier?

However, the settlement date is a little trickier because it represents the time at which ownership is transferred . It's important to understand that this doesn't always occur on the transaction date and varies depending on the type of security.

When Do You Actually Own the Stock or Get the Money?

If you buy (or sell) a security with a T+2 settlement on Monday, and we assume there are no holidays during the week, the settlement date will be Wednesday, not Tuesday. The 'T' or transaction date is counted as a separate day. 2

What does the transaction date mean?

As its name implies, the transaction date represents the date on which the actual trade occurs. For instance, if you buy 100 shares of a stock today, then today is the transaction date. This date doesn't change whatsoever, as it will always be the date on which you made the transaction.

Do all mutual funds have the same settlement period?

Not every security will have the same settlement periods. All stocks and most mutual funds are currently T+2. 3 However, bonds and some money market funds will vary between T+1, T+2, and T+3.

Do security transactions have to be done manually?

In the past, security transactions were done manually rather than electronically. Investors would wait for the delivery of a particular security, which was in actual certificate form, and payment happened upon receiving the certificate. Since delivery times could vary and prices always fluctuate, market regulators set a period of time in which securities and cash must be delivered.

What is a Treasury bond?

U.S. Treasury bills, notes, and bonds, together known as “Treasuries”, are issued by the Treasury Department and represent direct obligations of the U.S. government. Treasuries are backed by the full faith and credit of the U.S. government, and have very little credit risk.

How long after trade date is settled?

Settle regular-way, which is one day after the trade date (T+1).

How are Treasury notes issued?

Treasury notes and bonds are issued through yield auctions of new issues for cash. Bids are separated into competitive bids and noncompetitive bids. Competitive bids are made by primary government dealers, while noncompetitive bids are made by individual investors and small institutions. Competitive bidders bid yields to three decimal places for specific quantities of the new issue. Two types of auctions are currently used to sell securities:

What is secondary trading in treasuries?

Secondary trading in Treasuries occurs in the over-the-counter (OTC) market. In the secondary market, the most recently auctioned Treasury issue is considered ‘‘current,’’ or ‘‘on-the-run.’’ Issues auctioned before current issues are typically referred to as ‘‘off-the-run’’ securities. In general, current issues are much more actively traded and have much more liquidity than off-the-run securities. This often results in off-the-run securities trading at a higher yield than similar-maturity current issues.

How often are two year notes auctioned?

The price paid by these bids (if allocated a portion of the issue) is an average of the price resulting from the competitive bids. Two-year and 5-year notes are issued once a month. The notes are generally announced near the middle of each month and auctioned one week later. They are usually issued on the last day of each month. Auctions for 3-year and 10-year notes are usually announced on the first Wednesday of February, May, August, and November. The notes are generally auctioned during the second week of those months and issued on the 15th day of the month.

How long does a noninterest bearing bond last?

Negotiable, noninterest-bearing securities with original maturities of three months, six months, and one year.

How are T bills issued?

T-bills are issued at regular intervals on a yield auction basis. The three-month and six-month T-bills are auctioned every Monday. The one-year T-bills are auctioned in the third week of every month. The amount of T-bills to be auctioned is released on the preceding Tuesday, with settlement occurring on the Thursday following the auction. The auction of T-bills is done on a competitive-bid basis (the lowest yield bids are chosen because they will cost the Treasury less money). Noncompetitive bids may also be placed on purchases of up to $1 million.

How long are Treasury bills?

What are the maturity terms for Treasury bills? Among bills auctioned on a regular schedule, there are five terms: 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks. Another bill, the cash management bill, isn't auctioned on a regular schedule. It is issued in variable terms.

When is interest paid on a bill?

The only interest payment to you occurs when your bill matures. At that time, you are paid the par amount (also called face value) of the bill. (Bills are typically sold at a discount from the par amount, and the difference between the purchase price and the par amount is your interest.)

What if an auction results in a price that's not exactly to the penny?

Treasury calculates auction results to the sixth decimal place. In determining the particular dollar amount an investor will pay, Treasury rounds to the nearest penny using conventional mathematical rounding methods.

How often do we auction cash management bills?

We auction 4-week, 8-week, 13-week, and 26-week bills every week. Typically, we auction 13-week and 26-week bills on Monday and 4-week and 8-week bills on Thursday. We auction the 52-week bill every four weeks. Cash management bills aren't auctioned according to a schedule.

Does Treasury Direct give a refund?

Treasury Direct customers who reinvest a bill may receive a refund (or discount) when the bill is issued. It is possible for a bill auction to result in a price equal to par, which means that Treasury will issue and redeem the securities at par value.

Is cash management bill auctioned?

Cash management bills aren't auctioned according to a schedule. For specific dates, see our Tentative Auction Schedule, which shows auction dates months in advance, or " Upcoming Auctions ," which shows auctions that we have officially scheduled. (Auctions are officially scheduled only days before they are conducted.)

Can I buy any Treasury bill directly from the Treasury?

The 4-week, 8-week, 13-week, 26-week, and 52-week bills are available in TreasuryDirect. Cash management bills aren't.

Understanding Settlement Dates

- The financial market specifies the number of business days after a transaction that a security or financial instrument must be paid and delivered. This lag between transaction and settlement datesfollows how settlements were previously confirmed, by physical delivery. In the past, securi…

Settlement Date Risks

- The elapsed time between the transaction and settlement dates exposes transacting parties to credit risk. Credit risk is especially significant in forward foreign exchange transactions, due to the length of time that can pass and the volatility in the market. There is also settlement riskbecause the currencies are not paid and received simultaneously. Furthermore, time zone differences inc…

Life Insurance Settlement Date

- Life insurance is paid following the death of the insured unless the policy has already been surrendered or cashed out. If there is a single beneficiary, payment is usually within two weeks from the date the insurer receives a death certificate. Payment to multiple beneficiaries can take longer due to delays in contact and general processing. Most states require the insurer pay inter…

Understanding Settlement Dates

- When an investor buys a stock, bond, derivative contract, or other financial instruments, there are two important dates to remember, i.e., transaction date and settlement date. Transaction date is the actual date when the trade was initiated. On the other hand, settlement date is the final date when the transaction is completed. That is, the date when the ownership of the security is transf…

When Does Settlement occur?

- The settlement date is the number of days that have elapsed after the date when the buyer and seller initiated the trade. The abbreviations T+1, T+2, and T+3 are used to denote the settlement date. T+1 means the trade was settled on “transaction date plus one business day,” T+2 means the trade was settled on “transaction date plus two business days...

Settlement Date Risks

- The lag between the transaction date and the settlement date exposes the buyer and the seller to the following two risks:

Additional Resources

- CFI is the official provider of the Commercial Banking & Credit Analyst (CBCA)®certification program, designed to transform anyone into a world-class financial analyst. In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful: 1. Commodities: Cash Settlement vs Physical Delivery …

Definition and Examples of A Settlement Date

How A Settlement Date Works

- It has always been important to settle trades in financial markets as quickly as possible. Unsettled trades pose risks, particularly if market prices drop steeply and trading volume soars. A long period between trade and settlement in this situation increases the riskthat investors could no longer pay for their transactions. To decrease the risk, the regulation regarding settlement dates …

Types of Settlement Dates

- Settlement dates differ depending on the security you purchase. While there are some exceptions, the guidelines for settlement dates are generally as follows: 1. Stocks, bonds, and ETFs: two business days (T+2) following the purchase or sale 2. Government securities and options: one business day (T+1) following the purchase or sale 3. Mutual funds:...

What It Means For Individual Investors

- The settlement date informs an investor when the necessary funds to cover a purchase must be available in their account. In addition, the settlement date may be important for tax, accounting, and other purposes, including: 1. Whether a sale occurred before the end of a tax year 2. Whether taxes on any dividends received are short-term or qualified dividends 3. If purchasing a stock th…